Here’s the whole problem:

Scope-4 impact measures add up the total environmental inputs resulting from business, personal, or policy choices. That’s so we can compare different choices, and make the better one. Sounds like what sustainability metrics should do!

Standard sustainability metrics, however, collect impact information by where they occur,

not by what choices cause them…

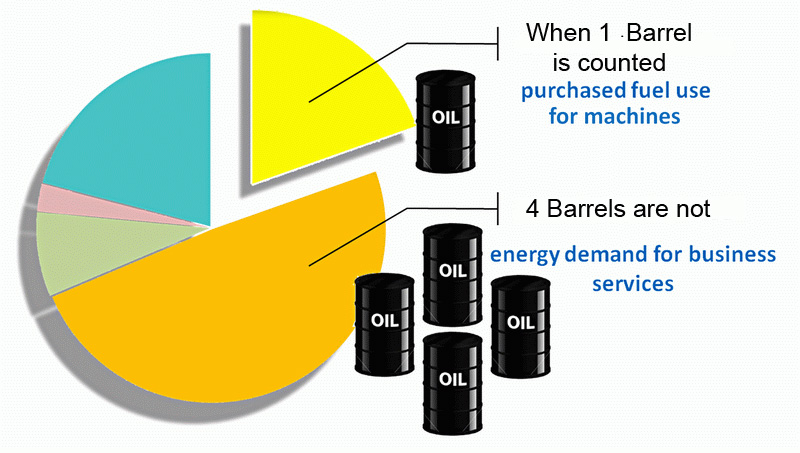

So our whole metric system needs to be rethought. Today if a business decision involves employing six new machines and six new people, all that is counted are the impacts of the machines. The impacts of hiring the people or paying the investors or the government… aren’t counted. Nature sees all the kinds of impacts incurred by business decisions exactly the same way, though! It was our accounting community, going back centuries it actually seems, that decided to count one and not the other.

The omitted impacts are actually not hard to scientifically estimate for scale. That’s what Scope-4 accounting does. As you work with it you find more and more ways having the numbers right results in big changes the terms of discussion. The core scientific issue then, is having a metric that does not associate environmental impacts of business with the choices that cause them, but with the locations where the information is collected. That inconsistency may be as fundamental to economic accounting as to have originated in how business records were kept in ancient times on clay tablets.

The [ e = mc^2 ] LAW OF SUSTAINABILITY

ln(e) / ln($) = c

It says our growing earth impacts and growing earth economy are directly coupled.

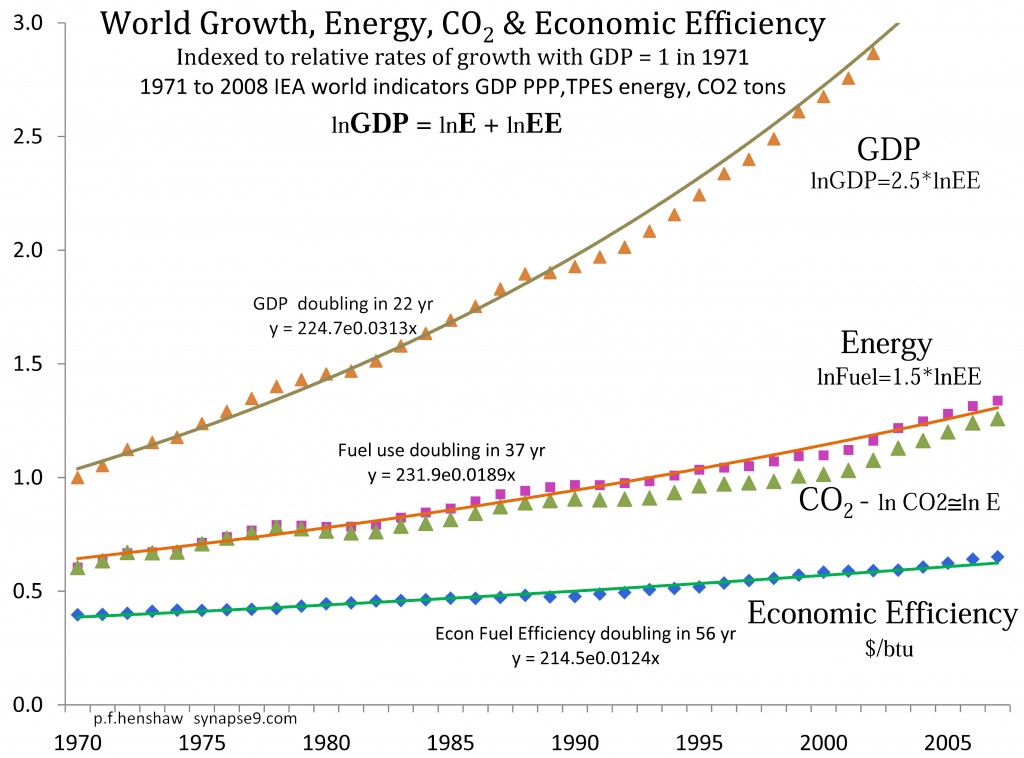

The natural constant observed, [c], is the coupling of GDP and Energy use, as a measure of everything physical the economy does. It’s expressed as a ratio of their growth rates (here as a ratio of their natural logs). That coupling has been a constant [0.6] for a long time. You see it clearly in the figure below, showing a 40 year official world record for the economy’s growing Energy use and GDP.

It says that our increasing use of energy for altering the planet to make money grows only a little slower than GDP, at 0.6 times the growth rate of GDP, AND that this direct coupling has not shown any tendency to change over time! People imagine that ‘efficiency’ changes the coupling, but even with growing efficiency the ratio has actually quite constant. You’d need global efficiency in energy use to double every ~20 years like GDP generally has to really make a difference, so having growing value in a steady GDP is far more possible.

Of course, like e=mc^2, it’s not possible to tell quite where the natural constant observed comes from. That’s a big part of the scientific interest. Natural constants are emergent properties of the system, seemingly here a natural rate of societal innovation and adaptation, like a “natural learning speed”. The benefit of the constant is giving us a better way to measure inclusive sustainability, using the mathematical implication that:

— average shares of GDP pay for and are responsible for causing

average shares of GDP earth impacts —

The power of this rule the direct coupling between responsibility for shares of Earth Impacts and shares of Earth GDP. It’s a measure that combines all the impacts of extracting energy and all the impacts caused by using energy, i.e. everything the economy does, with financial earnings from the economy. When the data is aggregated correctly, it allows a complete accounting of the GDP impacts, and “closed accounting” for shares of responsibility for them. So that for whole supply chains, one can measure their share of exhausting all our resources, forest and species loss, paving over productive land, etc. Delivering goods for an average dollar of GDP causes an average share of the whole economy’s impacts.

.

Scope 4 CO2 assessment

The science for applying this constant natural coupling of money and GDP impacts was published in 2011 in a research paper “Systems Energy Assessment” found at the SEA resource site. More detailed research notes are in the article What’s “Scope 4″. The physics is sufficiently general and inclusive that the same technique can be comfortably use globally, to assign responsibility for all impacts of GDP on the earth, and have a way to “internalize all externalities” that can start and remain valid as it is incrementally improved, as in “A World SDG“.

Discussion:

The real tragedy is that this bias in our business impact metrics assigns TOTAL responsibility for environmental impacts to the people who are paid to do them, who would not do them unless they were requested and paid for by someone else.

So then ZERO responsibility is assigned to the people choosing to request and pay for the impacts, communicating their requests for them by the transfer of money.

In criminal law, as when paying to have a crime committed, requesting and paying for it is considered the principle direct cause of the crime. The person paid to do it may be penalized equally or not. As far as physically causing economic externalities, in the court of environmental responsibility, it really should be decided the same sophisticated way.

What Scope-4 accounting does, then, is start from the complete list of things a decision pays for. It could become a tremendously long list, with lots of things only known from the money spent rather than from exactly how the service was provided. So for those you need to do research on what default assumption to make in case in case more detailed information does not become available. I’m still waiting for people to study it themselves and compare results, but I think the proof is completely convincing that absent other information the necessary default assumption is not “zero” but “average”.

Elementary technique:

- If you get stuck in deciding what to count, just remember, businesses don’t pay for things except for business reasons, so you need to count *everything*.

- You then think about the different categories of spending, and what their “direct” (material) and “indirect” (economic demand) impacts are.

- The initial rough estimate rule for economic impacts is to count them at 90% of the world average per $GDP, like around 7000BTU/$.

- Make sure you use inflation adjusted $’s and state the index year.

- That’s easy to do, and lets you reserve your time for estimating the direct impacts, according to the added information you can collect.

So for the energy content of purchased fuels, for example, you’d count BOTH the direct energy content of the fuel, AND the economic energy impact of the spending, at 90% the world average. The reason is that the fuels come from nature, and the spending goes to people, paying them for the consumption they do to bring you the fuel.

If done correctly, the bottom line is a unique pie slice share of the world’s impacts

for delivering your share of GDP.

Another one to think through is how to estimate the impacts of retained earnings, used for either financial or business expansion investment. The economic impacts of that spending needs to be estimated with a multiplier over time… The whole purpose is to truthfully estimate the types and scale of consequences for our economic decisions.

More discussions can be found searching the journal or the web for “Scope-4” or “SEA-LCA” as interchangeable names for the same group of accounting methods.

jlh 11/8/14

_______________ Continue reading Easy Intro, “scope 4” use & interpretation