This post was for the UN’s OWG 5 meetings on Sustainable Development Goals (SDG’s) from 11/23 to 11/27, submitted as an NGO contribution to Post2015 energy development positions. The issue here is that there’s a big mismatch between local and global measures for current accounting methods used to estimate the energy uses businesses are responsible for. It’s an accounting discrepancy commonly on the order of five or tenfold, i.e. so large and undefined that local measures become not scientifically comparable. It comes from the way the local measures are defined not including a way to account for the energy uses incurred as businesses pay for the services they use to operate. The global accounting includes them by being the total of all economic energy uses combined.

They have “consumption for production” just like technology, but just not yet being counted!

_____________________

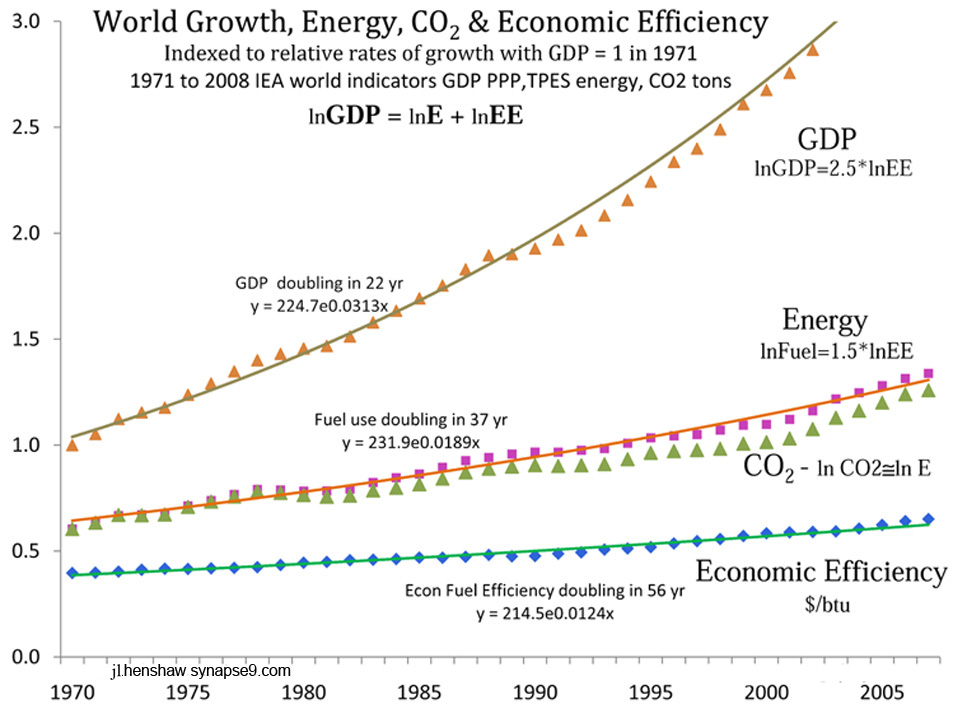

The global data is very clear, increasing GDP always requires proportionally related increases in energy use. Our local sustainable business plans for all sorts of projects seem to suggest the reverse, though, increasing revenue (fractions of GDP) with decreasing energy use!

What’s up?? Our math and the world’s seem to disagree!

Could some projects be outsourcing energy services and not knowing it??

There are two possibilities. Either there are hidden energy uses that our SD proposals are a)not responsible for, or that they b) are responsible for. It’s hard to chase down puzzling discrepancies like this, but this one had an answer, published in Sustainability (MDPI) in 2011, as Systems Energy Assessment (SEA).

What seems to be happening, all over the world, is the amount of **untraceable energy use** is growing… and so making SD figures unreliable and overly optimistic.

Continue reading Local views of global systems – mismatch of impacts & responsibilities