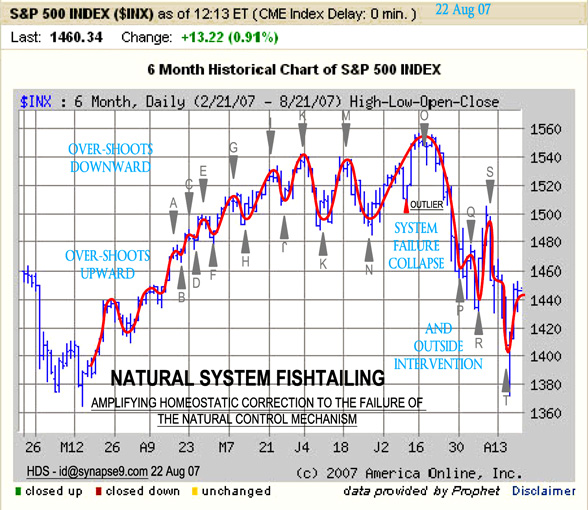

What’s it look like to you? The price swings in the S&P; 500 over the last 4 months seem to display the natural complex system self-controls of the financial system ‘fishtailing.

Hi folks,

…this week’s global run on credit seems like a casebook example of how a natural system failure to provide growing physical returns on investment would effect financial commitments for endlessly growing financial returns. They naturally conflict.

One thing we can do is watch it closely, so others may learn from our experience. Because systemic collapse is a big physical process in a big physical system, displaying all-together new kinds of rapidly spreading behaviors, watch for that. If you see that sort of thing perhaps you’ll ‘believe your eyes and ears’ and not feel the observations were ‘planted’ in your imagination somehow.

Remember what things seemed to mean before and after,

and make note of it.

New systems science, how to care for natural uncontrolled systems in context

Systemic failure is generally the consequence of pushing self-correction mechanisms beyond their response limits. Continue reading Overshoot self-correction to collapse in the S&P 500 Mar-Aug 07

Systemic failure is generally the consequence of pushing self-correction mechanisms beyond their response limits. Continue reading Overshoot self-correction to collapse in the S&P 500 Mar-Aug 07