Most of my economic writing revolves around what we inherited, an economic system design for changing faster and faster, exponentially. It’s a dangerous design for which we now have no exit plan at all.

Lots of people mistakenly blame the use of fiat currency for the persistent instability and inequity of the economy. The problem isn’t technically with fiat money at all though… It’s with the deeper compulsion of users of money to use wealth and power as a weapon (we call “investing”), to pay for professional help in taking more wealth and power. It’s the core behavior in question in “the tragedy of the commons” too, that one farmer uses his cattle capital to multiply till the community suffers. Fiat money (basing credit on the value of investments) would actually not be a problem if investors didn’t compound their investments… It’s of course also a broader cultural issue of ignorance about our place in the web of life… but I think the compounding of returns is from what the economy’s growing inequity and disruptions actually originate. I think if investors took care to spend their profits to relieve their demands on the commons when needed then an economic system with fiat money would level out and stabilize.

We need a mid-course correction for the evolution of our economy

What a surprise it will be if to avoid the crises we see coming today, the economy needs a “Circular Jubilee”? It would be a massive effort to give away a great deal of money, very carefully, with the aim of slowing down the economy’s unstable acceleration. Done correctly it would relieve the rapidly building strains we all see, letting us escape from racing the economy ever faster till it fails.

It would be like learning to take our foot off the economic accelerator, to relieve strains and coast a little at the same time. We really need the relief. That really does seem necessary to relieve the economy’s building strains in a lasting way. It would restore society’s resilience and allow us to become more self-healing again too! The design is fairly simple, …to do just the opposite with financial profits as we do now. People would be persuaded to join together and turn away from collecting profits to reinvest in collecting more and more profits. It’s that very widely practiced way of managing money for ever faster growing returns that also sets the course of the economy for changing at exponential rates of acceleration. It has the globally destabilizing results we now see all around.

That traditional way of managing money we inherited is quite untenable in the long term. The one truly sustainable alternative is for investors to learn to spend their profits rather than continually reinvest them! It’s simple math. That’s the the Jubilee part, investors choosing to “release” their profits back to freely circulate in the exchange economy again. The “circular” part is that those profits then freely circulate in the economy again, and return to the investors as sustainable profits. That is the opposite of how we manage our money today.

Today the profits concentrate in the hands of investors at ever faster rates, to only circulate in the economy with promises of being repaid multiplied. It seems to investors that they are becoming more and more wealthy as their world and all its strains increase faster and faster. That’s the fatal path, pushing us toward society’s many possible breaking points. We can do better.

Compounding profits may sound good,

but driving economic change faster and faster

till we are pushed to disruptive and unstable change… is a real problem

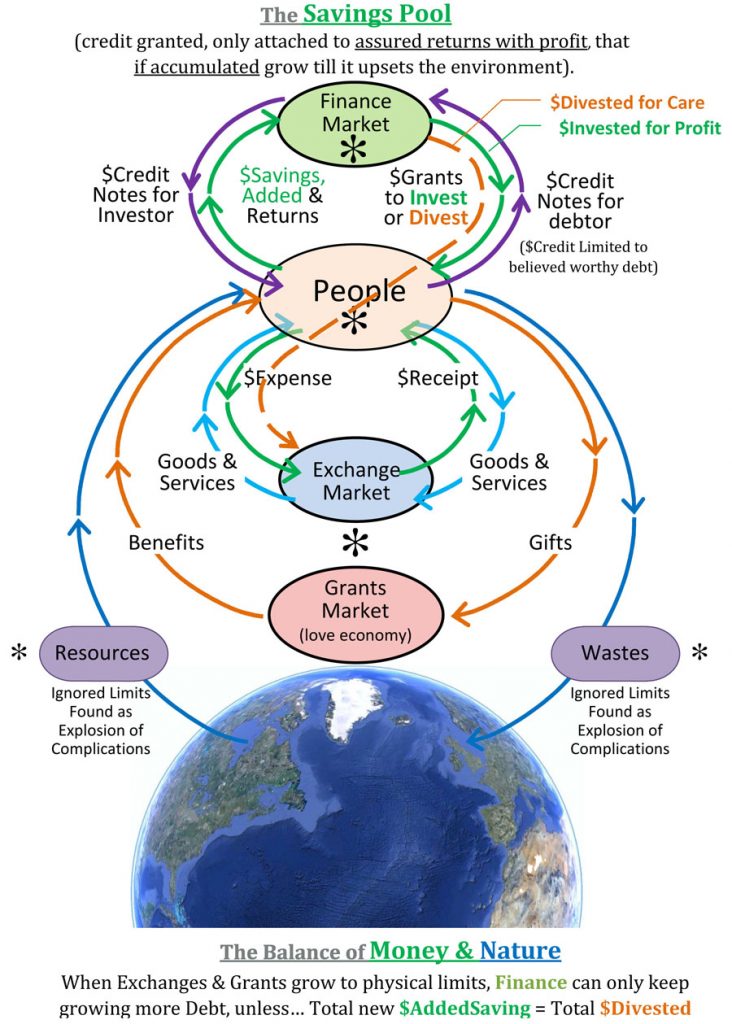

((in the diagram, the choice is shown as the alternative between

“$Divested for Care” and “$Invested for Profit”. ))

JLH

(note: first published in 2017 but back dated to 2014, as more consistent with proposals of that time. Using collective profits to care for the commons (rather than for abusing the commons) has been the natural general solution to the tragedy of the commons first recognized by Keynes, and that I’ve proposed in various ways since I first noticed it’s simple necessity around 1979. For more of my writing on it search for my discussions of Keynes.)