John Fullerton posted “Hell hath no limits” on how Wendell Berry’s poetry clearly speaks of the great error of economics, also discussed by Herman Daly, in overlooking the issue of “scale” as having natural effects far different than numbers do. My comment was:

__________

The different effects of scale in the natural world is indeed one of the more important but oddly overlooked realities. The subject could be powerful in helping communicate what we need to, if people give it some study. It’s very good that you picked that out!

It’s not just the quite curious omission of the subject from economics. It’s also a quite curious omission from physics. Physics represents nature as only composed of “number” on limitless scales, with no grain or scale of any kind except as assigned or reassigned at will. Even natural units of measure derived from physical quantities lose all the constraints of natural scale in how they’re used.

It’s only physical things and processes, and the relationships between them, that have inherent scale as a part of their nature. Having not generally considered the concept of scale as a subject when describing nature, we shouldn’t underestimate the enormous effect on shaping modern science and our present image of the natural world.

That omission of scale from the understanding of natural systems and relationships by science is also closely related to our failing to consider time as a process of change, but instead treating it as a directionless string of numbers, without scale too. Representing both the objects and processes of nature as having no natural scale also seems to be the direct reason for why economic models confidently project infinite growing wealth by consuming he earth, without raising concern about having the wrong model, even as that expectation has clearly already failed.

The deep reason why scale matters is that the physical world is made of “stuff” and not numbers. For the stuff of the physical world “scale” refers to the natural operating limits for the working parts of things, minimum and maximum organizational scales, inherent in the how their complex systems developed.

You can have people large and small, but you can’t make people the size of a peanut or as big as a house. Those are “out of scale” for the natural structural design limits of humans. You can make the same kind of true statement about anything else that exists physically. The working parts that a person is made from can perform the roles only within the limits of their own organizational scales.

It may take time to get others to think and talk about it…, but what can pull these many threads together into a single rope is noticing the very suspicious relation between :

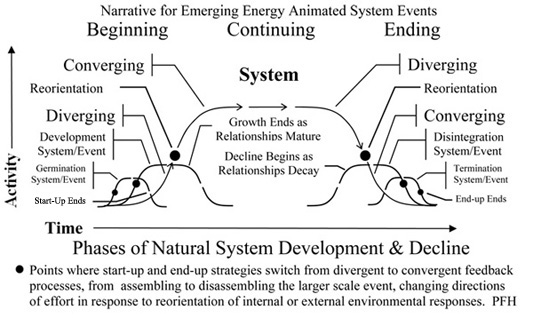

- the universal development sequence of change over time, starting small by increasing steps to end large by decreasing steps (as required for continuity), and

- growth and decay as the start and end for all organization in place, such as required for all both living and non-living energy using processes.

Both require complexly coordinated sequences of changing organization to accomplish changing scale. That whole narrative of succession in scale is what gets left out, just omitted, by representing nature with equations. Some of my references on it are linked from my Chapters of a Whole Event that discusses each of the many parts of that universal sequence of development:

As to Wendel Berry’s insights, you quote him saying:

“Among its other wrongs, usury destabilizes the relation of money to goods….”

which is a matter of exceeding the limits of scale for the relationship between money with no inherent scale, and creating goods that does. Exactly why those two, then, don’t stay in scale with each other is definitely something to study. I think the need to find the critical difference between the mechanism of changing scale for money, and the mechanism of changing scale for goods.

Studying that can take you to a point of understanding why running our world according to a logic that has no natural scale gets in trouble, since real world we’re running does. That’s part of what Keynes was pointing to as well, when saying that the critical problem at the end of growth would be how financial savings would continue to grow when the productive economy does not.

The ability of financial savings to grow by adding %’s would continue indefinitely, only limited by financially exhausting (and destabilizing) the productive economy is where it ends. The productive economy is unable to expand to infinity, as it has very natural limits of organizational scale.

My piece “Why finance has a bigger appetite than the Earth” has a diagram and discussion one can use for studying the particulars. It traces the interaction between the two great pools of money circulation, the finance economy and the cash economy. It does take thinking, but if you follow the logic of it, keeping in mind that one has natural organizational limits and the other does not, how the relation becomes distorted becomes clear.