Note: this is a draft concept for the Apr 2011 article on “what to do” aimed at a wider business audience “A decisive moment for investing in sustainability“

For other discussions of “what to do” from an environmental systems science view, see also the 6/10/11 notes for Alex Jakulin’s Foo Camp talk on my work and my various discussions of the natural limit for money that Keynes identified which comes down to one thing. That’s the subject for slides #5-8, for for Aleks’ talk. or search my site for “what to do”.

________

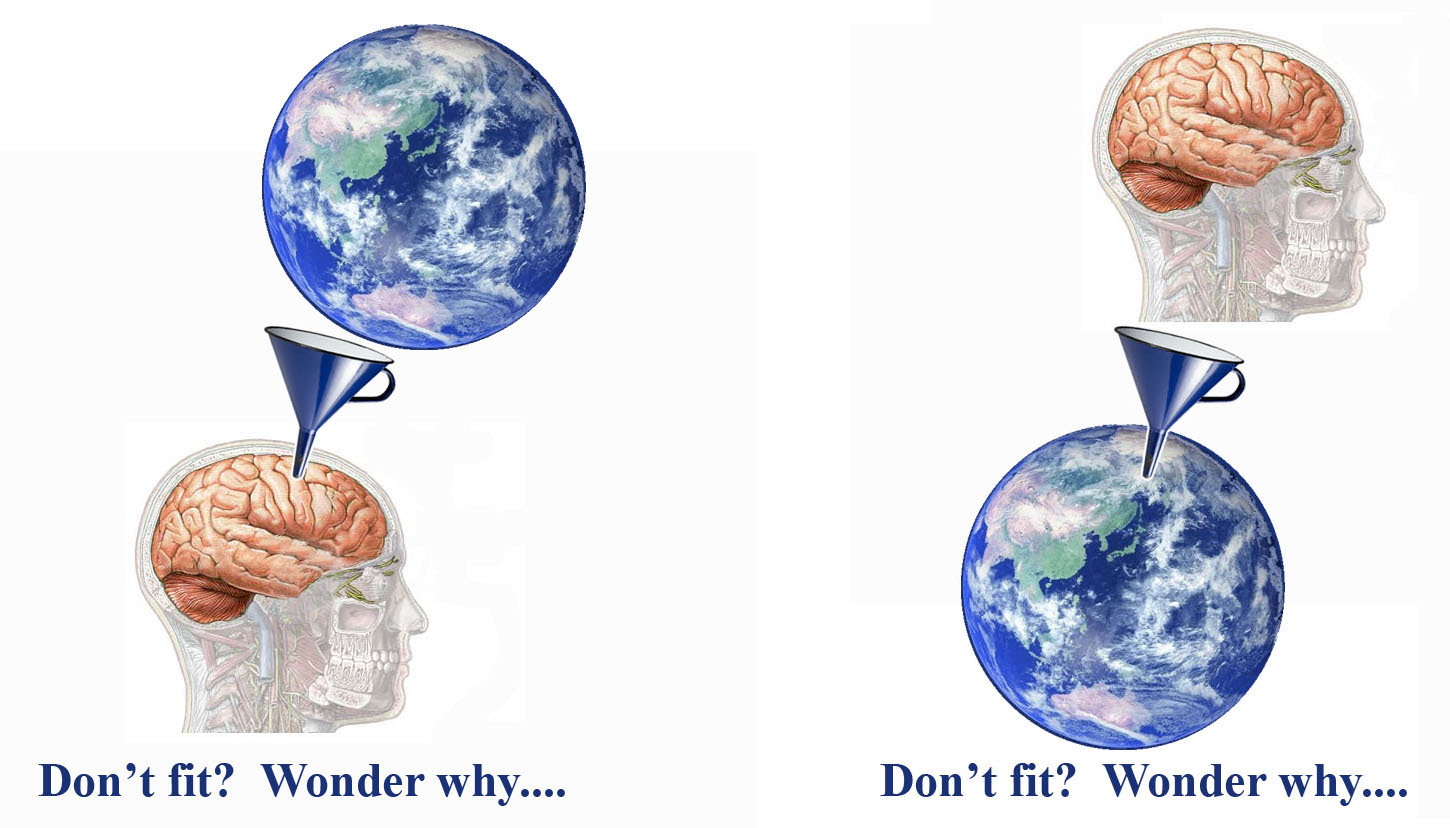

All natural systems start with growth like economies, using a “seeding mechanism” for planting seeds to multiply the “start-up” system. That mechanism, which for money is the use of investment to grow investments, has to change form to become a “steering mechanism” [switching from being a “Crash Cow to a Cash Cow” so the “end-up” system can transition from growth to becoming sustainable, if it is to survive beyond its start-up period.

The world seems to be at a particularly decisive moment, not quite being recognized. There’s a strong and creative professional sustainable investment advise community, emerging and being given paid positions and increasing influence, throughout the finance, business and government economic decision making communities. Continue reading Nurturing “cash cows” or “crash cows”?