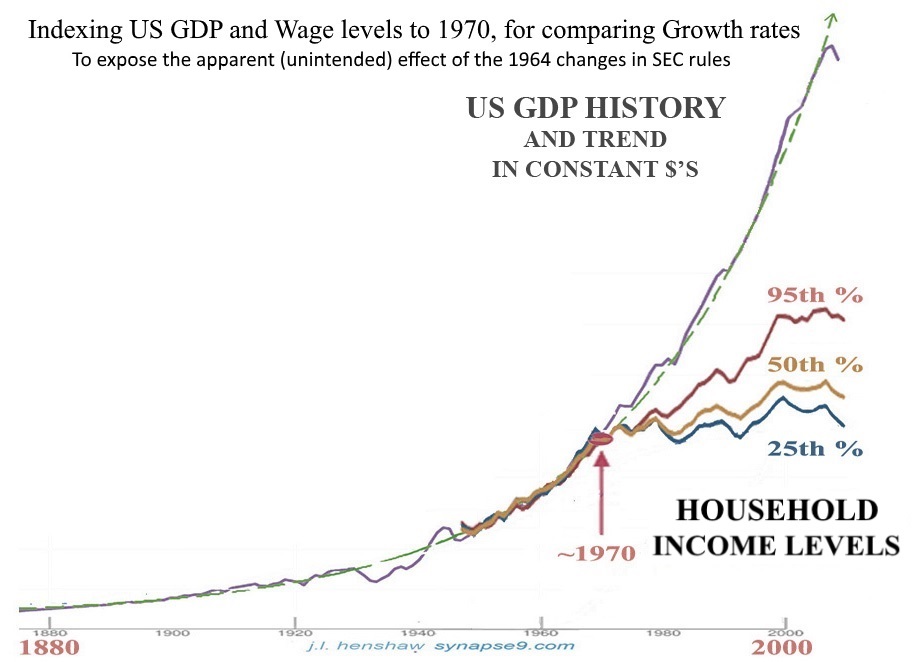

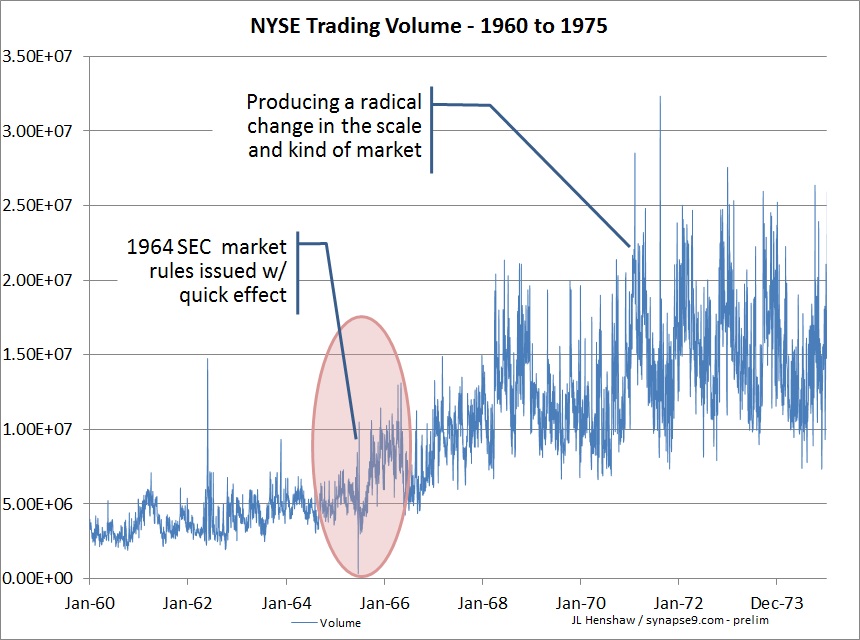

Preface: The 1964 SEC rules change seems clearly connected, but what really happened to so dramatically change the whole economy at the end of the 60s?? Figure 1 below shows that something DID abruptly change the whole future of the US economy, in about 1970, causing a permanent great acceleration in societal inequality. Figure 2 below also clearly shows the pattern of trading on the US stock market began to radically change in 1965 too. There’s also other evidence mentioned below on what happened. The Marketplace.org radio program 6/14/06 gave another part of the story for the evident sudden change in the relation between Wall Street and Main Street. They said it was what Milton Freedman wrote in the NY Times in 1970:

- The big change began with a professor. At the University of Chicago, economist Milton Friedman (who would later win the Nobel Prize) wrote this in the New York Times Magazine in 1970:

- “There is one and only one social responsibility of business — to use its resources and engage in activities designed to increase its profits.”

The coincident magazine article almost fits the data…, but when did a single comment by an economist suddenly change the world? Never of course. So I think it was some deep change in the rules of business, that may have been made possible by the SEC rules change of 1964. That the break was so sudden indicates pent up pressure for it that was suddenly released. The smoking gun is that the bottom 95% of household income levels suddenly went from growing together with the whole economy, to splitting apart. It reflects some kind of fairly sudden reprogramming of business. We were just computerizing everything, and standardizing new business and stock market accounting methods, so that would have to be somehow connected. The new definition of business value as the “bottom line” was being standardized at the time, along with maximizing “shareholder value”. Those changes would seem to have served anyone being paid in proportion to profits, shareholders, stock traders, executives… and to disadvantage everyone else. [1/1/2018]

_______

For those less familiar with my work, I study an evolutionary development form of physics, using explanatory principles of physics to ask leading questions about how complex systems rapidly reorganize and change form, perhaps the most inexplicable thing nature does. The clue is that it is generally associated with the rapid expanding organization process of growth. Other scientific methods treat it only as a numerical shape, but there is much more going on. Much can’t be explained, but what can be firmly predicted is that any growth process produces a crescendo of change, that will upset its own process and cause it to change form. We should all learn to study that transition.

_______

2016 forward:

In the figure below, the economy as a whole is shown continuing to grow as before, while the various levels of household income suddenly split apart.

Whatever the change, it would clearly be catastrophic for the resilience of wage earning communities. The question remains whether what kind of culture change is exhibited in the data. Was it as I’ve suggested made possible and facilitated by the comprehensive SEC and Congressional revision of the stock exchange rules in 1964. Outwardly the SEC’s purpose was to bring the markets into the modern world, to make it more convenient, secure and efficient. Other things were happening too, seen in the trading data (2) in how suddenly after the rule changes were passed the behavior of the NY Stock market dramatically changed. There was an immediate wave of high volume trading unlike the past, seemingly ushering in the culture of fast and high volume trading for “playing the markets” we’ve seen since. It notably also included a redefinition of business value for the sake of the markets, redefined to be a single number, “the bottom line”, introducing the widespread use of the term to represent a new way of market savvy business.

If you think about how it might effect businesses, to be graded every month as succeeding or failing to make the “grade” set by market prediction of business value, it’s clear what a force it might become. For CEO’s and board rooms across America would be forced to make decisions favoring the expectations of the market. I have not found it yet, but my view is the some center of business thinking was discovering how much profit could be squeezed out of the economy if business was managed by computer for that purpose, and that was the pent up pressure that needed rules for rapid trading, ready to go as soon as they were in place. It would change business and investor decision making like school teachers required to “teach to the test”. As we know that raises grades an hollows out the student’s education. Here driving American businesses to meet the numbers, to please Wall Street set for “maximize profit at any cost” was very costly. Driving stock price increases with continual forced “efficiency” and “productivity” gains naturally drains a system’s resilience, as a real kind of enslavement. It requires endless cuts that dismantle what had previously been thought of as “good business”.

_________________

Prior study since 2010:

My first notes on the subject were in 2010. Your can find lots of examples of complexity itself being a natural limit to growth, and I initially associated this change in how the economy worked with the rapidly emerging complexities of life. We all experience life as a growing struggle, an escalating “rat race” of new complications, and a constant search for simpler answers. Clear evidence is found in the sudden rise in use of the phrase “information overload”, from the late 60’s on. At the same time there has been slowing use of the word “complex”, I think indicates the complexity of things stopped being of as much interest. Those issues are discussed in: Complexity too great to follow what’s happening… ?? Then in 2012 I realized 1970 was also when computers started being used to manage business complexity, as the first “killer app” of computing really. The global effects would include giving business management a growing information advantage over others, telling them what can be cut and remain profitable, and making business financial analysis based purely on numbers rather than judgement, and somewhat incontestable, as discussed in: Computers taking over our jobs and our pay?

These preliminary studies still seem valid, but fairly incomplete. They didn’t really explain why the change occurred in 1970, or why so sharply. That is what the SEC rules change of 1964 now helps to provide. It appears that the implied “fitness function” of business was redefined to advantage the stock markets and executives, and hollow out the economy for everyone else, in effect violating all of Isaac Asimov’s laws of robotics, as the first big thing we thought of doing with automation.

_______________

The Rules That Wrecked the Economy

It takes a little time to explain the evidence, here showing the long record of US GDP growing by leaps and bounds for 120 years. Overlaid are Household income levels, scaled to equal GDP at 1970 so their proportional changes are displayed. Household incomes are seen perfectly tracking GDP from the 1940’s to about 1970, and then start to dramatically fall behind. It shows the economy completely stopped “lifting all boats” in 1970, completely disproving the endlessly promoted business lobby idea that how to cure the “malaise” was to give the rich more money. Households suffered from the having to manage the ever faster growing complexity of life, but without the growing resources. It might not have been intentional, but these trends do seem to literally display 40 years of US households being increasingly devalued, cheated out of the economic value they created, even as investors were cheated too, by businesses being driven to develop unsustainably, only becoming a great public issue now.

The next figure shows the behavior of the stock market at the time when the SEC rules bringing “efficiency” to fast trading and market manipulation by traders, a 14 year record of NYSE trading frequency beginning at 1960. You can clearly see how the strongly pattered trading followed right after the rules were implemented, as a dramatic change from the sleepy manner of trading before. You might also be curious about the 40 year record, from 1960 to 2000.

When you see a genuine behavior change like how the trading volume suggests a “sleepy” market from 1960 to 1965 followed by a market of manic movements thereafter, it means people have really changed what they’re doing. I’m not completely sure how well my hypotheses about that behavior change will hold up, what it was and what effect it had. I have a rather good record on a number of other things, though, so I think they’re at least rather close.

I would love to have help going more deeply into how the culture change involved took place. The SEC annual report mentions a number of meetings that might have been involved, and getting those notes might be very valuable. The documents I found most useful so far are a 30 pg excerpt from the SEC Annual Report of 1964 and a NY Times article reporting demand for “the bottom line” . The latter interestingly reports on the woes of bankers, as if not sure of how businesses defined their values, as an argument for reducing the value of businesses to a single number in a quarterly report. I think that way of redefining the value of businesses shows a clear “spin” favoring the fast trading culture about to emerge. It quite neglected the possible effect on the lasting values of businesses, that seems to have been the mainstay of Wall Street thinking before.

__________

Work to be done includes

- updating the data from original sources

- more detailed study of the 1964 SEC rules and their adoption, amendments, and “side agreements”.

- studying why the rules were a pivotal “breaking point” for a rapid large scale culture change in how American businesses are managed and how the new style trading cause business practice to change

No doubt there would be grand scale malfeasance discovered, and perhaps prosecutable criminality too. As what happened is really culture-wide, I think finding criminality would depend on when the original meaning of “fiduciary duty” was lost, that would be the basis of requiring financial managers act in the interest of the people they make decisions for. The main crime seems to be self-destructive, a culture change. The ideal policy would be to guide people to understanding their own errors and learn how to follow a new path. New York City, like all the “money centers”, is directly implicated in needing to find a new way to make money, for example. For 50 years money centers have depended on maximizing the extraction of wealth, not securing the future of wealth, and so have relied on promoting disruptive innovations with no heed to what was disrupted… No fury seems adequate to express the stupidity of that, What is does indeed come down to is finding that those money centers will shortly “be out of a job” unless they become as creative at helping to put the world back together as they were at ripping it apart.

Added work to do includes:

- further studying the very special problems of societal manias…. as that is what we see here. What sort of “policy” can one have for societies taking the wrong path, having wandered SO far from creating a world to live in that can last.

If you think of money as physical energy, money being what we use to release our use of it, you can think of the global economy as a rocket ship. The problem of course is our culture having settled on operating civilization that way, as a rocket ship, programmed to only accelerate and never land. Our main societal “business plan” is to multiply our energy use, investing to accelerate our fuel consumption as fast as humanly possible, forever. Of course to do that some money and energy are reserved for keeping people somewhat happy, but if the policy is for maximizing growth rates every other purpose is secondary. So here’s the question, how do we change course when changing course is nowhere in the plan? Do we shove the drivers out of the vehicle? Do we hope to explain to them the use of the gas peddle, steering and breaks? There may be equivalents in the rocket ship already, but the driver seems utterly unaware of them conceptually. It’s a lot to explain, and a lot to learn,

- collecting our understanding of real scope of the problem

The ancient legal principle of “fiduciary duty” is a deep principle of professional practice requiring professionals to act in the interests of those they serve, and another example of selective redefinition for for managing money. There probably is a clear history of successive misleading revision, with a legal paper trail to follow for how it came to be turned on its head to serve mainly the self-interests of trader paid for their extraction of short term profits, not for serving the interests of the people whose money they traded. I appears that legal opinion now holds it to actually prohibited for traders to consider anything than short term financial returns as the interests of investors, even though no one is served by that except traders and CEO’s who are paid in % of short term earnings. That is the complete opposite of the original intent, of course. So the redefinition of “fiduciary” seems to have come from cultural blinders like those that produced the SEC rules of 1964 too.

Another, even clearer example I’ve noticed, I also spent a lot of time thoroughly documenting. It’s how all manner of scientific principles are being willfully ignored in managing the world survival project called “sustainability”.

One certainly can’t fault anyone stumbling through this confusing time, making sincere efforts to learn about how our very complex world can come to work again. We’re in a period of unprecedented permanent change in who we are, not planned by anyone it seems. That said there are also large systematic errors one can find in the efforts people are making, related to persistent influence of money. One very consequential case is in efforts to reduce environmental impacts that businesses are responsible for use, using widely circulated very unscientific rules for counting them. The standard for environmental accounting instruct people to measure the global impacts of their use of the economy as what is recorded locally. How that “slipped” by so many world institutions and communities is what’s shocking.

People are just told never to count the impacts of using money (even though that’s the main thing causing all our global impacts). If you’re not allowed to count the impacts of money it limits your view to your boundary local observations. So sustainable cities don’t count the resources consumed from outside the city. The same applies to national measures of sustainability, like Sweden not counting the external energy consumption for either the majority of their income and consumption. that happens to be outside its national borders. I’ve published and written on this extensively, and tying it all together in my UN proposal for scientific method for steering world sustainable development, a World SDG. It starts out very simple, learning to do the math right at least, and leads to giving people a full understanding of what our money pays for.

I’ve also studied fairly deeply how all these confusions could arise. Is there something wrong with our minds if our effort to hold onto reality is fraught with difficulty? What would allow the meanings of important words to unexpectedly change, largely unnoticed? The line between the words that are and are not prone to radical change is between definitions we get from experience and ones we get from other people. Most words directly refer to natural patterns of life and our own experience of them. They really can’t lose their root meanings as new variations on their meanings accumulate over time. The problem is with words defined conceptually, social agreements and things like the economy that we can’t really observe, and so only understand abstractly. Being unable to distinguish between those terms of conceptual thinking and words for natural experience, we tend to trust what ever usage of any kind is current in our immediate cultures. So in the money world, or in any social or professional or religious community too, people may be making up new abstract meanings for convenience that may drift widely from one group to the next, and over time, and not be noticed.

That inability to distinguish between natural and conceptual meanings seems to spill over as part of all our problems. We rely on natural and scientific language for grounding our idea in the patterns of nature, but we’re at risk if we can’t check the wandering meanings of our other languages. At present though, the scientific meanings of natural language are not being taught, and our scientific thinking is limited to the classroom, lab or office. We might try to find how to use scientific principles to check what we’re told to believe, and may wonder if conflicting interests have distorted.

That’s more or less what I’ve done, collected some things I see how to go back to nature any time to double check, to help show were work is needed to get the story straight! ;-)

__________

(draft in progress)

JLH

One thought on “Was Shareholder Value What Did It??”