Post to UN NGO thematic consultation on: Environmental Sustainability and Equality

Why growth is now driving inequity,

not the reverse

A popular but mistaken idea is that what is needed to relieve inequity and the food crisis, is a restoration of long term economic growth. Now that the economy is beginning to press ever harder on the fundamental limits of the earth’s resources, the exact opposite effect is taking place, as growth efforts cause competition to intensify for shares of less and less available resources.

We’re at the limits of cheap resources. That’s the line we crossed. So to provide the supplies demanded by the most profitable and fast growing sectors of the world economy, resources need to be taken away from the less profitable sectors, causing them to stop growing and go into ever greater debt.

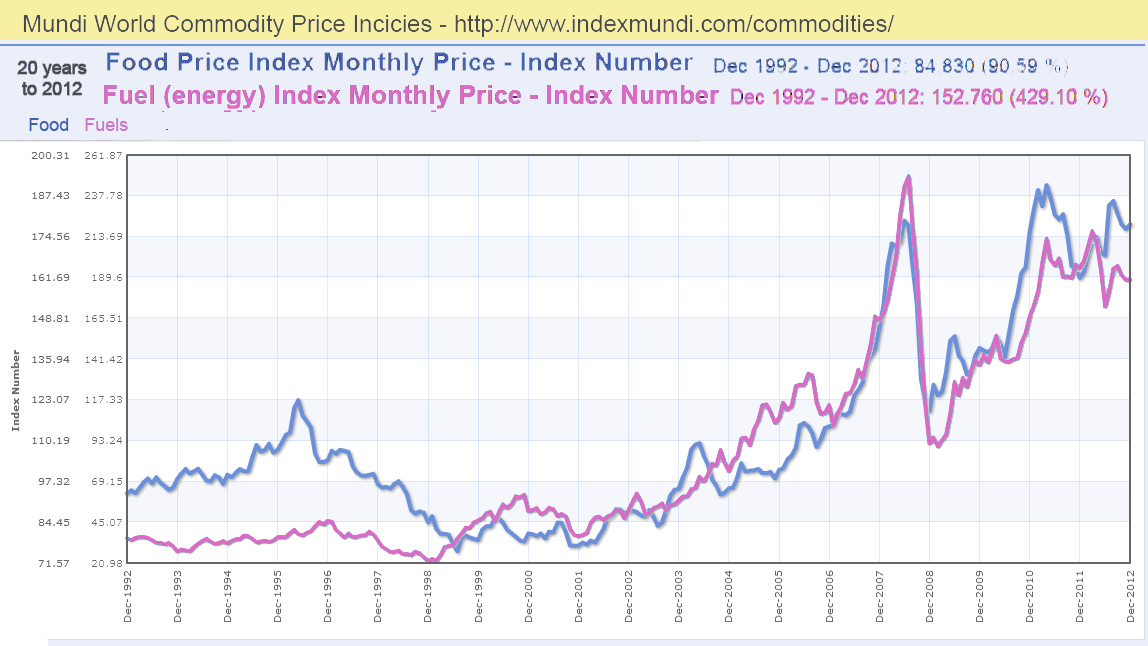

The evidence of that happening in how the commodities markets have exhibited 10 years of escalating prices for essential food and fuel resources. That directly indicates the transfer of resources from weak to the strong competitors, that the resources available are going to those who can afford higher and higher prices. That is greatly adding to the other strains causing the food crisis and the world debt crisis, both experienced as “increasing inequity”.

Unfortunately, I’m one of very few serious natural scientists using a behavioral view (rather than a theoretical view) of the natural behavior of our economy as it collides with the limits of the earth. “In theory” the economy is not supposed to behave as it is behaving, which I take as a clear sign the theory is mistaken, not the planet… “The theory” is based on past experience not present experience, is the problem.

What is actually needed to relieve inequity is relief from the demand for endless growth, and the use of those resources for solving the avalanche of problems now being caused growth. That’s deeply problematic politically, though, due to the strong popularity of ever expanding wealth as a policy, and the institutional structures to continue operating the economy to double the rate at which we consume the earth about 3 times a century. That is the rate at which we’ve been doubling our energy consumption and rate of changing the earth historically, so in a century we would be consuming and changing the earth 2*2*2=8 times as fast as the already outrageous and unsustainable rate we are today.

The solution to recognize a very common investment principle as applying to economic growth, that everyone is already very familiar with. It’s that, like any process of building something, growth first needs resources for building, and then needs the same resources to be used for using and caring for what was built. If you just keep building you run out of resources to care for it. So as an investment principle, resources are first most valued for growth, used to build up new systems, and then become most valued for taking care of them and their environments, making them sustainable.

For alert investors, seeing the approach of limits to growth is a signal of shifting values for investment, from using resources for growth to devoting them to care for what was built. Our problem is that “in theory” our investors will never need to do that, and don’t realize that devoting resources to growth has now come to undermine the value of what the economy built, now causing ever increasing inequities rather than comfort and security as investing for sustainability would.

What’s needed is a new model for steering our investment choices. We need unified SDG (goals) and SDI (investment) choices, using our communications networks to facilitate multi-stakeholder engagement to integrate the scientific, economic and cultural choices. Then the financial markets will again understand what will be profitable for us in the long term. Driving growth to further exhaust the earth, creating ever increasing inequity, isn’t one of them.

How a commons approach might be implemented to do just that, facilitated by the UN, is sketched in the brief “Ideal Model” SD Goals & World Commons Economy, a concept proposal combining my understanding of how we might mimic the way natural systems become sustainable at the end of their compound growth, and the contributions of the other members of Commons Action for the UN.

JLH

_________

Following that post the moderator commented on 4/23:

The first week of this online consultation on Environmental Sustainability and Equality might have seen limited traffic but it has raised some big questions. The moderators have asked whether the key questions for environmental sustainability and equality are social and economic inequalities or inequalities in access to natural resources. For a goal of environmental sustainability is it enough to address social and economic inequalities (e.g. poverty and jobs)? (For more on the latter, readers who have not already done so might want to check out the online discussion on Environmental Sustainability and Poverty.)

And following is my comment on that question was:

To give my response, having raised how the scarcity inexpensive resources naturally becomes a struggle over shares of diminishing affordable supplies, I think there is little doubt that political and social inequity and economic inequity are closely connected. Over the past few decades expectations have been raised for recognizing the human rights and the equality of all, but in practical terms that can’t take effect if economic inequities are growing by leaps and bounds, as seems to be happening as the economy hits the limits to its growth.

The need for high profit sectors for growing resource supplies then drives a macro-economic shift of both financial and material resources from the many to the few, and can’t help but defeat the social intent to create a more equitable world. That this has not been noticed yet is certainly odd, given the clear dependency of economic growth on using growing amounts of physical resources, so those who can pay more take larger shares from those who can’t when total supplies are limited.

That is not at all hard to understand, but it does take whole system thinking. The evidence that it is happening globally now is everywhere when you start to piece it together. That for 10 years speculators have been able to continue raising resource prices higher and higher is clear direct evidence of global shortages of total supply. Just from how market pricing works, it’s easy to realize that if there were plentiful resource supplies anywhere, speculators just wouldn’t be able to do that.

Whether there is such a thing as “green growth” is a longer discussion, but highly doubtful from a whole system view. GDP certainly does not measure human welfare any more, especially now that it is measuring a wholesale shift of resources from the less competitive businesses and communities to the more competitive ones.

But GDP also measures what it is that people want to buy, by telling you the quantity of natural resources going into end user consumption is declining, but at only slow and steady rates. So the impression that “green growth” can continue to increase financial wealth without causing resource consumption, the fabled “decoupling”, seems to overlook what people use money to buy. My published, peer reviewed, research shows that the resources consumed by what people working in “green growth” businesses buy, is actually not counted in their “green growth” impact measurements, … by definition! Systems Energy Assessment (SEA)

JLH