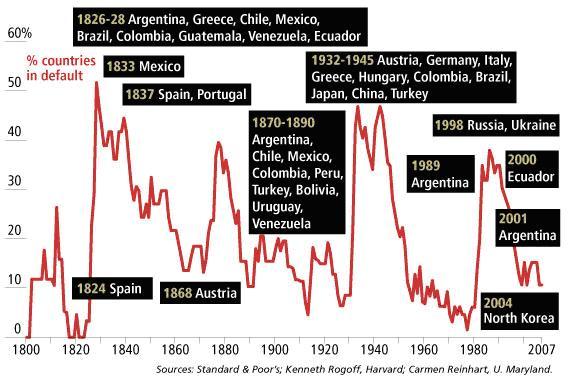

The great financial crises of the past have occurred once or twice a lifetime in every banking society throughout history. Solutions to fix the problems that each crisis of the past exposed have all been like recent ones in one extremely important way. They’ve always provided temporary fixes that set the stage for still greater financial crises to come. That’s a sign that people have been asking for the impossible.

It allows the appearance that earnings from finance can keep growing in proportion to past earnings, without any goods and services involved.

A simple but seemingly valid overview is that our ever failing “fixes”, for our ever greater financial panics, all come from not realizing that our information models of finance are not the economy’s source of value. Models and promises to follow them can indeed extrapolate to infinity. That is not possible for the physical work of the economy that is the only real source of economic value, that the promises of finance eventually need to rely on.

When the economy grows from physically “small” to “big” relative to its resources or its own technologies or social organization, it becomes a trap for our financial system. The financial markets are designed to search for any escape from financial constraints. Investing for rapidly growing returns, when delivering goods and services is running into more complications, draws fast money into self-fulfilling speculative manias. They promise limitless profits, by exploiting gaps between the rules of money and the reality of a changing economy.

Money has real value only when it corresponds to credit for deliverable physical goods and services. The actual physical connection between goods and services and money, and our responsibility for the physical resource uses and impacts caused, are the same. It’s that our “use” of money constitutes our way of communicating our instructions for delivering physical goods and services from exploiting those resources.

As an economy grows it is constantly reorganizing, but some kinds of reorganization require more complex changes than others, like our transition from using fossil fuels to renewable fuels today. As the scale of the economy expands toward the limit of efficiency for its original form of organization or the reserves of affordable environmental resources, the value of further expansion naturally changes.

When changing from ‘small’ to ‘big’ relative limits the value of continuing at previous rates of expansion reverses sign. It’s the simplest of all environmental principles. Literally anything that goes from small to big that we deal with has its “laws of economics” for further development extensively rearranged.

That kind of reorientation does not spontaneously occur for the information models for financial growth, which continue to project future expansion in proportion to past expansion without limit. Money valued as a speculative bet on the future value of other speculative bets can literally go to infinity, too, based only on trust that no one will check to see if there are deliverable goods and services to back it up.

Financial values can be based purely information about self-fulfilling information, like circular bidding in a housing, gold or art market. Those values only exist in the “bubble”, though, having no upper bound until the credits within the bubble have to be converted to deliverable goods and services. When the physical economy is “small” attempts to guarantee growth rely on expanding opportunity for growth. When the economy is “big” and not keeping up, the ever inflating performance of finance becomes a clear “promise too good to be true” and the most attractive place to put your money.

So asset values can appear to inflate automatically based only on trusted assurances of inflating values and seemingly reliable bets on them. Then when the delivery of material value in goods and services becomes relatively unreliable, people are drawn to put their financial trust in asset bubbles, further inflating them. It’s illusory wealth, but promises ever growing information about financial value based only on trust.

So the formation and collapse of financial bubbles relies on assets valued only from promises for growing value, and the cultural manias that develop as in slow growth times people put their bets on (illusory) fast growth assets.

My approach to solving the problem is related to the unappreciated insights of Keynes and Boulding on this question. It’s that changing the essential procedures used to create financial wealth independent of corresponding goods and services would eliminate or make the problems associated much more manageable. Two of the particular questionable procedures at the center of inflating asset bubbles are among the most common “economic stimulus” and “capital appreciation” practices. They seem to have been in use formally or informally, and creating bubbles that collapsed on the people around them, since the historic beginning of banking.

One is the practice of treating “assessed” values as real values, such as treating the value of a mortgage as an asset to then base further lending on. That is the basis for fiat money creation. Using debt as an asset for lending more money could also be the working capital of a business, valued by their delivery of goods and services. In an economy undermined by financial manias any asset might be as risky a bet as a Ponzi scheme. To reduce that effect, banks might either not be allowed to use speculative asset values to increase lending, or need to have a claim on only the realized value of such assets in the future, and so accept the risks of speculative market value decline.

The other implicated practice is the basic procedure of capital accumulation, reinvesting the proceeds of speculative investments. Compounding investment returns makes it possible to have self-fulfilling asset appreciation automatically, by signaling communities of investors to transfer their investments into the speculative bubble. That’s just like a Ponzi scheme works, but as a natural social phenomenon.

It allows the appearance that earnings from finance can keep growing in proportion to past earnings by money inflation within the bubble, not relying on any value in delivering goods and services. The self-reinvestment that stimulates added money inflation within a bubble offers higher returns than the real economy. That pulls investment funds away from the cash economy while the common practice of only putting money into it where growing rates of taking money out is available.

So instead of supporting the cash economy, finance changes to become a dynamic one-way drain on it, as it further weakens. Both investment and spending for goods and services are curtailed. Money is drawn into finance, based on trust, that the weakening real economy is growing ever faster in the financial models, while really tilting toward collapse.