|

Linking

Economics

& Natural

System Physics...

& pointing to a clear way

out

|

JL.Henshaw

contact

3/20/09 5/25 7/22 9/19 11/26/10 12/05/26

ref's |

Using money and power to

expand your money and power, naturally pushes all the relationships you know

about and lots you don't,

to their very limits, unless you're aware and respond by using your resources to

make peace instead...

There are 3 versions, from simple to complex (and from new to older)

1.

Why finance has a bigger appetite than the earth

| 11/26/10 2/5/11 |

The ideal investment |

|

.... for people think of

investment only for the money is one that assures that putting money in

will let you take more out, and let you add that gain to your

investments over and over and over. One can only imagine

that to be sustainable, though, when considering nature as a concept

rather than an environment. It results, of course, in an

eruption of complications when the complexly coordinated physical

processes that had been trusted to multiply without consequences become

uncoordinated and collapse. Why people have repeated that

experiment with it's naturally certain result over and over, at large

and larger scale, to the point of running their societies by it, is more

the mystery because we so clearly understand the consequences in our

personal and community affairs. So it appears to be the

central feature of all great financial panics, and at the heart of all

"tragedies of the commons" like the numerous collapses of otherwise

magnificent complex societies, is that it besets us for physical systems

we think of as capable of behaving like mental concepts, without

environments or limits.

The

linked PDF [that needs edit] has a slightly more complete

diagram and 1 page discussion. The endless spiral of finance

relies on a guarantee that putting money into things will let you take ever more

out. That is only possible for the information side of the economy, and

not for the physical side. So conflict between our

information and reality develops. On the physical side, the profits

of ever greater scale being accumulated rely on ever growing creativity in making things work,

by people unknown to fund owners,

money managers, and even the officers of businesses organizing the uses

of investment funds. What physically generates profits is

the active learning of all the participants that causes the system as a whole to organize

itself to produce more value than the costs of

the parts. It also wouldn't happen without the ability

of the economy as a whole to transfer surplus resources from one place

to another for the purpose, the investment function. Using those profits to

the system's the point of disruption or

exhaustion, though, is not productive. We seem do it over

and over creating great eruptions of wealth that collapse the

environment they developed in, thinking of finance as a concept rather

than steering the main self-control mechanism of our economic

environment.

|

|

|

| The solution is conceptually simple, though assuredly, changing

concepts for people not accustomed to observing change in their

environments is rather hard to explain... sometimes inexplicable. So

assume people will need help. A money manager has a natural fiduciary

obligation, to do a good job, for the system they are steering. As

limits are foreseen, or the needs of other things with inherent worth,

the main control allowing a complex economic system to be responsive to

things in its environment is switching the use of its surpluses from

increasing the system scale to improving the quality of its design.

When you spend your retirement savings that’s “divesting” your lifetime

savings and investments. If you have enough there are better things

to do than pump your environment for multiplying profits, like spending

financial earnings for higher purposes. It’s similar for financial

institutions, is the bigger point. The natural limits for drawing

multiplying profits from the environment are the explosions of

complications that causes as it disrupts the commons as a whole. So,

for our security, they and we need to consider that as their point of

“enough” and time to divest their earnings too. |

2. Why ownership grows even when wealth doesn't,

.... the true market system correction

Simple Statements of the concept: 2/28/10

4/29 6/15/11

|

-

Keynes, "widow's cruse"

|

Why did Keynes write

the concluding chapter of his master theory of economic growth on the

natural limits of money and what to do when increasing investment became

increasingly unprofitable? It's because that would happen at

natural limits to growth, and then a new kind of economic model is

needed. Investors need to become spenders of last resort

to restore the profitability of the system, relieve debt and preserve

the health of the environment.

|

|

-

Invest in "cash cows" rather than "crash cows"!

-

A new idea for Investment in Deep Ecology |

The global model

shows the global principles for how banks and finance companies will

need to operate, but individuals and businesses will need to adapt too.

These are two of the discussions

on my blog, that you can find under the topics "natural

economy" or "for

teachers"

|

|

- Deflating asset bubbles

|

When financial values escalate based on

bets in themselves and diverge from sustainable values, correct the

accumulating misinformation between promises and realities by a)

redefining the debt obligations in proportion to the measured divergence

|

-

Einstein, Keynes,

Boulding and Jacobs

|

Other popular articles related to the subject

|

2/28/10

Comment to "To the Point" - excellent

For the political view to make sense requires people to see

that keeping our economic system profitable is a necessity for every

individual's survival. Still, it sounds crazy for creditors to

spend their money instead of compound their wealth, as a matter of

survival, but from a natural science view it's quite clearly the only choice.

It may "sound funny" but for a growth system to switch from

taking more and more control of its environment, as every growth system does

during that phase, to establishing a stable niche for itself and maturing to

become resilient to change, is actually the quite

practical solution to natural limits. All natural systems that

survive their growth seem to demonstrate the principle, and provide ample

diverse examples to study for ideas. It's a big task, though, and at

this late date with so much lost of our natural heritage already, all we

actually do is commit to learning and try to bring others along.

2/8/02 11/18/09 2/8/02 We have

made promises for a future that are not materializing. By far the

cheaper solution is correcting the error in the promises, adjusting what

creditors hoped others could earn for them, rather than shutting down all the

businesses that are failing to perform according to the misinformation they bet

on.

Which would you choose?

Would it be a casino, like Wall Street, where you hope you're guaranteed to

win, on average, or one where you're guaranteed to loose, on average, like Las Vegas? ...The odd

answer is "it depends". It depends on whether the casino, in either case, spends its own winnings

so you can earn them back with labor if you happen to lose... or not. If the casino doesn't spend its own

winnings from your bets, everyone always loses.

Our present effort to stabilize the

economies and the earth is mostly aimed at the stabilizing the completely wrong

thing, stabilizing the money pumps

for making and keeping ever multiplying bets. It creates bubbles of unreal

expectation that no containment could be devise to prevent from popping...!

Why? Because the casinos we are betting in are not spending their own

earnings. Stabilizing multiplying bets WAS the appropriate strategy once, back before nature stopped

responding ever more to our investments in her limited spaces and materials and

delicate living systems.

Complex systems in which everything interacts

can be difficult to understand, and difficult to explain.

Ask

questions. I'm learning all the time. Note the dates for when sections were written.

The foundation of my work is a universal certainty, the physics that points to why "all things come and go" and

that for physical continuity events need continuity

of change

to get there, following a succession changing directions of

accumulation.

7/22/09 9/19

Growth stimulus continues to grow in good times and bad,

until the inflated expectations is creates collapse. The

reason is our "odd" primary purpose of regulation, stabilizing financial rates

of return to help investors steadily add their returns to their investments and

have them continually

multiply. That ever multiplying "good" turns explosively bad is an

absolute law of nature. Any way you do it, trying to

continually multiply the scale, complexity and natural impacts of the economy is

a problem. The equations won't break, but all our relationships

between things on the earth will. There's only one way to have

stable interest rates and a stable economy. That's to do

something about the other part of that first sentence... the continual

compounding of returns. It pumps up bubbles of obligations and

expectorations that can't be fulfilled, allowing investors to continually

multiply their ownership of other people's future work, as if that was a way

everyone could have ever growing earnings.

Economies that grow to

become part of nature, rather than just blow themselves up, provide an

alternate model. This page is more about our particular problem and

options. It might all be "thinking to sleep on" though, because it's about

opportunistic (uncontrolled) systems and how they are able to take very good

care of themselves. People are generally trained to think only in

terms of deterministic causes. It's the opportunistic chains of

events, both within and around natural systems, that steer them into the future,

though.

The need is to find a strategy for changing a machine designed for automatic

multiplication into a stable and responsive organism, so it can take care of

itself and its world instead of blowing up in conflict and confusion.

The surpluses of the system and what opportunities they are used for that are

the natural "steering mechanism" of all natural systems. The

surpluses first used to multiply the system then need to be redirected to making it sustainable. Our

whole economic "project" is to build a comfortable new home on earth.

That's the real purpose of growth. What could prevent us from

finishing it, and leave it generally uninhabitable, is our failing to switch to

completing it, as if a home builder used up all the lumber on building walls,

and didn't have enough wood left to build a roof. Failing to

complete any kind of design causes it to be abandoned.

Switching our purpose from starting up ever more to completing the economy is a broad

but extremely firm boundary condition for any possible solution to our deep

global system problems. The returns on investment need to be

used by investors for stewardship rather than multiplying. How to

assure everyone does, and sees how, starts with a few people seeing the real

necessity.

Why

we need to do it now has to do with the whole system going past it's point of

diminishing returns probably 50 or more years ago, and increasingly

"profiting from

scarcity". Real earnings growth is failing

because we're pressing the limits of the earth and bidding up the global cost of

resources as we accelerate their depletion, with every expansion of the system . What

happened is that getting ever bigger caused the system to become "big", and all

the relationships of relative scale reversed!! We just didn't change

out economic theory...

It's a dead end, and we need to stop expanding and as quickly as possible begin

to carefully contract. We've crossed

a dangerous tipping point in our relation to the earth. It's also one that has been clearly

approaching for decades, of course, but we've been treating it as a dream and it

isn't. We're continuing to run up the whole economic

system's overhead costs as it runs down its resources, at accelerating rates.

Like musical chairs, promoting the growth of more

productive parts of a system in a zero sum game removes access to resources for

all others, and pushes the system through successive waves of unsustainability.

We noticed the one that happened in 2008 and continues, but don't notice lots of

the others. High productivity growth beat out less productive

struggles for survival, causing the economy to shed

whole webs of previously stable 'necessary' parts. The present global

contraction demonstrates that well, and is an example of what will surely get ever

worse along our present course of accelerating our use of every usable. If you think of the

financial definition of "optimal growth" and you see the real problem.

Optimal growth is greatest steady rate using up the affordable resources on

earth at as fast an accelerating rate as humanly achievable. That's what

the "profiting from profit" rule physically means,

and always did. In the past, though, the more we used

the more we found. That reversed about 50 years ago... To

preserve the capital of the world system we built, and discover how to complete

it to make the earth a good home, growth needs to become responsive

to its environment and our future, planning for a long and stable vitality living within

its limits on earth.

3/20/09 5/25 Debt and ownership keep growing even

when wealth does not because stabilizing the investment markets assures a

positive financial return and the compounding of returns. The

responsiveness of the earth to our investments is not in as direct control of

our regulations as the money system is, that's the problem.

Physical growth has not kept up from the 1970's to the present, has been in a

condition of *over-stimulus* since then and unable to produce earned incomes to

match, so what the financial markets kept growing on was transferring ever more

ownership from the product market to the financial market and creating debt.

That created misinformation throughout the economic system.

Financial obligations kept growing when the physical system didn't, creating

false expectations and a major information error about the reality of the

economy's real products.

When information and reality drift apart

the choice is whether to change the information or to change the physical

system. In this case the problem occurred because we had been trying

to change the physical system and found it unresponsive. The

US and G20 policy appears consistently to protect the misinformation as much as

possible and prevent the further collapse of bad debt instead of find as smooth

a way as possible to reduce it to match the reality of the physical system.

The source of the distortion not being

corrected is that the rules allow the growth of financial obligations and the

growth of physical economies to diverge( ), except constrained by overshoot and

collapse. It's a design flaw in the rules. Maintaining a positive interest rate as is

needed to make markets work, allows people to have guaranteed multiplying

financial winnings on their economic bets, even when

the physical economies are not multiplying. It's a globally

institutionalized promise too good to be true.

), except constrained by overshoot and

collapse. It's a design flaw in the rules. Maintaining a positive interest rate as is

needed to make markets work, allows people to have guaranteed multiplying

financial winnings on their economic bets, even when

the physical economies are not multiplying. It's a globally

institutionalized promise too good to be true.

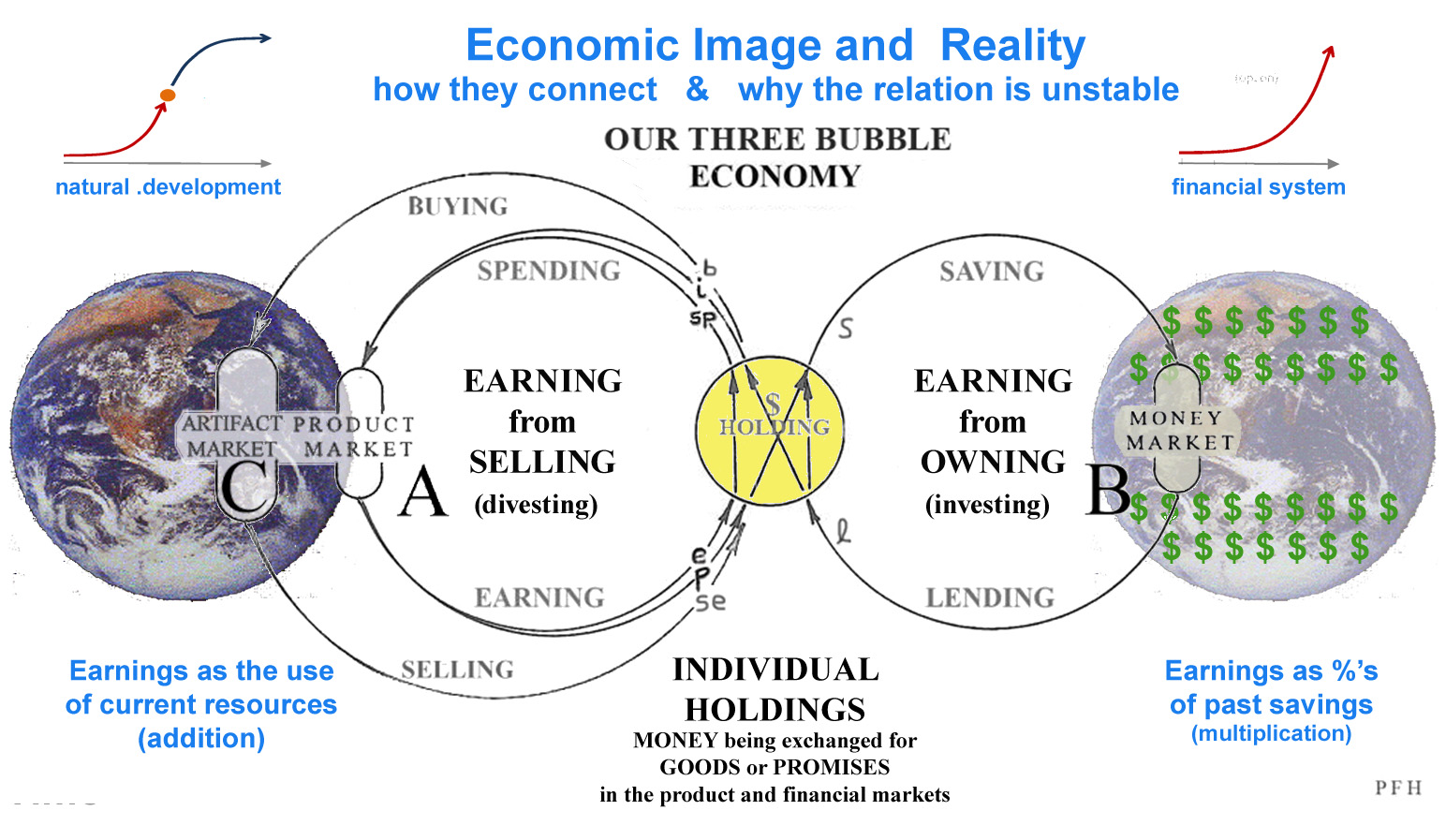

Why didn't the scientists connect the

two kinds of models before? It's both because of the natural

academic self-isolation of professions, which our professional academics are

then very responsible

for, and that connecting different modes of description for complex systems

takes breakthroughs. A complex systems principle is that it generally

takes a different mode of explanation to describe different aspects of the same

complex system. That is one of the core reasons they're called "complex". Here I'm

using a legitimate way to connect physical and information models.

It models the freedoms of physical systems guided by

choices made in information

systems, connecting the physical and perceptual worlds as we use them in

parallel. The information model gets out of

synch with the physical model after the point of diminishing returns as the

physical system responds to getting big, but the financial

information about it doesn't.

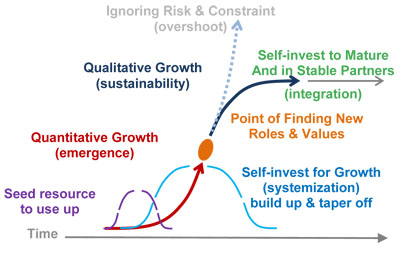

The explanatory principle of natural systems physics is that: As things get

larger they eventually get big, so

changes in scale become changes in kind, as new kinds of organization in their

internal and external physical relationships require new kinds of information for how they're

explained. The meaning of the proof is that if, as it seems,

the limitless growth assumption for the responsiveness of the physical system no

longer applies, but we keep using it, then collapses of the kind we just

experienced then necessarily become the rule rather than the exception.

3.

Physical systems have limits of elasticity

... and financial

calculations don’t.

|

6/15/11 - Many systems approach limits of

elasticity and develop inflexible responses at the limits, not

working like they did. A balloon only becomes sensitive

to a pin prick at the point when the surface can no longer flex.

Resource markets responding to greater demand than available supply

need to reject buyers by raising the price.

A

decisive moment for Investing in Sustainability |

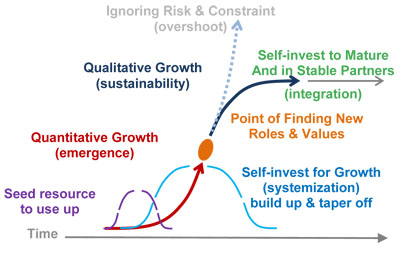

4/16/09 - Because it’s necessary to have a positive interest rate to maintain working markets, compound returns and other credit expansion need to be limited to the

comfortable ability of the physical and environmental systems to respond.

As Soddy, Keynes and Boulding, all said before, there needs to be a natural

limit to credit. Here the proof is that that limit must be a limit

of compounding, the choice to not spend returns. At present the economic assumption is effectively (if unintentionally) the

reverse, to increasingly stimulate a naturally overstressed physical system in

an attempt to restore automatically multiplying

financial returns. What's missing is understanding what nature uses growth

for, to begin things, and how living systems need to

switch to completing directions of development by maturing to solidify gains and

assure lasting

vitality (5). That seems to provide the one model available for economies to climax without

collapsing their environments.

|

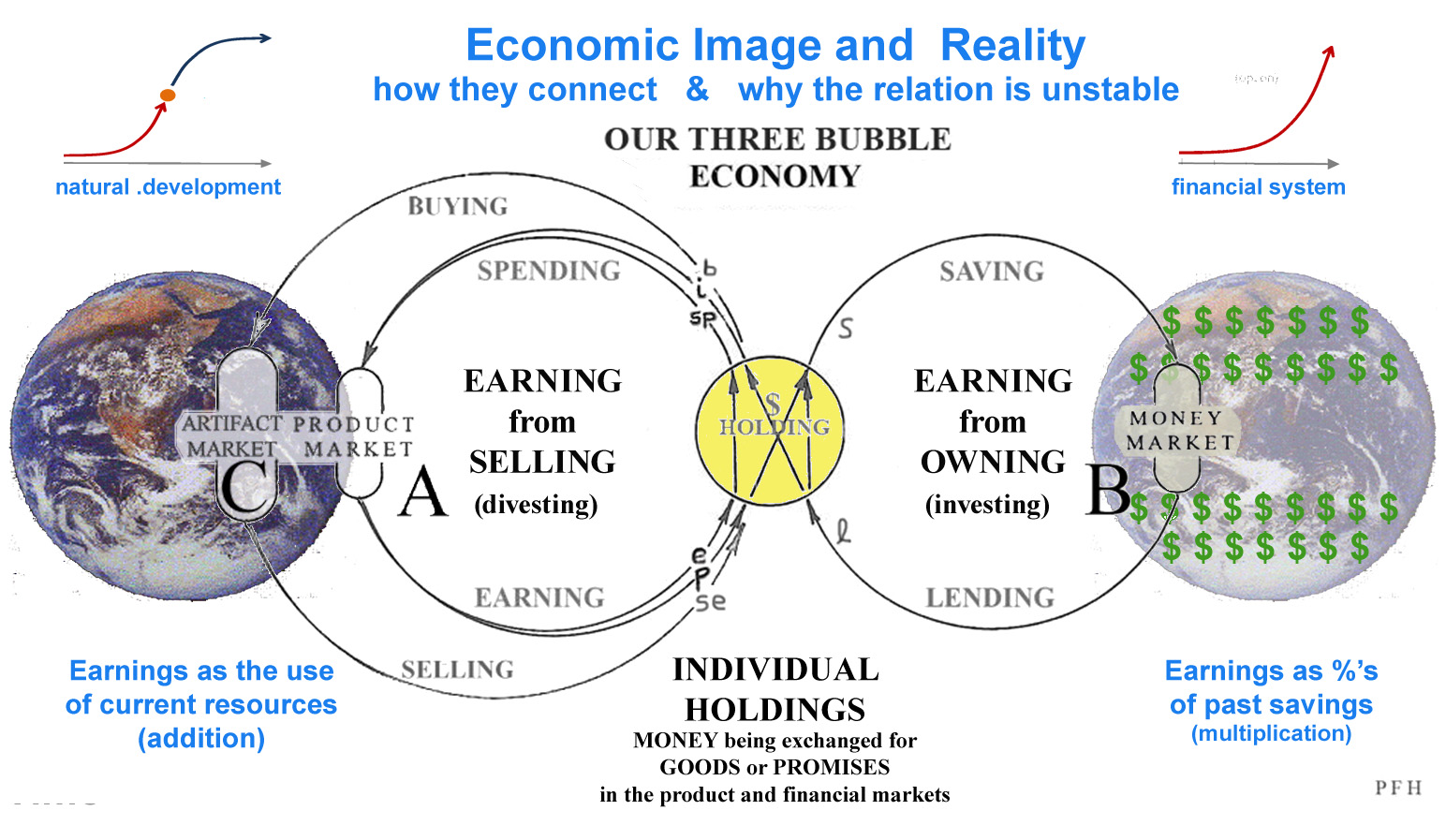

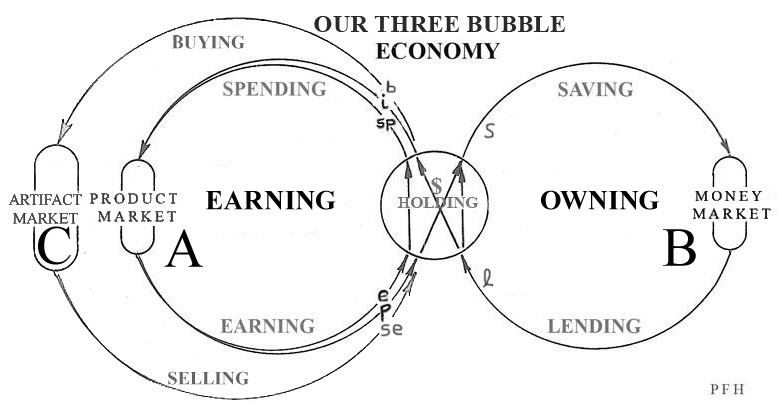

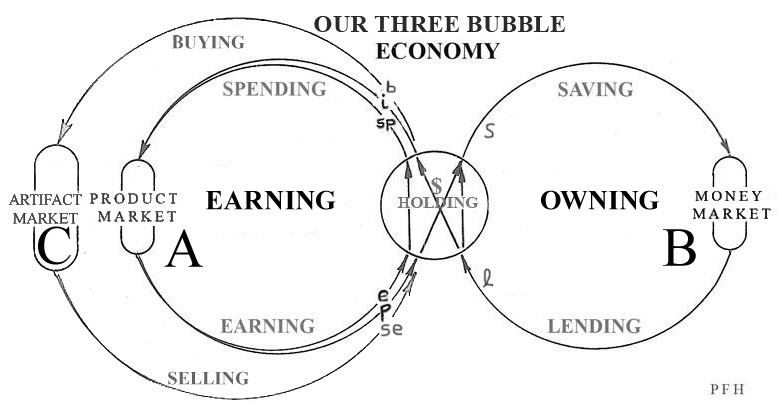

When Ownership Grows and Wealth Doesn't

This diagram represents a map of all ownership transfers for an exchange of money:

Goods & Services consuming energy are exchanged for money in the product market A

(the real wealth),

Money for

Promises to return more money are exchanged in the money market B

(ownership), and ownership of

unchanging property is exchanged in the artifact market C (artifacts). $-Holding (in

the center) represents each individual's separate money and their choices

to pass it through markets A, B, & C representing their individual interactions with each

other. If "Holdings" was a stack of disks, one for each individual, the model

in time would represent each and every individual exchange of money for

materials. Ownership collects earnings from wealth as a guaranteed

growth of debt, and in nature the real growth of wealth is not guaranteed. |

Even when people are not "gaming" the system,

distortion can develop between the money market (trading financial instruments),

and the product market (trading physical goods and services).

Physical products can't be created by imagination alone, but information

products can, so things like circular

price inflation for artifacts not changing in value (like real-estate) can

take the two markets in different directions as a whole. That creates falsely inflated information

about the future value of both artifacts and business investments.

It's not that individual deals could be somehow judged for how much

"misinformation" they contain, but that a disconnect can develop between the

real scale of the product market and the real scale of the money market as a

whole, even when both are operating "properly".

There

have been many technology transitions in the past that matured and then gave way

to another in a continuous succession of compound real growth. It used to

be that the more we used the cheaper and more available it got. What's

different now is that most resources are showing signs of exhaustion, increasing

price and decreasing availability as we increase investment, requiring

successively increasing investment to not decline in availability.

We formed our cultural expectations and economic institutions for the reverse,

what was always the case before, but isn't now. What's different in

particular from the 1930's recovery is that we can't pump investment as our way

out of it, since we burned up all the cheap resources we used to do that before,

and now they're gone. We need a new strategy. The one

available seems to be the one that nature demonstrates with every individual

system she builds that has a long period of mature vitality after it's initial

growth spurt, using a period of maturation to complete and perfect things that

growth begins(5).

In

the market economy we designed during our long growth period distortion naturally

develops when goods and services traded in the product market A stop multiplying for any natural cause.

Then obligations for monetary returns for the money market

B continue to multiply because of compound investment, since even a non-growing physical economy needs a

positive interest rate. So exponential growth in

financial instruments continues by exploiting the necessary system liquidity

even when the physical system is not growing. It creates an illusion

of "making money" while making nothing but false expectations. It's done

by compounding returns at a time when wealth isn't similarly growing.

The distortion that causes develops to a limit of the

physical system's elasticity, overextending to a point of failure unless

it is stopped some other way. One of the

frequent signs of this developing is inflation in the price of artifacts of no

changing real value C such as the housing bubble. Physically diminishing

returns on investment for the system as a whole have been evident in the

divergence of total US GDP and US median income since 1970

(1).

The main "inelasticity" in economies of both natural and human design is the

learning responses of their parts. Economies are learning systems, and

learning takes time. (2, 3). Human learning about complex systems we

depend on and are part of is notably slow for many reasons thought can be

somewhat improved by new kinds of thinking (4).

(reference links below)

the Letter to Bernanke

This page began, as much of my work, with a letter. I posted this page

for references in a letter to Ben Bernanke, Chairman of the

US Federal Reserve Bank on 3/20/09 as follows:

Chairman Bernanke,

There is a violation of physics built into our standard

model of investment. I respectfully request that you let me answer the

questions that should raise for you. Our financial model is what is failing,

and I believe our present actions are pushing the bottom lower.

I discovered how investment incorporates a critical error

in treating physical systems as being information systems 30 years ago. The

physics is simple and unequivocal. Physical systems have limits of elasticity

and financial calculations don’t. I have always been able to walk people

through it, but instead of asking for that help they have generally just offered

their uninformed judgments. You should not do that if you are sincere about

fixing the economy. I have also been improving my methods and my

understanding of the broader issues ever since too, of course. For a diagram &

notes on how the problem develops see www.synapse9.com/issues/concept$.htm

.

To fix it there is more than one way to begin, but the end

is a sustainable economy. The main feature is an investment sector using

savings from earned income rather than from compounding unearned income as its

resource. In the interests of preserving both present physical and financial

capital, and make the best of our shrinking physical options for a sustainable

economy in the long term, now is the time to switch.

----- fyi (to put it in context)

To fix it there is more than one way to begin, but the end is a sustainable

economy. The main feature is an investment sector using savings from earned

income rather than from compounding unearned income as its resource. In the

interests of preserving both present physical and financial capital, and make

the best of our shrinking physical options for a sustainable economy in the long

term, now is the time to switch.

The breaking point of our economic system has

been visibly approaching for 30+ years, in the divergence between our

multiplying financial obligations and the diminishing responsiveness of our

goods & services economy and environments. The correction is to correct the

misinformation that accumulated in the growing financial obligations, i.e. mark

down the financial obligations in proportion to their distortion, to rebalance

them with the capabilities of the physical system to keep up. That would

relieve debtors of the falsely accumulated obligations and end the contraction.

To relieve the strains of that dislocation, and to respect the interests of

non-debtors, a measured amount of non-debt created money should be printed and

distributed to people in proportion to their average earnings, and as a way to

start the new stable financial system.

Continuing to protect the financial

misinformation and its excess obligations for the physical system, rather than

correct the balance, will force the current contraction to continue, just as if

a doctor was trying to save a patient by applying more leaches. Medicine

actually began that way, you know. There are a number of ways we

misunderstand the systems of nature as if we were applying leaches to drain “bad

blood”, thinking it’s the best way of healing them.

It’s simply not physically possible to maintain

a positive interest rate and have stable compounding returns on investment. It

constitutes a promise too good to be true. The lag times between demands and

needed responses multiply, to where the tolerance for that is exceeded and the

elasticity snaps. Because it’s necessary to have a positive interest rate to

maintain markets at all, compound returns and other credit expansion need to be

responsive to the responsiveness of our physical systems, environments and our

own rates of learning.

Best regards,

Phil

Henshaw ¸¸¸¸.·´ ¯ `·.¸¸¸¸

Background

References

- 1) US

GDP and US median incomes - one of many measures of physical & financial

system divergence.

- 2)

Neoclassical Economic Theory - History and error of basing economics on

physics

- 3)

Complex

Systems - History & open Issues - draft for Encyclopedia of the Earth

- 4) Bump on a curve notepad

- a set of general exercises for those discovering systems

thinking

- 5) Chapters of a whole event - Growth

to maturation appears to be how nature makes so much durable diversity seeming

to efficiently resist the laws of decay, by first beginning things with a

local growth process and then finishing them with a local maturation process.

It uses the system itself as it's own information storage location, explaining

the mystery of where the 'rules' for them are, using independent behavior

within the laws, not imposed by the laws but just made possible for individual

systems that develop on their own.

Synapse9

jlh contact