Emily Spence had sent me a PNAS paper on the “Tipping elements in the earth’s climate system” and “Is Economic Growth a Delusion” by Steven Stoll

Emily,

Thanks much again. The PNAS paper on tipping elements, though as good as I’ve seen from established scientists, is still a bit flimsy relative to what you could say. You could consider the evolving physical systems of the earth as developmental processes, with organization of their own that can be destabilized themselves, rather than as mathematical models.

Models just don’t have many of the behaviors that natural systems do. They use controlled variable theory to represent distributed uncontrolled systems with independently changing and reacting parts…

Their definition of ‘tipping point’ shows an effort to address the subject, but ends up being a reiteration of the belief which was what got us in such trouble. That’s the idea that nature is an equation. I wish these kinds of people would talk to me!!

The strong empirical evidence of the type of hazardous tipping point approaching is persistent growth of whatever system you’re discussing. That is primary evidence the system will create conditions to destabilize its own growth process.

That principle is not understandable until you think of systems as physical things having growth as their own process of organizational development. Growth is the development of the system whose behaviors are the subject, rather than equations.

Equations are definitions and have no organization of independent complex parts and could not destabilize themselves. Only physical systems do. Considered as physical things you can realize why any growth system is a ‘machine’ for multiplying changes in the environment that will create conditions that upset itself.

Economic growth then, both is and is not a delusion. Every kind of organized system begins with it, and then the growth process upsets itself in one of a variety of possible ways.

Whether small things might alter how the growth system upsets itself, to either form a mature and sustainable system or to collapse in a pile of dust (or various similar ways or in-between) is the question. It’s not certain at that point of upset whether small things could tip the evolution of the system in different directions, like toward exhaustion or stability.

That is just the usual time when those possibilities open up if they are going to. That’s when such windows of opportunity for redirecting the system appear.

It’s a little like how space craft are guided using gravitation neutral points, called Lagrange points where the pull of gravity in different directions cancels out, making changes of orbital direction at those points very easy. L1 and L2 are the famous ones [http://en.wikipedia.org/wiki/Lagrangian_point].

For the growth of systems, the point where the system of compound growth destabilizes, is where some of the bonds between the parts that define the system are broken and others are reinforced. It’s a developmental “phase change” in which relationships are pulled apart, rather different, but conceptually a bit like chromosome mitosis in cell division.

In concept the parts are free to reorganize at that ‘tipping moment’ for reorganization when the rules of the system change. The big one we are now at or near, of course, is the destabilization of the whole growth mechanism of modern civilization. Most people who see it see it as very likely to be disorderly.

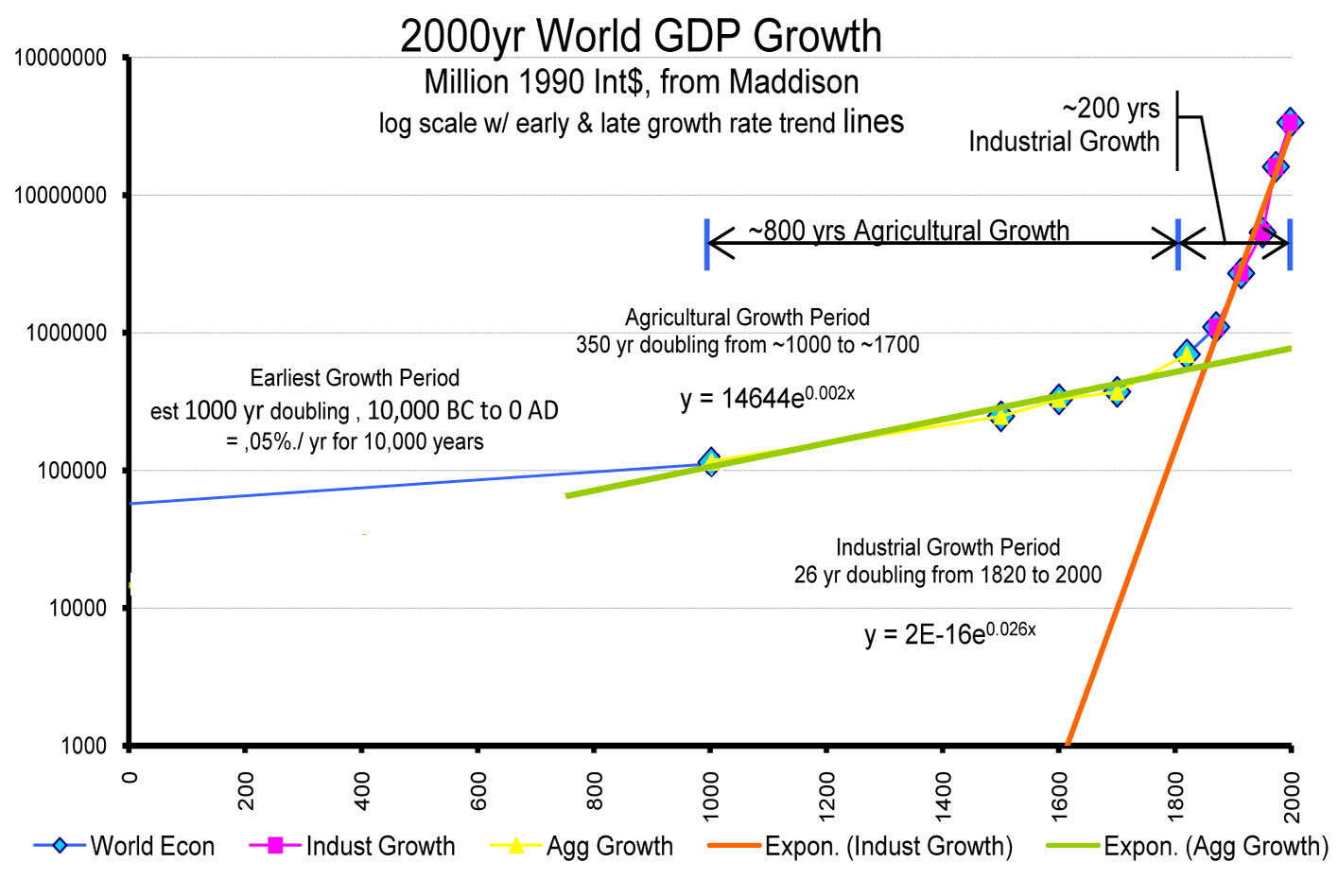

The economy has been steadily working itself up to this point of profound uncertainty about its future, by steadily getting bigger by ever bigger and faster steps of change. Historically its been for at least 500 years, and maybe a 1000, with a period of more rapid growth starting around 1780.

Modern civilization is, in my view, what grew out of the remains of the Roman empire once ‘the dust settled’ from its failure. Here’s a digest of the whole system development curves I think help put that into context.

Steven Stoll is accurately summarizing what I think also agrees with Herman Daly, Bill McKibben, James Speth and I all see as some of the symptoms of the deeper problem our point in history represents. I also see a couple levels more, I believe, into both the problems and the solutions.

The most “wicked” part of the problem they sort of miss, is that our economy is truly designed for maximizing its rate of growth. How the economy works is to do that by maximizing the efficiency at which we consume usable and affordable resources, and so a humanity wide effort to exhaust them as fast as humanly possible. We’re accomplishing that, crippling our ability to invest in sustainable systems in the process.

There is also a vastly superior way to respond to this tipping moment than what they generally recommend. The first step is recognizing that our physical exponential growth has ended as a sustainable process, and culturally we find ourselves with no other plan.

What others mostly recommend is to keep capitalism the way it is, …but just make it a zero sum game using constraints on it’s ability to operate freely. In cultural terms it doesn’t immediately seem like it, a dreamy world control solution, but unavoidably becomes a pure and simple plan to institute feudalism.

What you’d have is increasingly intense internal competition and conflict due to all the parts of the system continuing to try to multiply, because how capitalism manages money, its “information sub-system”. I don’t recommend it. It requires someone to have absolute power to make it stable, and no one including themselves are ready for King Herman, king Bill or king Gustav. It would be both ill-mannered and definitely not work as intended.

Our entire problem with the earth is believing that we were “given” our powers of magical thinking to have dominion over the earth. That’s the fools notion we need to get rid of.

On a planet that works only because independent things take care of themselves, it’s a mistake.

Trying to control uncontrolled systems just doesn’t work, anyway, no matter how hopeful the intent.

The other choice seems to be for people to discover now is the time to switch from using their wealth to multiply our own wealth. It’s done by retaining the earnings from investments for multiplying investments, and so amassing ever growing privilege and power.

Everyone with a decent income on earth is actually trying to do that now. Doing it all together is in the process of collapsing our whole economic environment, perhaps even permanently. So, we could think of doing something more useful and satisfying to do.

That switch in purpose to use returns on investments for “doing good” with rather than “taking more” ,

would make money flow to what people VALUE rather than concentrating power.

The alternative is to spend the same earnings on *something else* of value. That switch in the purpose of having returns on investments, to use them for “doing good” with rather than “taking more”, would make money flow to what people VALUE rather than concentrating power. All the sustainability projects that deserve it would get the funding, instead of money going into pumping up ever higher stakes games for using up the earth…

Well, or at least that’s what it sure looks like to me!! ;-)

Best,

Phil Henshaw ¸¸¸¸.·´ ¯ `·.¸¸¸¸

NY NY www.synapse9.com