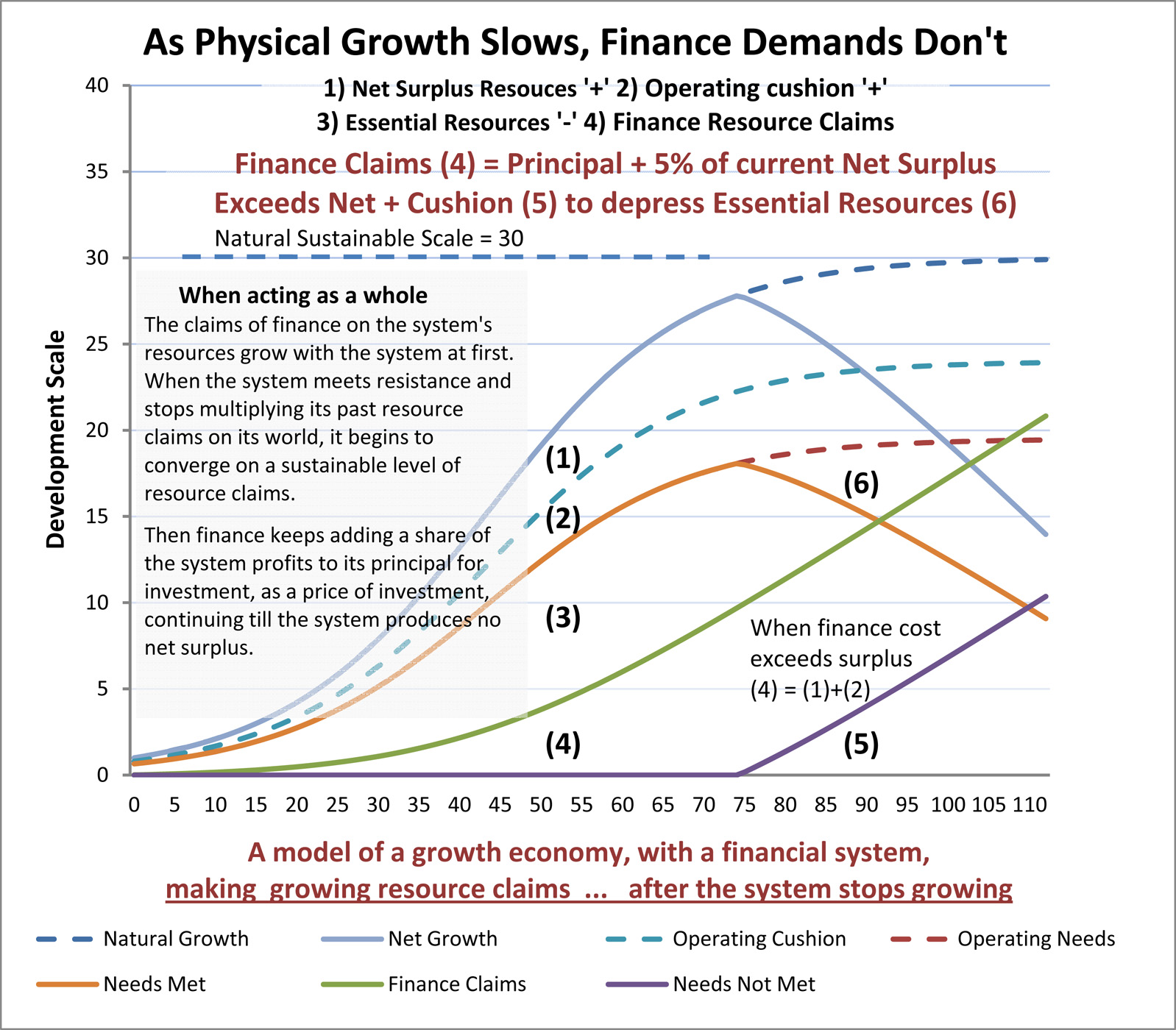

The authors of “The Story of Stuff” published a nice little update called “The Story of Broke”, about the vast sums of money the government spends on subsidizing private business…. This sequel “Part II (the end of broke)” was first posted in a comment, on how the still bigger story of broke, debt piling on top of debt, both was missing from the list of now overwhelming government costs, and has a … very natural end. Government debt provides guaranteed growing returns, whether the economy grows or not. Lenders take government interest payments and add them to what they lend back, multiplying their lending and returns. It builds up, slowly at first then explosively, as the world’s debt burden

grows on little but the good faith and credit of government guarantees.

You’ve heard of government debt called a “safe haven”. It’s where investors put money to be “safely assured of ever multiplying returns” when they can’t find even better growing returns elsewhere. Where that debt spiral comes from and goes to has been a subject of many have tried to explain. The view Keynes came to, that I think is the most clear headed of all, outlines the necessities for surviving a debt spiral for a market economy. Nature would surely not shape her facts of life on earth for our approval, but most people react to the facts of life for surviving debt spirals as if to reject nature’s requirements as “socially unacceptable”, … apparently not seeing Keynes’ elegantly clear logic. So this is written in the story telling style of Free Range Studio in their Story of Stuff. —

The End of Broke, the True Whole Story of Debt!

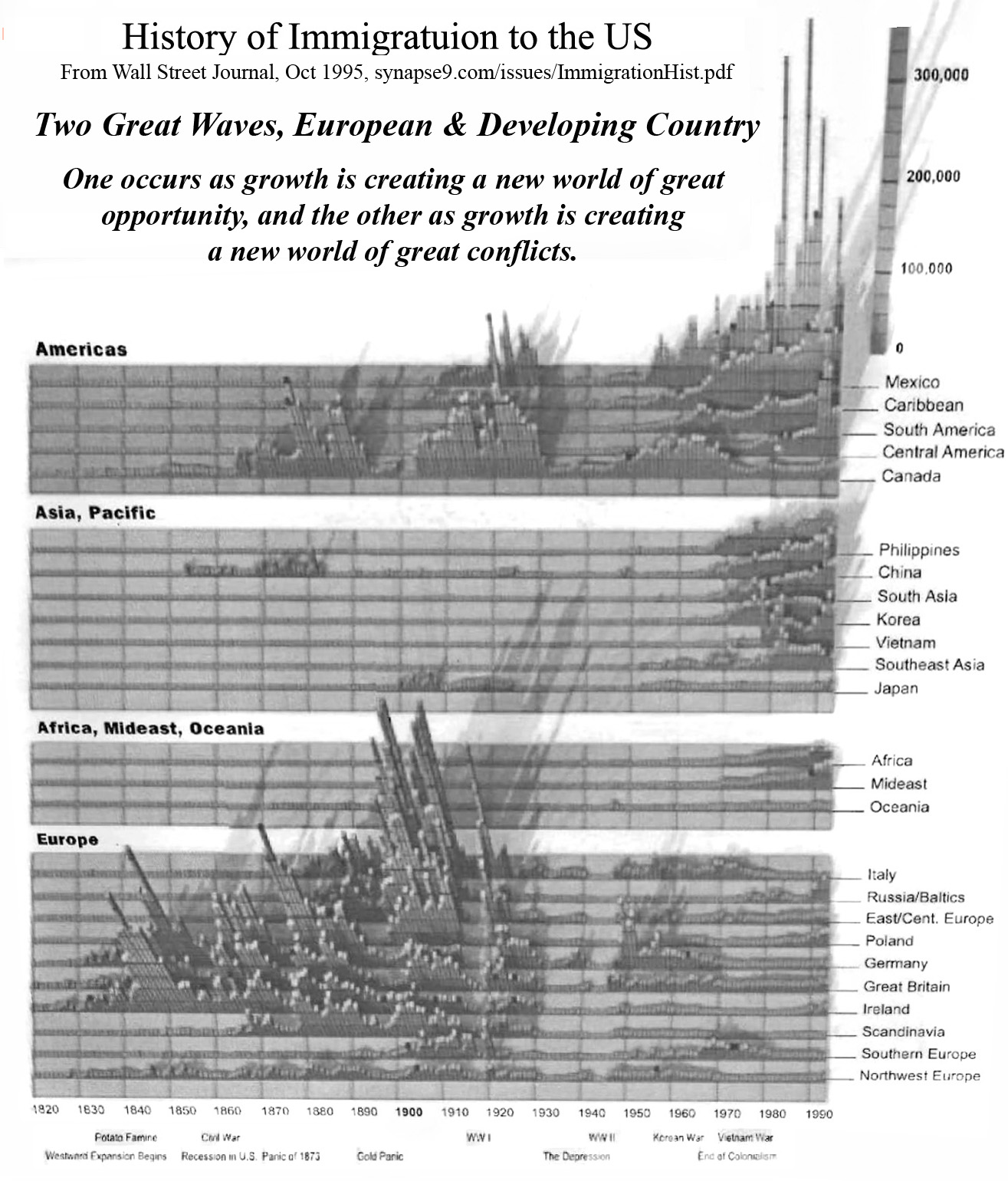

The BIGGER “Story of Broke” is one that starts quite small, but is designed to actually keep growing ever bigger. As it does so it also casts its own vote in the story of business influence in government and demand for subsidies and preferential services, persuading government that’s the way to get money to pay its ever growing debt! It’s the story of how a small amount of debt naturally grows relentlessly big, with no natural end other than either creditors spending it or both government finance and economic collapse.

The whole story of debt is a very very simple little thing. It’s that some of us earn by $units and others by $%’s… and by providing guaranteed returns to lenders, in an economy you can actually earn by $%’s till the economy collapses. What seems like a totally innocent “little difference” in measurement, between units and ratios, makes AN INFINITE DIFFERENCE over time in life. Some people have called it “our misunderstanding of the exponential curve”, others simply call it “greed”. The problem with this kind of greed is how very addictive it is and that it grows explosively, making a “little greed” become SO.. GREEDY, with its promise to multiply the rewards of greed forever. Continue reading the Story of Broke – Part II (the end of broke)