Note: this is a draft concept for the Apr 2011 article on “what to do” aimed at a wider business audience “A decisive moment for investing in sustainability“

For other discussions of “what to do” from an environmental systems science view, see also the 6/10/11 notes for Alex Jakulin’s Foo Camp talk on my work and my various discussions of the natural limit for money that Keynes identified which comes down to one thing. That’s the subject for slides #5-8, for for Aleks’ talk. or search my site for “what to do”.

________

All natural systems start with growth like economies, using a “seeding mechanism” for planting seeds to multiply the “start-up” system. That mechanism, which for money is the use of investment to grow investments, has to change form to become a “steering mechanism” [switching from being a “Crash Cow to a Cash Cow” so the “end-up” system can transition from growth to becoming sustainable, if it is to survive beyond its start-up period.

The world seems to be at a particularly decisive moment, not quite being recognized. There’s a strong and creative professional sustainable investment advise community, emerging and being given paid positions and increasing influence, throughout the finance, business and government economic decision making communities.

It comes somewhat in the character of a “hail Mary pass”, though, as business is only belatedly becoming aware of the need to pay attention to how nature works as numerous long term environmental/business disasters unfold. One of those of particular urgency, but also not quite recognized yet, could be called “planet change”. It’s our finding that global demand for food and fuel resources now perhaps permanently exceeds affordable supply.

Having demand systemically exceed supply changes the profit equation for the whole economy. It makes increasing productivity as a way to increase supply destabilizing for prices instead, and so decidedly unprofitable for businesses and societies worldwide.

It’s not not predicted by familiar economic theory, is part of why you haven’t heard of it. It’s just observable as how the world economy is clearly behaving as a whole.

One way to understand is with the basic difference between business models designed to achieve maximum sustainable profits, like a well managed cash cow, and those designed to achieve maximum rates of growth, to end in a crash. “Cash cows” provide “milk” for the next generation and nourish their environments.

“Crash cows” don’t do that. They promise limitless growing returns and then crash their environments.

The natural difference between the two is simple enough. The one involves switching earnings to investing in securing a business and its environment, rather than growth, signaled by the hidden internal or external liabilities of unsustainable growth becoming visible.

So it’s about being observant and responsive. The opposite is accomplished by continuing to invest for high returns used for growth, abandoning anything not producing it, to end up being drawn into investing in opportunities that promise large returns but have still larger hidden liabilities. That’s what the unobservant and unresponsive investor is naturally blind to.

One of the more useful observations is what’s called “cognitive dissonance”, between how most people are so “good at” doing both. People demonstrate tremendous talent for being observant and finding more profitable choices when it concerns needs within the system of their community, family, office or profession.

Then we can reason the situation and intuitively understand how the parts relate to the whole. When people are thinking of their environment as a theory, though, made of rules and explanations our whole world can be vividly displaying the most abnormal behavior and we won’t be in the least bit aware of it.

Last week I went to a very nicely run conference on “Investing in a Sustainable Future”with a whole community of “observant and responsive” investment advisers. It was at the NY Hilton organized by the Financial Times in association with the Social Investment Forum. Socially responsible investing, as an ethical choice for investors, has a 30 year history.

The profession of sustainable investment advisors, using a range of scientific tools and partnership methods, is fairly new. It seems to be rapidly emerging as a position being filled by businesses with large portfolios to manage, all looking ahead to a very complex and risky investment environment.

I was really impressed with what I saw, but I’m not sure they’re ready to find how overdue it really is that business started noticing the need for them. Nature has been sending us “funny” signals, you might call them, for a long time. That business is finally asking for help steering around them, is wonderful of course.

I also got the WorldWatch “Vital Signs 2011″ in the mail last week, and put together a kind of storyboard that summarizes the resource depletion events leading the world economy to what seems like a real impasse. The new pattern looks very much like the start of a repeated cycle of spiraling resource costs followed by partial collapses knocking out losing competitors in around the world, over and over. That’s the natural symptom of “demand exceeding supply” for a growth economy.

We’re now suffering the second global resource price shock of that kind, as demand for basic food and fuel resources continues to grow and costs shoot up as expanding supply lags behind. As it’s the global economy, people only understand it as a “bunch of rules and beliefs”.

This strange new natural phenomenon seems quite unlike the past, but is virtually invisible to people, not even mentioned in the media at all really. Everyone’s “solution” remains unchanged from before, to become more efficient and productive, as if nothing changed.

What changed though, is that being more and more productive and continually increasing our take from the environment, stopped being profitable, triggering resource price spirals as nature’s last way of shutting down excessive market demand.

The trick in reading the curves below is understanding that what you’re looking at is the “invisible hand” feature of how economies coordinate their internal parts. They trade resources and technologies of different kinds to balance inequalities.

That makes economies highly resilient and elastic, up to the point when its whole network of resource exchanges hits a limit of elasticity as a network all at once. If you think about it, anything at all that displays elasticity has that same property. When you push people or things to the limits of their flexibility you get to their natural point of rigidity.

How investor’s view the resource price spirals we’re experiencing is as a windfall. In the short term they produce secure high rates of return.

The escalating prices of resources around the world cause a major wealth transfer from the businesses that use physical resources to the largely non-resource using side of the economy, investing in trading them. It “looks” like an enormous windfall to them, so not a threat at all, raising no alarm either when it began around 2003, or as it came to look more like a long term departure from normality.

From the other side, it’s physically crippling as the whole physical economy is drained of surplus funds, but no one knows who to blame.

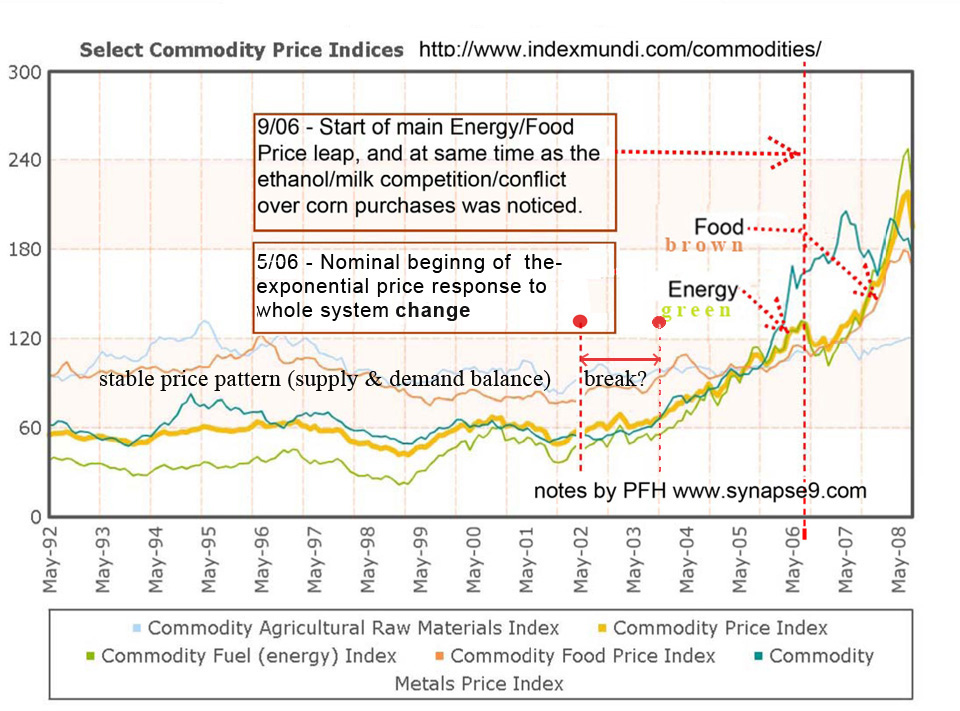

Below is a commodities market graph and my notes, showing how the first economy-wide resource price spiral looked just before the 2008 crash. It shows commodity prices all growing at an average ~25% per year leading up to the collapse.

To me, this is our largest and most immediate problem of “planet change”. Solving it will also go a long way to solving “climate change”, because we’d have to finally start paying attention to how the natural world is responding to what we do.

Figure 1

You can tell just from the curves that the event has natural causes. All the different markets are doing much the same completely uncharacteristic behavior of diverging from normal, at once.

It’s evidence that what is determining the price has globally switched, from prices set by the least expensive supply to being set by the maximum sustainable price, to ration scarcity. Of course, as an end to this price spiral, the maximum sustainable market prices were not sustainable for the financial system itself.

It was also unstable for many other considerable miscalculations of its own. This major apparently unprecedented dislocation in the resource markets by themselves, though, might also be sufficient to upset an over-leveraged financial system by itself too.

That’s what “demand exceeding supply” means, prices spin out of control till something breaks. There’s no immediate limit to the quantity of resources potential available, at some price.

The kind of limit demonstrated is *a limit of affordability for expanding the whole resource network*, of formerly interchangeable food and fuel resources. For physical economists, the kind of limit displayed is like a systemic condition of EROI < 1, when a net-energy system no longer breaks even and has to jettison costs of some kind to recover.

It’s not just the traders, responding to a “naturally cornered market” and pushing prices higher and higher until demand collapses to relieve the condition. It’s the normal decision making of everyone in the supply chain too.

It’s a little faster acting, but much like how the housing bubble came from everyone’s normal decision making, in making bets on housing values that seemed unable to fail. Because the commodity price spiral is caused by persistent growing demand opposed by persistent lack of supply, these spirals could just repeat more or less indefinitely, shocking the economy over and over as global conditions continue to deteriorate.

Some sectors will be able to take more and more and others have to do with less and less, as repeated waves of working capital are transferred from the producing economy to the financial economy.

If you read it as a signal from mother nature, it’s a natural signal to change directions. A physical system driving itself into a natural dead end, needs new direction.

Giving up its working capital to the investment community, whose job is to find ways to steer the economy more profitably, could be just exactly the right thing for a rational economic system to do, in fact. It could be seen as our natural steering mechanism for being responsive to change, and keep us from repeating the many failed experiments with advanced complex societies of the past.

The newly important profession of sustainable investment advisors I caught a glimpse of last week, is growing rapidly. It’s a position being filled in large businesses, throughout the government, banking, corporate and financial communities.

It’s job description is to provide practical investment advice on how to use sustainability information to respond to emerging regulations and identify hidden opportunity, or more simply, help the economy fit with reality. It’s still relatively young and not powerful yet, but I saw a great display of its talent and vision.

I don’t quite think they realize they are key players or realize what their job description entails, though some clearly understand that as a whole culture and society we are at very decisive moment. Because it’s what they’re being hired to do, they are exploring the interesting job of advising the managers of large assets of all kinds on what would be profitable to do in a world economy actually going haywire.

That the world economy is already colliding with the hard limits of the earth and responding disruptively, as a result of people not noticing what we’d run into, seems yet to be appreciated. So the moment we seem to be at, is needing to set about completely reeducating the financial system.

Nature wouldn’t stop feeding a cow just because it’s milk isn’t multiplying, but that is exactly what happens following the old rule of “growth at any cost”. That’s still what’s being followed throughout the established finance, business and government community.

The natural principle for lasting profit is different. It is that as you approach diminishing returns, and growth pushes your internal or external limits, then *it’s then more profitable to invest your earnings in your environment* rather than multiplying your take from it.

An important point not to be missed is that this kind of change in the economic environment hurts business. It particularly hurts struggling “green” businesses that our transition to sustainability importantly rests on, and that are not promising to be “perpetual growth tigers” in any case.

This change in the economic environment will cause struggling businesses to fail first, perhaps wiping out much of the world’s present wave of creative start-ups.

So instead of directing resources to those businesses trying to invent our way out of the natural crisis of limits, the traditional rules of finance serve to take resources from them. The 2011 view of food and fuel resource costs, as most know, is a rerun of 2008, another run up to a “once in a century” economic crisis only three years later, as you can see in the FAO world food price data.

It’s compounded by the lingering financial dilemma, of course, that a world owing ever more profits from resources producing less is still with us.

Figure 2

Figure 2

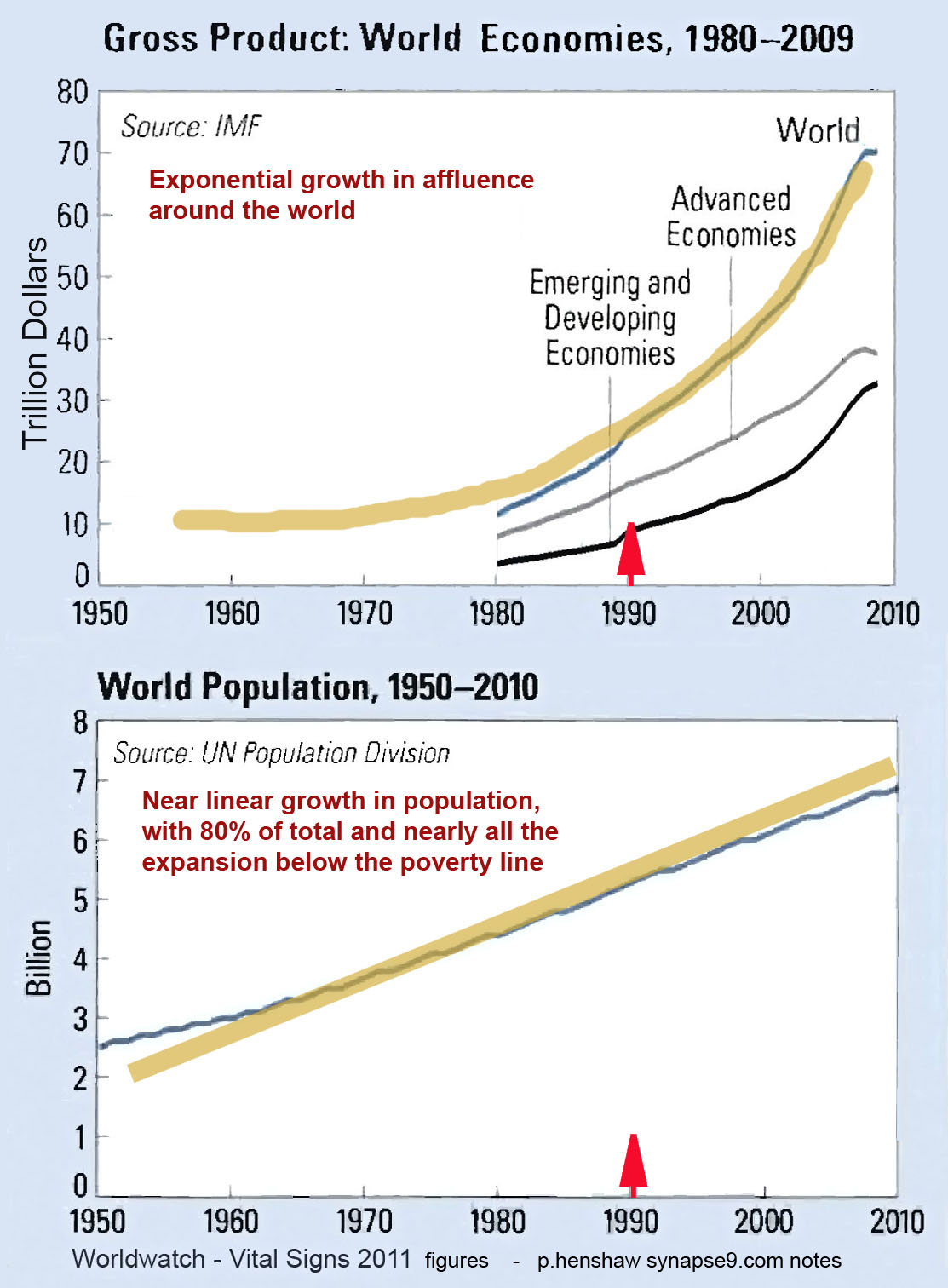

The driving factor pushing the world economy across the elasticity limit of its food and fuel resource network is, of course, unbounded population and affluence growth, shown here as published in WorldWatch.

What you see is exponential growth in affluence which represents the economic ideal of the vast majority of the human population, now growing at close to linear rates. Those represent the global demand curves.

.

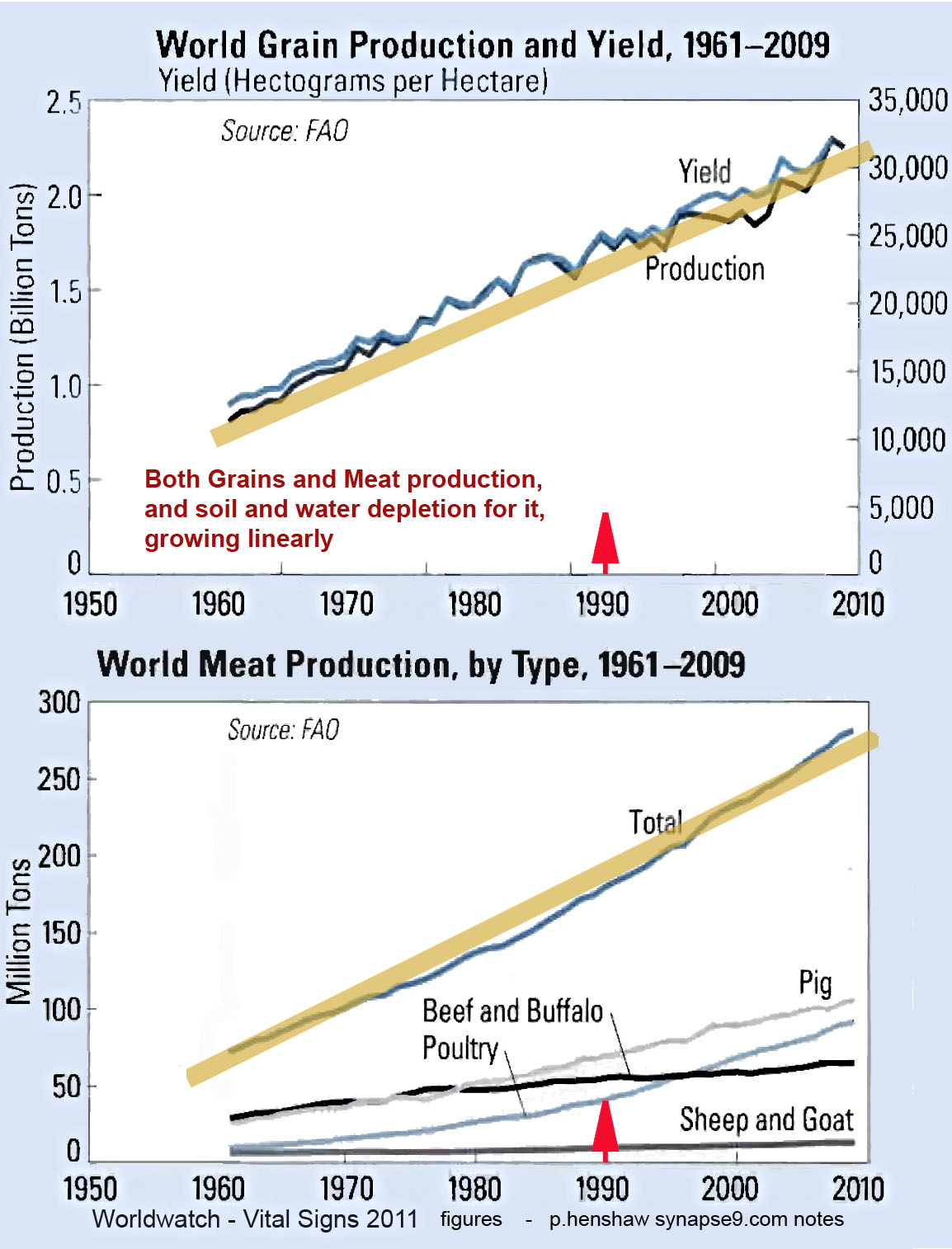

Figure 3 .

The other curves below show either linear or slowing increases in supply. That spells out the Malthusian dilemma, that has been so well studied by some and so completely ignored by the most successful people in business and finance… If interested the above figure and the three others below are available collected on a single page. I needed to graphically stretch the time scale on some of them to get them to all have the same one.

The scenario I see in them is that, growing population and affluence created resource demand exceeding supply, allowing prices to be set by scarcity for food and fuel resources, pushing costs up for some and out of reach for others.

It’s somewhat like Malthus’ idea, exponential growth of wealth meets slower growing supply of food and fuel. As we Discover the network of exchangeable resources is unable to expand w/o sharply rising prices.

Both Grain and Meat supply increase linearly, limited by soil and water depletion and fuels taking land and pushing up fertilizer cost.

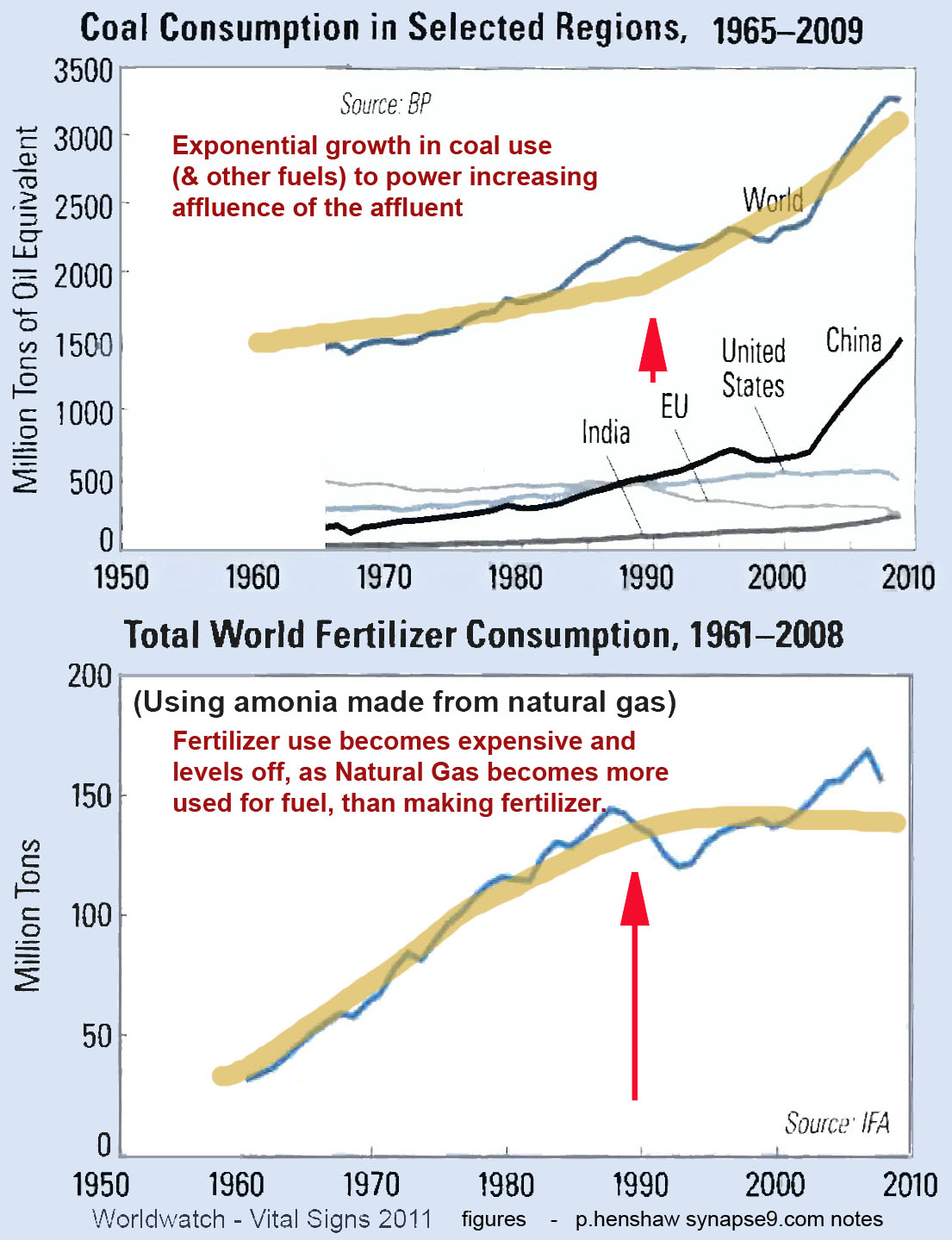

Figure 4

Exponential growth in coal use (& other fuels) to power increasing affluence of the affluent. Fertilizer use becomes expensive and levels off, as natural gas stops being used to make ammonia for fertilizers, and becomes more used for fuel.

Figure 5

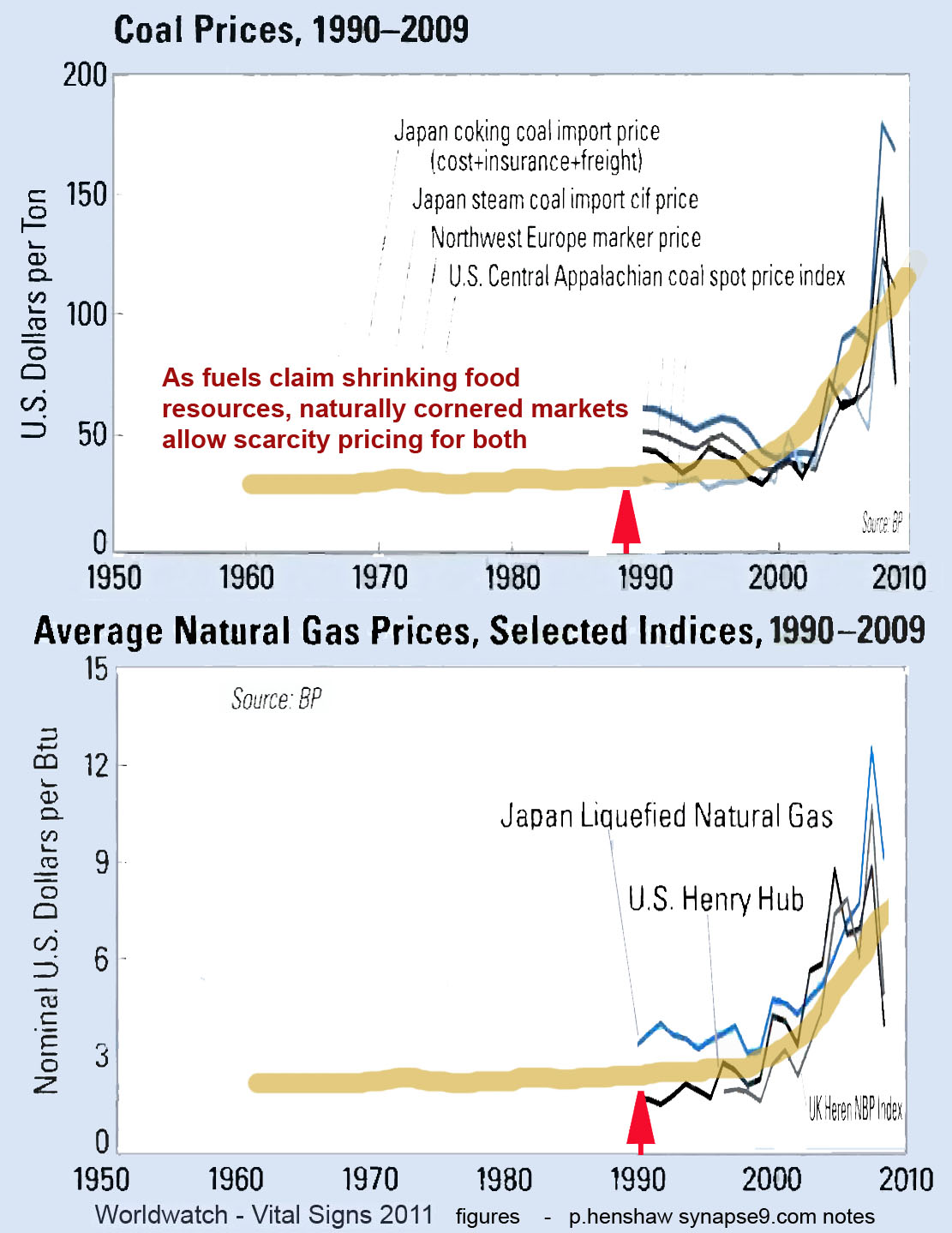

As fuel use takes more food resources, naturally cornered resource markets allow scarcity pricing for both

Figure 6

So what’s mother nature to do with us?? Well, apparently it’s up to us, to learn how to hear her voice. I mean that both figuratively and literally.

Mother nature has a “homemaking” task like any mom who is responsible for putting all the pieces together and bringing out the family’s joy in being assembled. It seems to be define our present relationship with the earth.

We follow our own explanations and theories so faithfully, it causes our linear thinking to completely miss the signals we need to respond to for living as a member of a complex living community, as natural environments are.

adj: 2/25/12