New graphics and update for Concept$.htm

__________

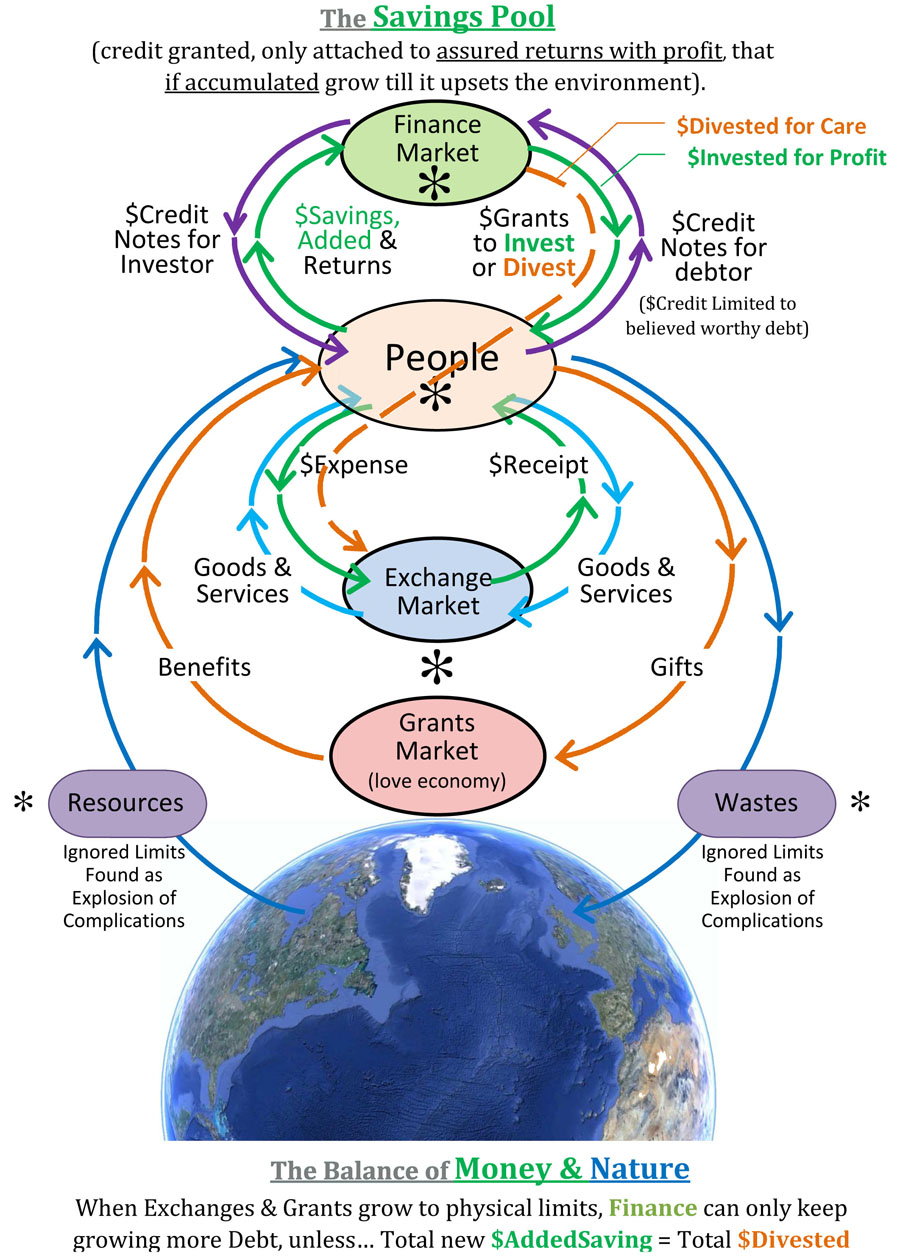

The ideal investment …. for people think of investment only for the money is one that assures that putting money in will let you take more out, and let you add that gain to your investments over and over and over. One can only imagine that to be sustainable, though, when considering nature as a concept rather than an environment.

It results, of course, in an eruption of complications when the complexly coordinated physical processes that had been trusted to multiply without consequences become uncoordinated and collapse. Why people have repeated that experiment with it’s naturally certain result over and over, at large and larger scale, to the point of running their societies by it, is more the mystery because we so clearly understand the consequences in our personal and community affairs.

So it appears to be the central feature of all great financial panics, and at the heart of all “tragedies of the commons” like the numerous collapses of otherwise magnificent complex societies, is that it besets us for physical systems we think of as capable of behaving like mental concepts, without environments or limits.

The linked PDF [that needs edit] has a slightly more complete diagram and 1 page discussion. The endless spiral of finance relies on a guarantee that putting money into things will let you take ever more out.

That is only possible for the information side of the economy, and not for the physical side. So conflict between our information and reality develops.

On the physical side, the profits of ever greater scale being accumulated rely on ever growing creativity in making things work, by people unknown to fund owners, money managers, and even the officers of businesses organizing the uses of investment funds. What physically generates profits is the active learning of all the participants that causes the system as a whole to organize itself to produce more value than the costs of the parts.

It also wouldn’t happen without the ability of the economy as a whole to transfer surplus resources from one place to another for the purpose, the investment function. Using those profits to the system’s the point of disruption or exhaustion, though, is not productive. We seem do it over and over creating great eruptions of wealth that collapse the environment they developed in, thinking of finance as a concept rather than steering the main self-control mechanism of our economic environment.

The solution is conceptually simple, though assuredly, changing concepts for people not accustomed to observing change in their environments is rather hard to explain… sometimes inexplicable. So assume people will need help. A money manager has a natural fiduciary obligation, to do a good job, for the system they are steering. As limits are foreseen, or the needs of other things with inherent worth, the main control allowing a complex economic system to be responsive to things in its environment is switching the use of its surpluses from increasing the system scale to improving the quality of its design.