The elementary problem of our economic system’s design

The problem arises because finance operates by a cultural belief system of multiplying forever,… That once seemed to be how the physical economy worked. Now it’s become obvious to most people that it was an illusion and never corresponded to the physical reality, and doesn’t allow the real economy to operate with its real resouces.

In a way it’s a very natural confusion, because people for thousands of years have thought of nature as their cultural belief system, run by Gods, theories of the future being like the past, or “Urban myths”, whatever. It’s an “easy” way to look at a natural world, that has too many independently working parts to quite fathom. So in our minds we get in the habit of substituting an imaginary world that pleases us… and confuse the world we invent that “we see” for the world we don’t invent that “we’re looking at”.

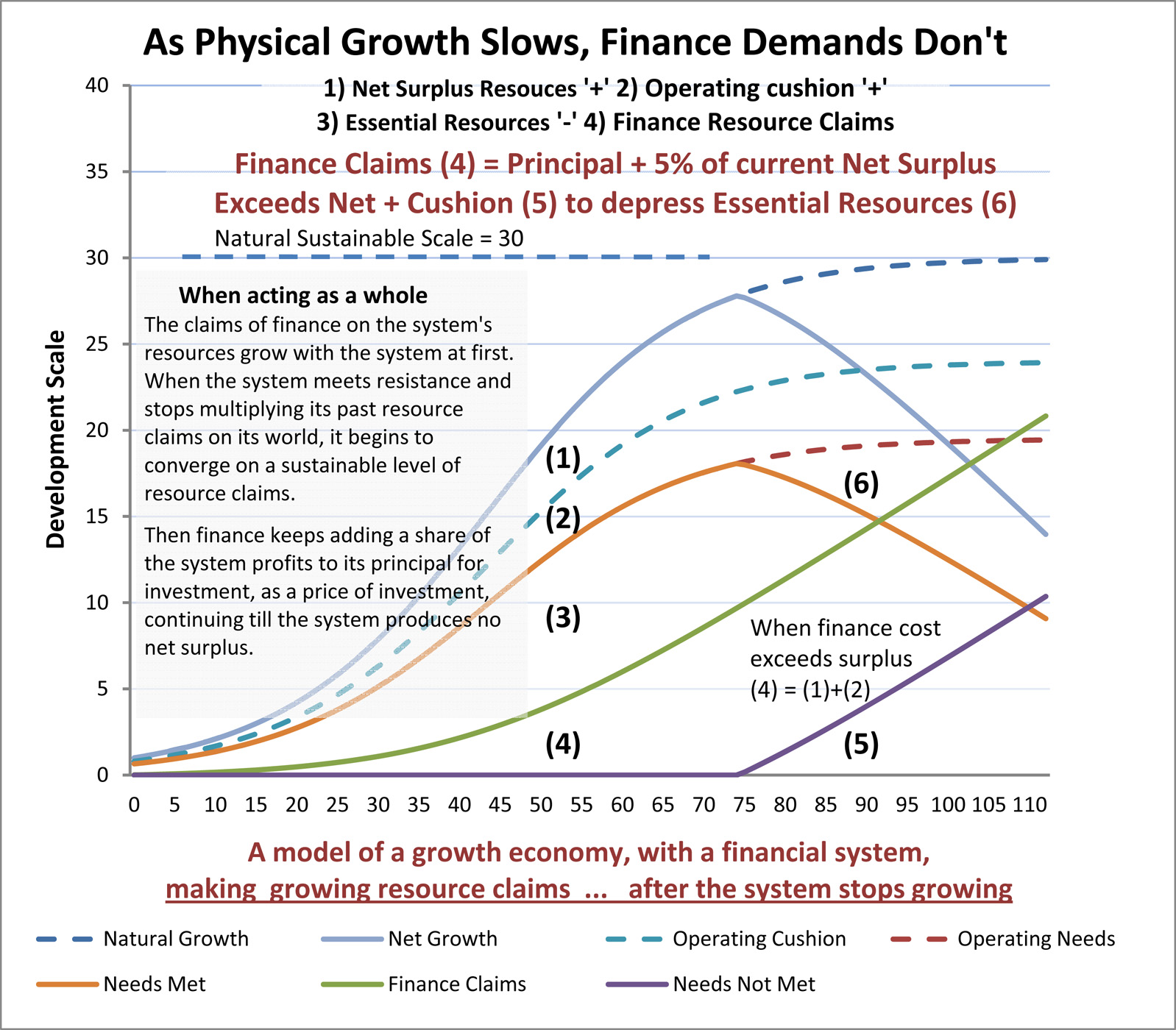

The simplest idea of what needs to change is to stop finance from continuing to grow its claims on the resources of the physical world economy. The real economy has already begun to converge toward the natural limits that will allow it to continue. Conceptually the task is:

— now that we’ve hit the tree, first take our foot off the gas —

That means that investing needs to change purposes, to stop being for multiplying investment, to being for the purpose of having money to spend. Spending from savings reduces financial capital. The right amount of spending from keeps the demands of finance on the economy and the earth at a stable sustainable level. At least, finance needs to restrain its demands on the economy to match how the economy is naturally responding to its limits. It might mean finance has to “give back” half or more of the economy’s wealth.

Otherwise the resources the physical system functionally needs to operate will continue to be increasingly claimed to serve the continual growth of finance, undermining the physical system.

Titus, thanks for the notice. You say that it indicates a “contradiction between the supply of Nature (limited by its ability to recover) and global demand imposed by macroeconomic policy”

That’s definitely the discussion it applies to. The natural limits of supply also include our own escalating difficulty of managing the complex technical fixes for natural limits. Technologists seem hard to persuade that at a point even their kinds of solutions become ever more costly, inflexible and unmanageable. To that’s the technical challenge I think we face that is truly insurmountable, that our own solutions become self-defeating.

It’s similar with macro-economic policy, quite largely just to stabilize what people naturally do with money. For not looking into what people do with money that becomes quite unnatural, the world policy to stabilize it becomes completely self-defeating too.

re: http://blogideologic.wordpress.com/2011/11/04/oferta-naturii-si-cererea-macroeconomica-globala/trackback/