Sometimes it pays to recognize circular arguments with no escape, and realize one or more of the core assumptions causing that needs to be questioned.

The presently brutal and worsening job market in the developed countries is often discussed with a circular argument: that stimulus isn’t working so we need more, but governments run a risk of collapse if the jobs are not productive… That is now heard over and over, and it’s worth looking at it as painting a circle of common assumptions that everyone would like to escape.

The problem caused by economies becoming unresponsive to Keynesian stimulus was actually brilliantly studied by Keynes… His simple conclusion was that when stimulus provided by governments filling in as “spenders of last resort” didn’t work then investors would need to take that role, even to the point of ending the accumulation of investment to make economies physically sustainable. The assumption that is not variable is that we live in a finite world.

The circular dilemma of *instability in every direction* that everyone now sees facing the world economy, comes from unemployment and the economies not being responsive to stimulus… That is what JM Keynes addressed in his “widow’s cruse” proposal, when conditions “became so miserable” that net returns on investment approach zero, due to systemic over investment. What he proposed, and was roundly criticized for and eventually simply dismissed as “the fallacy”, … switching the “spender of last resort” from government to investors.

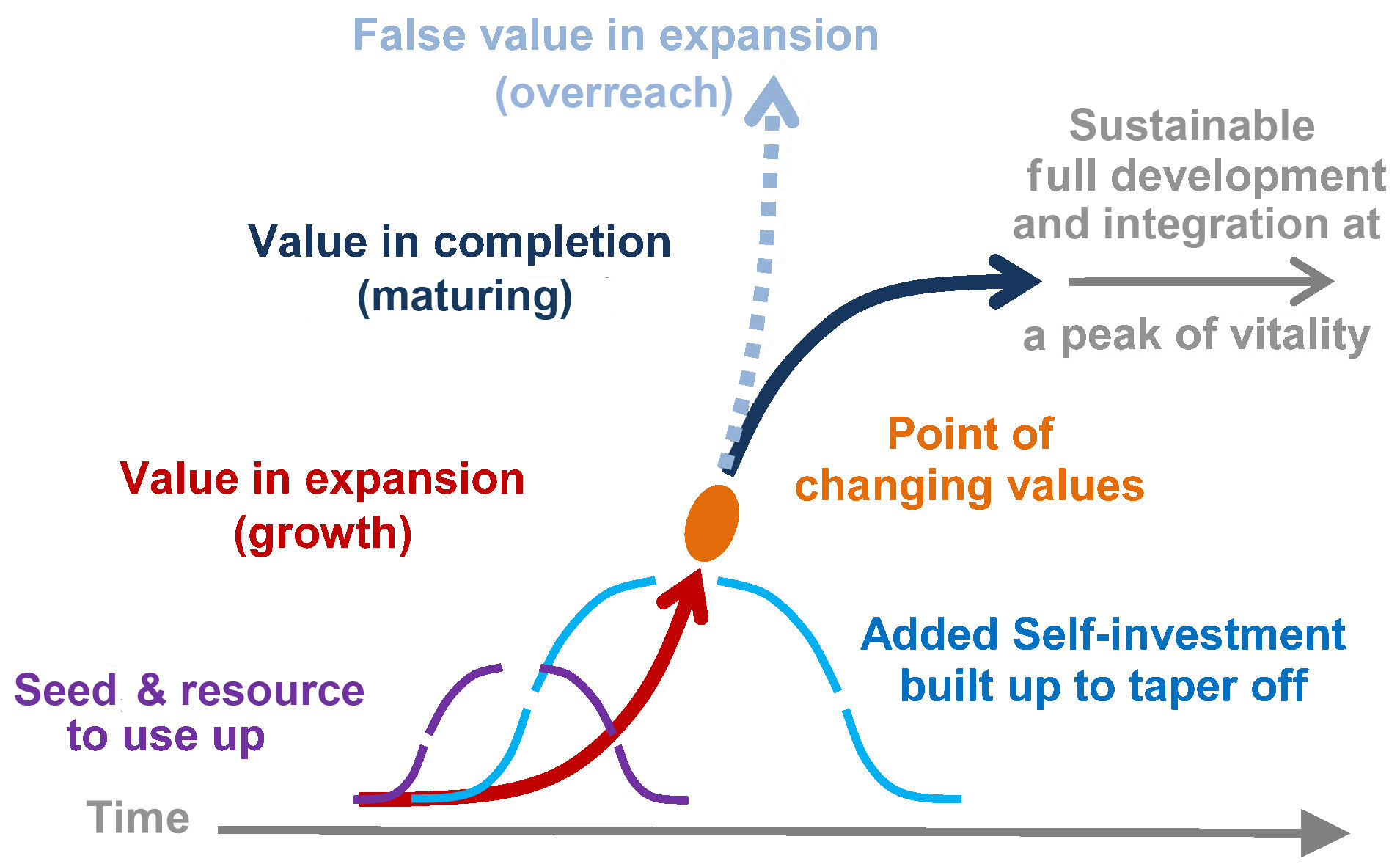

From a political view it does sound crazy, but from a systems science view it’s quite clearly the only choice. Kenneth Boulding pointed to the natural necessity of it when facing either temporary or permanent limits to growth too. I’ve also written on it a good bit as systems physics. It closely matches one of the tricky changes of plan that apparently all natural systems that become sustainable figure out how to do on their own. They switch to using the surplus they devoted to auto-catalytic growth to something else that’s productive when that self-inflation process becomes unproductive. (see development path model below)

It may “sound crazy” but it is actually a quite surprisingly practical solution. That is to persuade the Saudi’s, Chinese, our own super rich and other investors to *spend the economy back to health*, giving back to the economic system that made them rich instead of continuing to sit around and expect the world to make them ever richer when it is in fact actually failing badly.

It takes the kind of brilliance displayed by Barack Obama in observing that if the Republicans in the US Congress had decided to take over the government’s ability to function, then they had implicitly assumed a responsibility to govern too. That brilliance didn’t make them do it, of course, but at least it pointed to the problem. Today, investors have largely taken over control of the world’s financial institutions and governments, in fact, and need to take responsibility for assuming that role.

www.synapse9.com