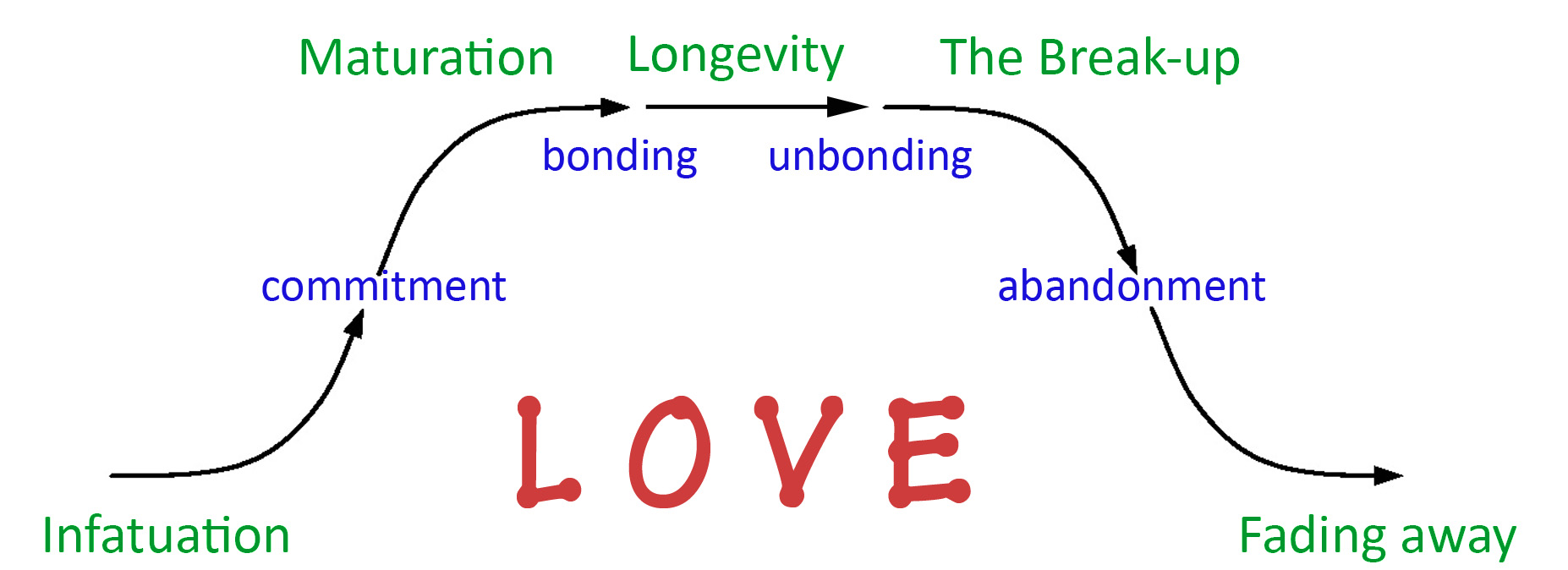

Bankruptcy occurs…

when a system becomes unable to supply its own needs, and gets cut off from former supplies. So, it’s a system that may seem to be working fine, but drifts over the line of profitability, and is abruptly rejected by its environment.

…when systems can’t generate “net-energy”

resource productivity * societal productivity < 1.0

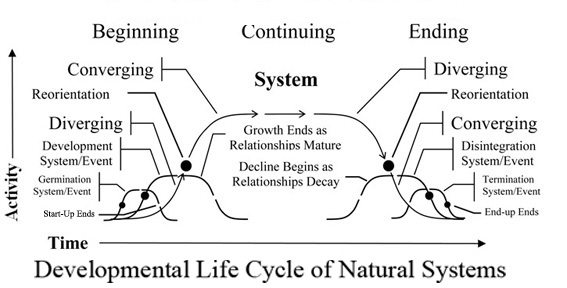

From beginning to end environmental systems need to produce some minimal margin of excess resources as profit, to maintain cushions for everything. Otherwise their parts will not have time to respond to shortages and their environmental connections break down.

Becoming both more costly to supply and more costly to run, to the limits of profitability, causes system bankruptcy, as it did for Rome. Rome wasted resources on making its high society richer throughout its decline, as if that would reverse its resource depletion.

… disillusionment occurs and systems break into parts, to end their lives.