The radical separation of humans from nature, our being so self-absorbed and seeing nature as defined in our heads rather than the other way around, has been a deep mystery for a long time.

My interest in it came from noticing how mathematics became our standard for representing nature but cannot describe or help us study what makes life so lively, the abounding creative processes of nature.

I’m not against math, a fabulous art, that does help us identify certainties, however, our desperate search for certainty is what seems to have betrayed us, splitting our minds between attentiveness and total blindness to our environments, having defined in our minds nature as our rules for how to control nature…

A general systems theory and demonstration of the problem and solutions are to be presented on Jul 9 at 3:30 at the 2022 ISSS world systems science conference. See the preprint Holistic Natural Systems – Design & Steering – Guiding New Science for Transformation.

____________________________________

First Openings

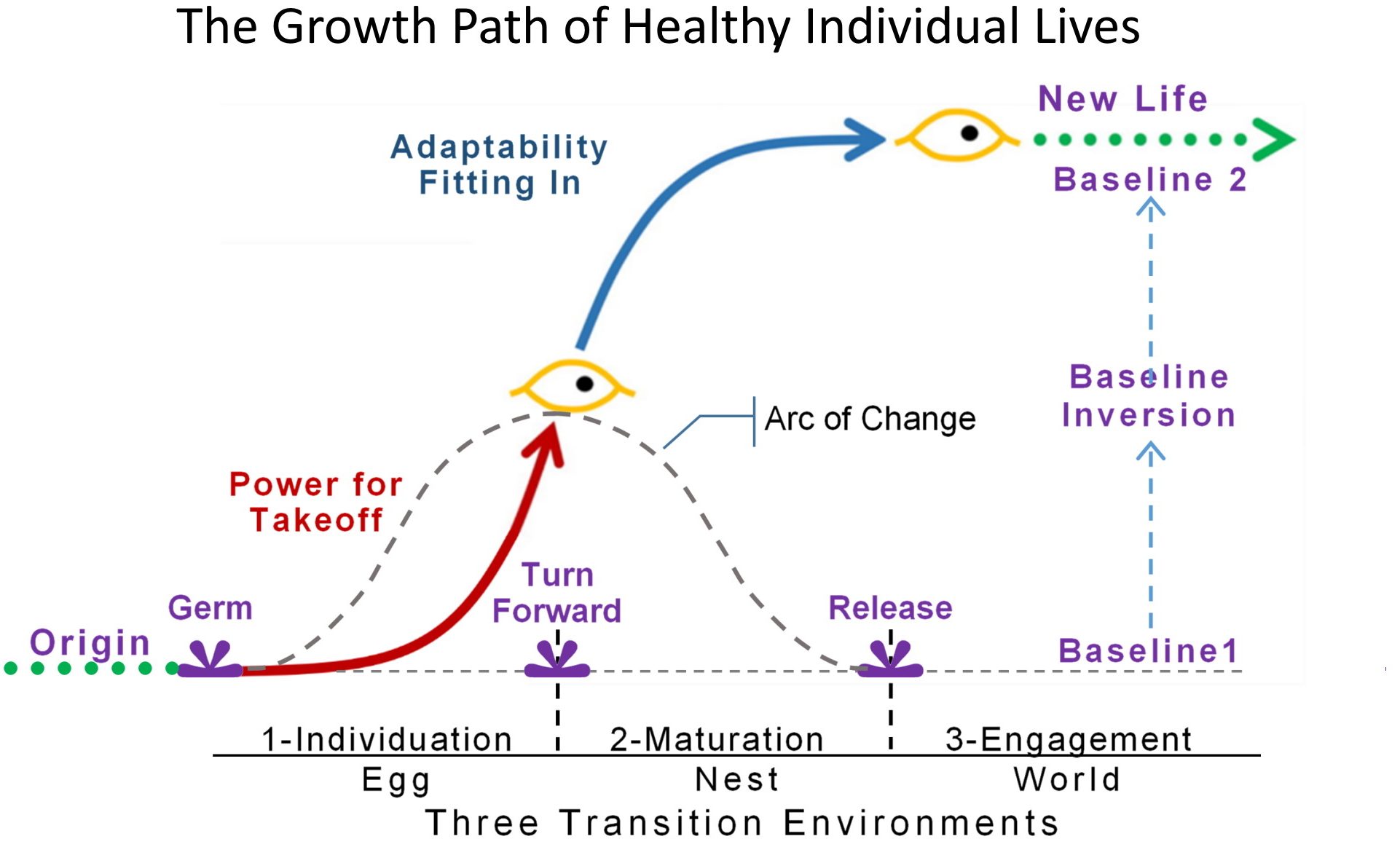

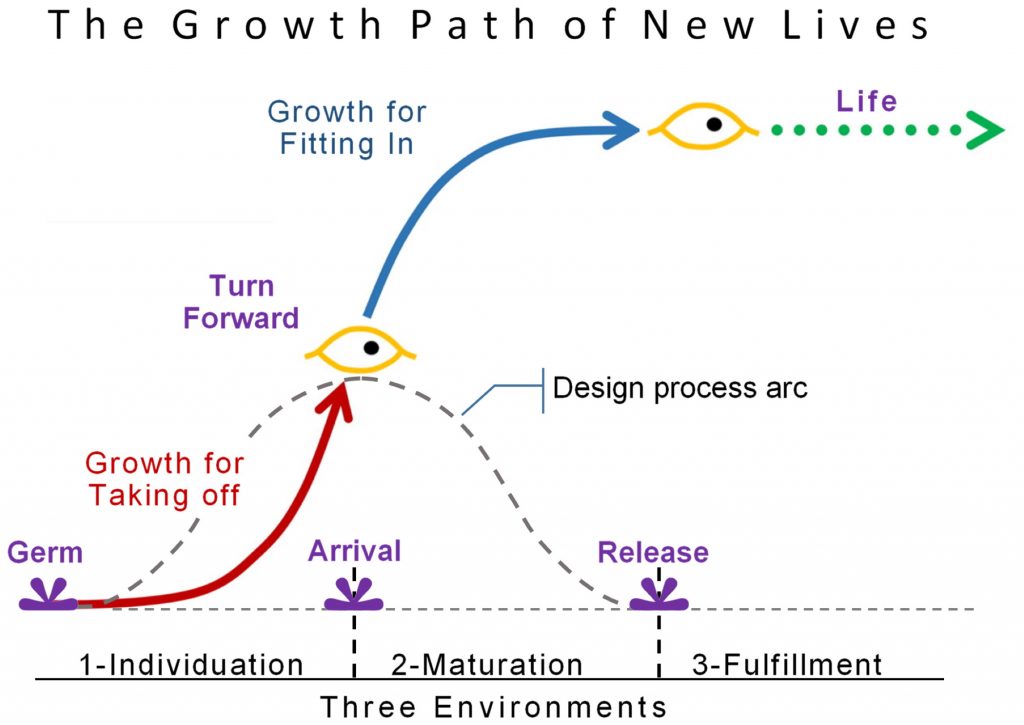

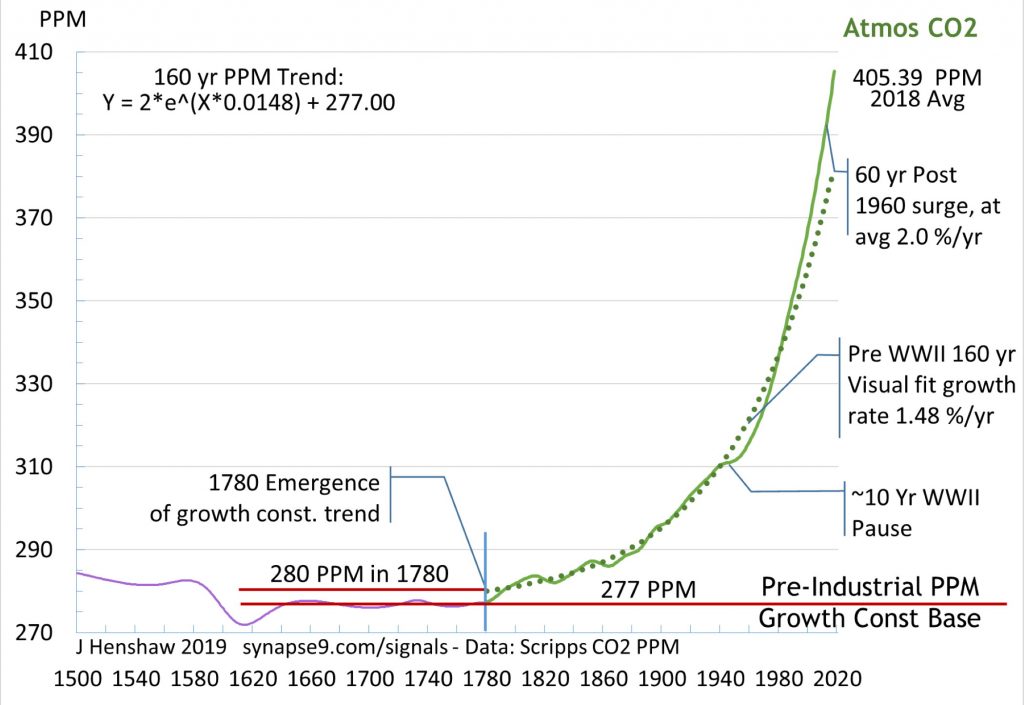

The search for answers in mathematics, the language of determinate relationships that science uses, has proved extraordinarily profitable, leading to growing human comforts that have also taken us to the point of our increasingly destroying the natural world. Our mysterious detachment from nature seems very directly at fault. The animation of life, its rich relationships, and creativity are all left out of the formula when people are guided by determinate rules. It’s something I’ve long studied as a physicist, having first noticed that every event begins and ends with some little dynamic transient of change.

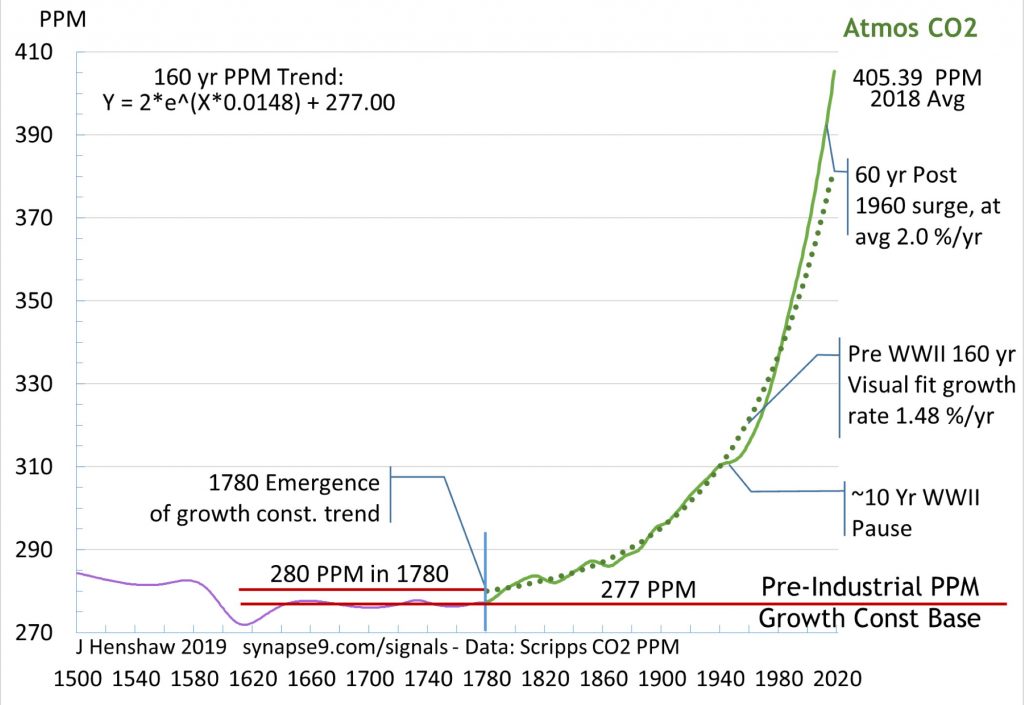

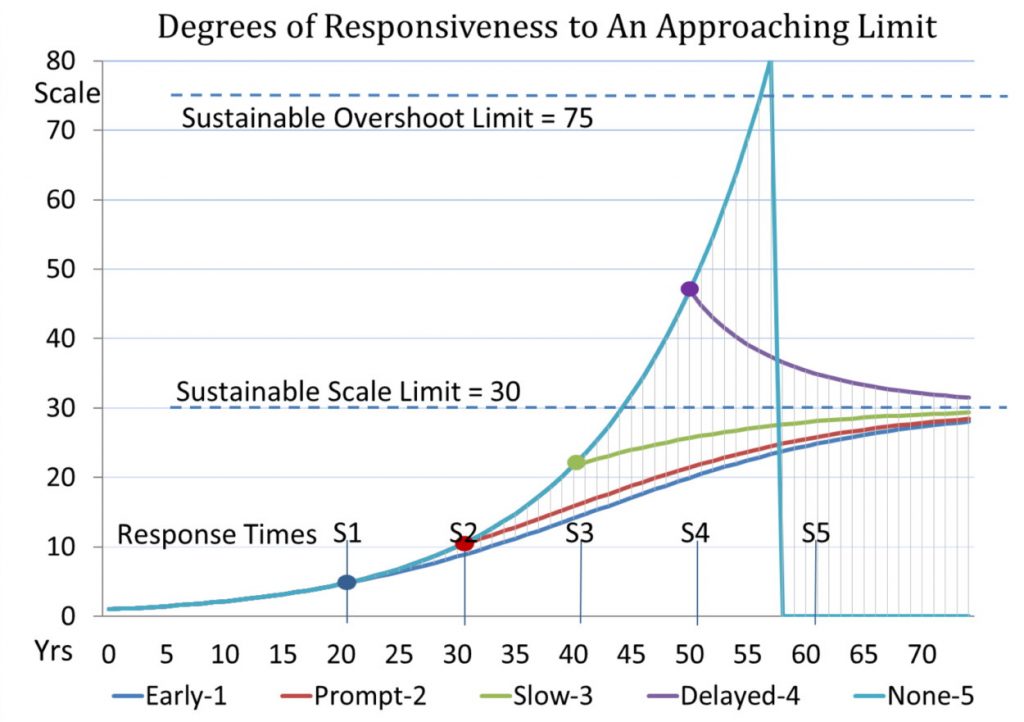

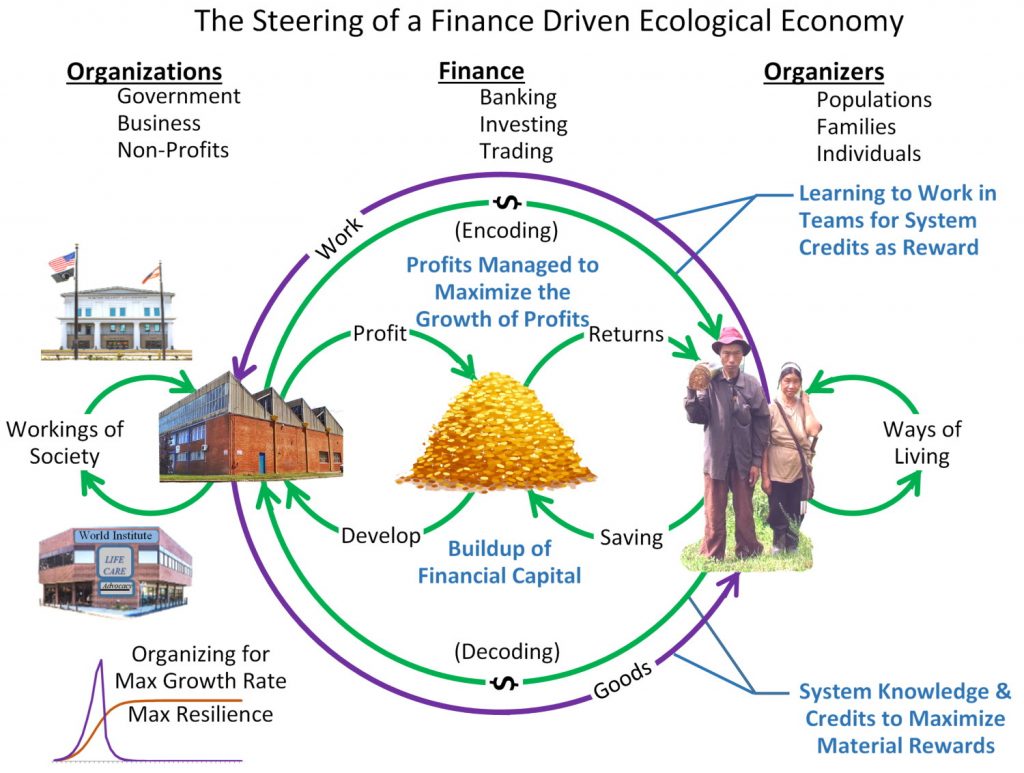

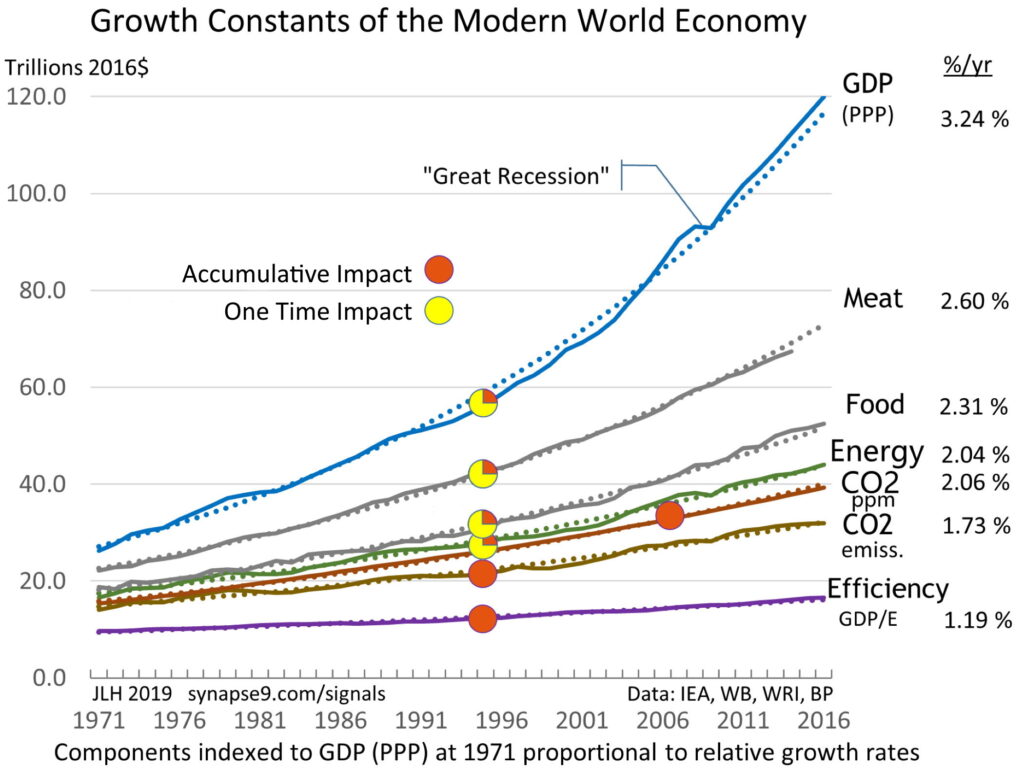

I think part of the problem is that language was actually reflected our first highly useful systems thinking, with all its words and grammar arranged to communicate important experiences, designs, and relationships IN THE NATURAL CONTEXT. Math makes rules abstracted from a natural context, that are most profitable when offering easy ways to control nature without concern for the context. So they work great but pass on no information on when they are being overused. That is as clear in the simple cases and most extreme cases, such as the world consensus plan to maximize our economic growth rate, for regularly doubling the wealth we extract from nature while ignoring its rapidly degrading impacts on nature, called “externalities.”

But who is it that is blind to what, and how in the world do we face an existential dilemma evidently buried so deep in human consciousness?

Finding the right path forward

We see humanity’s deeply split personality, generous and playful as well as obsessed with expanding our control of the world but need to find its source. Then we will finally begin to make progress, to slowly dig our way out of the terror our powerful minds seem to have created for us. Somehow we allowed our truly wondrous designs to create a new world of enormous cruelty, following their promise of relieving nature’s cruelty. That’s definitely happening, and definitely not good.

One of the paths to a cure could come from studying the differences between how people behave in one or the other way. We might then cure the blind way of abusing our powers by restoring the principles of staying in touch with environmental contexts. The direct approach, helping others immerse themselves in the natural environments they are in trouble with, works great using an experienced teacher. The living systems scientist like Ostrom or Midgley do it by lead communities through a process of exposure to how their worlds work, leading to their making much better choices.

As parents we also talk to our kids that way too, helping them to understand problems of insensitivity to others. Every good family does that, but the children still grow up to follow the rules of maximizing growing profits and ignoring the economy’s ever-growing impacts. That very clearly defines the split between how people behave in familiar contexts, where they can feel the strains on relationships, and in the public sphere where they don’t. In the public sphere rules for profit give people only feelings of self-interest and blind them entirely to the enormous building strains in the wider world’s relationships.

I’m not saying that is the only strong force causing humanity’s spiritual separation from life, but one we can see plainly enough to realize we very much need to act on it, despite the difficulty of communication that recognizing errors in our plans naturally creates.

Modern society presents other special problems of communication too, confronting us with thousands of self-serving silos of narrow beliefs, personal, social, religious, national, and professional. I look at them all as “cultures,” the “cells of knowledge” we build to guide us on how to think, work, live, and talk to give us some local sense of security in a confusing world. Cultures are also a saving grace as well as a way to divide us, given how most are deeply rooted in what worked in the past, with authentic copies passed on from generation to generation.

Of course, individual people have individual saving graces too, to use in helping us climb out of the trap we find ourselves in. Some have vision, steady hands, charisma, moral clarity, persistence, or wonderful person-to-person good hearts. Those don’t come from theories of control, that betray our powerful minds. They come from the opposite, from our loves and cares largely cut out of the public sphere by the rules we blindly follow. Saving graces in our institutions seem harder to find. We mostly built them around ideas of expanding control or being funded by it, not on learning how to make free associations work well.

What it seems we need to rely on is family culture and their central one for all and all for one life agreement. I’d include in that both the home and work families we center our lives on, which generally make us acutely aware of the non-verbal as well as verbal cues indicating openings and strains on our relationships. That is the very kind of environmental awareness that enables our personal and family survival instincts.

That is what seems most missing from the public sphere institutions, seemingly blinded by following abstract rules rather than navigating relationships with the world. It’s not even that the world doesn’t act as a whole. It certainly can and does, as you see in the effect of managing a global economy to work as a whole. To feel where the world is going, and change our collective steering, we’d need to count all the global strains we have not been counting.

An Experimental Partial List of the mostly uncounted growing strains on our relationship with life.

The Top 100+ World Crises Growing With Growth

__________________________

(note on the home science of Hestian proto-Greek culture now the new post: Bronze Age Roles of Hestia and Hermes

JLH