The problem is not exactly with the banks.

It has to do with society asking the banks to permanently stabilize a system for multiplying financial returns.

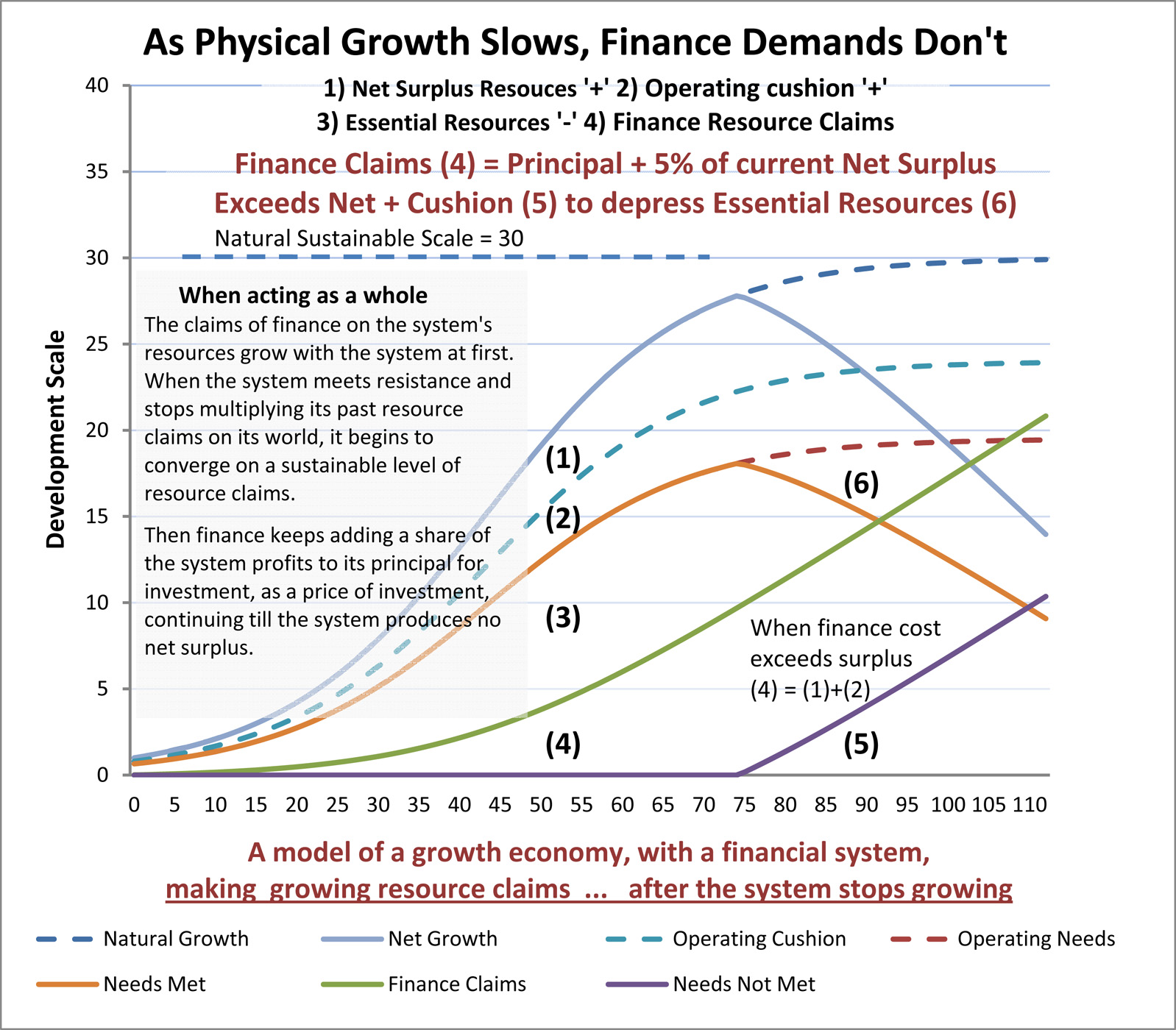

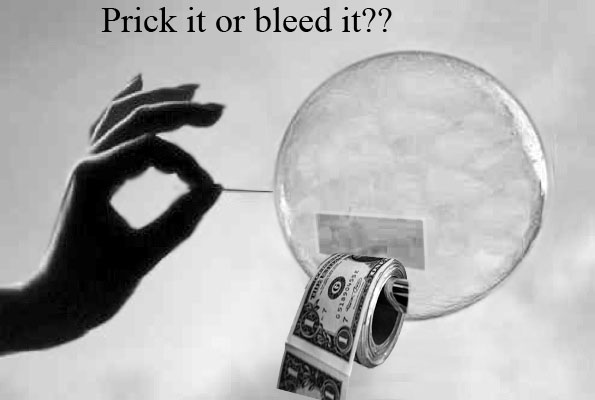

So when the economy can’t generate growing earnings the banks multiply its debt instead, creating “a debt bubble” and promises that won’t be fulfilled. The promises that won’t be fulfilled grow without limit until there’s a collapse of confidence (‘pricking the bubble’), unless 1) the economy finds totally new ways to expand ever more rapidly, 2) a “Jubilee” is declared to write down the debt, or 3) investors start spending their profits to create earnings rather than lending them to create debt (‘bleeding the bubble’) to relieve the pressure so the economy can return to health.

The Jubilee idea, to write down all the debt (something like a global bankruptcy) is much more disruptive than needed, and is just a temporary fix. How natural economies solve the same problem, so they can smoothly pause their growth when needed, will also cure the problem for all time and give us a healthy free market economy in the end.

……

I responded to Joachim Sturmberg on the NECSI Linkedin Forum regarding The Eurozone as a complex network: New analysis shows connectivity as a problem and a solution.

JS 11/20/11 – All of this is really interesting. However, isn’t there another fundamental point being lost, the core attractor of the whole system? It is all well and true to understand the interconnectedness, if the core aim of the game is all about making ever more money by whatever means, the system network will exactly do that. It may be dumb to have an exponential growth attractor, but if you have one a necessary outcome of the workings of systems is unsustainable exponential growth with all its consequences. 11/20/1

The solution is a change of attractor, and “common sense” would suggest that sustainable economic development would be a better attractor than greed – thinks a non-economist.

PH 11/20/11 – Well, yes of course. That’s why I termed my first paper on the subject “The Infinite Society, growth induced collapse”. I don’t think that’s an “attractor” you’re talking about though, but a “procedure”. Procedures can be changed. Keynes and Boulding also came to the same conclusion, that at the limits of productive investment it was necessary to have investors stop adding as much of their earnings to their savings, to spend more of them instead. Continue reading Prick or Bleed, drain the bubble or burst?