A wide and welcome discussion of our economy’s tendency to produce increasing “inequity” has followed the US publication of Thomas Piketty’s book, “Capital in the Twenty-First Century”, and offered me many chances to comment for general readers with interest in the deeper scientific questions. I think my best so far were my most recent two, for the special issue of the AAAS journal Science on “The Science of Inequality“. It’s really great to now have this chance to discuss the core dilemmas involved.

I hope not, but more or less expect, this opportunity to “come and go” without much consequence. That’s happened over and over, for a very long time. I’ve been watching it come up again and again for the past 40 years, and seen how each discussion fails to get to the heart of the issue, and have looked into the long history of “great debates” around it going far into the past. There are just clearly very deep conflicts between “how we think our money should work” and “how our world apparently works”, that are still with us. Science should be our tool for solving such problems, but hasn’t. So it seems we won’t get to the bottom of it until we find the right language to discuss it in. I think the language of natural systems is what will do the trick eventually, starting with “growth” being nature’s “start-up” plan and design for the invention and development of new types of systems, so the subject of what’s happening to our growth system is a good place to start. Let’s see! :-)

_______

Comments on Piketty’s inequality, “r > g”

For: – Science, the Financial Times, the Economist, New Yorker, Capital Institute, the Guardian, Salon, Piketty in ‘The Bully Pulpit”

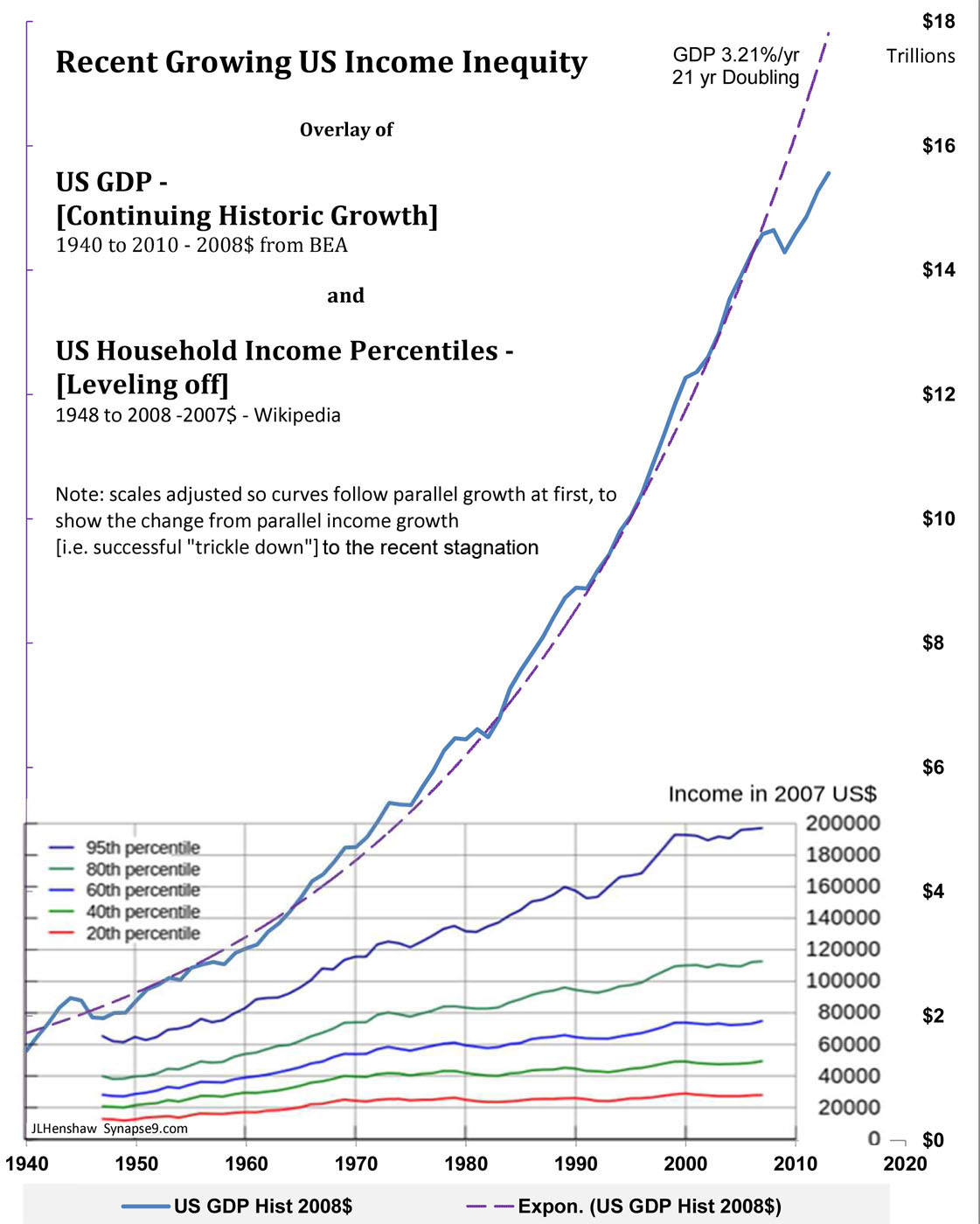

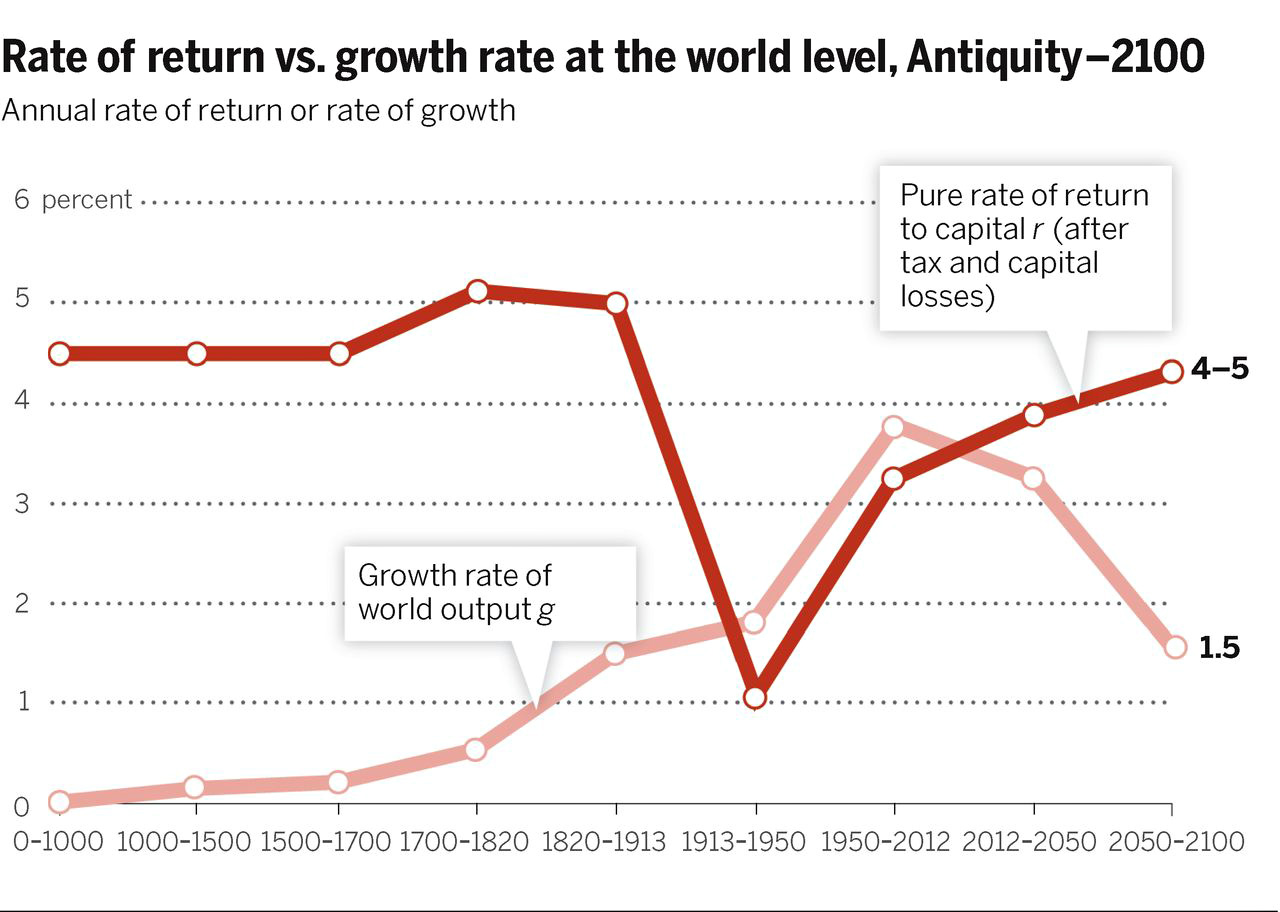

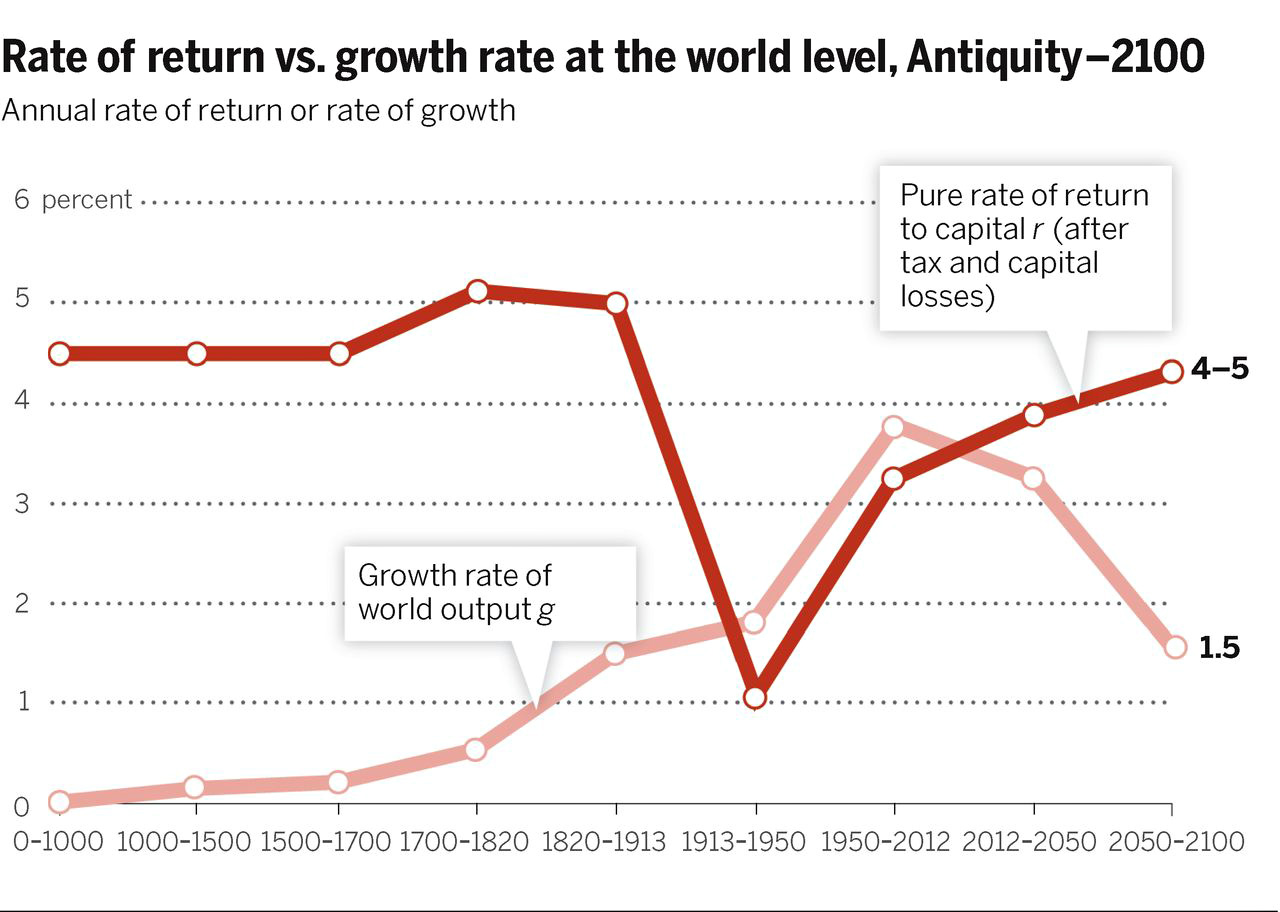

>> Returns on investment seem to outpace the Growth of the economy <<

(.. so incomes from wealth and work .. d i v e r g e ..)

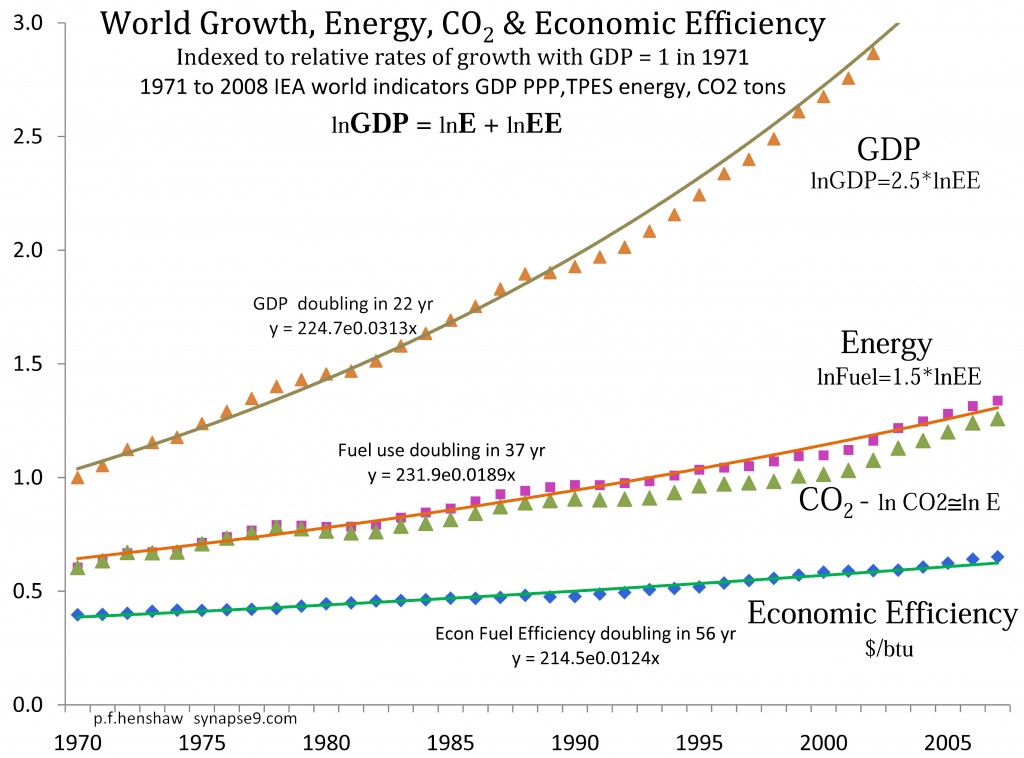

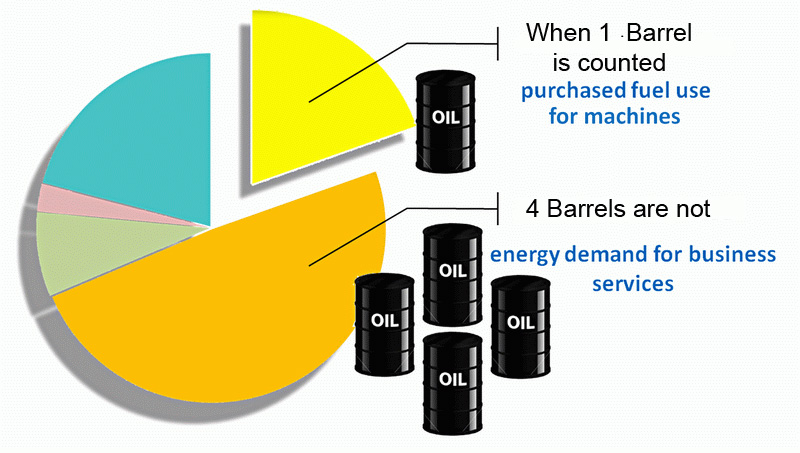

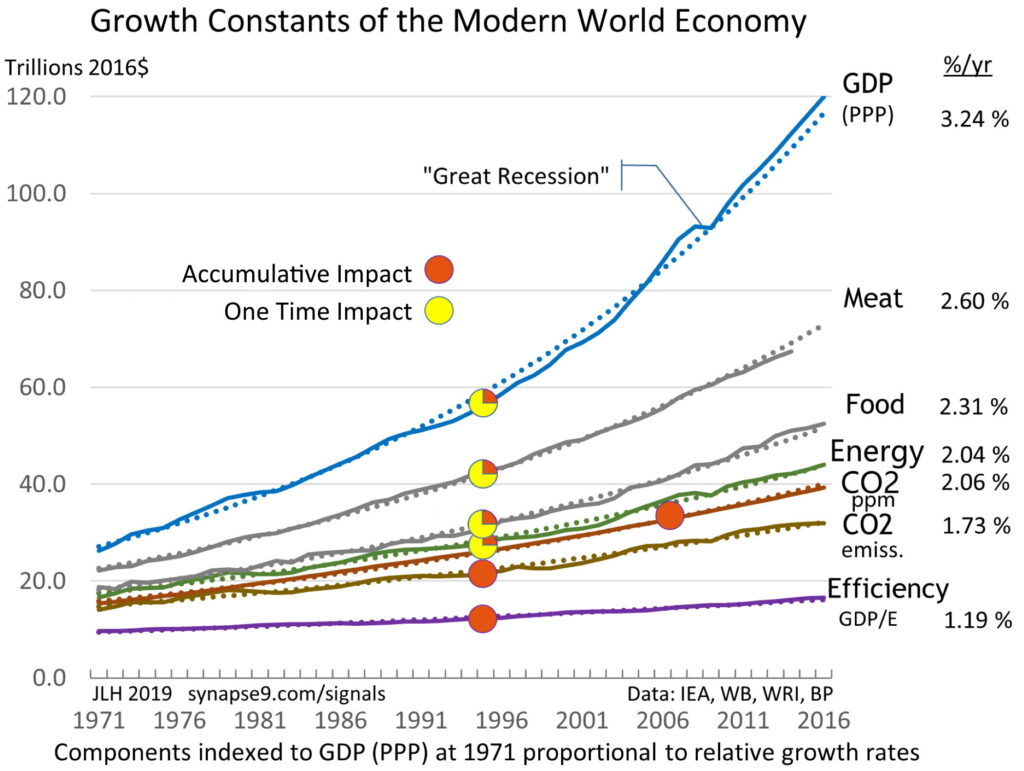

The true reason seems to be our long habit of maximizing growth ** measured as ** maximizing returns for re-investing …particularly now… when growth is pressing natural limits, and meeting natural resistance and complications that increase faster the harder we press them. What we need is to understand that turn of events. JLH

_________

Comments to the press:

I. on Inequality in the long run by Thomas Piketty & Emmanuel Saez; in the Special Issue on the Science of Inequality, Science magazine – Comment 5/28 link

As with the “Occupy Movement” the diagnosis of the problem here is really wonderful. And for me it is VERY satisfying that someone finally found a way to raise an actually serious discussion on it. I’ve also been studying this phenomenon, as a natural systems scientist, for 30+ years though. So as much as I am really delighted to again hear the complaint being well expressed, as “Occupy” also did, I don’t yet see a move toward the level of understanding needed to point to feasible (win win) solutions for it.

One step in that direction would be a discussion of how investors change what they invest in. This is a “system” after all, and we need to look at how it works. Buy using the profits from a “good bet” to multiply good bets you change the odds, by physically changing the environment being bet on. That also naturally concentrates unequal wealth, in the hands of investors using that leverage to multiply investments.

Historically that seems at the very heart of all financial manias, like the kinds that develop before great panics and crashes. The rub is “multiplying sure bets” does almost nothing more certainly than “create bad bets”. That prefer to believe in the manias, though, instead of the obvious is part of the emotional struggle and problem. So… we have contradictions here. We’re still talking as the economists long have, of “ever faster accelerating increases in scale and complexity” as a “steady state”.

OK, in a theoretical world that’s OK. But here the discussion of “inequity” poses a problem of unfairness, regarding having “unequal shares” of what we now also see is “ever increasing instability”. That’s not ‘OK’. ;-)

—

II. on Physicists say it’s simple by Adrian Cho; in the Special Issue on the Science of Inequality, Science magazine – Comment 5/27 link

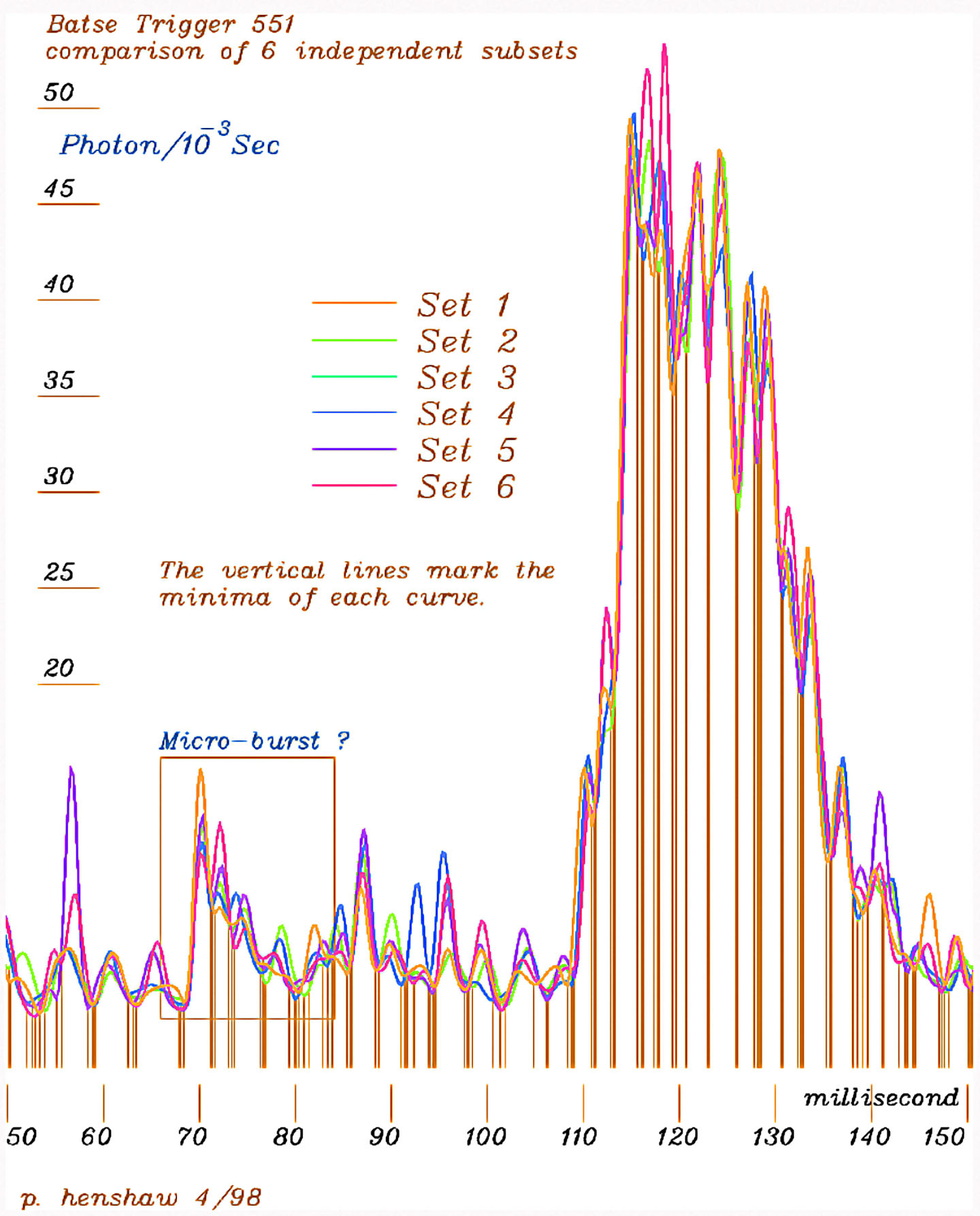

Physics is certainly the right tool for this, but you need a technique of getting the universe to slow down tremendously, to let you see how the seeds of swelling inequities emerge and what they lead to. I did that on the way to developing a new physics theorem, that I hope will soon to be widely studied.

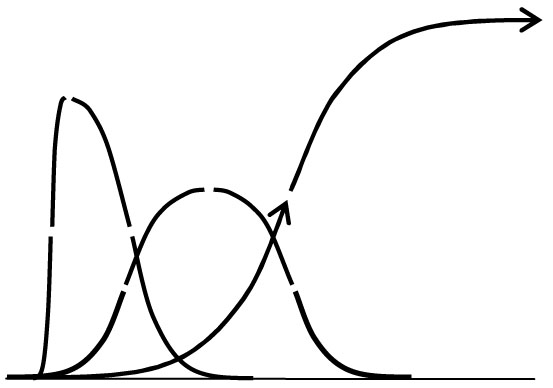

The theorem unifies the conservation laws to offer a general “law of continuity in change”. It doesn’t say theories can’t have discontinuities, only that uses of energy can’t, while pointing quite directly to nature’s marvelous “approximation to discontinuities”, her way of multiplying inequities on the way to precipitating dramatic changes in form in the organization in her complex systems.

Unifying the conservation laws shows its important to understand them as an infinite series of conservation laws, for all the derivative rates of change for energy use in physical processes. So as a whole it offers “a law of continuity”. http://www.synapse9.com/drafts/LawOfContinuity.pdf You can simplify the idea of it to saying “it takes a process to change a process”.

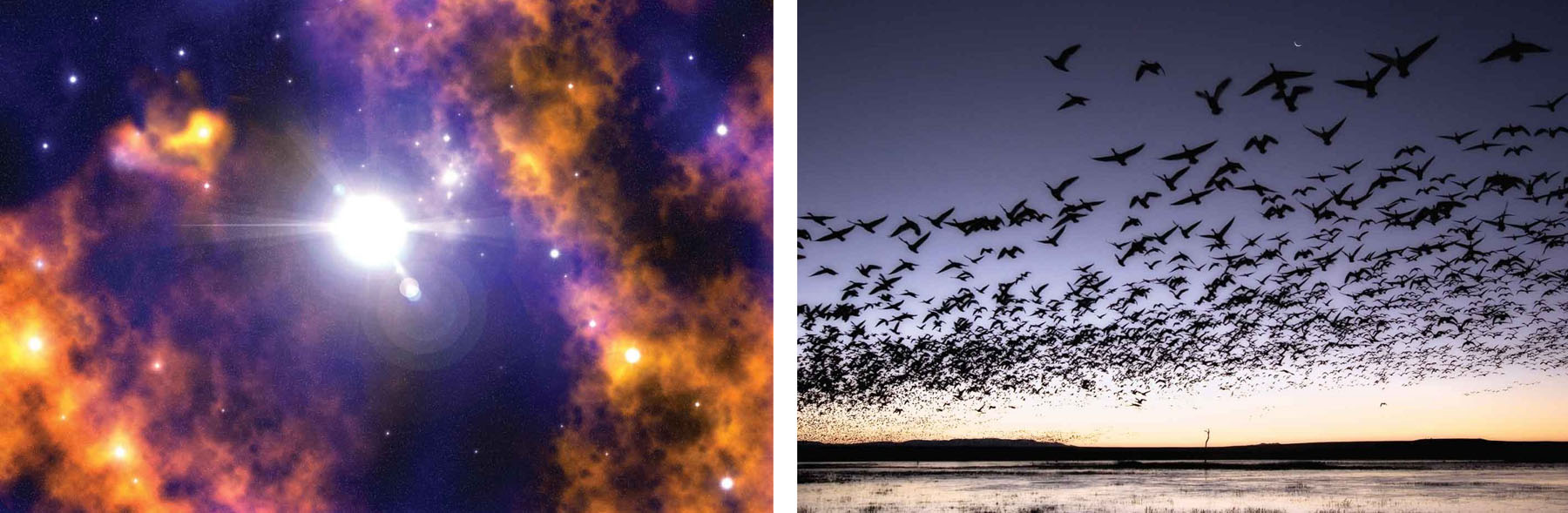

To see it happen you watch transitions intently enough to slow down the universe for your eyes, closely examining the steps nature takes to get things started, a fire, an eye blink, a plant, or any other “event”. What you find are little bursts of self-organization, following a non-linear trend most people would call “growth”, a process just full of things happening with a bang.

Growth is a distributed process of multiplying inequalities, is the relevance here. It’s a process of continually swelling inequities throughout a system, an explosion of increasing energy use, complex organization and change, that invariably triggers its own change in form. Where I first got the idea was by training my eyes to slow down the flowing changes of natural air currents, so I could watch “what made them so lively”, letting me discover how stable convection cells form from the instability of growing ones.http://www.synapse9.com/airwork_.htm

So, inequity is a natural byproduct of growth, essential to the systems growth builds, and as a process naturally leading to a change in form. In economics one common way for it to first cause growing inequity and then result in stability is by people realizing they’ve built as much as they can manage. Then they devote their resources to caring for what they built instead of continuing to build till that destabilizes it.

Is that possible for us?? I don’t know, but I think the physics implies we’re sure to find out.

— Continue reading a Whole Systems view – Piketty’s “r > g” →