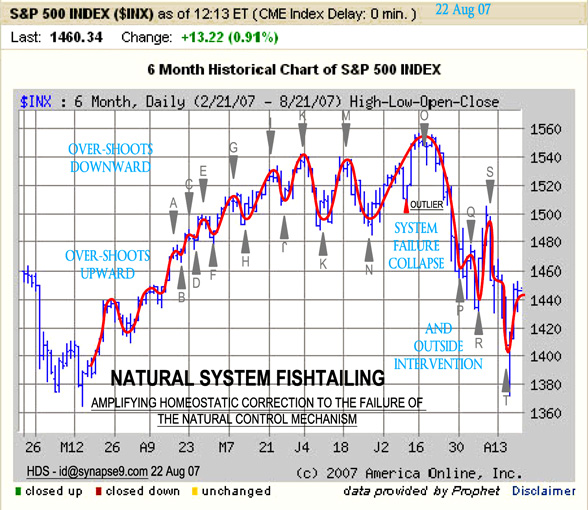

What’s it look like to you? The price swings in the S&P; 500 over the last 4 months seem to display the natural complex system self-controls of the financial system ‘fishtailing.

Systemic failure is generally the consequence of pushing self-correction mechanisms beyond their response limits.

Systemic failure is generally the consequence of pushing self-correction mechanisms beyond their response limits.Trying to respond to each other too little and too late amplifies and leads to all failing at once. I don’t know how to measure that directly, but observe the same system physics operating as in many other dynamic disordering cascades like the onset of turbulence in flows, and draw the conclusion from that. [in case you notice, I label the downward overshoots as occurring at the top of the cycle, as they should be, because the overshoots are in the rates of change] Link to latest S&P price history.

In response you want to think of it as stabilizing the pumps that are going out of control. You want to relieve the pressures by turning off the pumps, and really hope someone takes a whole systems point of view toward seeing what’s next.

Phil Henshaw ¸¸¸¸.·´ ¯ `·.¸¸¸¸