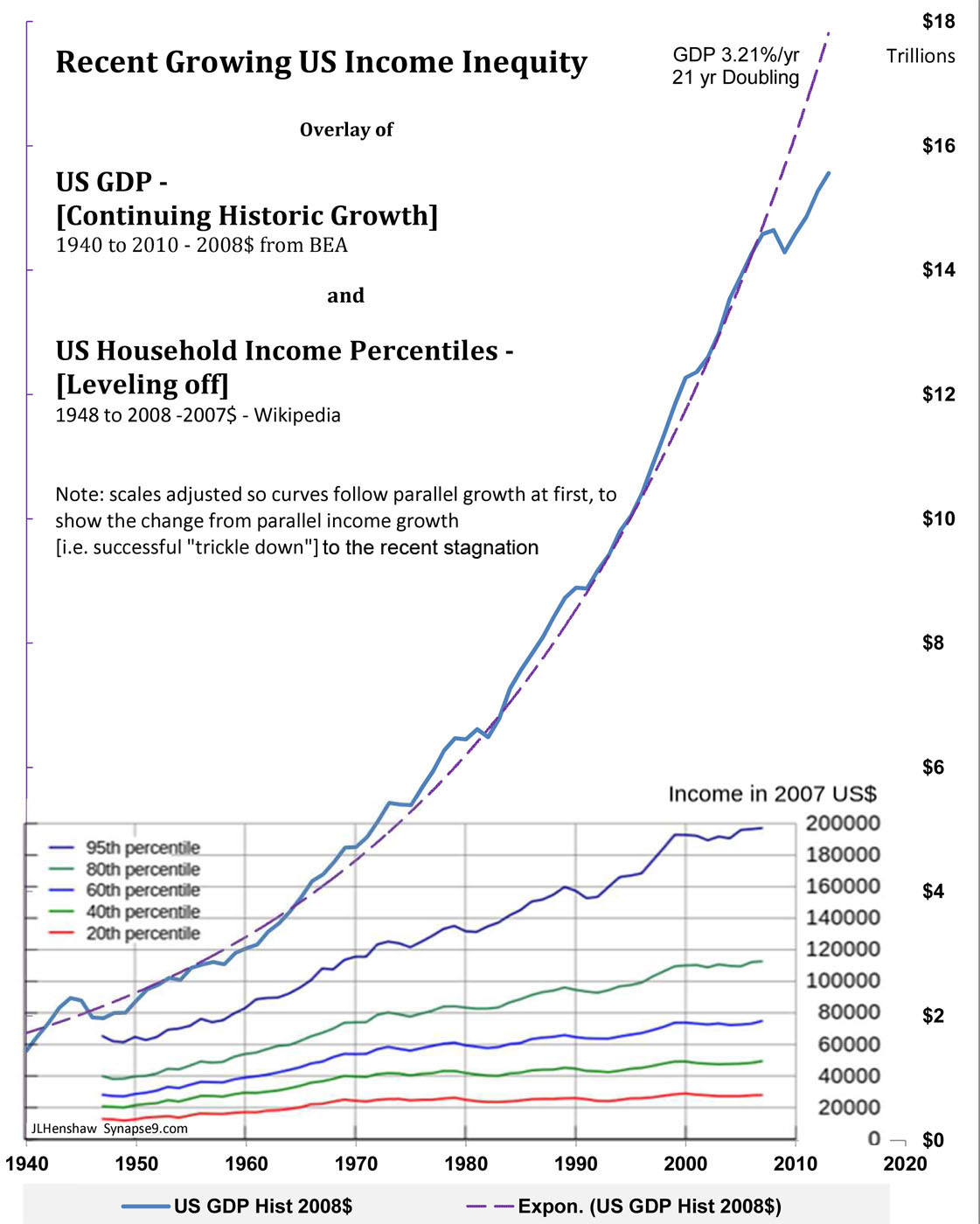

This is as simple a story of this amazing change in our economy. What happened is that the economy ran into increasing resistance from the environment. The inequity came from how that slowed down wage growth more than the investment income growth. Below are two simple ways to understand the natural cause of the problem, that were posted to the discussion on NPR.org today.

“A challenge to the new congress: Fix Stagnant Wages“

Without a major rethinking of our growth strategy it really can’t be fixed, not by this congress or any other, as it’s “natural”. The problem is our growth strategy is running into ever increasing natural “drag” and “resistance”, that affects labor more than investment earnings.

See also my recent articles:

“Kepler” – a great story of student discovering how to understand the big picture

“a Whole Systems view – Piketty’s “r > g” – Relating it to Thomas Piketty’s book on global inequity

- Comment 1

You never seem to be allowed to talk with the people who know why wages began stagnating in about 1970. There are very specific natural reasons.

Keynes predicted it. I’ve detailed it to the Nth degree. It’s a perfectly common problem in many ways. The simple word to call it is just “drag”. The economy is meeting ‘drag’.

You experience drag as a kind of resistance to what you were doing before. There are millions of kinds. The evidence of very numerous kinds of resistance increasing at accelerating rates more or less all together at once, for the whole system… goes back about a century.

You should talk to people who know.

https://synapse9.com/signals/20…

- Comment 2

None of you seem to understand that economies are designed to run themselves. Nobody mentions that in the media either, or even the smart pundits. I guess it’s because the people you hear talking about it are really just competing for attention or promoting their ‘angle’ or don’t know any better.

The real situation is that economic growth is stimulated by the money earned by investors being added to the pool of money for creating more businesses. So with growing investment you get a growing economy,… and it’s markets expand, using more and more of every resource they can find on earth…, till something goes wrong.

When things are going right, like in growth periods up to 1970, the incomes of the rich grow faster than anyone else’s, *but* there’s enough left over to “trickle down”, so the incomes of everyone else keep growing too, just a little slower than for the rich. After ~1970 the relative rates started spreading apart further and further, till most people don’t even increase their incomes as fast as inflation…

One of the things going wrong is the economy is running into natural resistance, from its growth having changed the world, to make it less bountiful. The economy is slowed down by needing to use more costly resources, from increasing complications of regulation, increasingly complex designs and teamworks needed to get anything done, increasing costs of global competition and conflicts between industries demanding growing shares of diminishing resources.

What’s most obvious if you look at the data is that after 1970 growth continued for the richest and not for the rest of the wage scales. I think there were all the above problems creating drag for the whole system, effecting the productive economy and lower incomes the most, and the people at the top the least. People of course saw that was where to make the money, and those that could went in to investing to use money to may money that grows without actual work. Investing is a kind of ‘work’ where the more money you have the more you earn, without any actual “labor”. So, that kind of earning really took over.

There’s lots more interesting to say, looking at the economy as I do as self-guided system driven by people’s choices and the capacities of the earth the find to use and use up that way. The bottom line, though, is that there’s too much unproductive investment.

The one and only way to reverse that (other than “resetting” the game with gigantic financial collapses) is for the wealthy to *spend* their earnings rather than *accumulate* more unproductive investments. JM Keynes actually proposed that would be necessary, as the solution for this very problem, that he saw as likely to come up in what he saw as the relatively near future, from the 1930’s.

I’ve written lots on it myself, but it’s “unpopular” because you need to look at the financial implications of our having been running into increasingly resistance to growth as approaching limits, for 50+ years…. That subject was made socially “taboo” in discussion groups not unlike this one all over the world in the 70’s, in case you don’t know about that. And the whole world went to sleep in total denial of there being limits to growth or anything eles, population too.

_______________

jlh