from my Finance Lab blog posts

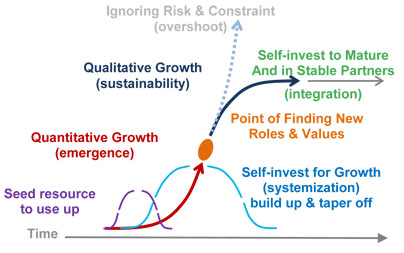

Nov 2013 note: Since this popular post was written I’ve kept pushing my search for better explanations. It’s basically a very simple universal principle for how growth leads to stability. Every successful ‘project’ in nature, of any kind or scale, starts with using its resources to build more access to resources, expanding on itself, and then stabilizes by changing its strategy before it is overbuilt. It’s easy to recognize that turning point in one’s own projects or new relationships. It’s that point when you “have enough to manage” and can turn to bringing it to fruition, not taking on more for seeing good reason to secure what you already have. Taking on more for no reason would threaten what you began.

As a shift from taking territory to homemaking

Your self-investment strategy begins with searching for how to expand on a great beginning, using gains to expand your gains, and is uninhibited at first. It’ll only succeed if sensitive to the approaching need to stabilize and switch to “homemaking”, and creating a secure “niche” in the environment for what was built. What changes in the investment strategy is its “targeting radar” for the best use of its resources.

As the organization is built up it first prospers by expanding its control of its environment, creating new internal organization and overhead costs. The value of building by bigger and bigger steps (creating more overhead while depleting the availability of resources) naturally reverses. Then like homemakers who “see success in sight”, the radar shifts to caring for what they built as a whole and that “near environment” it needs to be secure. It’s a switch from taking territory and building bigger things, to caring for how things fit together and work smoothly throughout the whole, from aggression to caring.

____________

Mar 12 2010: Twenty-five years ago I learned that Keynes had come to the a similar conclusion I then had had, about how to achieve a stable steady state economy. At the same time I found out Ken Boulding, the leading economic theorist and leader of the General Systems Theory community, had been talking about it for decades after Keynes too. But their efforts had gotten culturally buried.

Because it was pure systems ecology, without any cultural roots in the business or finance community, his proposal seemed utterly radical. He first called it “the widow’s cruse” after a biblical story about Elijah giving an old widow an inexhaustible cup of oil and bowl of flower (1, 2).

Keynes’ had realized that capitalism would produce an over-investment crisis when the environment started producing diminishing returns. At that time acting to stabilize growing investment, as his main work had been about, would destabilize the economy as a whole.

The real crisis would come from those with wealth continuing to increase their investment savings and so multiplying their investments and demands on the productive economy for growing returns. The Increasing demands on the non-growing economy would then undermine the economy’s profitability to the breaking point.

It was called “the fallacy” by everyone around him, though, and so it broadly remains considered today, by the few who know of it.

It’s a neat bit of history, and points to a side of the issue with many practical and moral quandaries that must, of physical necessity, be solved. It’s only clear to me that Keynes saw the obvious logical conclusion and everyone around him was outraged and offended by it… I guess he saw right away it “wouldn’t fly”.

He thought it would be the “more favorable possibility” when the earth produced declining rates of return for people with surplus savings to divest them at least as fast as they accumulated. That’s what would prevent average returns from falling to or below zero.

The issue is that when an economy is stable it produces a stable positive rate of returns on investment. Because people tend to put their savings into those guaranteed bets and continually add their winnings to their bets, the growth of investment naturally keeps growing when the earths capacity to produce uniform positive returns does not.

There are actually a wide variety ways to solve the problem, but you have to start by addressing it first. Discussion of it doesn’t seem to start till it becomes obvious that continuing increases in investment inevitably drive average returns below zero and would undermine everyone’s investments of every kind.

That’s a “physical world” perspective, not a cultural or theoretical world perspective. People need to get creative to discover their own theoretical or cultural responses. It wasn’t to be “reasonable” that nature made growth systems so they would upset the conditions of their own growth.

Nature only needs things to work physically. That growth systems can upset themselves is one of her collection of ways to cause complex systems to change form. She’s quite happy to have systems that require their parts to respond ever faster to ever bigger changes and spin out of control to produce a lot of new compost… ;-)

So, I think it is the attempt to assure guaranteed compound returns that is creating impossible tasks and choices for people to respond to all over, and dramatically propelling the whole world toward chaos. It’s a fascinating reality that I’ve been studying for some time.

It includes surprising twists and turns, like exposing how much garden variety folk wisdom really applies globally. The solution is really quite similar to how any normal small store owner manages their business, when they have used their profits to maximize their market return, they turn the use of the profits to something else.

I have a longer summary as a draft article Economies that become part of nature and an earlier proposal for Natural system economies with more on Keynes’ Widow’s Cruse and other things.

_________

1) Widow’s Cruse references at end of The one Real option… natural climax, a longer 2008 discussion of the subject.

2) Excel model discussed – Stabilizing Economies by Ending Compound Investment

3) Follow up notes in 4/1/2010 post Keynes’ “widow’s cruse”; capitalism v. natural growth

4) Background on Natural Systems Theory, as versatile scientific method based on the conservation of energy for locating and studying the nidden organization of the natural world.