The collection of “Hacks” for the Long Term Capitalism Challenge offered byHarvard Business Review, McKinsey and MIX, for the M-Prize for Management Innovation now has this proposal from me…

Please leave comments for reviewers on The official competition entry at the MIX site (here too is fine for conversation). If you request information I’ll respond as I did for Bill Rees, and post it if it’s OK with you.

It’s a nice new version of the long series of proposals for using natural economies as models for better ways to organize ours, a kind of systems biomimicry.

General References: (added proposal references at the end)

- For closely related world system biomimicry see “News of the Commons“

- To introduce systems ecology “Self-organization as “niche making”

- I got very good detailed questions on the MIX proposal from Bill Rees, and posted my responses as Questions from Bill Rees.

- For an introduction to the physics and general systems theory of natural open systems, see Natural Systems Thinking

_______

The Summary

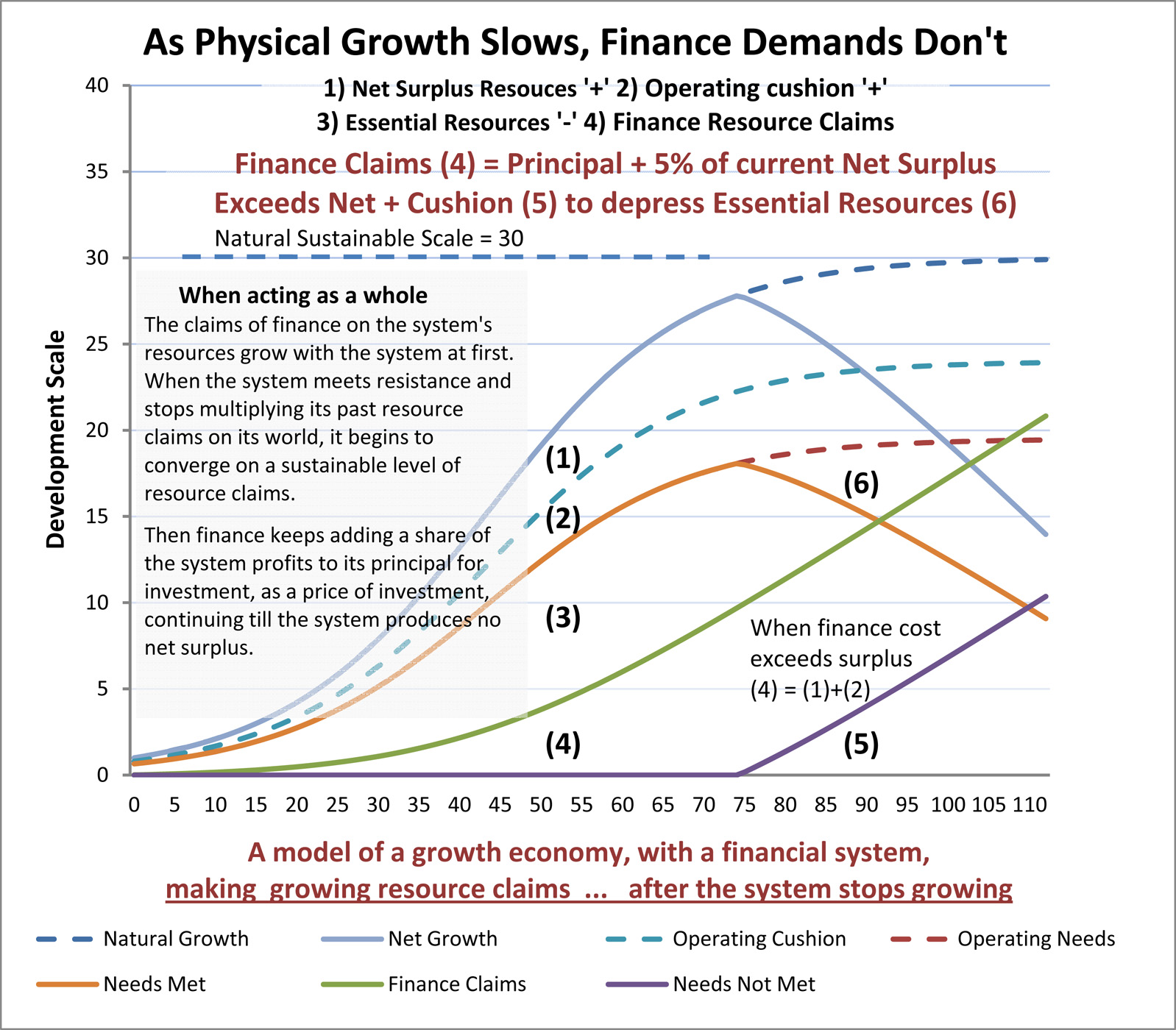

A good goal for growth would be to end at a stable peak of vitality providing a sound capital endowment for life on earth. That would be better than ending at a peak of exhaustion, like other “tower of Babel” societies of the past such as Rome and the Mayans.

It can also be thought of as a change of “ism’s”.

It would also represent a change in form for our economic system, while still being the very same economy with the same people and rights, and reliance on creative innovation funded by investors. By giving profits an end purpose, of caring for things rather than just for multiplying profits, it woud give the whole economy a very different purpose. So, it can also be thought of as a change of “ism’s”. Continue reading Adopt natural system principles to keep economies profitable at their limits