This is as simple a story of this amazing change in our economy. What happened is that the economy ran into increasing resistance from the environment. The inequity came from how that slowed down wage growth more than the investment income growth. Below are two simple ways to understand the natural cause of the problem, that were posted to the discussion on NPR.org today.

“A challenge to the new congress: Fix Stagnant Wages“

Without a major rethinking of our growth strategy it really can’t be fixed, not by this congress or any other, as it’s “natural”. The problem is our growth strategy is running into ever increasing natural “drag” and “resistance”, that affects labor more than investment earnings.

See also my recent articles:

“Kepler” – a great story of student discovering how to understand the big picture

“a Whole Systems view – Piketty’s “r > g” – Relating it to Thomas Piketty’s book on global inequity

- Comment 1

You never seem to be allowed to talk with the people who know why wages began stagnating in about 1970. There are very specific natural reasons.

Keynes predicted it. I’ve detailed it to the Nth degree. It’s a perfectly common problem in many ways. The simple word to call it is just “drag”. The economy is meeting ‘drag’.

You experience drag as a kind of resistance to what you were doing before. There are millions of kinds. The evidence of very numerous kinds of resistance increasing at accelerating rates more or less all together at once, for the whole system… goes back about a century.

You should talk to people who know.

https://synapse9.com/signals/20…

- Comment 2

None of you seem to understand that economies are designed to run themselves. Nobody mentions that in the media either, or even the smart pundits. I guess it’s because the people you hear talking about it are really just competing for attention or promoting their ‘angle’ or don’t know any better.

The real situation is that economic growth is stimulated by the money earned by investors being added to the pool of money for creating more businesses. So with growing investment you get a growing economy,… and it’s markets expand, using more and more of every resource they can find on earth…, till something goes wrong.

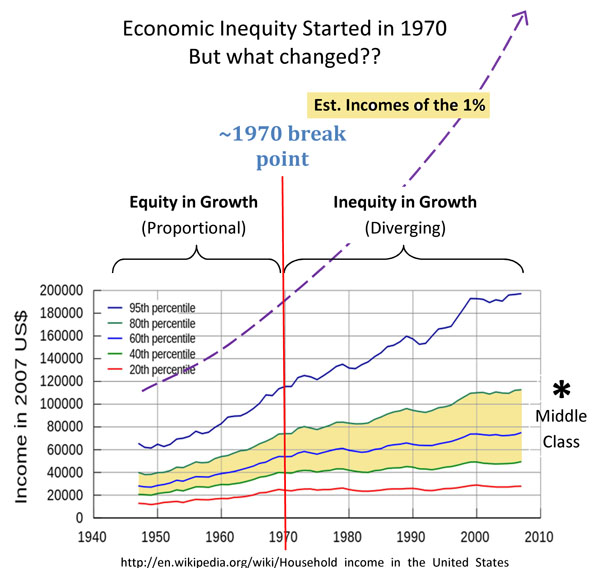

When things are going right, like in growth periods up to 1970, the incomes of the rich grow faster than anyone else’s, *but* there’s enough left over to “trickle down”, so the incomes of everyone else keep growing too, just a little slower than for the rich. After ~1970 the relative rates started spreading apart further and further, till most people don’t even increase their incomes as fast as inflation…

One of the things going wrong is the economy is running into natural resistance, from its growth having changed the world, to make it less bountiful. The economy is slowed down by needing to use more costly resources, from increasing complications of regulation, increasingly complex designs and teamworks needed to get anything done, increasing costs of global competition and conflicts between industries demanding growing shares of diminishing resources.

What’s most obvious if you look at the data is that after 1970 growth continued for the richest and not for the rest of the wage scales. I think there were all the above problems creating drag for the whole system, effecting the productive economy and lower incomes the most, and the people at the top the least. People of course saw that was where to make the money, and those that could went in to investing to use money to may money that grows without actual work. Investing is a kind of ‘work’ where the more money you have the more you earn, without any actual “labor”. So, that kind of earning really took over.

There’s lots more interesting to say, looking at the economy as I do as self-guided system driven by people’s choices and the capacities of the earth the find to use and use up that way. The bottom line, though, is that there’s too much unproductive investment.

The one and only way to reverse that (other than “resetting” the game with gigantic financial collapses) is for the wealthy to *spend* their earnings rather than *accumulate* more unproductive investments. JM Keynes actually proposed that would be necessary, as the solution for this very problem, that he saw as likely to come up in what he saw as the relatively near future, from the 1930’s.

I’ve written lots on it myself, but it’s “unpopular” because you need to look at the financial implications of our having been running into increasingly resistance to growth as approaching limits, for 50+ years…. That subject was made socially “taboo” in discussion groups not unlike this one all over the world in the 70’s, in case you don’t know about that. And the whole world went to sleep in total denial of there being limits to growth or anything eles, population too.

_______________

jlh

Category Archives: Natural Economy

how economies can work comfortably within ecologies

Kepler

…and the laws that move you from maximizing power to maximizing resilience.

Like many young college women Kepler awoke that morning with other things on her mind than the project she had planned for the day. She had been dreaming about how she loved her drawers of personal things, in colorful piles, neatly rolled, in little bags and folded, each in its own style and fit together. Maybe she would become a “collector”, she thought, they gave her such a thrill. How nature was “quite a collector” too fascinated her too, creating all the natural world’s very special arrangements, with everything having it’s own individual home, utterly improbable in such number and variety, and so highly organized and grouped with fitting parts everywhere.

She’d also been told that lots of scientists thought nature’s patterns came from a natural law of energy, that everything sought to maximize its power, which honestly, just made her wrinkle her forehead… She did not know, of course, but thought there was something hidden in the magic of how things in nature so often yielded to each other, an obvious secret to how things come to fit so closely. So she quietly thought perhaps that seemed at least or was perhaps even more important.

What she had planned to do that day was use her old graphic calculator from high school, to do an experiment in rewriting the history of the economy, laughing as she said it that way. Could you show an economy as being responsive, seeking to get along, rather than just getting more and more aggressive in looking for, in the end, how to get in ever bigger trouble? What would it be like, she wondered, if people could be responsive as a rule. The idea had come up in reading that the climate change scientists, the IPCC, had said we needed to reduce world CO2 production to half what it was in 2010. It was only recently in fact that the world economy had been below that, and now everyone was saying we had to go back but probably couldn’t. She felt she had all the facts, though.

So she had the idea to just…

– totally redraw the history of ever growing CO2

– to show mankind as being responsive to the approach of climate change

She didn’t get it to work till quite late that night, but it worked! What she had of course been thinking about, and felt that anyone who mattered constantly worried about behind every other subject, was the strange continual way the human society was so energetically trying to destroy its own future. The evidence could not be more clear, with the ever faster consumption of everything useful on earth, that an economy maximizing its growth unavoidably does. Anyone can plainly see that happening, as climate change keeps accelerating faster than expected. Everyone hears about the ever increasing loss of natural species from disrupting ever more natural habitats too, and the impossible debts nations have accumulated making their decision making impossible, and so many other disturbing things.

It wasn’t a “debate” to her. It also wasn’t her “cause” either. She also did not really see it as her job to change other people’s minds. It was just something she personally needed to know, about her own life, and whether it could be meaningful. Continue reading Kepler

How can prosperity be based on “Putting money in to take more out”?

The trick is that there are two ways to do that. 1) you can add the money you earn from investing money, to increase what you then reinvest, so it multiplies what you take out (to put back in to take out more), or 2) you can use the money you earn from investing to take care of the things your investments built, or anything else.

Some links to other discussions of it are below, and a request for your comments.

Here’s an excerpt from a Facebook exchange. It goes another step in explaining why this particular difference, using profits from investments to build more and more to profit from, or to care for things, causes major confusion in our modern world. We want both, definitely want both! But they’re mutually exclusive and there’s a kind of “deadline” for making a choice that most people, for some reason, would quite prefer to ignore, as if there was no choice to be made

Jessie Phyllis Rose Henshaw Speaking of money… Doesn’t “inequity” come from the wealthy PUTTING MONEY IN TO TAKE MORE OUT (and so to then put even more in to take even more out)? It *seems* fair… WHEN IT STIMULATES FASTER GROWTH, but that isn’t determined by people, but nature is it?

Jessie Phyllis Rose Henshaw Speaking of money… Doesn’t “inequity” come from the wealthy PUTTING MONEY IN TO TAKE MORE OUT (and so to then put even more in to take even more out)? It *seems* fair… WHEN IT STIMULATES FASTER GROWTH, but that isn’t determined by people, but nature is it?-

Helene Finidori That’s a great statement Jessie. Could we say faster extraction? Also well I guess many want to put some input into something to get a little out (think of mom and pop savings for retirement). The question is to what limit… Could you plug this somewhere on the pattern language site? Because this is typically the ‘more of the same’ that any new solution would like to avoid…

Helene Finidori That’s a great statement Jessie. Could we say faster extraction? Also well I guess many want to put some input into something to get a little out (think of mom and pop savings for retirement). The question is to what limit… Could you plug this somewhere on the pattern language site? Because this is typically the ‘more of the same’ that any new solution would like to avoid…  Jessie Phyllis Rose Henshaw Yes, I’ll put it there. If I’ve finally said it so people would ask questions, like you just did, then I’ll need help expanding on it so I don’t lose people with the details. The issue is *the balance* between the strains on nature and people and the increasing scale of the whole system.If it were a policy decision, it would be to “stop counting on an ever bigger windfall from the future”. The default way to do that would be to ask everyone to plan for a future of “pay as you go” and people with large investments to use their profits, primarily, to heal the strains on the commons instead of continuing to invest their profits in expanding our burdens on it. Mom & Pop’s savers tend to do that anyway, so no policy required!

Jessie Phyllis Rose Henshaw Yes, I’ll put it there. If I’ve finally said it so people would ask questions, like you just did, then I’ll need help expanding on it so I don’t lose people with the details. The issue is *the balance* between the strains on nature and people and the increasing scale of the whole system.If it were a policy decision, it would be to “stop counting on an ever bigger windfall from the future”. The default way to do that would be to ask everyone to plan for a future of “pay as you go” and people with large investments to use their profits, primarily, to heal the strains on the commons instead of continuing to invest their profits in expanding our burdens on it. Mom & Pop’s savers tend to do that anyway, so no policy required!

Challenging Puzzles and Propositions

“Pattern Languages” give meanings to patterns in nature, theories, relationships or experience, but we often don’t know quite how. Like, we all tend to consider our own conscious view of things to be the world we and everyone else all live in… even though everyone is making up their own view of that. That kind of real world doesn’t fit into any simple explanation, of a world in which everyone is seeing a world that is in large part a reflection of themselves. It creates a lot to untangle.

Continue reading How can prosperity be based on “Putting money in to take more out”?

What is a “rights” agenda, with ever increasing inequity?

It helps to look at the long term trends to recognize the long term pattern.

In a world of ever increasing inequities we clearly can’t sustain a real “rights agenda”. Even the strongest of moral commitments is no match for a world economy which in a lasting physical way, is systematically splitting apart.

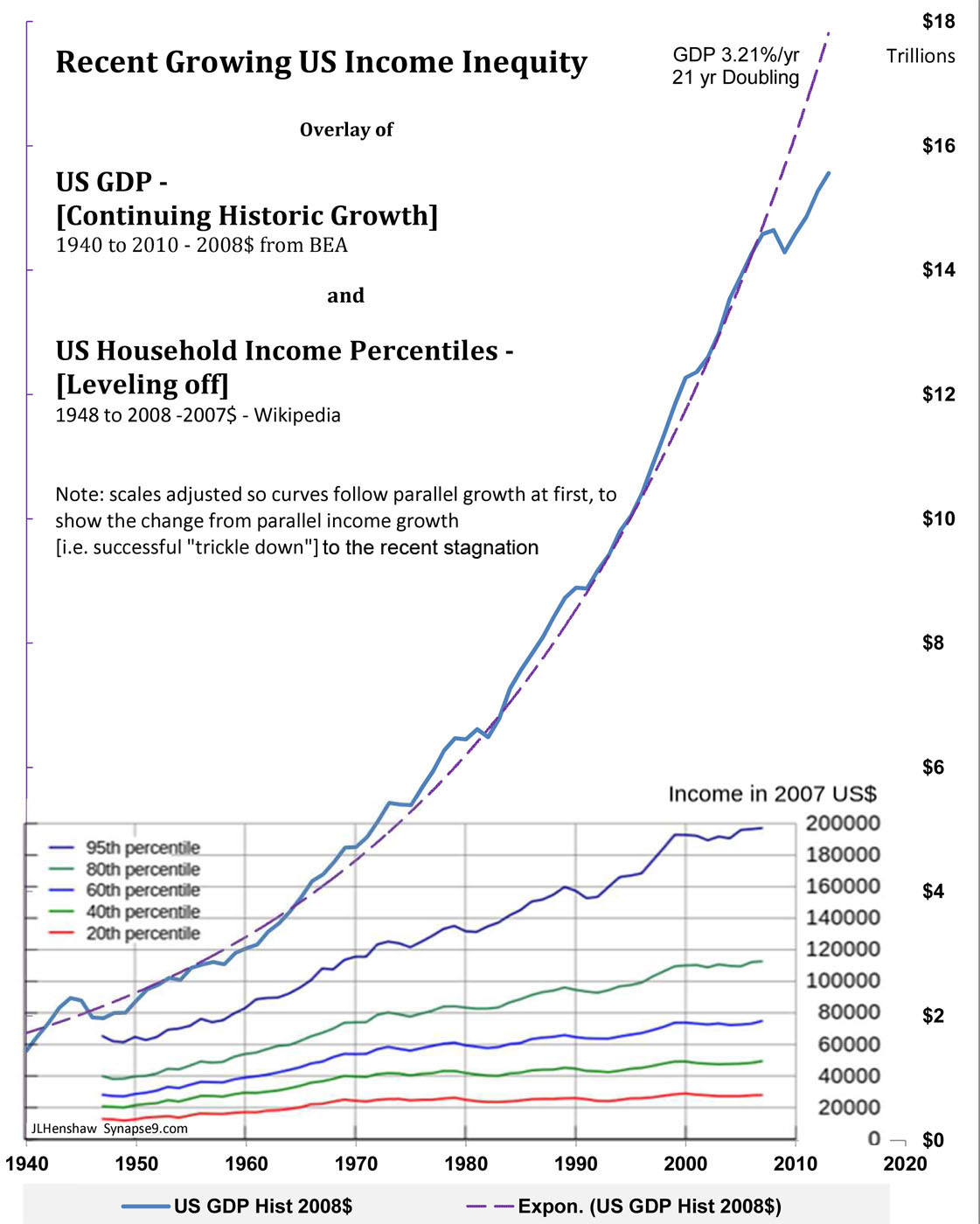

Sometimes local inequities can seem to be blamed on local conditions, but not when it’s a long sustained accelerating global trend. That’s what we see in this US data from 2008, showing that growing inequity in household income has been a very persistent trend. It’s a very familiar subject of discussion and increasing complaint too, that ever increasing shares of the wealth are going to the wealthy. It’s been a central motivation for the UN’s debates on how achieve sustainable development too. So the trend as of 2008, if anything, has probably only been getting worse. Little is likely to change, either, with the SDG’s having no language for reversing the pattern of the wealthy being the only winners in the modern economy.

It’s the household incomes of everyone else that stopped growing.

showing US & Global GDP having continued to grow as before.

To understand the root cause you need to think about it as a symptom, a symptom of how the global economic system is behaving. The key piece of information is that “What is happening, is happening for the world economy as a whole”. Around ~1970 what happened to the US economy, as the bellwether for the world, is that the wealth of the wealthy kept growing exponentially, more or less just as before. Nothing else did.

The shape of the Data explains the operation of the system

Continue reading What is a “rights” agenda, with ever increasing inequity?

The option called Circular Jubilee

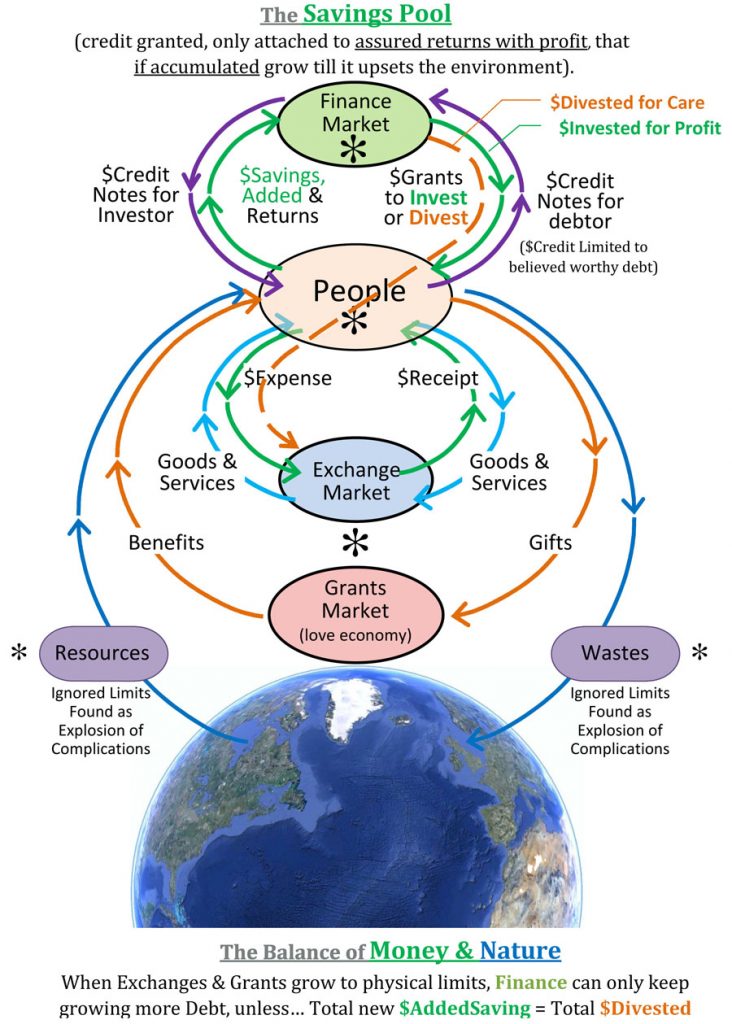

Most of my economic writing revolves around what we inherited, an economic system design for changing faster and faster, exponentially. It’s a dangerous design for which we now have no exit plan at all.

Lots of people mistakenly blame the use of fiat currency for the persistent instability and inequity of the economy. The problem isn’t technically with fiat money at all though… It’s with the deeper compulsion of users of money to use wealth and power as a weapon (we call “investing”), to pay for professional help in taking more wealth and power. It’s the core behavior in question in “the tragedy of the commons” too, that one farmer uses his cattle capital to multiply till the community suffers. Fiat money (basing credit on the value of investments) would actually not be a problem if investors didn’t compound their investments… It’s of course also a broader cultural issue of ignorance about our place in the web of life… but I think the compounding of returns is from what the economy’s growing inequity and disruptions actually originate. I think if investors took care to spend their profits to relieve their demands on the commons when needed then an economic system with fiat money would level out and stabilize.

We need a mid-course correction for the evolution of our economy

What a surprise it will be if to avoid the crises we see coming today, the economy needs a “Circular Jubilee”? It would be a massive effort to give away a great deal of money, very carefully, with the aim of slowing down the economy’s unstable acceleration. Done correctly it would relieve the rapidly building strains we all see, letting us escape from racing the economy ever faster till it fails.

It would be like learning to take our foot off the economic accelerator, to relieve strains and coast a little at the same time. We really need the relief. That really does seem necessary to relieve the economy’s building strains in a lasting way. It would restore society’s resilience and allow us to become more self-healing again too! The design is fairly simple, …to do just the opposite with financial profits as we do now. People would be persuaded to join together and turn away from collecting profits to reinvest in collecting more and more profits. It’s that very widely practiced way of managing money for ever faster growing returns that also sets the course of the economy for changing at exponential rates of acceleration. It has the globally destabilizing results we now see all around.

That traditional way of managing money we inherited is quite untenable in the long term. The one truly sustainable alternative is for investors to learn to spend their profits rather than continually reinvest them! It’s simple math. That’s the the Jubilee part, investors choosing to “release” their profits back to freely circulate in the exchange economy again. The “circular” part is that those profits then freely circulate in the economy again, and return to the investors as sustainable profits. That is the opposite of how we manage our money today.

Today the profits concentrate in the hands of investors at ever faster rates, to only circulate in the economy with promises of being repaid multiplied. It seems to investors that they are becoming more and more wealthy as their world and all its strains increase faster and faster. That’s the fatal path, pushing us toward society’s many possible breaking points. We can do better.

Compounding profits may sound good,

but driving economic change faster and faster

till we are pushed to disruptive and unstable change… is a real problem

((in the diagram, the choice is shown as the alternative between

“$Divested for Care” and “$Invested for Profit”. ))

JLH

(note: first published in 2017 but back dated to 2014, as more consistent with proposals of that time. Using collective profits to care for the commons (rather than for abusing the commons) has been the natural general solution to the tragedy of the commons first recognized by Keynes, and that I’ve proposed in various ways since I first noticed it’s simple necessity around 1979. For more of my writing on it search for my discussions of Keynes.)

A World View of Off-Shore Energy use

There’s been a long debate and mystery caused by economic accounting for the world’s energy use not being able to trace the trade in economic energy services, the amount of China’s energy embedded in our TV’s and the amount of of France’s energy embedded in Soviet block heavy industry… etc.

(See also “Pictures of WhatGDPMeasures” with 11 figures and brief explanations tracing the Money/Energy link)

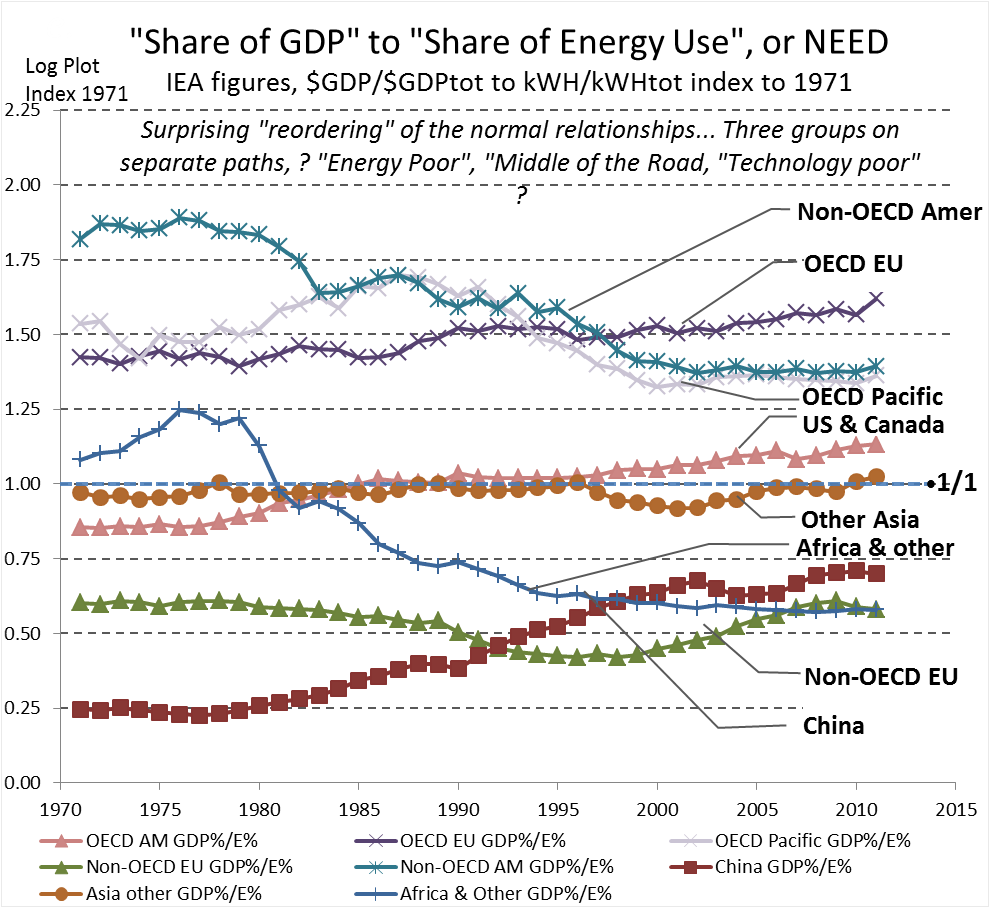

A country’s Share of the World’s GDP per Share of World Energy, measures

“Relative Economic Energy Dependence” ‘NEED’

a strong indicator of how much of its economy is fed by off-shore, mostly ‘fossil’, energy services, most often not being counted in national energy accounts. Countries do have different energy productivities, but World competition actively selects competitive energy uses wherever they are found. So like waves on a pond… the national accounts vary in relation to each other, and the global accounts are smooth and reflect the gradual changes of the system as a whole.

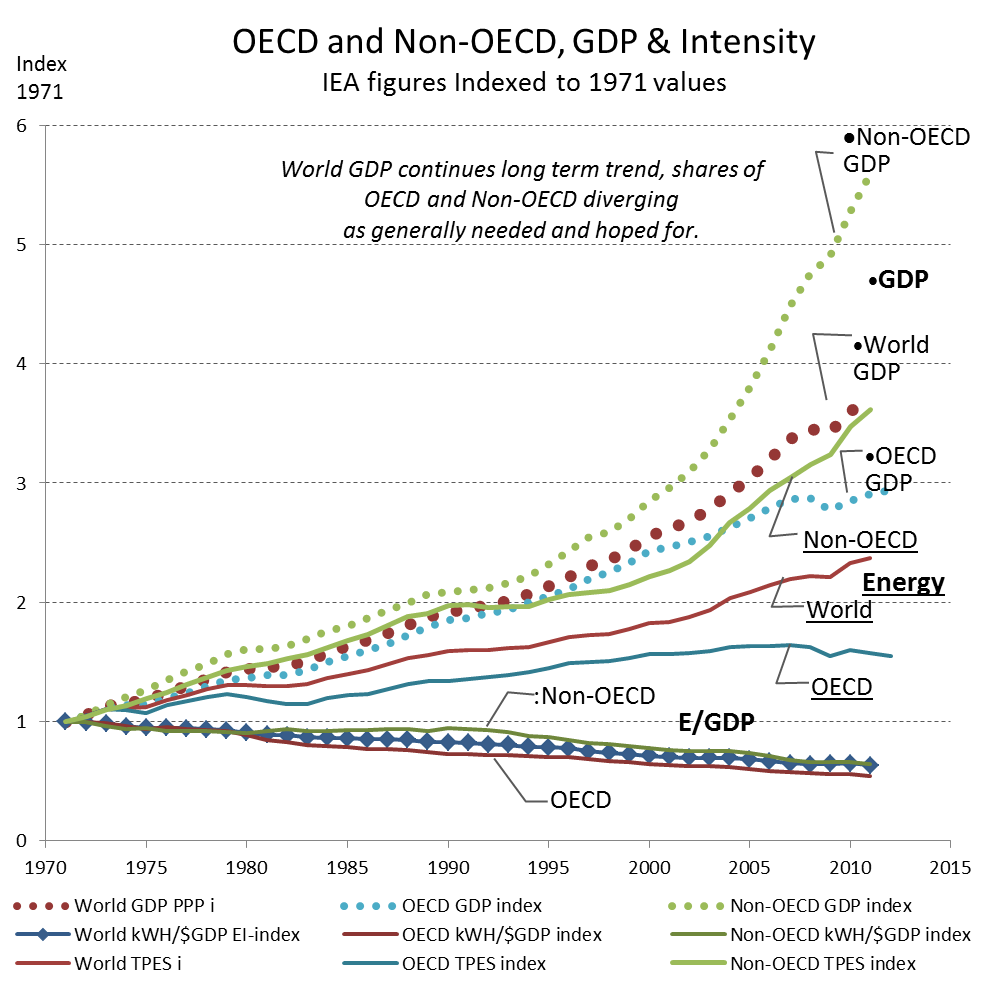

We see in Figure A strong diverging trends in GDP and Energy use for OECD and Non-OECD groups, along with converging steady trends for the ratio Energy/$GDP, over the past 40 years.

- As the less developed remain smaller, but grow faster, the more developed are giving them development space.

- The Energy/$GDP (intensity) is continuing it’s long historic path of quite steadily decline, NOT diverging, showing how smoothly the interlocked productivities of the world economy “level the playing field” for energy services, delivered to where they are most valued..

Figure B shows the NEED of the major 8 World Sectors shows much more variation, and you can see some of he fitting shapes that cause the total to be a straight line.

- The US & Canada are close to the 1/1 average, but steadily rising

- The EU, Japan and Australia are ~1.5/1 rather dependent on Off-Shore energy services, lacking abundant sources.

- So the ridh “Energy Poor” economies need to purchase more and more of their energy in the form of energy services from their neighbors, as “how economies work”.

- It causes a likely mistaken impression the EU is more “sustainable”, greatly outperforming the US & Canada.

- National Energy Accounts don’t trace trade in energy services, only trade in energy materials, needing a “Shares of GDP” proxy measure as here to find it.

The National Energy Accounts are not set up to trace trade in energy services, only in materials, requiring a “Shares of GDP” proxy measure to find it.

It shows a very good reason why we all need to learn, as in Scope-4 impact accounting for the World SDG, the use of GDP as a proxy measure of average economic energy use, and also why it works so well. The “global economy” and it’s highly competitive use of world information on the most profitable uses of energy. It makes energy use a universal “currency” naturally, as a useful measure of GDP for many purposes, and the use of GDP as a proxy for energy use and environmental “externalities” resulting from our obtaining and using energy to alter the earth for our purposes.

_______

JLH

a Whole Systems view – Piketty’s “r > g”

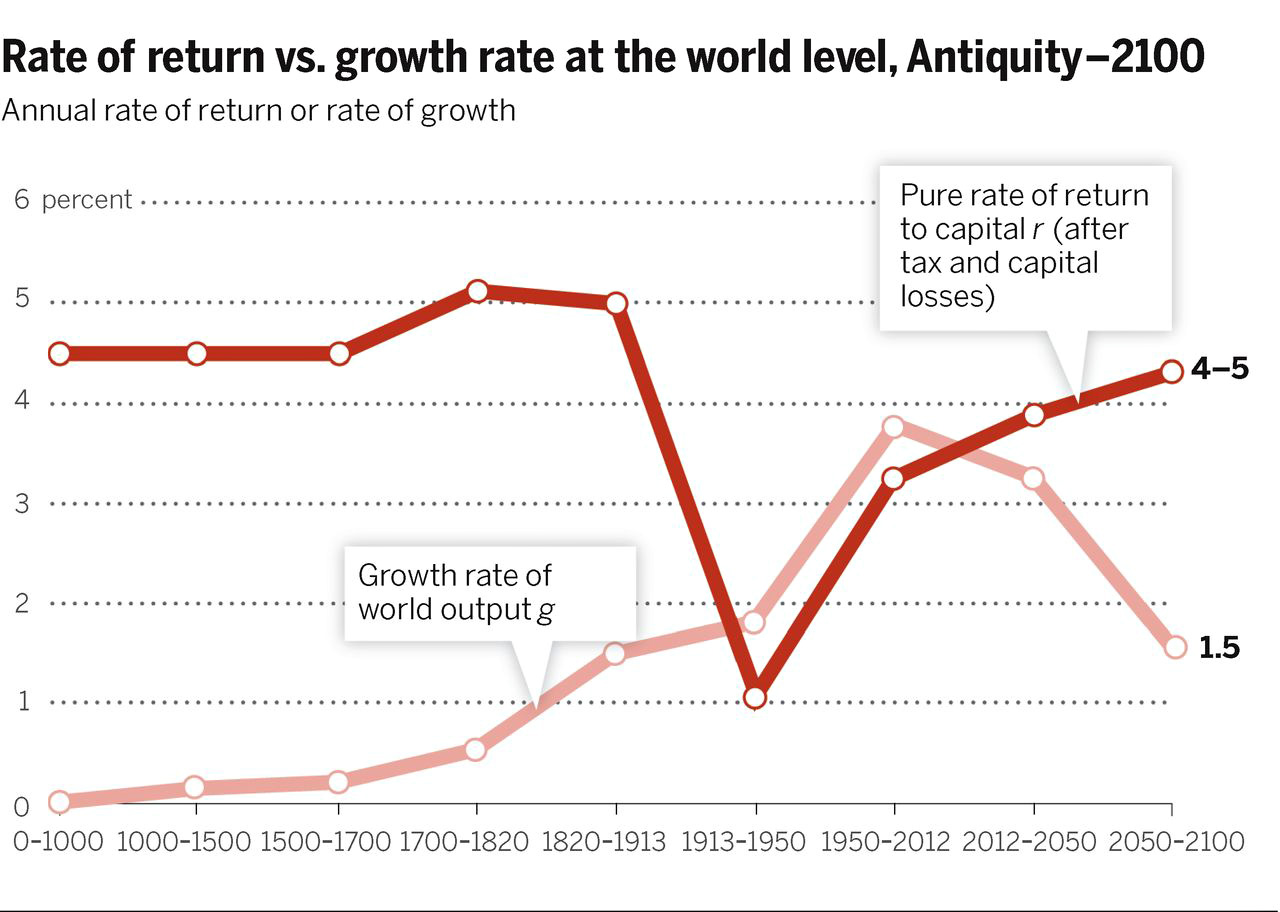

A wide and welcome discussion of our economy’s tendency to produce increasing “inequity” has followed the US publication of Thomas Piketty’s book, “Capital in the Twenty-First Century”, and offered me many chances to comment for general readers with interest in the deeper scientific questions. I think my best so far were my most recent two, for the special issue of the AAAS journal Science on “The Science of Inequality“. It’s really great to now have this chance to discuss the core dilemmas involved.

I hope not, but more or less expect, this opportunity to “come and go” without much consequence. That’s happened over and over, for a very long time. I’ve been watching it come up again and again for the past 40 years, and seen how each discussion fails to get to the heart of the issue, and have looked into the long history of “great debates” around it going far into the past. There are just clearly very deep conflicts between “how we think our money should work” and “how our world apparently works”, that are still with us. Science should be our tool for solving such problems, but hasn’t. So it seems we won’t get to the bottom of it until we find the right language to discuss it in. I think the language of natural systems is what will do the trick eventually, starting with “growth” being nature’s “start-up” plan and design for the invention and development of new types of systems, so the subject of what’s happening to our growth system is a good place to start. Let’s see! :-)

_______

Comments on Piketty’s inequality, “r > g”

For: – Science, the Financial Times, the Economist, New Yorker, Capital Institute, the Guardian, Salon, Piketty in ‘The Bully Pulpit”

>> Returns on investment seem to outpace the Growth of the economy <<

(.. so incomes from wealth and work .. d i v e r g e ..)

The true reason seems to be our long habit of maximizing growth ** measured as ** maximizing returns for re-investing …particularly now… when growth is pressing natural limits, and meeting natural resistance and complications that increase faster the harder we press them. What we need is to understand that turn of events. JLH

_________

Comments to the press:

I. on Inequality in the long run by Thomas Piketty & Emmanuel Saez; in the Special Issue on the Science of Inequality, Science magazine – Comment 5/28 link

As with the “Occupy Movement” the diagnosis of the problem here is really wonderful. And for me it is VERY satisfying that someone finally found a way to raise an actually serious discussion on it. I’ve also been studying this phenomenon, as a natural systems scientist, for 30+ years though. So as much as I am really delighted to again hear the complaint being well expressed, as “Occupy” also did, I don’t yet see a move toward the level of understanding needed to point to feasible (win win) solutions for it.

One step in that direction would be a discussion of how investors change what they invest in. This is a “system” after all, and we need to look at how it works. Buy using the profits from a “good bet” to multiply good bets you change the odds, by physically changing the environment being bet on. That also naturally concentrates unequal wealth, in the hands of investors using that leverage to multiply investments.

Historically that seems at the very heart of all financial manias, like the kinds that develop before great panics and crashes. The rub is “multiplying sure bets” does almost nothing more certainly than “create bad bets”. That prefer to believe in the manias, though, instead of the obvious is part of the emotional struggle and problem. So… we have contradictions here. We’re still talking as the economists long have, of “ever faster accelerating increases in scale and complexity” as a “steady state”.

OK, in a theoretical world that’s OK. But here the discussion of “inequity” poses a problem of unfairness, regarding having “unequal shares” of what we now also see is “ever increasing instability”. That’s not ‘OK’. ;-)

—

II. on Physicists say it’s simple by Adrian Cho; in the Special Issue on the Science of Inequality, Science magazine – Comment 5/27 link

Physics is certainly the right tool for this, but you need a technique of getting the universe to slow down tremendously, to let you see how the seeds of swelling inequities emerge and what they lead to. I did that on the way to developing a new physics theorem, that I hope will soon to be widely studied.

The theorem unifies the conservation laws to offer a general “law of continuity in change”. It doesn’t say theories can’t have discontinuities, only that uses of energy can’t, while pointing quite directly to nature’s marvelous “approximation to discontinuities”, her way of multiplying inequities on the way to precipitating dramatic changes in form in the organization in her complex systems.

Unifying the conservation laws shows its important to understand them as an infinite series of conservation laws, for all the derivative rates of change for energy use in physical processes. So as a whole it offers “a law of continuity”. http://www.synapse9.com/drafts/LawOfContinuity.pdf You can simplify the idea of it to saying “it takes a process to change a process”.

To see it happen you watch transitions intently enough to slow down the universe for your eyes, closely examining the steps nature takes to get things started, a fire, an eye blink, a plant, or any other “event”. What you find are little bursts of self-organization, following a non-linear trend most people would call “growth”, a process just full of things happening with a bang.

Growth is a distributed process of multiplying inequalities, is the relevance here. It’s a process of continually swelling inequities throughout a system, an explosion of increasing energy use, complex organization and change, that invariably triggers its own change in form. Where I first got the idea was by training my eyes to slow down the flowing changes of natural air currents, so I could watch “what made them so lively”, letting me discover how stable convection cells form from the instability of growing ones.http://www.synapse9.com/airwork_.htm

So, inequity is a natural byproduct of growth, essential to the systems growth builds, and as a process naturally leading to a change in form. In economics one common way for it to first cause growing inequity and then result in stability is by people realizing they’ve built as much as they can manage. Then they devote their resources to caring for what they built instead of continuing to build till that destabilizes it.

Is that possible for us?? I don’t know, but I think the physics implies we’re sure to find out.

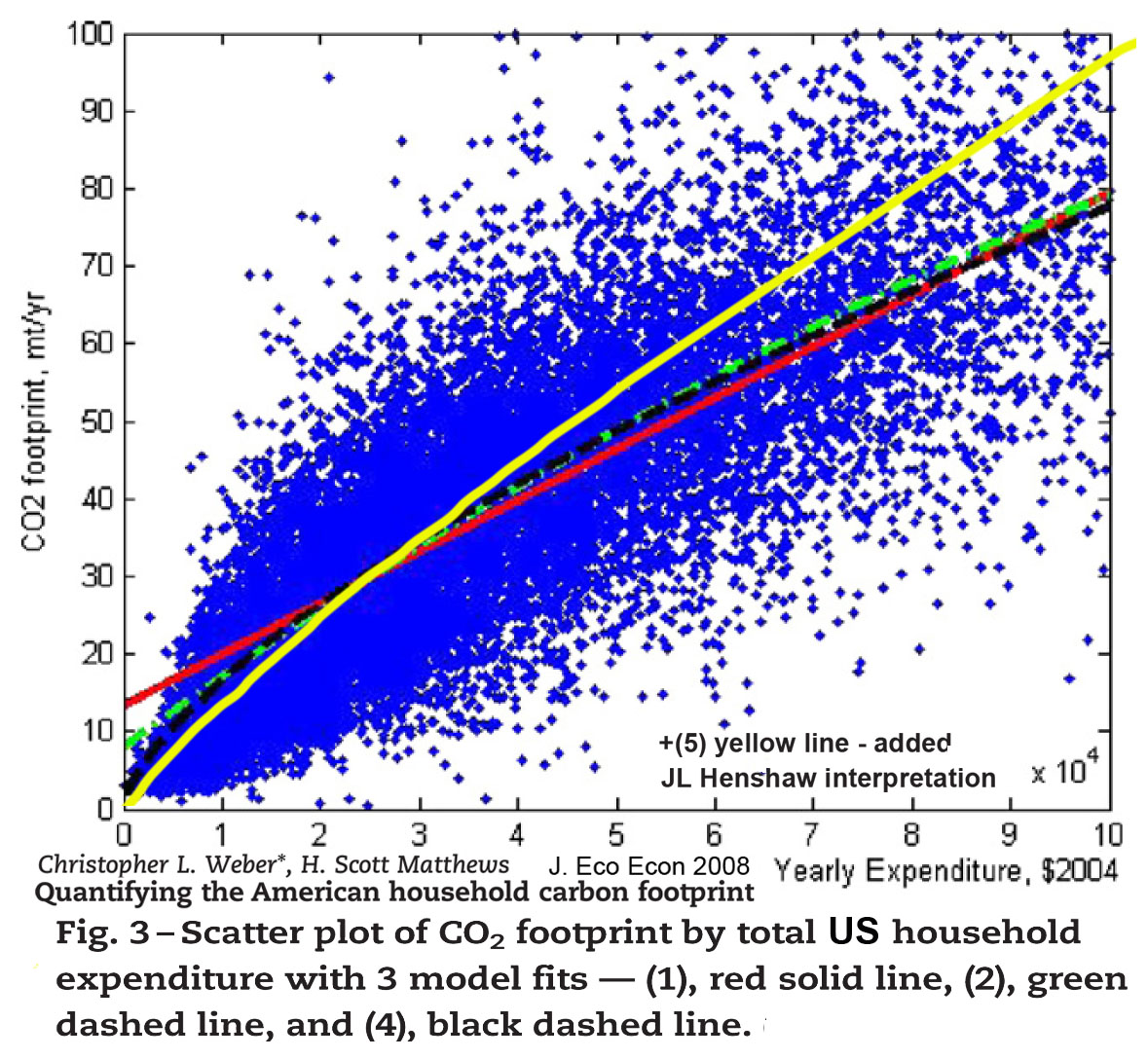

A telling image… money measures our impact

- A “telling” image… connecting dots: the distribution of US household CO2 footprints, by income level from Weber and Mathews 2008

The average Co2 intensity is shown as ~1.0 kg CO2/$1 of income (the scales go to 100 tonne/yr CO2 and $100,000/yr income). That’s about twice the world average CO2 intensity, which was closer to = ~ 0.45 kg/$ GDP in 2004, (declining at 1.24%/yr historically). What it does nicely is confirm one of my most contentious conclusions from the Systems Energy Assessment (SEA) paper and so called “scope-4” assessment. It shows what it means to use average spending, like household “wages” as a baseline measure of average economic consumption impacts. Because the slope of the curve is so different from what I expected I think it remains to be confirmed. The US consumption intensity seems to be about double the world average. It doesn’t seem right but I don’t know what would cause that.

In any case, none of these household impacts being funded by businesses are being counted as impacts of operating businesses by the widely used sustainability metrics! That disclaimer of responsibility seems mostly to be for historical reasons, though, and for the simplicity of accounting for information coming from different places. It also shields business sustainability decisions from having to deal with quite the whole problem at first. Sustainability decisions will later be found to need to deal with it, of course, appearing now to start with a limited task, like a start-up problem, a bike with training wheels.

For the 2010 & 2011 SEA studies of a typical wind farm business plan, we tested what would happen if we were to include this discounted part of the business footprint as having a “world average” CO2/$ intensity. Our including it increased the total measure of energy and CO2 impacts for the business by 400%, as human services actually proved to dominate this seemingly technology centered business. With this new information on the US household impact distribution, I’d now need to say US businesses might actually have footprints 800% larger than presently being counted.

It seems we’re in the middle of quite some learning process! ;-)

fyi..

___________

jlh

The Decoupling Puzzle

Preface remarks

- This exploration of a pivotal world issue, on which the success or grand failure of our present global development strategy rests… is an example of the wide range of penetrating treatments of important topics covered in the Research Journal “Reading Nature’s Signals“. It document’s Jessie Henshaw’s current application of the the natural systems identification and organizational exploration methods that originated with a discovery in the 1970’s of how transitions in the continuity of natural processes expose the design of the systems and how they are changing, introduced in: The Physics of Continuity = ladders of change

- For more substantiation of this scientific view of how the economy and earth are connected see:

– a Whole Systems view – Piketty’s “r > g”

– A World View of Off-Shore Energy use - For a study of decoupling trends and fluctuation for 1971 to 2017 see

– Evidence of decoupling still zero.

__________

Introduction:

We have a responsibility to use both the words of science and also the methods, when choosing methods of “Sustainable Development” to rely on for our effort to save the earth. It’s often not easy to do. Ask any scientist. It’s often as hard as sitting down to write a great poem, a different kind of creativity but just as demanding. This article discusses the correct scientific method for defining measures of “decoupling” our growing economy from its growing impacts on the earth.

That’s the part of the “Decoupling Puzzle” I can actually answer, offering a way to scientifically define an SDG for Post 2015 “economic decoupling”, and the measure of compliance. See also to the PDF file and XLS file to see the details of the model. It’s a bit different from the approach shown in the UNEP report on decoupling . What I define is an evidence based scientific measure of a growth economy departing form its reliance on growing resource use. It could be used in regulating the economy’s approach of our best understanding of the natural limits of sustainable development:

“A world Decoupling Rate that would assure, within planetary boundaries,

adequate development space and “carrying capacity” to fulfill the intent of the SDG’s.”

How to transform the economy to create growing wealth without growing resource use is left to the reader or other discussions, though I give a hint to what that “entirely new kind of wealth” might be at the end.

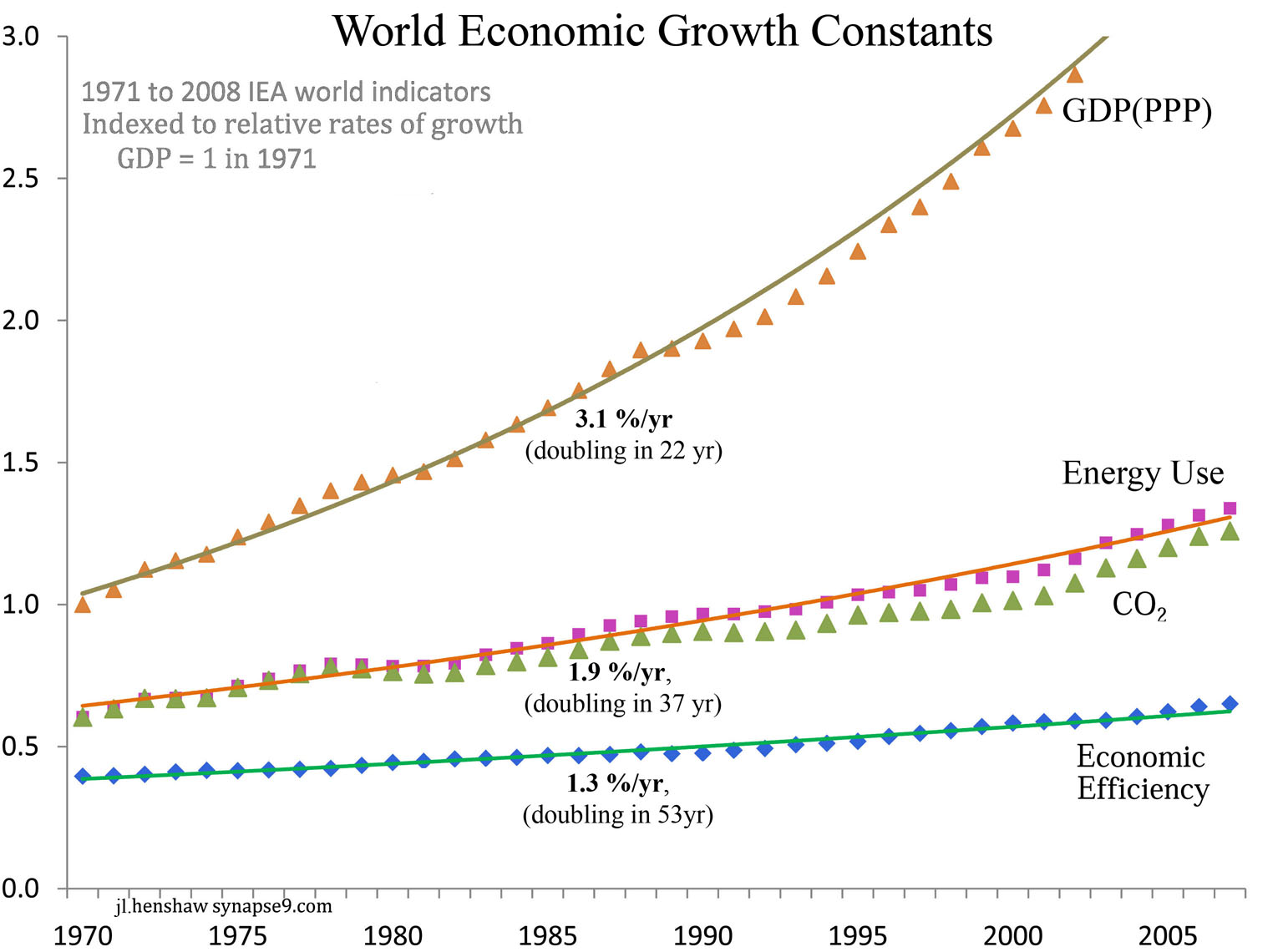

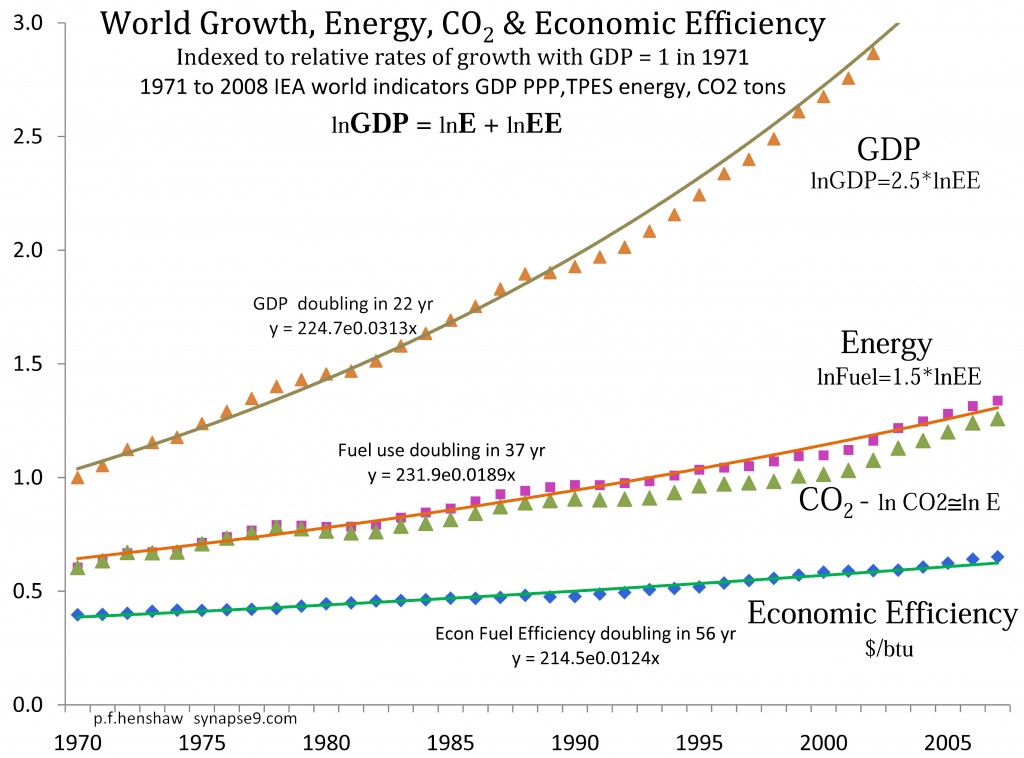

We start with the historic records that display the past “growth constants“ of the world economy. Figure 1. shows GDP, Energy use, CO2 and the GDP energy efficiency of the economy all growing together, with growth rates that are in constant relation to one another. That is the “coupling” of GDP and resource use that needs to be “decoupled”.

That evident constant growth rates and their proportionality (i.e. the “coupling”) is called “natural” because throughout history people have noticed it, tried to explain it, and also tried to change it, all to no avail. This coupling of these measures of the whole economy has continued as if measures of a growing person’s “height and weight”, growing at different rates, but still growing together. It has seemed to be just how the economy works.

As a systems ecologist, myself, I see them as displaying humanity’s natural rate of whole system learning, limited by coordinating all parts of human innovation and development efforts, while struggling to expand at the fastest accelerating rate possible. Systems ecology, then, does not consider economic growth as a “monetary progression” but as an “organizational progression”, a process of “whole society” building on its past to create a new future. This historical record is “how we’ve been doing it” so far, and now that we’ve found it unsustainable we need to change to something different.

…”growth” is a process of our learning how to coordinate doing what we want.

To measure a departure from that we start with the “Economic Growth Constants”:

GDP (3.13 %/yr), Energy use (1.89 %/yr), and Energy Efficiency (1.24 %/yr) . The linkage between the GDP and Energy curves, is the “Energy Coupling Rate” (60.4 %/yr the ratio 1.89/3.13), how fast energy use grows relative to wealth.

The idea and fallacy of “Decoupling”

is to weaken that linkage between earth and economy to zero, changing what has long been a constant coupling rate of 60% by successive reductions to 0.0%, just by continuing to dramatically improve the efficiency of resources use as before. Many people believe new technologies should revolutionize development to do that, other’s think innovation will create products people prefer that just don’t consume energy to produce or to use. What both would agree is that 60% needs to decline toward 0.0%

We could define that transition as a “Decoupling Rate”, the rate at which the Coupling Constant of the past declines toward ‘0.0’. That would allow continued growth in wealth without adding to what we now see are globally unsustainable scales of energy use impacts on the earth. Defined for energy use alone would serve to define it not just for the impacts of fuel extraction and consumption, but also ALL the impacts of a material kind we cause by using the energy we extract for creating economic products.

So.. that would be generally inclusive of all economic impacts

that needed energy to be produced.

Continue reading The Decoupling Puzzle

Easy Intro, “scope 4” use & interpretation

Here’s the whole problem:

Scope-4 impact measures add up the total environmental inputs resulting from business, personal, or policy choices. That’s so we can compare different choices, and make the better one. Sounds like what sustainability metrics should do!

Standard sustainability metrics, however, collect impact information by where they occur,

not by what choices cause them…

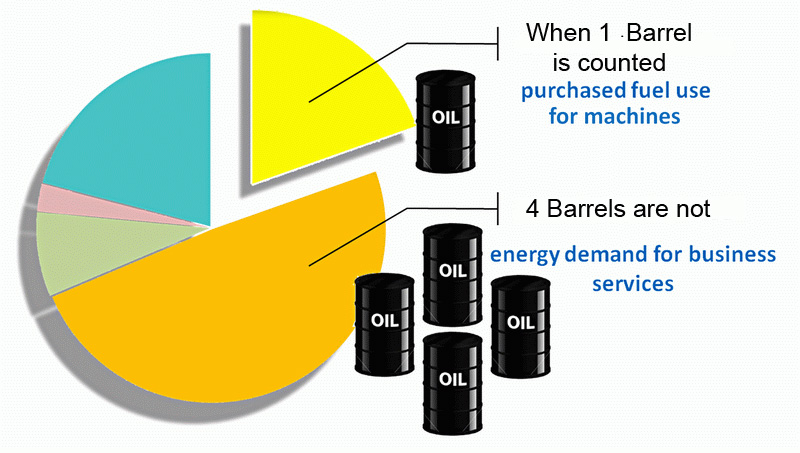

So our whole metric system needs to be rethought. Today if a business decision involves employing six new machines and six new people, all that is counted are the impacts of the machines. The impacts of hiring the people or paying the investors or the government… aren’t counted. Nature sees all the kinds of impacts incurred by business decisions exactly the same way, though! It was our accounting community, going back centuries it actually seems, that decided to count one and not the other.

The omitted impacts are actually not hard to scientifically estimate for scale. That’s what Scope-4 accounting does. As you work with it you find more and more ways having the numbers right results in big changes the terms of discussion. The core scientific issue then, is having a metric that does not associate environmental impacts of business with the choices that cause them, but with the locations where the information is collected. That inconsistency may be as fundamental to economic accounting as to have originated in how business records were kept in ancient times on clay tablets.

The [ e = mc^2 ] LAW OF SUSTAINABILITY

ln(e) / ln($) = c

It says our growing earth impacts and growing earth economy are directly coupled.

The natural constant observed, [c], is the coupling of GDP and Energy use, as a measure of everything physical the economy does. It’s expressed as a ratio of their growth rates (here as a ratio of their natural logs). That coupling has been a constant [0.6] for a long time. You see it clearly in the figure below, showing a 40 year official world record for the economy’s growing Energy use and GDP.

It says that our increasing use of energy for altering the planet to make money grows only a little slower than GDP, at 0.6 times the growth rate of GDP, AND that this direct coupling has not shown any tendency to change over time! People imagine that ‘efficiency’ changes the coupling, but even with growing efficiency the ratio has actually quite constant. You’d need global efficiency in energy use to double every ~20 years like GDP generally has to really make a difference, so having growing value in a steady GDP is far more possible.

Of course, like e=mc^2, it’s not possible to tell quite where the natural constant observed comes from. That’s a big part of the scientific interest. Natural constants are emergent properties of the system, seemingly here a natural rate of societal innovation and adaptation, like a “natural learning speed”. The benefit of the constant is giving us a better way to measure inclusive sustainability, using the mathematical implication that:

— average shares of GDP pay for and are responsible for causing

average shares of GDP earth impacts —

The power of this rule the direct coupling between responsibility for shares of Earth Impacts and shares of Earth GDP. It’s a measure that combines all the impacts of extracting energy and all the impacts caused by using energy, i.e. everything the economy does, with financial earnings from the economy. When the data is aggregated correctly, it allows a complete accounting of the GDP impacts, and “closed accounting” for shares of responsibility for them. So that for whole supply chains, one can measure their share of exhausting all our resources, forest and species loss, paving over productive land, etc. Delivering goods for an average dollar of GDP causes an average share of the whole economy’s impacts.

.

Scope 4 CO2 assessment

The science for applying this constant natural coupling of money and GDP impacts was published in 2011 in a research paper “Systems Energy Assessment” found at the SEA resource site. More detailed research notes are in the article What’s “Scope 4″. The physics is sufficiently general and inclusive that the same technique can be comfortably use globally, to assign responsibility for all impacts of GDP on the earth, and have a way to “internalize all externalities” that can start and remain valid as it is incrementally improved, as in “A World SDG“.

Discussion:

The real tragedy is that this bias in our business impact metrics assigns TOTAL responsibility for environmental impacts to the people who are paid to do them, who would not do them unless they were requested and paid for by someone else.

So then ZERO responsibility is assigned to the people choosing to request and pay for the impacts, communicating their requests for them by the transfer of money.

In criminal law, as when paying to have a crime committed, requesting and paying for it is considered the principle direct cause of the crime. The person paid to do it may be penalized equally or not. As far as physically causing economic externalities, in the court of environmental responsibility, it really should be decided the same sophisticated way.

What Scope-4 accounting does, then, is start from the complete list of things a decision pays for. It could become a tremendously long list, with lots of things only known from the money spent rather than from exactly how the service was provided. So for those you need to do research on what default assumption to make in case in case more detailed information does not become available. I’m still waiting for people to study it themselves and compare results, but I think the proof is completely convincing that absent other information the necessary default assumption is not “zero” but “average”.

Elementary technique:

- If you get stuck in deciding what to count, just remember, businesses don’t pay for things except for business reasons, so you need to count *everything*.

- You then think about the different categories of spending, and what their “direct” (material) and “indirect” (economic demand) impacts are.

- The initial rough estimate rule for economic impacts is to count them at 90% of the world average per $GDP, like around 7000BTU/$.

- Make sure you use inflation adjusted $’s and state the index year.

- That’s easy to do, and lets you reserve your time for estimating the direct impacts, according to the added information you can collect.

So for the energy content of purchased fuels, for example, you’d count BOTH the direct energy content of the fuel, AND the economic energy impact of the spending, at 90% the world average. The reason is that the fuels come from nature, and the spending goes to people, paying them for the consumption they do to bring you the fuel.

If done correctly, the bottom line is a unique pie slice share of the world’s impacts

for delivering your share of GDP.

Another one to think through is how to estimate the impacts of retained earnings, used for either financial or business expansion investment. The economic impacts of that spending needs to be estimated with a multiplier over time… The whole purpose is to truthfully estimate the types and scale of consequences for our economic decisions.

More discussions can be found searching the journal or the web for “Scope-4” or “SEA-LCA” as interchangeable names for the same group of accounting methods.

jlh 11/8/14

_______________ Continue reading Easy Intro, “scope 4” use & interpretation