On now to recognize the somewhat universal responses to system and relationship overload, as strains resulting in loss of resilience and a risk of sudden disruption; replying to Helene on Systems Thinking World on her “UN Call for Revolutionary Thinking” thread.

The most general pattern is resilient relationships becoming rigid, like the surface of a balloon does *before* it can be easily pricked by a pin, or as people become rigid before losing patience. I think that comes directly from resilient systems generally being organized as networks of things that share their resources, and when all the parts run out of spare capacities to share at once the system can’t be flexible, and is then vulnerable to sudden failure.

_________

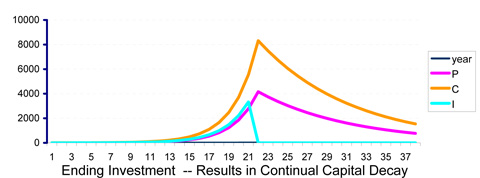

@Helene – Thanks for the reminder. Here are some principles for detecting and responding to the inflection point. Mathematically it’s “passing it’s point of diminishing returns”, when increasing benefit of expansion starts to decrease. Long successful habits of expanding a system become a liability, and strain their internal parts and environments.

It means about the same thing for a whole economy as for a little girl outgrowing her only party dress. Ignoring strain on one’s limits brings an unexpected end to the parties. The problem for systems operated by abstract rules of thinking, is that responding to change isn’t in the rules. So there’s a need to revive common metaphors for responding to the unknown, like for “overdoing it” or “crossing the line”, as strategic signs of externalities needing close examination.

The most common signs of “overdoing it”, and needing new strategy, are formerly stable and flexible sub-systems

becoming “unresponsive”,

developing “the shakes” or “become rigid”

Continue reading Principles for detecting and responding to system overload