It seems our natural confusion about nature is quite natural. We are part of nature, but we behave so differently, seem so powerful and talented, yet have kept making huge mistakes throughout history. Is there a way for us to live “normally” and not keep having to make such lasting trouble for ourselves?

__________________________________________

One of the noticeable common patterns in both human and natural behavior can help us see the hand of nature, or God, if you prefer. Both our bodily and mental behaviors are energy processes, and in one important way, like all observable behaviors, they are alike in how they begin and end

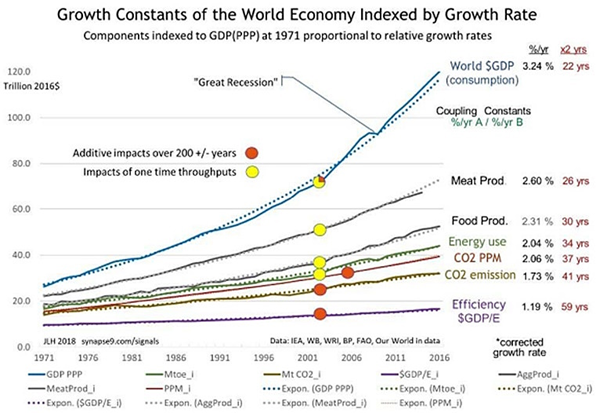

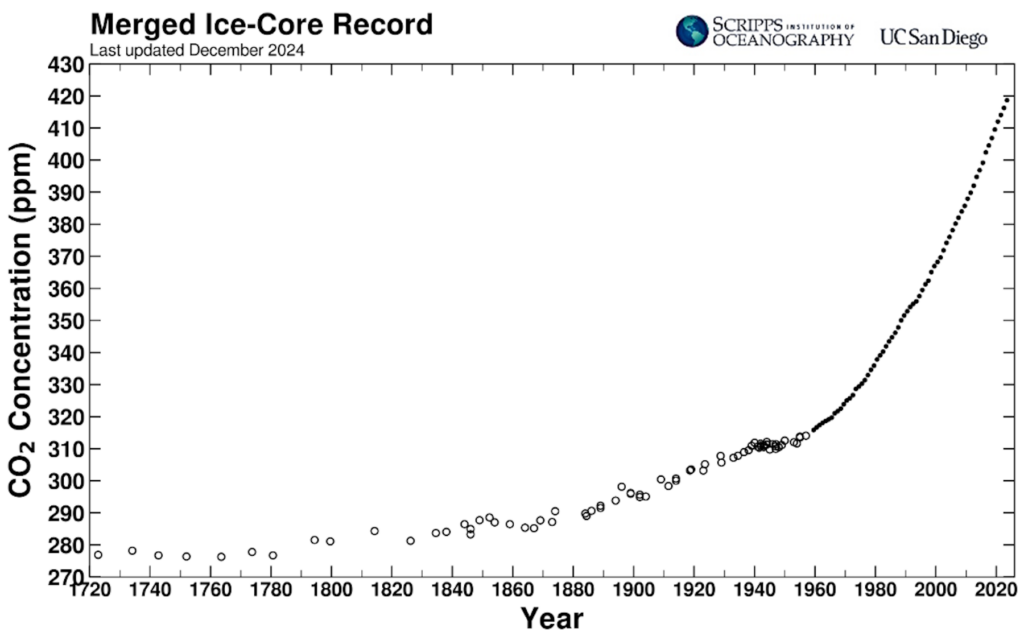

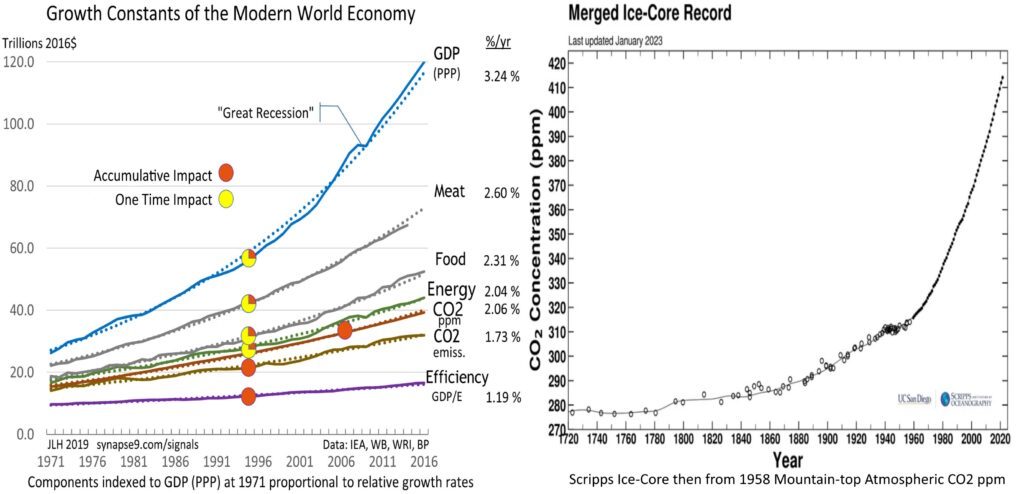

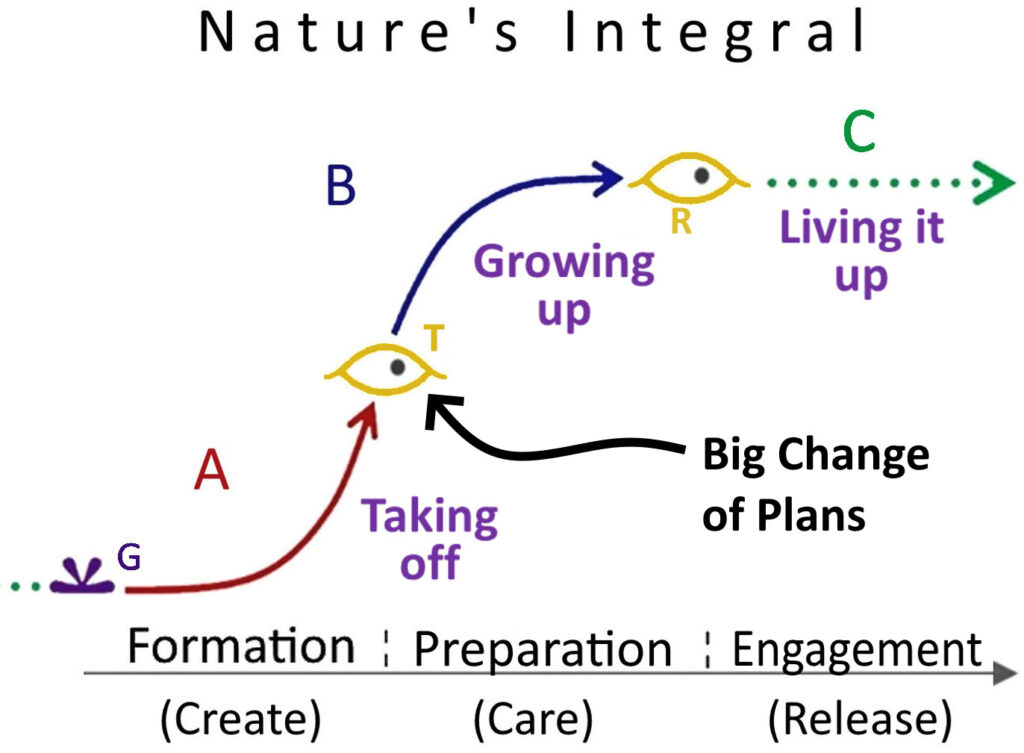

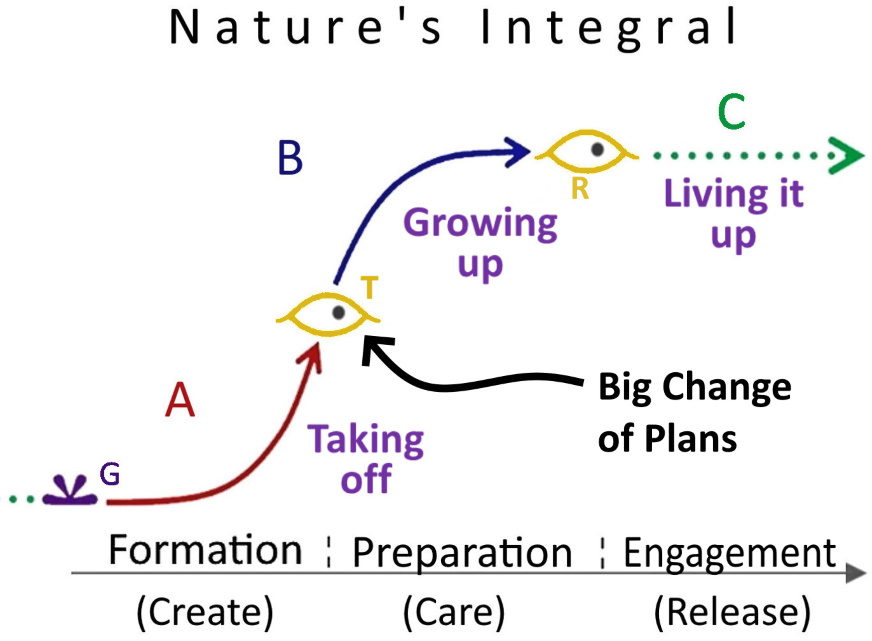

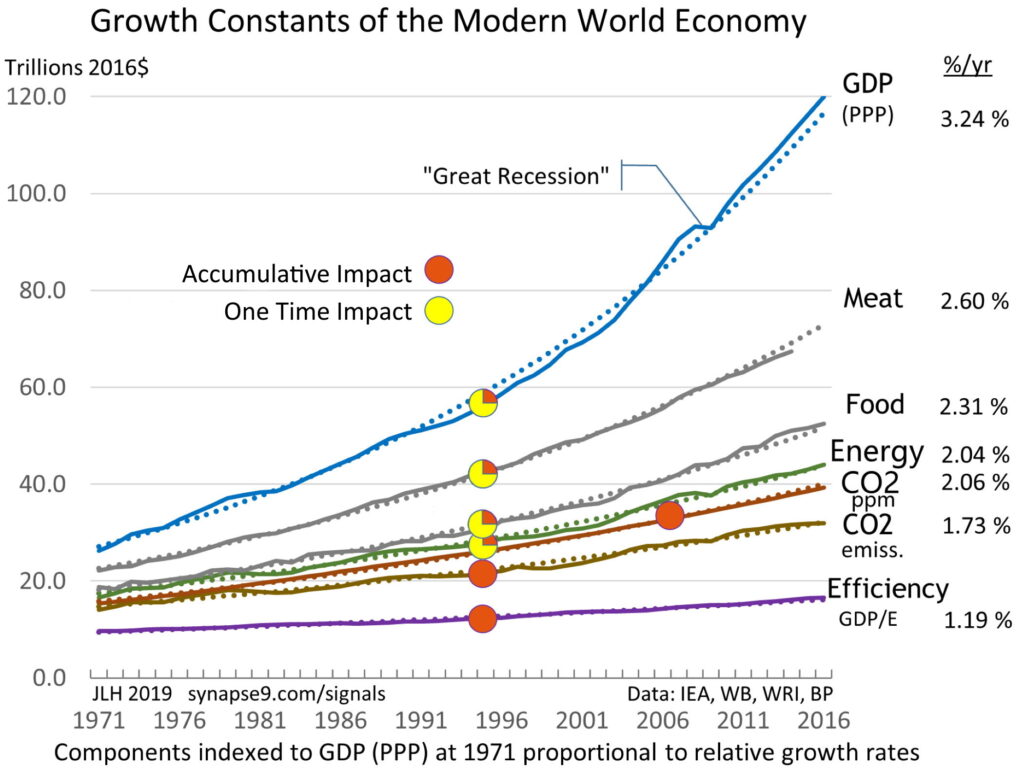

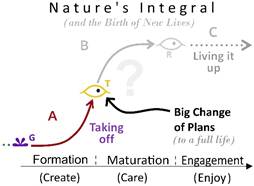

Their changes all begin and end with long or short chains of “emergence and convergence,” as local system “startup and finish-up” processes develop and subside, allowing nature to build up and taper off its energy system designs. They’re necessary for nature, including for our bodies and minds, but may only be visible from the pervasive, smoothly connecting S-curves of change that are found everywhere in nature.

- S-curves of Change, periods of emergence and convergence: All observable events begin with a period of cumulative compound growth, simply because nothing can start from its top rate of change, but has to start slow and build up.

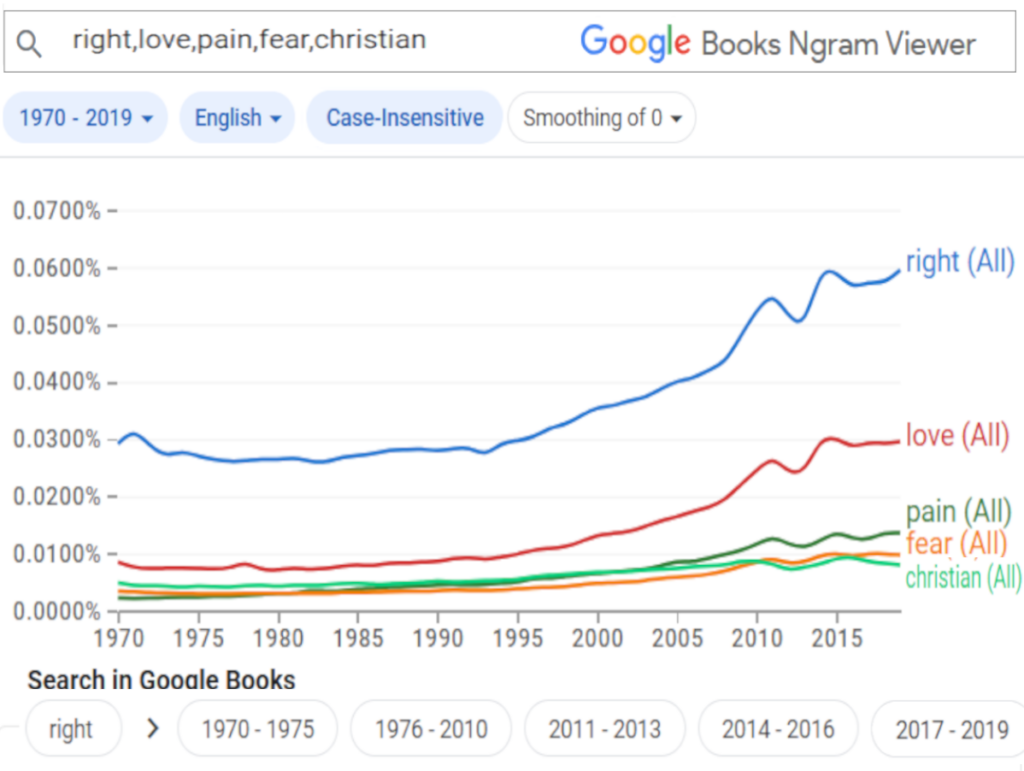

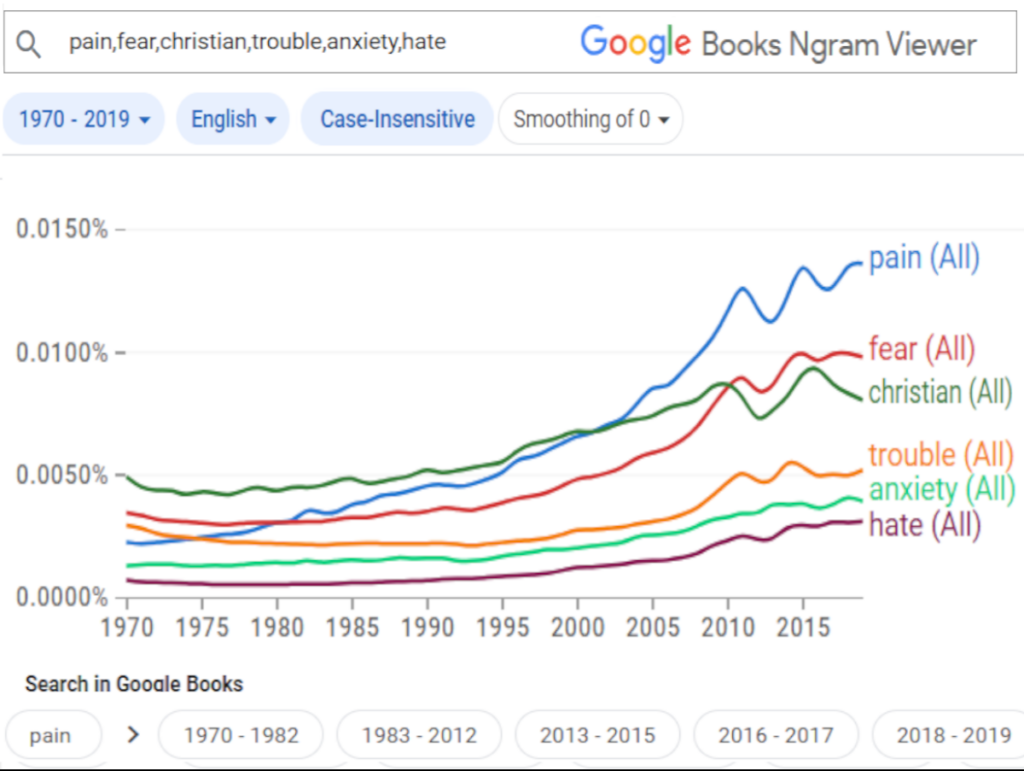

Those common features are parts of the solution. The great problem facing humanity is that as we separated ourselves from our animal experience, we also lost much of our once considerable ability to intuitively read what was happening around us, from our senses responding to the changing directions of these natural curves; symbolized above.

We still feel the sharpness of movements when traveling, sometimes signaling emergency needs for preparations or, the opposite, “that everything can relax.” We have thousands of words to describe these informative connections with the natural streams of information from the behaviors of the world around us. What would you do, for example, if great nations suddenly and rather wildly began heading off in unexplored directions?

It could happen, and it just did!! So, for as long as one can keep close to things that will still matter, the continuity of life and our connections with each other will be maintained. We also lose connection with how our world is responding to us by “making up stuff” about what’s happening, in place of “observing and feeling stuff.”

It seems not too hard to reeducate one’s bodily feelings that would normally respond to environmental signals of change, like feeling a hesitation is someone’s response to you, sometimes good to verify, sometimes better not to. It’s this way of being alert to what’s happening in a way that revives our original way of feeling our way along, reading the world as in step with our understandings, that will be key to successfully restoring a little comfortable order to the Earth again.om how they push one way or another, feeling comfortable or increasingly uncomfortable as “signals” from nature we feel in our guts.

What seems to have created a deep deception for us is that we started making up our own realities… rather than learning how falsely simplify our view of nature, we have generally represented those creative periods with equations, **erasing** evidence of their emerging processes and the contexts they emerge in, permanently blinding people to the organizational complexity of how nature works!

In effect, that choice represented all of nature with business models for how to interfere with nature for profit or to “buy low and sell high” in the business world.

The turning point in the history of mankind’s struggle with our own false self-importance –the only way to put it – came during the recovery of civilization, ~600 years after the Bronze Age Mediterranean civilization’s collapse from it. It was the emergence of science, from the great innovations offered by Thales, that formalized what we call “the growth to collapse model” for very creative, yet certain, civilization development to self-destruction.

It’s only a fairly firm research opinion, but science may have developed by combining the creativity of two earlier groups of Mediterranean cultures, group A) the marvelous design abilities of earlier Egyptian, Cretan, and Greek cultures, and group B) the Babylonian and Hebrew cultures that focus on abstraction and absolutes, providing the mathematical foundation for sysematicly empowering group A. That, unfortunately, also organizes modern civilization science designed around a business model for endlessly multiplying its power. Anyone could see it would not last, but for self-important people, it is often too captivating to resist.

The fatal flaw would not be noticed for a long time, as the highly profitable but faulty change in Mediterranean societal leadership from connecting group A design cultures focused on natural designs (which give warnings of destabilizing limits) and Group B cultures from the more unforgiving Fertile Crescent and Middle East, focusing on statistical rules that easily project to infinity, which tied to even forgiving natural environments will fail before the get there.

What caused the amazing productivity of these partnerships to end in utter disaster was probably discovered by many, but was put down again and again as social forces, as they so often do, for lack of explanations, and disoriented by their proven formulas for success terribly failing again and again, blind to the role of contexts.

Even today, society’s commitment to maximizing growth **without concern that the growing instability of ever more sudden change** (the actual symptom we’re experiencing that we feel as being jerked round) may not have a good chance of settling down as our growth systems turn to relieving strains and perfecting their designs, on the path to surviving our period of ever faster growth.

So,1) given humanity’s often misleading feelings of self-importance and 2) our deeply entrenched cultures committed to growth, we could collectively see the advantages of finding how to care for what we made, or keep bickering.

___________________________________________

JLH 2025-06-10