The problem is not exactly with the banks.

It has to do with society asking the banks to permanently stabilize a system for multiplying financial returns.

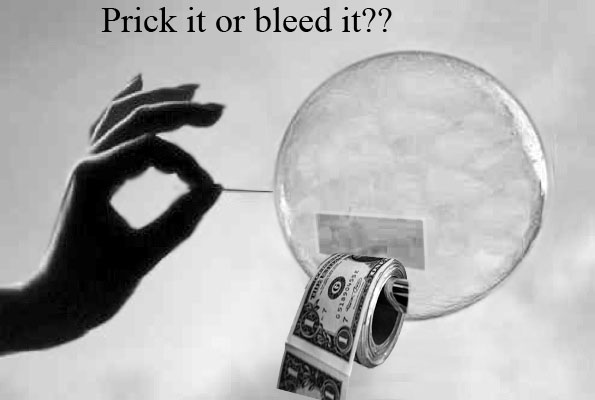

So when the economy can’t generate growing earnings the banks multiply its debt instead, creating “a debt bubble” and promises that won’t be fulfilled. The promises that won’t be fulfilled grow without limit until there’s a collapse of confidence (‘pricking the bubble’), unless 1) the economy finds totally new ways to expand ever more rapidly, 2) a “Jubilee” is declared to write down the debt, or 3) investors start spending their profits to create earnings rather than lending them to create debt (‘bleeding the bubble’) to relieve the pressure so the economy can return to health.

The Jubilee idea, to write down all the debt (something like a global bankruptcy) is much more disruptive than needed, and is just a temporary fix. How natural economies solve the same problem, so they can smoothly pause their growth when needed, will also cure the problem for all time and give us a healthy free market economy in the end.

……

I responded to Joachim Sturmberg on the NECSI Linkedin Forum regarding The Eurozone as a complex network: New analysis shows connectivity as a problem and a solution.

JS 11/20/11 – All of this is really interesting. However, isn’t there another fundamental point being lost, the core attractor of the whole system? It is all well and true to understand the interconnectedness, if the core aim of the game is all about making ever more money by whatever means, the system network will exactly do that. It may be dumb to have an exponential growth attractor, but if you have one a necessary outcome of the workings of systems is unsustainable exponential growth with all its consequences. 11/20/1

The solution is a change of attractor, and “common sense” would suggest that sustainable economic development would be a better attractor than greed – thinks a non-economist.

PH 11/20/11 – Well, yes of course. That’s why I termed my first paper on the subject “The Infinite Society, growth induced collapse”. I don’t think that’s an “attractor” you’re talking about though, but a “procedure”. Procedures can be changed. Keynes and Boulding also came to the same conclusion, that at the limits of productive investment it was necessary to have investors stop adding as much of their earnings to their savings, to spend more of them instead.

What that does economically is a little like the so called “Tobin tax” proposed recently to tax financial trades to constrain speculation. The “bubble tax” would be scaled to restrain investment growth to not exceed economic growth, to keep the bubble from growing till it burst. Traders could return most of the proceeds from their trading to the creditor they were trading for every day, to be spent in a non-profit way.

Those funds would become spending going directly toward the earnings of working people, is another part of why the possibility hasn’t dawned on people yet, not go to the government. So it would relieve the struggling economies from both sides, restraining ballooning debt while creating earnings the natural way. The main problem seems to be it’s anti-social thinking for business people and investors alike. You could even call it the “Scrooge tax” because the turnabout is to convert the act of hoarding of money, squeezing your world for ever more, into gifts to revive it… But the Scrooges won’t like it, even the ones whose environments are about to crash.

Will it just shift the bubble to the physical economy??

I forwarded the comment to Stan Salthe who copied friends on “thegreatchange” @yahoogroups.com, saying he thought finance would be slowing down the economy already, so transferring funds from the finance economy to the cash economy would speed up the physical depletion of the earth (at first)…PH – I guess we’d have to talk, as I’m thinking that if you take your foot off the accelerator the vechical slows down, and you’re thinking it would speed up, it seems.

SS – I am seeing the Wall Street function as a way to accelerate, and create (phony) wealth, without having any effect on the material world.

PH – Perhaps the present social value of finance has become that, but as part of the physical economy its main role has and still is to allocate the economy’s surplus to its future paths of development. That’s the physical steering process of the growth system, making choices for how it’s products will be used to build its future process. Money managers select investments to receive funds from the savings and profits of investors to, usually intending to maximize investor profits.

It’s an accelerator because the scale of investments then grows exponentially if the profits are added to the investments. It’s that choice to add profits to investments that determines whether finance multiplies finance. So if you interrupt that feedback loop, growth of investment from that source would stop. You could either take the profits out of circulation or have their owners divest them, as one or another kind of spending, and so returning them to the cash economy.

If divested rather than invested, most of the money would be exchanged for goods and services to become earnings, by the people doing work. They would then be better able to save for their own security moving some of it back to finance. At present people are not able to save much, though. They have too much debt and the economy as a whole is becoming unprofitable, and its surpluses are shrinking. People are spending less and there are large increases in overhead costs. Some are voluntary like population and the desire for progress. Others are involuntary, caused by the growing natural costs, conflicts and complications of colliding with limits.

SS – If the speed-up were to be connected to the material world via projects (like dams and mining) and jobs, then we would destroy the natural world even faster than we do.

PH -That would happen if the physical systems were actually profitable, but they’re increasingly not. We already depleted those opportunities, as the profitable valley’s to dam and profitable minerals to mine were depleted. So, as net-energy systems, the economy is producing less and less net energy, due to ballooning overhead costs. So there’s physically less surplus energy available and less reason to grow the system. Those are all symptoms of the economy being “over-invested”. Like anything you’ve already taken all the easy profit from, there’s both less to invest in and less to invest with.

SS – So, I see the financial sector as a damper on material development, [not an accelerator] allowing the greed emotion to spend itself in paper promises.

PH – Again, it may seem so at the moment from a social value perspective. From a physical system view its present role is conflicted. It continues to put money into the cash economy, but only to create growing obligations for getting more back. It becomes an exponential driver of ever growing obligations for the cash economy. The money taken out of the cash economy is added to the pool of funds accumulating in the finance economy.

In the cash economy people just pass money around. In the finance economy they put money into things only to get more back. So the cash economy grows as the earth allows and the finance economy grows till the cash economy exhausts its ability to pay its growing debts to the finance economy, and goes bankrupt as we now see happening.

Why the circular motion of finance, putting money into the cash economy only to take more out, has not been recognized as a “perpetual” one way exponential drain on the cash economy till it runs out of cash, is a bit curious. It seems to be because economists have not been thinking about the economy as a physical system, but just as a source of financial profit.