The worst part of “A Glass Half Hidden” is the clear chance of discovering “An Iceberg of Risks” missing from the view.

Scope 1, 2, & 3 only count the impacts of the primary technology chains that businesses rely on to operate, and ignore the usually much larger impacts of the many chains of business services consumed too. That’s the iceberg of hidden responsibilities of business cause, being ignored due to using an unscientific method of measurement, i.e. counting only the impacts you see, and not accounting for the one unseen (what Scope 4 finally does). So there’s also a hidden iceberg of bigger than expected changes in plan to take care of too… that we’ve been unaware of needing for having a sustainable economy. It explains why our efforts so far still result in the economy degrading of the earth ever faster as we delay making meaningful change. The job doesn’t change, just how directly we’re able to address it.

What’s really hidden is that it’s our money that is directly paying for all the economy’s impacts, making us financially responsible. Now we also really need to know the total bill. Having a habit of not looking at what our money was used to pay for, we’ve been lulled asleep by the way money launders all the information on what our money pays for to deliver what the economy provides.

(see also What’s Scope 4, and… Why all the tiers?? for examples and full analysis)

______________

It is indeed a little ‘strange’ that a very basic scientific principle of measurement, that every scientist knows quite well already, would be overlooked in defining the world’s units of measure for saving the planet.

Scientific ways to measure things, need to measure the whole thing.

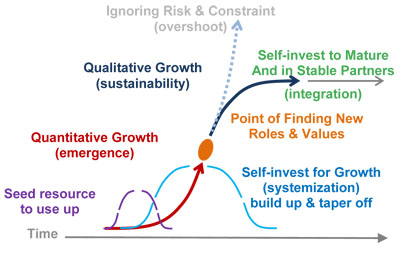

Sustainability metrics very largely don’t so that, lacking a scientific way to determine the scale of hidden impacts, the method for measuring economic impacts defaulted to the ancient practice of just counting what you have direct information on. The reality is that the great majority of business impacts actually don’t c come from what is most visible, but from widely distributed uses of the economy that businesses have no records of, paid for by employing all sorts of business services. The problem is that whether you know about them or not, the risk exposure to serious emerging economic liabilities… is exactly the same.

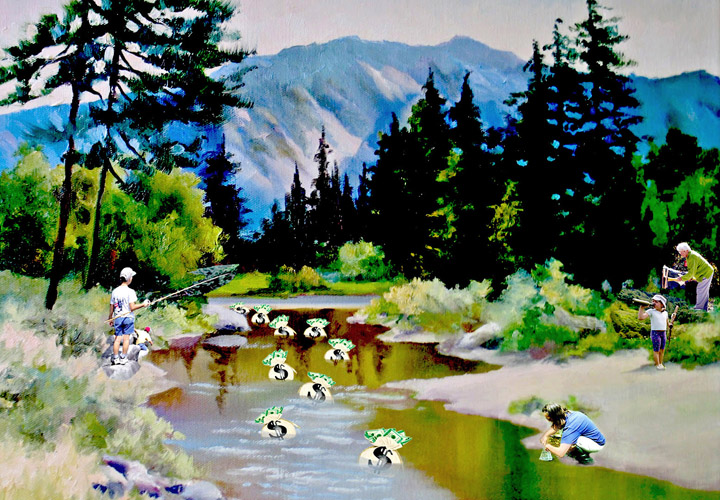

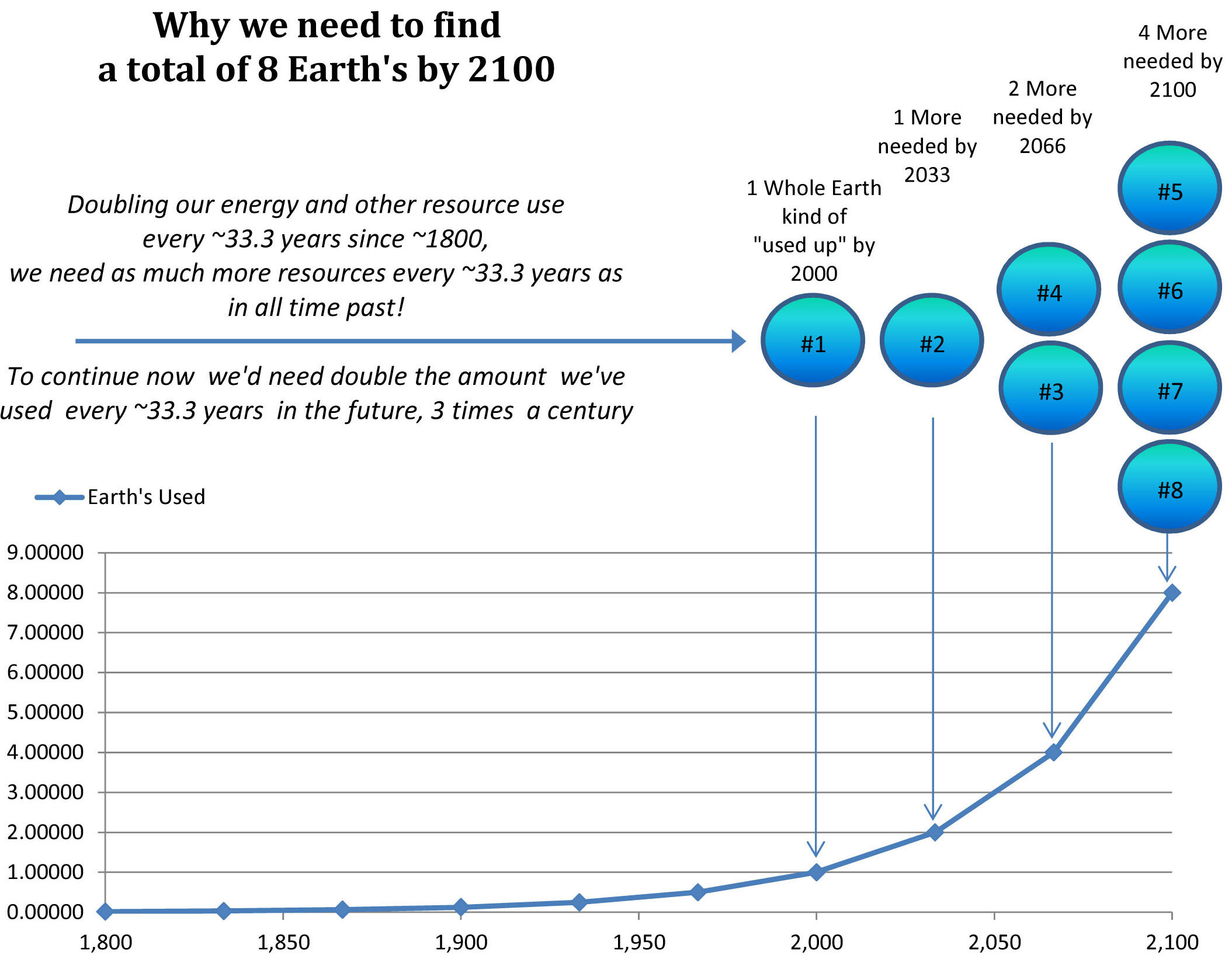

Here’s a new graphic to help picture the problem. It helps to shift from thinking about counting the energy “uses” a business and its suppliers operate with (i.e. traceable for Scope 1,2 or 3, and so on the visible side of the “glass half hidden”), to thinking about the energy uses its revenues are “paying for“, but often don’t have records of (Scope 4, on the hidden side). It’s the total of energy uses paid for that make a business both financially responsible and directly exposed to the emerging economic risks of physically causing economic liabilities and the harms done. It’s a serious major overlooked sustainability business risk. If 80% of the CO2 produced by uses of business revenue actually come from its services, and not its technology,

…it’s all the same to the investor exposed to the risks for the business as a whole.

For risk exposure it’s essential to measure the total impacts on the earth a business is financially responsible for, as that’s where the risk comes from. Just choosing not to count all the ones your revenue goes to pay for moves the risks to the hidden side of the “glass half-hidden”… but still leaves you just as exposed to the very substantial economic risks of business devaluation many see ahead. Continue reading How full is a “Glass Half Hidden”?