A wide and welcome discussion of our economy’s tendency to produce increasing “inequity” has followed the US publication of Thomas Piketty’s book, “Capital in the Twenty-First Century”, and offered me many chances to comment for general readers with interest in the deeper scientific questions. I think my best so far were my most recent two, for the special issue of the AAAS journal Science on “The Science of Inequality“. It’s really great to now have this chance to discuss the core dilemmas involved.

I hope not, but more or less expect, this opportunity to “come and go” without much consequence. That’s happened over and over, for a very long time. I’ve been watching it come up again and again for the past 40 years, and seen how each discussion fails to get to the heart of the issue, and have looked into the long history of “great debates” around it going far into the past. There are just clearly very deep conflicts between “how we think our money should work” and “how our world apparently works”, that are still with us. Science should be our tool for solving such problems, but hasn’t. So it seems we won’t get to the bottom of it until we find the right language to discuss it in. I think the language of natural systems is what will do the trick eventually, starting with “growth” being nature’s “start-up” plan and design for the invention and development of new types of systems, so the subject of what’s happening to our growth system is a good place to start. Let’s see! :-)

_______

Comments on Piketty’s inequality, “r > g”

For: – Science, the Financial Times, the Economist, New Yorker, Capital Institute, the Guardian, Salon, Piketty in ‘The Bully Pulpit”

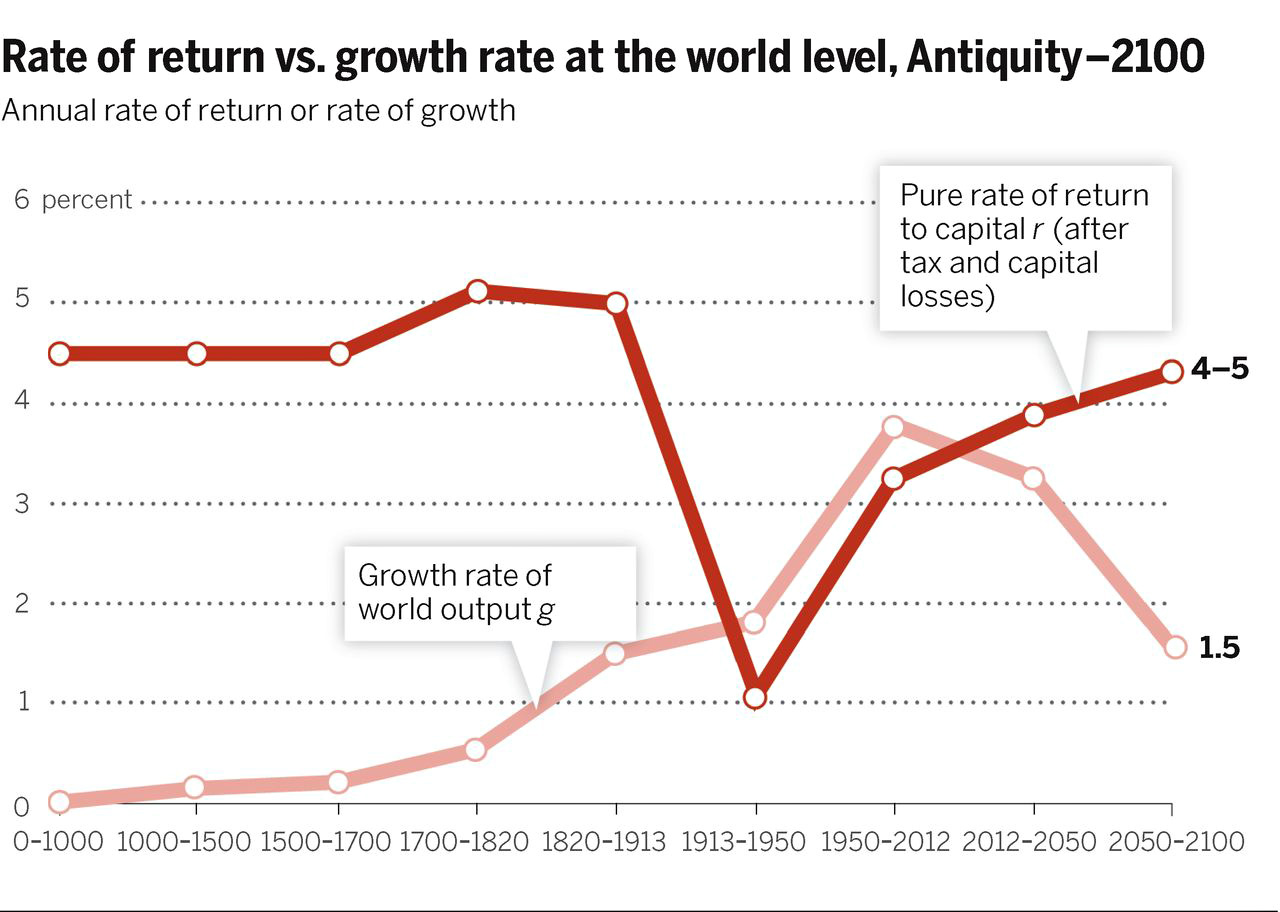

>> Returns on investment seem to outpace the Growth of the economy <<

(.. so incomes from wealth and work .. d i v e r g e ..)

The true reason seems to be our long habit of maximizing growth ** measured as ** maximizing returns for re-investing …particularly now… when growth is pressing natural limits, and meeting natural resistance and complications that increase faster the harder we press them. What we need is to understand that turn of events. JLH

_________

Comments to the press:

I. on Inequality in the long run by Thomas Piketty & Emmanuel Saez; in the Special Issue on the Science of Inequality, Science magazine – Comment 5/28 link

As with the “Occupy Movement” the diagnosis of the problem here is really wonderful. And for me it is VERY satisfying that someone finally found a way to raise an actually serious discussion on it. I’ve also been studying this phenomenon, as a natural systems scientist, for 30+ years though. So as much as I am really delighted to again hear the complaint being well expressed, as “Occupy” also did, I don’t yet see a move toward the level of understanding needed to point to feasible (win win) solutions for it.

One step in that direction would be a discussion of how investors change what they invest in. This is a “system” after all, and we need to look at how it works. Buy using the profits from a “good bet” to multiply good bets you change the odds, by physically changing the environment being bet on. That also naturally concentrates unequal wealth, in the hands of investors using that leverage to multiply investments.

Historically that seems at the very heart of all financial manias, like the kinds that develop before great panics and crashes. The rub is “multiplying sure bets” does almost nothing more certainly than “create bad bets”. That prefer to believe in the manias, though, instead of the obvious is part of the emotional struggle and problem. So… we have contradictions here. We’re still talking as the economists long have, of “ever faster accelerating increases in scale and complexity” as a “steady state”.

OK, in a theoretical world that’s OK. But here the discussion of “inequity” poses a problem of unfairness, regarding having “unequal shares” of what we now also see is “ever increasing instability”. That’s not ‘OK’. ;-)

—

II. on Physicists say it’s simple by Adrian Cho; in the Special Issue on the Science of Inequality, Science magazine – Comment 5/27 link

Physics is certainly the right tool for this, but you need a technique of getting the universe to slow down tremendously, to let you see how the seeds of swelling inequities emerge and what they lead to. I did that on the way to developing a new physics theorem, that I hope will soon to be widely studied.

The theorem unifies the conservation laws to offer a general “law of continuity in change”. It doesn’t say theories can’t have discontinuities, only that uses of energy can’t, while pointing quite directly to nature’s marvelous “approximation to discontinuities”, her way of multiplying inequities on the way to precipitating dramatic changes in form in the organization in her complex systems.

Unifying the conservation laws shows its important to understand them as an infinite series of conservation laws, for all the derivative rates of change for energy use in physical processes. So as a whole it offers “a law of continuity”. http://www.synapse9.com/drafts/LawOfContinuity.pdf You can simplify the idea of it to saying “it takes a process to change a process”.

To see it happen you watch transitions intently enough to slow down the universe for your eyes, closely examining the steps nature takes to get things started, a fire, an eye blink, a plant, or any other “event”. What you find are little bursts of self-organization, following a non-linear trend most people would call “growth”, a process just full of things happening with a bang.

Growth is a distributed process of multiplying inequalities, is the relevance here. It’s a process of continually swelling inequities throughout a system, an explosion of increasing energy use, complex organization and change, that invariably triggers its own change in form. Where I first got the idea was by training my eyes to slow down the flowing changes of natural air currents, so I could watch “what made them so lively”, letting me discover how stable convection cells form from the instability of growing ones.http://www.synapse9.com/airwork_.htm

So, inequity is a natural byproduct of growth, essential to the systems growth builds, and as a process naturally leading to a change in form. In economics one common way for it to first cause growing inequity and then result in stability is by people realizing they’ve built as much as they can manage. Then they devote their resources to caring for what they built instead of continuing to build till that destabilizes it.

Is that possible for us?? I don’t know, but I think the physics implies we’re sure to find out.

—

III. on Policy, not capitalism, is to blame for the income divide, Paul Mason in the Financial Times May 27 Comment link

I think everyone is overlooking several important things… but one at a time. The persistent failure of investors to see limits to their investing has preceded every great financial crisis…

From a biophysical systems view it’s caused by the “mirage” that you can keep compounding your earnings in what seem to be sure bets. The information lag will kill you every time. Even if we technically know that, in their minds investors just don’t lose faith in the mirage, as if they just don’t know what else to do. So they cling to the mirage as it multiplies bad bets.

So, it seems we need to sour on the idea of limitless accumulating capital. That will open the door to asking “what else is there to do?” We really need to know what to do with this amazingly wonderful machine for generating wealth we built, that is, …other than to compound our demands on it till it fails us (again).

What is hard about the real answer is the need to reach all the way back to “NORMAL LIFE” for the simple answer, that after you build things you need to take care of them. It applies to economies too. The money that goes into building is wasted if you keep building till in the end you can’t take care of what you built.

It’s an absolute law of nature really. Lots more on it at https://synapse9.com/signals

—

IV. on FT analysis of my book is ‘ridiculous’, says Thomas Piketty in The Independent May 27

T.P. – Congratulations on stirring up a storm. I think you’d maybe take it further if you asked why economies start with “g > r”, as how any growth system begins, and growing inequity commonly precedes the tragic whole system panics.

The connecting element is that 1)investment builds systems and 2)investors don’t see the time when they need to stop building to care for what they built. The mirage of limitless compounding sure bets gets them every time, that in a biophysical world can only end up compounding bad bets.

The arguments about measurements may not be settled as easily as the implications of the principle involved.

—

V. on A Piketty problem? by R.A. in The Economist

The arguments about measurements may not be settled as easily as the implications of the principle involved.

Growing inequity seems to generally precede grand scale financial panics, as a period of heady excess expectations and “irrational exuberance”. In those cases investors believe they are compounding sure bets, but are really just possessed by a mirage and compounding bad bets. It’s a very natural trap, that everyone knows about, goes to a lot of effort to avoid, and generally can’t in the end.

The real problem is that any system producing growing returns starts by producing a surplus, investors seek guarantees for it as a condition for investing… and if they’re provided they keep taking growing returns from the system they’re betting on till it ends in deficit.

The deficits that biophysical systems face (i.e. real whole economic cultures)can lead them to physical bankruptcy, in otherwise healthy seeming growth systems. Overbuilding to the point that there are insufficient resources to maintain what was built is one.

You can measure that as: growing inequity, loss or resilience, weakening infrastructures, excessive and invasive competition, declining adaptability, depleting and more costly resources, burdensome complexity, increasing overhead, increasing risks, unpredictability, etc… Those are measures of whole system “poor health” and “inability to thrive” for a system driven to grow beyond comfortable limits.

Still, if investors have guarantees…then compounding sure bets is so seductive it generally just multiplies, till all it multiplies is bad bets, with no one noticing till its too late.

To break the habit someone needs to notice that an economy is no different than a home. You need to stop building and use your income to take care of it, while you still can.

—

VI. On Piketty’s inequality Story in Six Charts and Forces of Divergence

by John Cassidy in The New Yorker

I greatly appreciate your versions of Piketty’s charts, and your longer “Capital in the Twenty-first Century”. I’m a systems physicist who developed a general physics of complex system development that helps me study all kinds of growth systems in nature (natural systems physics). I’ve been following the fateful course set for our economy since I learned how, for some 35 years. It’s unreasonable to expect it to continually double its output as our costs for the externalities produced double even faster.

The heart of the problem is that an economy is a complex physical system with myriad independent learning parts. Our theories are logic systems that portray the economy behaving logically, and on a course of quite uninhibited limitless expansion.

Because it is actually a collective learning system, being pressed to grow exponentially against numerous stiff physical limits, it is under increasing strain, to “make bricks without straw”, taking increasing risks with expanding demands for depleting resources, increasing complexity and decreasing resilience, attempting radical reorganization affecting wide sectors of society, with little idea of the consequences.

We need to look more closely at the inability of investors to see the approaching limits to their investing. There’s a notable burst of increasing investing and concentration of wealth prior to financial panics, a wealth fever. It’s a cultural mirage, of course, especially tempting in times of increasing risks when added pressure can produce increasing returns. It encourages overconfidence, that compounding investment in what seems like sure bets, is OK, as it creates bad bets.

Another thing to look at is the relative explosion of neglected externalities, as an “off budget” future societal cost. Neglected costs for our future are treated as a “societal subsidy” for negligent investment. If the real costs of profiting from depleting resources and squandering chance to avert climate change were “internalized”, it would totally change the motivations of investors. There are ways to measure the costs for the future that businesses are responsible for profiting from today but that isn’t getting factored in at all.

We could talk about a lot more. I’m on the UNEP FI technical working group drawing up a financial industry guidance for CO2 investment risks. There is close to no interest in even supporting research into these issues. They don’t see that as any part of the fiduciary responsibility of people making financial decisions for others… not at all.

https://synapse9.com/signals

https://synapse9.com/signals/2014/02/03/a-world-sdg/

—

VII. on The Central Contradiction of Capitalism that Piketty Overlooked

by John Fullerton in The Capital Institute, comment 5/22/14

John, I think you’re right that Piketty misses a great opportunity to tie the “r > g” idea to the “limits to growth”. With a careful look at history what I find is that there are several quite important choice points along the path from the initial hope it won’t work out that way… to the inevitable distressing end he and you and everyone else describes, and sees, and regrets. It’s what seduces us into so foolishly believing we can maintain “g > r”, despite the very clear and hard evidence of that failing all the time… that sometimes it doesn’t.

The real “central contradiction of capitalism” then, is that it promises “g > r”, and then we inevitably find it is only **temporary**. When you carefully study the steps of that “SNAFU”, you find other interesting questions. There’s no doubt whatsoever that there ARE simply wonderful growth opportunities. It is also absolute fact that everything we like actually begins with one. Growth is actually nature’s universal start-up process, used to initially build every life, including the lives of every business, and the lives of every society. Nature begins building things with growth. She’s then also happy to destroy them with more of the same, those lives that began with healthy growth that make the fateful choice of continuing to devote their resources to driving their internal and external strains to the breaking point, trying to make G > R perpetual. It can’t be. So it’s not important to try. It’s stupid to try.

So the secret to the puzzle seems to be:

**Once you’ve taken growth from “G > R” to spoiling its promise in its “R > G”**,

you’ve already missed the real opportunity it presented

—

VIII. 1) to 4) in comments in the Guardian

on Thomas Piketty’s real challenge was to the FT’s Rolex types

1) http://discussion.theguardian.com/comment-permalink/36220473 27 May 2014 8:31pm

Why don’t we ask the other question??? If increasing inequity grows in the end, so the productive economy does nothing but lose money… then… why don’t it also do that in the beginning???

It couldn’t have, of course. As things start they need to be profitable. What you need to ask then is “what changed”. What you find is THE SAME THING THAT CHANGED AND PRECIPITATED EVERY FINANCIAL CRISIS IN HISTORY. What changes is that the ever growing investment in “sure bets” produces “bad bets” (a clear and certain law of nature… that -people never seem to learn-).

If people were to learn… it would be that once you build something, it will fail if you don’t take care of it. The illusion that wealth can multiply wealth even in an economy “losing money on every sale”, is only a precedent to failure, the bust at the end of a very long chain of self-deceptions. Just because your financial wheel is owed ever more money, doesn’t mean the people who seem to owe you will be able to pay.

Or… those with wealth could learn TO TAKE CARE OF THE SYSTEMS GENERATING THEIR PROFITS, and use their profits for making the economy sustainable rather than driving it bankrupt.

—

2) http://discussion.theguardian.com/comment-permalink/36221004

The book doesn’t get the whole point ether, that the reason why money keeps making more money faster than the economy… is that the rich are possessed by the very same illusion that preceded every great financial panic in history.

When you multiply sure bets you end up with bad bets.

The “Rolex solution” won’t set it quite right. The rich would need to learn how to take care of the systems generating their profits. Anything you build in life then needs to be cared for, or it fails you.

—

3) http://discussion.theguardian.com/comment-permalink/36221259

The differences in numbers don’t eliminate the underlying problem, though, that multiplying your sure bets as is the habit in finance, that creates the ever growing inequity as overall growth slows, is a SERIOUS PROBLEM FOR THE BETTERS TOO.

The outcomes vary some, but the illusion that you can keep doing that without turning your sure bets bad appears to be the root cause of every great financial panic in history…

—

4) http://discussion.theguardian.com/comment-permalink/36221624

You don’t actually need a lot of analysis to prove the point, just to solve the problem once you see the problem.

From a natural systems view of growth systems it’s clear that they’re inevitably “S” curves, finding more and more resources faster and faster, till they don’t. Then those that “husband their resources” can survive essentially forever.

From a financial systems view money grows without limit, at ever faster increasing rates. That’s the illusion that precedes every great financial collapse too, that you can keep multiplying your bets so long as someone else lives up to their promises. They won’t.

The way out is for the wealthy to learn to care for the systems they are profiting from, now being pushed beyond their sustainable limits. That’s the healing and enduring “end of growth”…i.e. learning to live well.

—

IX. on The problem with Thomas Piketty by Thomas Frank in Salon

“Capital” destroys right-wing lies, but there’s one solution it forgets After “Capital,” we’ll never talk income inequality or meritocratic myths the same way. But we must talk unions”

Every new angle deserves a good discussion, when there’s a tightening rope around your neck! … Piketty forgets more than one major reality.

Labor unions are important to consider, but I honestly don’t think they can compete with ever faster growing inequity like Piketty points to as endemic in our economic system. There does seems to be another quite important unexamined question here.

The principle “finding” is that “R > G” (i.e. that the compound rate of expanding savings is greater than the compound rate of expanding wealth). What’s totally missing from it is that the reverse is ALWAYS true… but only at *the beginning* of new phases of growth (and then it always reverses).

That “G > R” is always true is specifically for the “start-up” phase of growth… when the new opportunity being exploited is “fresh” and new resources are being discovered faster than you can use them. As that is inevitably **temporary** constitutes the highly useful part of what seems so overlooked in this whole discussion.

Keynes, not surprisingly, was not half as shallow a person as today’s intellectuals like to paint him as being. He actually studied that quite natural problem and resolved the simple and obvious solution. That solution, of course, is for people using the economy to accumulate savings to follow the opposite principle at those times when R > G naturally begins to dominate.

That opposite principle requires you to stop compounding your earnings as it begins to destroy the economy you are taking your earnings from. That would be logical, no? But the question is could people ever be “logical”, and not hang themselves when their early pipe dreams turn out to be limited?

I’ve written about the many deeper in’s and out’s of that in various ways, but you might start from searching my site for mentions of Keynes

—

X. on Thomas Piketty: Did Inequality Contribute to the Financial Crisis?

by T. Piketty in The Bully Pulpit , comment May 22

I don’t think swelling inequity contributed so much to the last crisis in general. I do think there’s a real reason why swelling inequity seems to have preceded every great financial crisis though. I’m a systems scientist, and have been following this story for 30+ years, wondering why the community has yet to notice that economies become unstable if they have no good way to cap unbounded exponentials.

It’s the mirage, I think, that keeps investors from seeing the need for that, causing them to become repeatedly overtaken… by the appearance that you can keep compounding bets in a sure thing. The only truly “sure thing” about that is piling up bad bets. It “gets’m every time” though, throughout history it seems.

I could go into a lot more detail, but if in the end “r > g” as a rule, and in the beginning, to get started, you would naturally have had “g > r”, there are only a few options available to get back to “r < or = g” in the long term. The biophysics seems rather clear, that investors would need to feel some kind of revulsion for the mirage of limitless compounding bets or we’ll just have another, surely worse, financial crisis.

If there was a “break” and the power of the mirage of limitless wealth then we might talk about the one most normal true solution. People would have a chance study why it is in life that after you build things you need to take care of them, especially if you rely on them for your own income.

That simple realization could have lasting value in our situation I think.

____________

JLH