Marinella posted regarding research on self-organization at NECSI (the New England Complex System’s Institute LinkedIn forum):

“I’ve found this research really interesting, as it goes (finally!) against our deepest beliefs in human (in) ability to collaborate and be socially engaged without specific behavioral rules. People behave socially and ‘well’ even without rules Fundamentally people behave in a social and rather compassionate and ‘good’ way rather than aggressively, even without specified rules.”

I think the more useful relationship is that “rules” for how to behave quite often just affirm how things work best naturally. So *rules follow people rather than people follow rules*. Every sort of “system” is recognized as embodying an emergent sets of rules that work. So, social rules that describe what’s been found to work in the world assure that people are free to behave the way they’d mostly want to anyway.

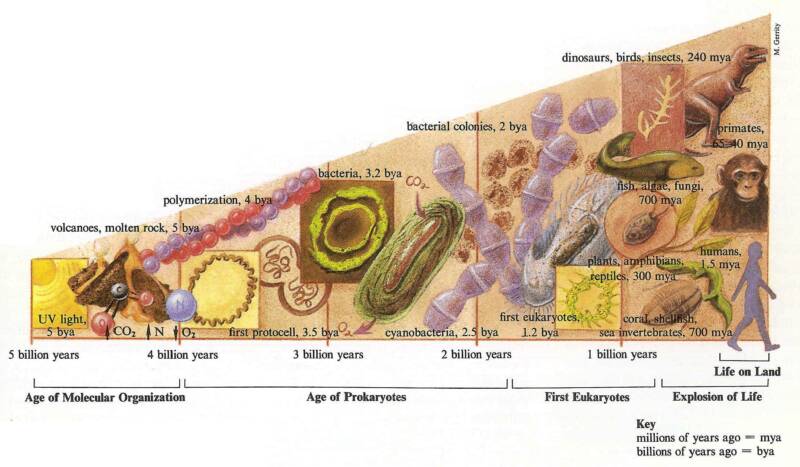

They’re also remarks about the whole self-organizing system of relationships displaying them, whether you call it a community, culture, nation, niche, commons, world, language, or movement, etc. Those rules, of course, may also need to change as the world around them does. It means that rules inherently also represent stages of learning for a system, not end points. That’s often the real source of friction, as old rules clash with the need to find new ways of making things work. My comments below expand on the way we find rules that work, as “niche making”.

Marinella,

Simple examples of self-organization like those really help. The common habit of explaining everything with deterministic rules needs to be shaken gently, it seems. I tend to not find cooperation as deterministically caused, for example, but opportunistically discovered. One easy way to pick it out is with seeing how niches for innovation form in the gaps between and to connect other things.

Diverse individual niches work to connect resilient cultural networks

After years of working with simple examples to help me separate those two paths to causation, I think the deterministic and self-organizing aspects of nature fit together just fine.

Seen as a difference between “imposed” and “discovered” causation can also then be understood as between “remotely determined” and “locally developed” causation. Examples of the latter might range from the opportunistic formation of a rust pit, on what had been a smooth shiny metal surface, or of social subcultures taking off in some whole new way. Continue reading Self-organization as “niche making” →