My article in New European Economy describes the 10 year global price spiral in natural resource markets as a true “Decisive Moment for Investing in Sustainability” (local PDF copy). It shows the world is now pressing natural limits for affordable resources, in a way as potentially explosive and dangerous to a growth economy as a global financial bubble, with more lasting effects.

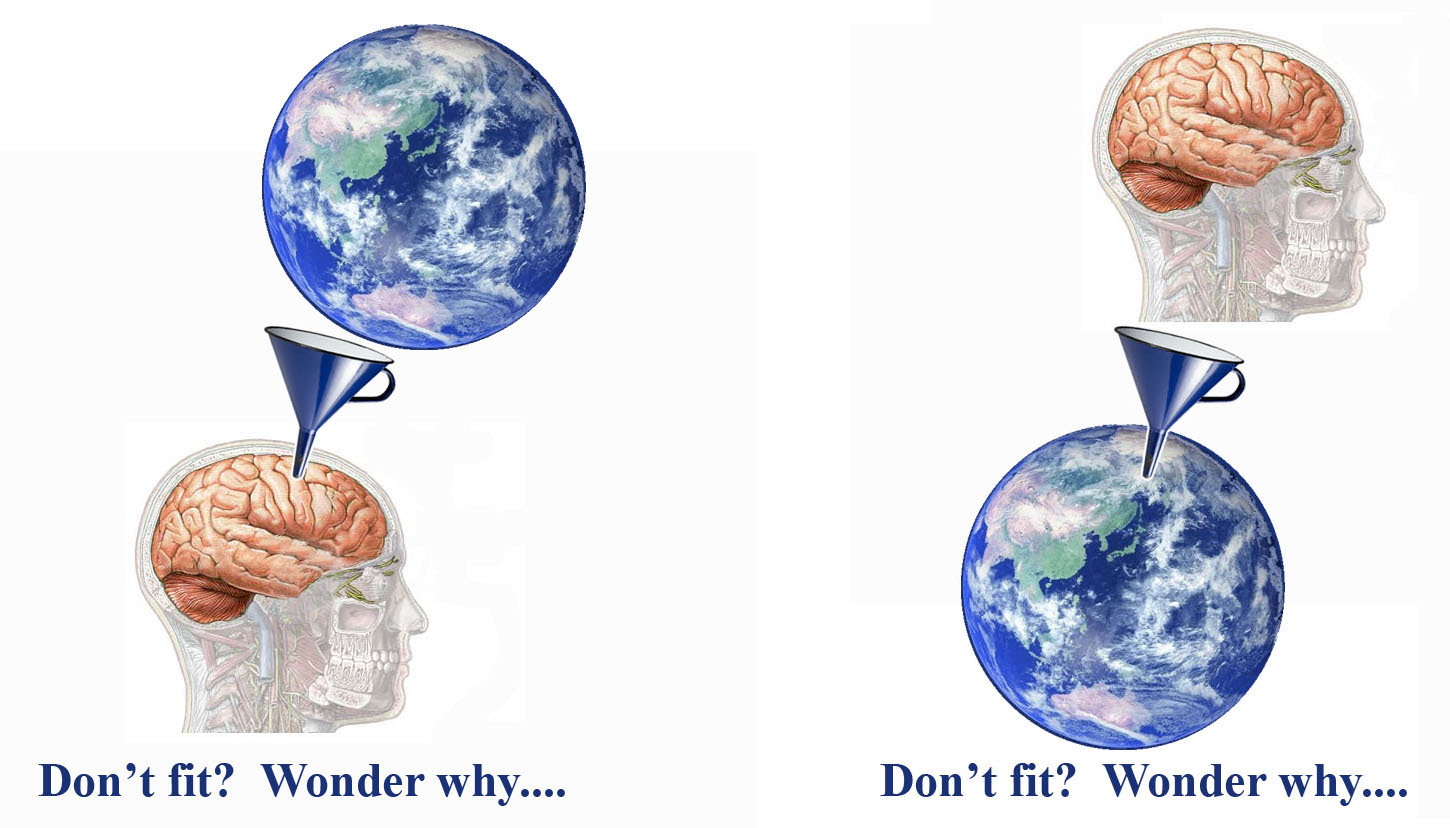

The long expected “big crunch” at the end of growth has a surprising shape.

________

For a growth economy shifting from having ever cheaper to ever more unaffordable resources is the long expected “big crunch” at the end of growth. We just didn’t know what it would look like, or that it would be a bigger and more urgent dilemma for prosperity than climate change.

A major business leader, Jeremy Grantham, recently issued confirming report on the future of natural resources from his view Wake Up! The Age Of Cheap Natural Resources Is Over (200k) . It’s a critical new issue, marking conclusive evidence of a change in the natural environment’s response to us. How people respond now matters a great deal.