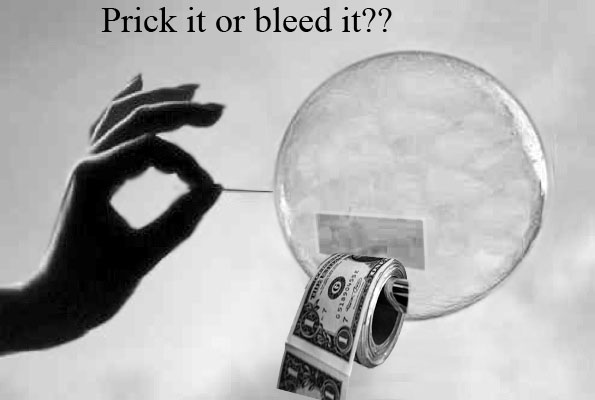

From a Pharaoh hardening his heart to confused children refusing to budge… complexly organized systems pushed to their limits often display emergent rigidity.

Things that develop their organization by new parts being added to existing ones, develop accumulative designs that become harder to change over time. It leads to organizational rigidity, that can either be seen as inhibiting change or enabling structure. These are aspects of the systems physics of self-organization.

Accumulative designs become harder to change over time

Crystallization works by replicating a pattern from a starting pattern, that remains the origin of the pattern throughout the process, like the process that creates snow flakes of a single design. It’s similar with road systems, that as you add connecting roads it becomes both unnecessary to add more and harder to change the established network.

Even with advanced computers the world financial system gets built around trusted expectations, leaving a rigid imprint of past thinking in our models for the future. If it becomes unmanageable and overwhelmed by floods of new kinds of information the models don’t contain, the system is not designed to make any response.

Organizational rigidity is natural, and develops in any system built by accumulation. A bureaucracy may be built to be very efficient and resourceful, for example, in responding to the original scale and kinds of demands. It’s initial designs may have been highly versatile for the variety of problems it started with. It naturally becomes mired in inefficiency at some natural point of piling on ever increasing demands of new kinds.

Continue reading “Organizational Rigidity” as a natural limit of growth