A simple model

of Keynes' Proposal for stable Economic Climax

Naturally

Stabilizing Economies by Ending

Compound Investment (for profitability)

J L Henshaw

id @ synapse9.com

09/16/07 05/21/08 08/26/08 6/19/12

More discussion of the theory from a

natural systems perspective is at NaturalClime.htm

and

searching the site and my blog for mentions of Keynes.

This page introduces a simple spreadsheet model showing the effect.

The automatic compounding of investment income ends to allow the physical

processes of economies to switch from expanding to maturing, and distributing

wealth thereby too. Real sustainable development is more complicated, but as a

financial choice it amounts to a single simple policy decision to preserve

capital by turning off the "multiplier". Otherwise the multiplier is only

turned off when investments or returns themselves collapse. The

general idea was first proposed by economist J. M. Keynes saying:

"may

be the most sensible way of gradually getting rid of many of the objectionable

features of capitalism" (General Theory, Ch 16)

It was then promoted for decades by visionary economist Kenneth Boulding,

which I discovered when working on it in the early 1980's.

This version focuses on the simplest rule that would end the

compounding of returns, voluntary spending by investment owners.

That would keep economies from falling into global credit traps, as so prevalent

in the long history of economic disasters. To keep economies

profitable in the long term investors would need to spend their profits in the

interest of maximizing the profitability of the environment they are profitinb

from, i.e. as an endowment for sustainability.

---

The short statement:

Economies grow because surpluses are reserved for expanding them.

Growth in a market economy is managed by allocating funds from a savings pool to

generate returns, and

those returns then added to the pool to increase the total amounts invested.

It increases the investments and the returns exponentially, by adding positive

%'s of the prior total. The end for that comes at a pont of

"over-investment" when increasing investment becomes less and less

profitable. Then, as the whole falils to prosper, investors still

seeking maximum growth for themselves do so as the expense of everyone else,

rather than as before to the benefit of everyone else.

Seeing diminishing returns for the whole approaching, a choice

could be made to

prevent a terminal decline in the profitability of the whole, by a collective

choice to end the general compounding of returns, as socially discredited.

One practical way would be to distinguish between earned and unearned income,

encouraging people to save from earned income, but prevent the saving of

returns on investment (unearned income). Then investors would need to

spend their unearned income on purposes serving other values.

It's

not important here to discuss all the reasons our

economy developed a plan to grow ever faster forever. It's only

important to note that literally all kinds of systems in nature initially

develop with a growth process, whatever their natural beginning or end.

It's essentially a law of physics, that nothing can start at it's full size, but

due to the conservatin of energy needs to begin with the kind of non-linear

development we call growth.

No

doubt ending economic growth would be a big adjustment, but it need not mean slowing

things down, except as people realize slowing down a bit might be a more

profitable way to go. It just means removing the steering principles

that result in automatic maximum rates of expansion, and guiding investors to

invest so the system as a whole remains profitable.

Nature

demonstrates this investment strategy as growth slows down at the point where

organisms or other systems begin to mature. At that time their

self-investment goes stabilizing at a peak of vitality and maximizing their

ability to interact with their environment. It's a process of

turning from inward to outward interests, like students perfecting their

development as they complete school so they can become independent actors in the

world. So turning the use of the investment profits from internal to

external growth is a way

to copy

nature's method.

The cybernetic steering

principle is for the viewpoint of cells that have doubling to grow their body,

as it begins to become taxing rathre than enriching, turn you attention to

perfecting other things. It's the standard investment principle of

family businesses, in which people work very hard to make it grow till it can

support their true interests in having a business.

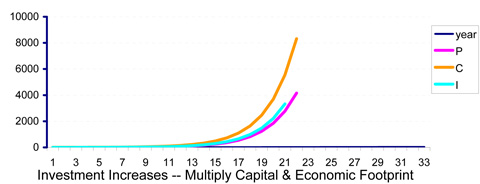

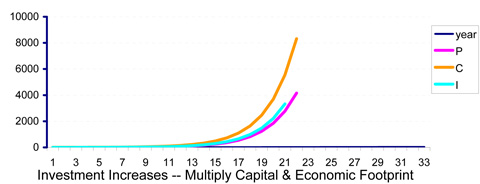

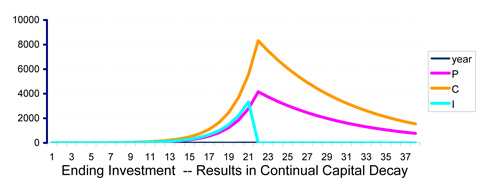

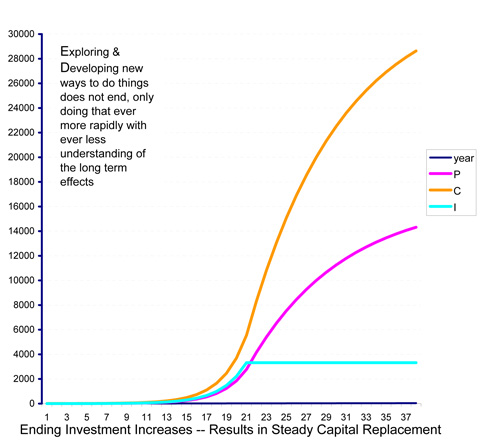

The graphs are of a very simple but very natural economic

"through-put" model from an Excel spreadsheet,

using the variables: Investment, Capital, Products and Returns on Investment (1):

1) Investment funds build Capital goods

2) Capital goods build Products

3) Capital

goods and Products

both decay over time

4) Investment

funds produce Returns and do not decay

5) Returns

are added to Investment

funds at first

6) So Investments, Capital

and Products first multiply and then stabilize

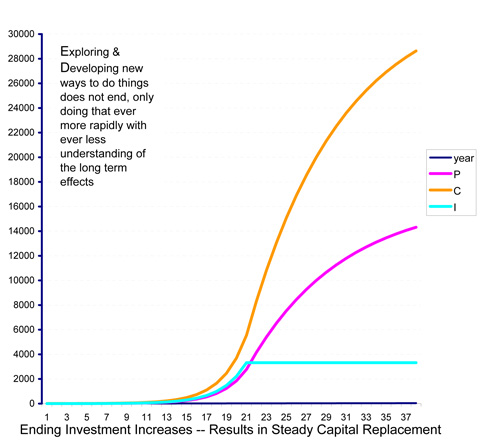

After year 20 in the model, to keep it simple, either

investment is stopped or compounding the returns is stopped, causing a developmental turning point. These

demonstrate the control potential for these two types of 'intervention', one

destructive and the other constructive.

What Keynes noticed was that as complications of growth set in, if the constructive choice was not made

the destructive one would happen.

|

A. In limitless economic growth, investment builds capital goods, and

capital goods build products. Returns of a small %

then adds to investment, and this forms a continually multiplying spiral of

expansion as long as resources of ever greater amounts and ever lower costs keep

being found too. |

|

B. If investment were suddenly ended, capital goods would decay with some

parts wasting away more quickly than others, and everything would wind down.

It's hard to imagine a choice people could make to end investment permanently.

It's easier to imagine how a gereral financial collapse might result in economic

breakdown and decay. The reality is that most complex societies in

history seem to have done something of the sort, and vanished without

leaving a record what the self-created problem they faced was, like

Rome, the Mayans, Easter Islanders. |

|

C.

Ending the compounding of investment would be an actually quite small

change in the economy, having a quite large accumulative effect. Here only the increment

by which investment is increased each year is restricted. The

behavior switches from a run-away explosion to

seeking a self-defined natural balance.

This represents transformative cybernetic control. It is a large

conceptual leap to imagine, but satisfies the necessity that we somehow end our

exploding economic footprint on the earth. It does so without disrupting

the physical economy of the time except to alter its rate of change.

What most people don't realize is that this is the growth sequence of their own

original biological growth and development. We all started from a short

period of exponential expansion (starting from a single fertilized cell).

That 'immature' explosive growth was followed by switching to maturation and

leading to our independence in the world. Maturation is the step to

independence. That's actually the normal development sequence for

all living things, and an option that is available for economies. If you

consider the time scale in the charts to be hundreds of years, give or take,

this might also suggest the general time scale over which this kind of change

might take effect, starting growth for a short period and maturing growth for a

long period. |

notes:

(1) definitions of the variables and the model and a few notes are to be

found in

GrowthSwitch.xls It's a series of 3 simultaneous relationships, Economic

Product: P1=C0*R, Capital: C1=C0-C0*d+I0

and Investment: I1=I0+I0*r.

Run 2 makes I0=0 at step 20, and run 3 makes r=0 at

step 20. That's the entire difference. Many more features

could be added, but the result is the same if, as here, 'r' includes all

the regularly reinvested returns on investment and setting it to zero has no

other effect on how returns on investment are used.