An exchange with John Baez on his Azimuth blog.

Phil Henshaw says: May 28, 2011 at 1:54 am

I think the actual problem, and why it’s so intractable, is that our “resource management system” is designed to serve our financial system,… not the reverse.

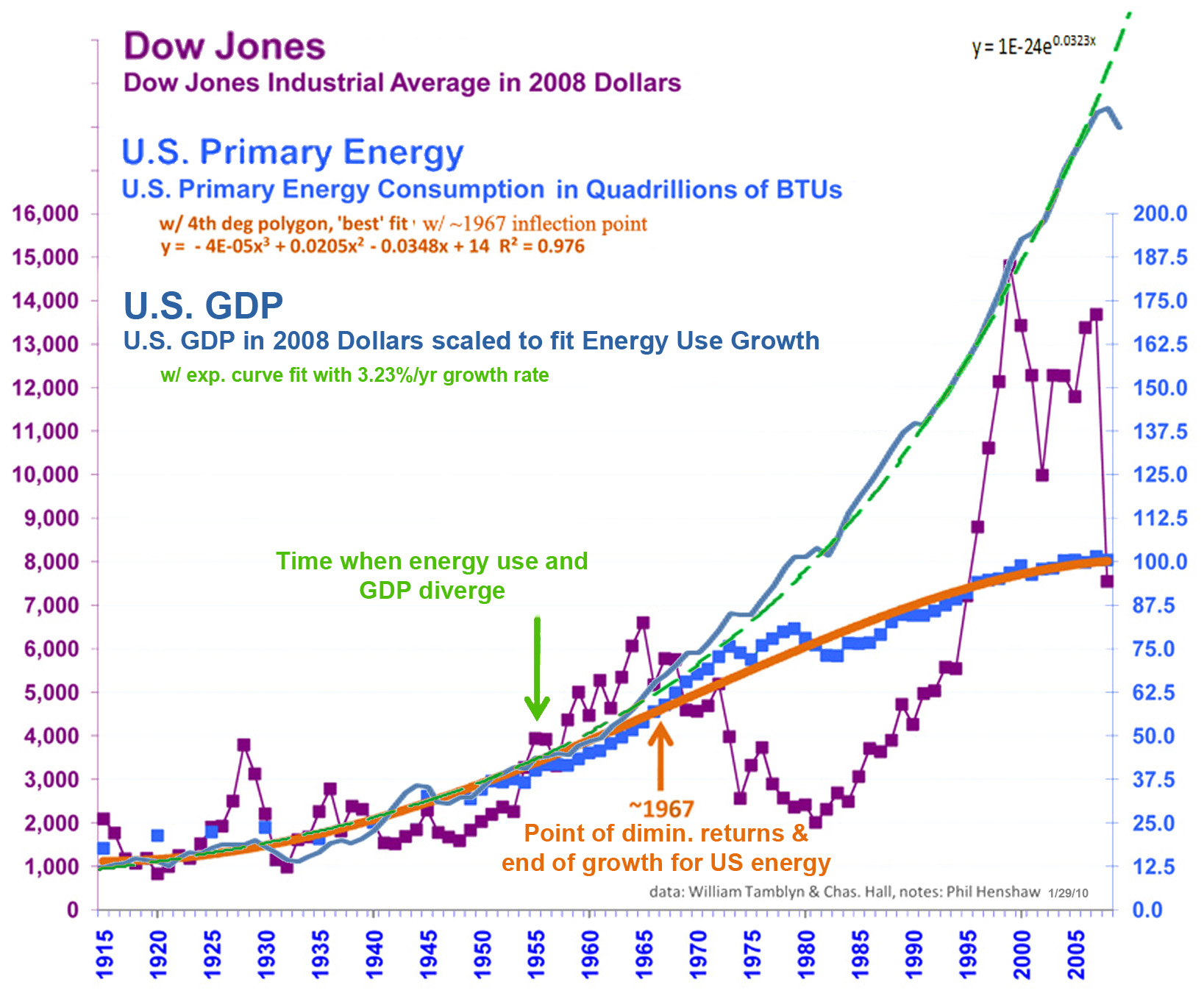

Our financial system is designed to create stable positive financial returns, so people can keep adding their winnings to their bets, and have an ever multiplying “free lunch”. The critical energy management decision necessary for doing as best one can at that (allowing punctuating the endless boom with enough busts all the time…) is to accelerate the economy’s use of inexpensive energy as fast as economically feasible, forever.

What results when people model their implementation of physical law following rules they happen to like for financial law, is it creates a simply enormous explosion of wealth that produces a completely unmanageable society and economic system (instead of a comfortable home on earth).

I think that’s a big part of what is so self-defeating in the human intention to “tame nature” to behave like we think it should. We haven’t seen the value of watched nature to see how it works first.

Reply, John Baez says: May 28, 2011 at 8:56 am

Can you translate these insights into an answer to the question: “What is the one best thing everyone could do to slow down climate change?”

If so, would the answer be some version of “think differently”? Or is there a concrete action that you can propose?

Reply, Phil Henshaw says: May 28, 2011 at 9:27 pm

The theoretically necessary step, that no one seems to understand when stated in abstract terms, is for the net-energy surplus that was first applied to growing the system, now be applied to adapting the system to a finite and fragile planet. The world’s institutional economic models and planning assumes there will never be a need for that, and money can keep compounding forever.

The practical means of changing that comes from J M Keynes, and what to do with money when the economy can’t grow. It follows from how the surplus resources for growing the economy were managed to start with, by the use of profits from investment to proliferate more investment.

To keep investment funds from becoming worthless when the economy can’t grow, and make the system manageable again, you’d need to deflate that money spiral. As a personal matter it means the people whose money it it need to stop growing it, and be careful to invest it in good purposes.

That would involve a)devoting investment funds to sustainable development rather “fast money” and b)stop adding investment profits to expand total investment, divesting net profits for some other good purpose. There would be a lot of negotiation as to how to achieve that, of course, as all our institutional plans assume it’ll never occur.

“That would involve a)devoting investment funds to sustainable development rather “fast money” and b) stop adding investment profits to expand total investment, divesting net profits for some other good purpose.”

I’ve been getting traction with some of the leading thinkers in the ethical investment community (John Fullerton, Hazel Henderson and others) by saying it’s a matter of combining “green investment” with “green divestment”, redirecting the savings in the “giant pool of money” for good purpose, to reduce the absolute scale of our demands on the earth.

Keynes actually wrote a whole chapter of his big book on it, Chapter 16 in The General Theory, though due to the cultural belief in perpetual growth his entire profession ignored it completely. I have a scanned copy on my site fyi. It’s readable, but you have to fight through his discussing it in terms of the aggregate variables of the world economic system, entirely ignoring any social or political debate… To find my references to that, and to “the widow’s cruse” parable he first discussed in in terms of, you can browse my blog posts mentioning Keynes –http://www.google.com/search?sourceid=chrome&ie=UTF-8&q=site%3Asynapse9.com%2Fblog%2F+keynes.

Phil

p.s. Yes, now it would seem that the business people of the time took the magical secrets Keynes offered for how to stabilize the growth system for making more and more money, and have now successfully run it completely into an impenetrable wall of natural complications and resource exhaustion, just as Keynes predicted and explained clearly how to avoid. So, the one thing everyone can do is start reducing appetites and investments, while divesting their profits and making that a new truth for society, as they begin to study and understand why.