In Continuing the Conversation on Resilience John Fullerton offered a provocative summary and invited more comments on the subject that started with examples found from Bill Reese and Donnella Meadows of resilience as “a Double Edged Sword”, like either social or biological diseases that change to become resistant to treatment. My comment on it got to be 1000 words…, so I just posted the introduction there, and continue it here, where I also can edit it if needed.

_________

Hmmm…. I think I both agree and disagree with all three, Geoff, Dave and Ted. I’m sure they’d point out problems with how I fit the various issues together, the way I draw the bigger picture too, of course.

The reality we’re looking for will need crucial parts contributed from many different perspectives, as no one sees what a complex society needs to work by themselves. Given our particular dilemma, critical success-or-failure issues still seem to dominate though. I myself have witnessed several decades of everyone’s seeming helplessness, in devising an escape from the converging crises many people have seen coming, and are now occurring.

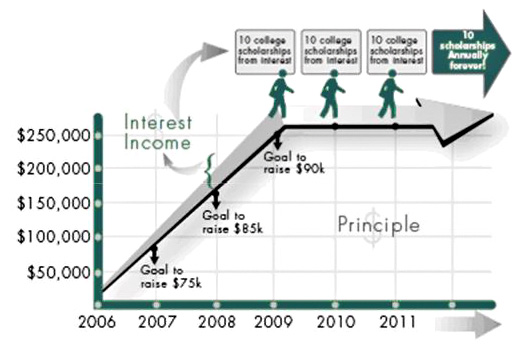

It’s very odd, indeed, that human society is very actively destroying its own planet, in the name of its own self-interest. What we need is something more like an endowment, that builds up, to then sustain things rather than ever grander schemes for expanding our demands on the earth, like a cancer. That kind of “progress” threatens both our host as well as ourselves, making us a fragile organism on an ill-advised quest, to “consume it all”.

We need to break away from how nature starts everything new, with a plan for becoming infinite.

Seeing it’s not going to work, we could conceptually just, “give that up”. Still we’d have to see how to do it, and evidently don’t. The situation is complicated by our needing to respond in the interests of our whole society, in a society organized around seeking self-interest. The threat seems to come from what most benefits individuals at the expense of society, that we institutionalized over the centuries, and is only now becoming a mortal threat to the whole. To survive, society more than individuals needs to break away from how nature starts up everything new, with a plan for becoming infinite.

Our solutions for instability are now for the first time ever, pushing the earth itself to the limit of instability.

The problem that we have repeatedly tried to solve it, but also repeatedly haven’t, has itself been an amazingly resilient problem. We think we’re so smart, but this one has been stumping us for a long time. The “solutions” to economic instability our culture of experts offers, again and again, are intended to bring lasting prosperity, but keep becoming very unstable themselves. They’re now also for the first time ever pushing the earth itself to the limit of instability in many ways at once too.

Something particular about our overall design for prosperity that makes it self-defeating. So we need to be more than usually open minded, and find what that is. It seems very unlikely that we’ll now become secure, with real solutions, after such an amazing history of self-deceiving solutions for just that purpose, without discovering some of the enormous blind-spots in our reasoning that we apparently suffer from too.

I have a number of posts on the way the internal workings of natural systems are generally hidden from view, and the huge effect that has on what “what we don’t know we don’t know” for example. From a scientific view it’s partly correctable if you “at least know that”!

eg.: Self-organization as “niche making” SEA – energy accounting “far more holes than cheese”(edit in progress 4/12) _________

As John quotes Geoff in Continuing the Conversation on Resilience: key to societal resilience has to be some kind of local self-sufficiency, for regional security and identity. History is certainly full of diverse examples of people adapting their culture to their landscapes to achieve that in unique ways.

Just because a model of local resilience had a “shining moment” of sustainability, like Colonial America, for example, doesn’t keep it from being being just a passing phase of a basically unsustainable design. It’s easy to mistake stories about “harmony with nature” based on that “harmony” being that nature is giving up her wealth ever more easily for a while…

Today I think the most important reason to carefully study what we mean by “self-sufficiency” is the big mistakes that seem common. Quite often it is described as developing local cultures that don’t rely on the extraordinary networks of diverse professions and technologies that created our global economy, that themselves cannot really exist without either.

It’s always been a complete mystery to me why the local self-sufficiency movements of all sorts, that keep popping up, never consider that they would all be technologically impotent. None of them, even with time and practice, could support a university, or create a new technology of the kind we completely rely on, or even make a pencil.

We’re obviously emotionally drawn to the images of local self-reliance, but.. to have that a global economy capable of taking care of itself is essential. That we don’t have that now and don’t know how to make one, happens to be the main problem we’re all talking about, that just “floats away” when people start talking about how they’d like to live in a somewhat dreamy way. There may be better ways to build economies, surely, but you just can’t avoid the need to have a whole world of them physically connected.

John saw David’s interest as centering on the need to do something with “financial cancers”. I would certainly agree that is close to the heart of our dilemma, but it’s a dilemma that we don’t understand what it is that actually turns one pile of money cancerous and another not, and I don’t see that reflected in his comments.

What makes a cancer is continuing the immature growth it began with, till that threatens itself and its host. The start-up strategy of every system in nature is to use its profits to multiply its methods, as if to overwhelm it’s host at some point. The ones that stop acting like cancers and switch to maturing instead, forming partnerships with their new environment rather than exhausting it.

Nature starts things with dangerous explosions of self-investment that multiply furiously, she then tames by switching to other-investment, switching the use of the immature system’s spare resources for building its future. First growth is expanding on an internal design and then if it matures the same resource for the future is used to build relationships for the new entity with its new environment.

I certainly don’t know how nature does that in every case, but study cases that suggest practical ideas for how we might. We already have a global information system for managing money for building our future, for example. If all we did was define a rule to remove the one thing that makes it act like a cancer, maybe it could then just work by itself.

We already have a global information system for managing money for building our future, for example.

In their speculations about the future, Keynes and Boulding also suggested the very same possibility, of a curiously simple and completely necessary change in the rules of money. It’s one that would not confiscate anyone’s property or impose social control over any institution. It would just make the minimum necessary change in common financial practice for our survival at the time growing like a cancer becomes a mortal threat.

Having a practical and sure way to “take the cancer out of Wall Street”, if we used it, would also in effect bring the “main street values” to it that David points to as necessary too. The broad stroke that would do it is to specifically remove only the procedure that causes pools of money behave like cancers, constantly adding their profits from greet to multiplying the power of their greed. For the system that drives, it’s simply removing the “multiply” part (and nothing else) that tames such relentless cycles of power multiplying power to force it to become locally adaptive.

To do it would mean adding a very simple rule to the governing principles of finance, that could be applied globally if desired, and phased in gradually as needed. From a natural science view it’s a completely necessary part of any way tame of taming a system that behaves like a cancer on the earth, like our global economy has become.

In this case we be getting together to do what’s needed for ourselves.

Having studied exactly what it does and doesn’t do, I think it could gain very solid support both socially and politically. To achieve that what and allow it to really work is then a way for people to understand the combined necessity and possibility for themselves. If they could see it as a simple choice with a clear difference, that what is threatened is our life, it reduces to the kind of “simple choice” that lets people get together to do what’s needed.

For centuries our cultures have mustered their courage and got together to do what was needed for all the horrible authoritarian rulers of the ancient past. We still very much suffer those scars, too. In this case we be getting together to do what’s needed for ourselves.

The most appealing thing about it, hidden behind the most shocking part, is how it would very strongly foster “going beyond monetary values”, that John quoted Ted as focusing on. To do that every individual with savings accumulated from financial earnings (as contrasted with savings from their labor earnings) would need to decide how to endow them for good works, in total.

It would mean no longer using their profits to multiply their savings, leveraging the creativity of others to multiply their own wealth and impact on the world. It would stop them from continuing to “trade on their own account”, and require them to do financial trading only in the interests of others.

It’s that kind of trading. on one’s own account rather than in service to others, that would necessarily have to change to stop money from behaving like a cancer. Most of the “giant pool of money” would become managed for the “higher values” of those same affected individuals that way, with the least restriction practical.

Of course, I’ve been told over and over an over again, “you can’t just undefine capitalism”!! I’d surely quite agree. Lots of other people would need to understand how the whole problem boils down to that. They’d need to see as I have that it’s the one correct way of “relieving its bubbles before they burst”, and that it’s the one escape possible from the financial cancer our economy has become on the earth.

It’s also a close match to what natural systems all seem to do to survive their own “cancer phase”. They just “stop growing as if to kill their hosts”, and do so rather suddenly, switching to “growing to get along” instead. One could rationalize what is happening by how natural economies have no fixation on what kind of growth is profitable but just go with what they find without complaint. They’re not bound by tradition, and as soon as one strategy tends toward bankruptcy, they pick on what’s then available.

Society would surely discover new values for how it uses money too, as it will be a huge learning task. As we discover the need to undefine one kind of cancer, we’d probably find other kinds of things running into worse and worse trouble too. Raising all these kinds of things raises large unexpected moral questions. That’s what I think is most important, recognizing the unexpected new moral questions we’er naturally faced with.

What’s very simple in our present situation is that

something has to give!

At first it would be slow to start but we’d get new ways of thinking and new politics, and new ways to mix the old and new, all of which would be everyone’s business. Change this vast is not simple at all. With the enormous cultural waves being set off by our physical impact on the earth, the direction of progress for humanity is about to dramatically change, either toward sustainability or disaster.

For the systems of nature that survive their immature explosive growth beginnings, ALL starting as nascent “cancers” as it were, the switch to forming lasting relationships with their new environments comes very simply. It’s just an “inflection point” on an “S” curve marking their accumulating design, responding to limits of taking their world apart to become whole themselves and a good partner instead.

It’s a kind of whole system tipping point, always “hidden in sight” it seems, that actually does tip whole systems in a structural way, at what amounts to a moment’s pause.

JLH

One thought on “Cancers or Endowments”