I’ve been discussing since the 70’d how and why growth creates growing complexity and so growing difficulty of problem solving, as a natural physical limit of growth for systems with physical working parts of any kind. A a discussion of the signs to look) It’s both a real concern as a threat to the health of an economic growth system, and good proof that the natural world functions very differently than a conceptual model. It led to my proposing a whole new set of scientific methods for how science can study natural systems in their own form, as forms of natural organization not concepts.

1970 marked the sudden end of steadily growing US wages, and the start of ever growing wealth inequity. “Information overload” as a threat to societal resilience was becoming a key topic of discussion as computers emerged as our premiere business tools

Was that how the economy changed behavior, as humans began to be replaced by technology as things got too complex?

Below this discussion of the general problem is the blog comment from 9/3/2012 observing the strangely logical connection of the emergence of computers as a (false) solution for the ever more numbing complexity of our lives.

A follow-up Sept 7 2012 post Computers taking over our jobs and our pay? explores a fairly reasonable cause for the systemic decline in demand for the products people produce, that the computers making them don’t buy them…

__________

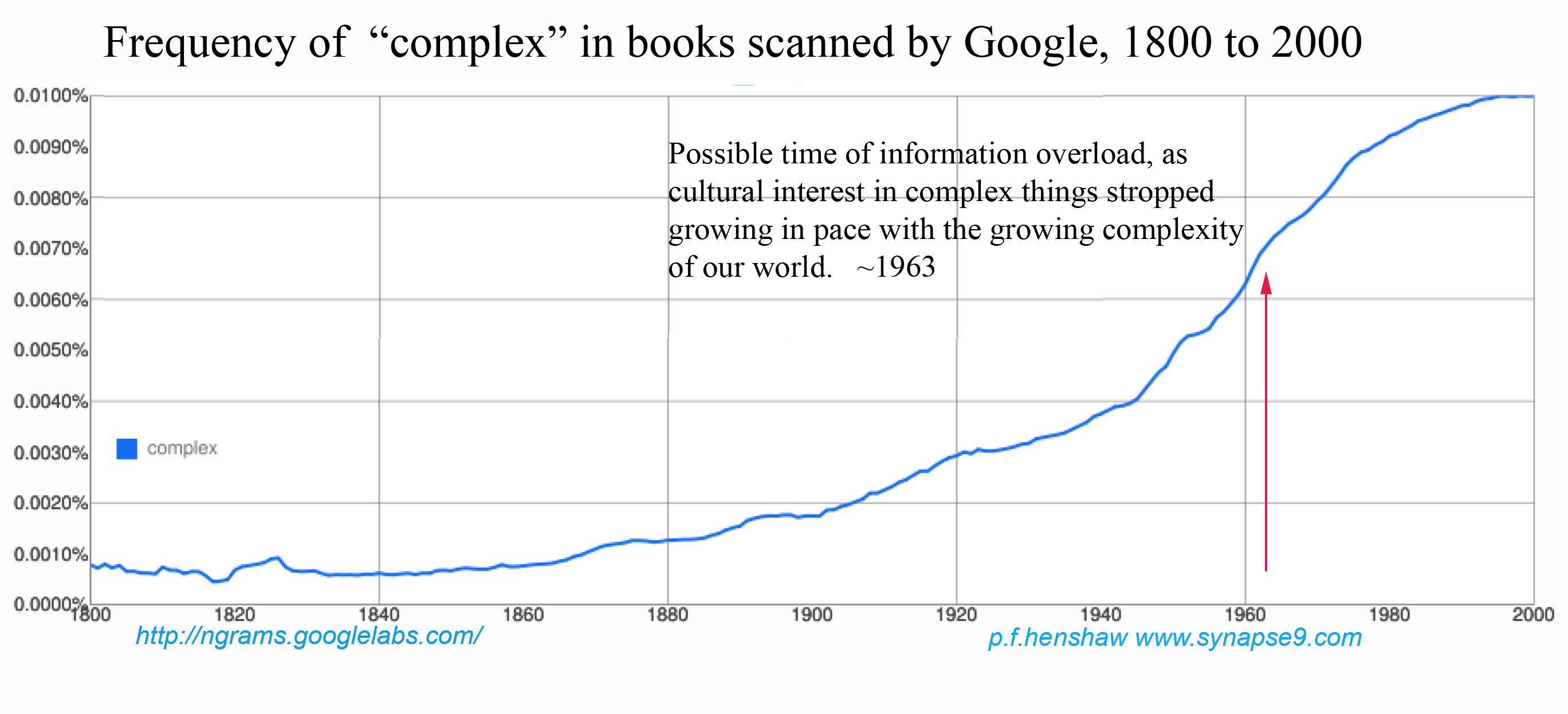

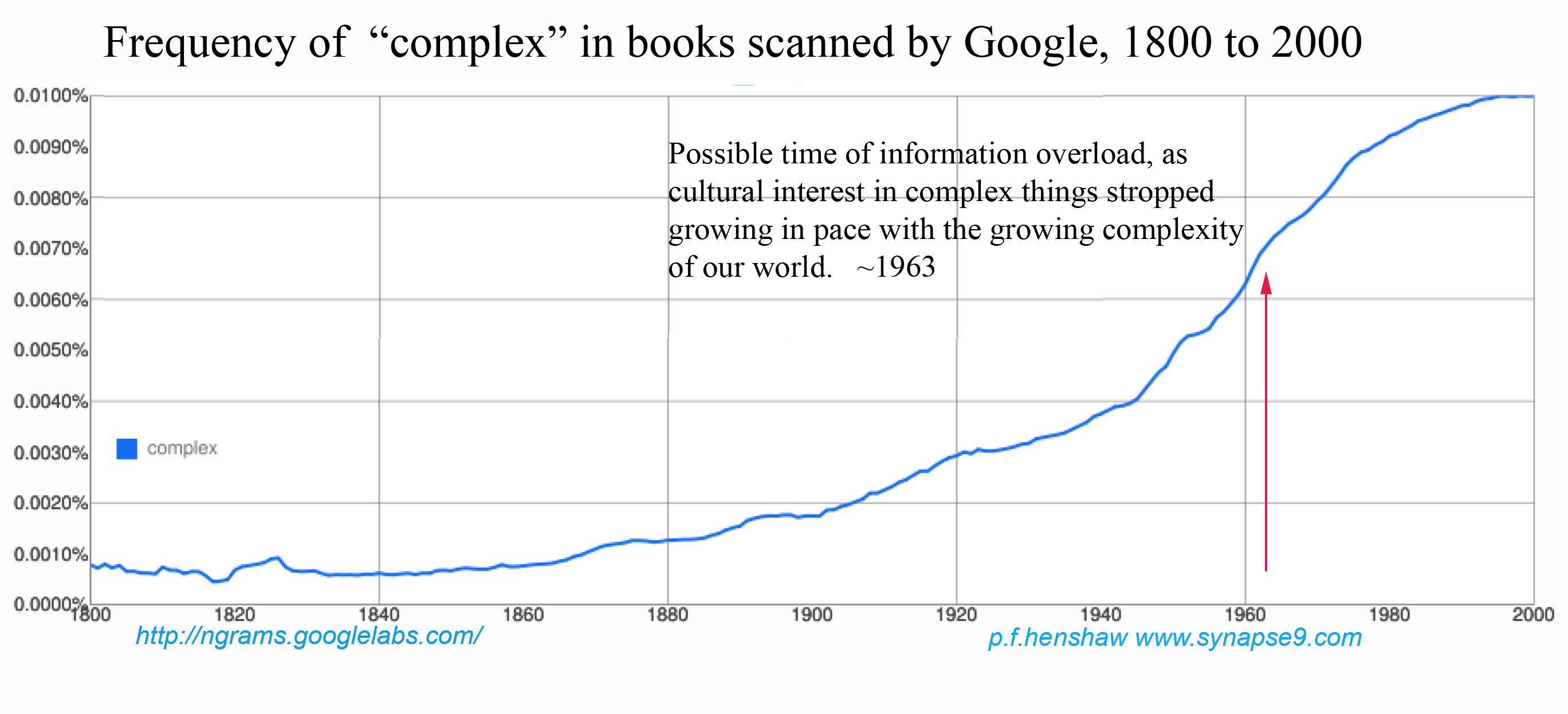

Here’s a graph of the use of the word “complex“, as found in books scanned by Google. It seems to show a distinct end to the long historic growth of interest in complexity, apparently in pace with the increasing complexity of the economy. The complexity of all our life issues, as well as demands of education, etc. have similarly increased with the growth of the economy, but only up to ~1963.

Google’s Ngram tool shows steady exponential growth in the use “complex” beginning in ~1840 and continuing to ~1963, where there’s a distinct growth “inflection point” (curvature reversal) in the trend. The clear end of increasing use of the word is a little mysterious.

The 1960’s, of course, coincided with the actual time when the complexity of the economy’s environmental conflicts, the emergence of computer use, and the rise of true globalization were noticeably exploding the complexity of things… That is also directly implied by the continuing explosive growth in real GDP, as shown in the combined graph below.

That divergence between the two trends would seem to imply that a very large gap, between the real complexity of our experience and our cultural awareness of it, began for some reason to grow faster and faster at that time. It seems to have starting in the early 1960’s and to continue!

Is that really “the mark” of information overload?

The combined data implies a subculture developed increasingly intense awareness of what was going on, as the rest of the culture stopped being able to focus on it. Continue reading Complexity too great to follow what’s happening… ?? →