from my Finance Lab blog posts

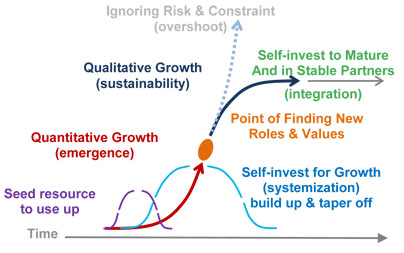

Nov 2013 note: Since this popular post was written I’ve kept pushing my search for better explanations. It’s basically a very simple universal principle for how growth leads to stability. Every successful ‘project’ in nature, of any kind or scale, starts with using its resources to build more access to resources, expanding on itself, and then stabilizes by changing its strategy before it is overbuilt. It’s easy to recognize that turning point in one’s own projects or new relationships. It’s that point when you “have enough to manage” and can turn to bringing it to fruition, not taking on more for seeing good reason to secure what you already have. Taking on more for no reason would threaten what you began.

As a shift from taking territory to homemaking

Your self-investment strategy begins with searching for how to expand on a great beginning, using gains to expand your gains, and is uninhibited at first. It’ll only succeed if sensitive to the approaching need to stabilize and switch to “homemaking”, and creating a secure “niche” in the environment for what was built. What changes in the investment strategy is its “targeting radar” for the best use of its resources.

As the organization is built up it first prospers by expanding its control of its environment, creating new internal organization and overhead costs. The value of building by bigger and bigger steps (creating more overhead while depleting the availability of resources) naturally reverses. Then like homemakers who “see success in sight”, the radar shifts to caring for what they built as a whole and that “near environment” it needs to be secure. It’s a switch from taking territory and building bigger things, to caring for how things fit together and work smoothly throughout the whole, from aggression to caring.

____________

Mar 12 2010: Twenty-five years ago I learned that Keynes had come to the a similar conclusion I then had had, about how to achieve a stable steady state economy. At the same time I found out Ken Boulding, the leading economic theorist and leader of the General Systems Theory community, had been talking about it for decades after Keynes too. But their efforts had gotten culturally buried.

Because it was pure systems ecology, without any cultural roots in the business or finance community, his proposal seemed utterly radical. He first called it “the widow’s cruse” after a biblical story about Elijah giving an old widow an inexhaustible cup of oil and bowl of flower (1, 2).

Keynes’ had realized that capitalism would produce an over-investment crisis when the environment started producing diminishing returns. At that time acting to stabilize growing investment, as his main work had been about, would destabilize the economy as a whole.

The real crisis would come from those with wealth continuing to increase their investment savings and so multiplying their investments and demands on the productive economy for growing returns. The Increasing demands on the non-growing economy would then undermine the economy’s profitability to the breaking point.