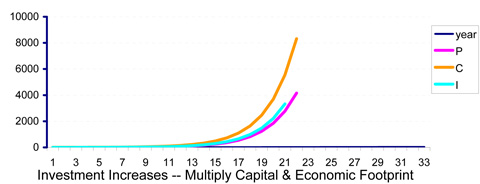

A. In limitless economic growth, investment builds capital goods, and

capital goods build products. Returns of a small %

then add to investment, and this forms a continually multiplying spiral of

expansion.

A. In limitless economic growth, investment builds capital goods, and

capital goods build products. Returns of a small %

then add to investment, and this forms a continually multiplying spiral of

expansion. More discussion of the theory from a natural systems perspective is at NaturalClime.htm. This page introduces a simple spreadsheet model showing the effect. The automatic compounding of investment income ends to allow the physical processes of economies to switch from expanding to maturing, and distributing wealth thereby too. Real sustainable development is more complicated, but as a financial choice it amounts to a single simple policy decision to preserve capital by turning off the "multiplier". Otherwise the multiplier is only turned off when investments or returns themselves collapse. The general idea was first proposed by economist J. M. Keynes as "may be the most sensible way of gradually getting rid of many of the objectionable features of capitalism" (General Theory, Ch 16) and then promoted for decades by visionary economist Kenneth Boulding. This version focuses on the simplest rule that would end the compounding of returns, voluntary spending by investment owners, to prevent undermining the entire principle of our investment in the earth, reducing the net benefits of investment (costs & benefits) toward zero and below.

---

The short statement: Economies grow because surpluses are reserved for expanding them. It's managed with money by investing from a savings pool to produce returns and those returns are then added to the pool to increase the amounts invested. It increases the investments and the returns exponentially, by adding constant %'s. The end is when the environment is exhausted and the investments no longer produce a return, or the returns are spent instead. Seeing a general failure of returns approaching, a choice could be made to prevent that by ending the automatic compounding of returns instead. One way would be to only allow earned income to be invested and require all returns on investment (unearned income) to be consumed.

People play a lot of 'shell games' with explaining the economies. We are the future that did not invent our way out of the jam the people in our past were so sure we would easily escape. Just think about the totals, and make sure anyone's list of parts is not just a put off but really adds up.

One reason the economic plan has been to multiply forever, and never climax, is that it seems the economies would be harmed if they stopped growing. There are painful imbalances that develop in recessions, between expectations and realities. The main one seems to be that to keep from getting poorer you have to keep the people with the money getting richer. That pressure would be gone too.

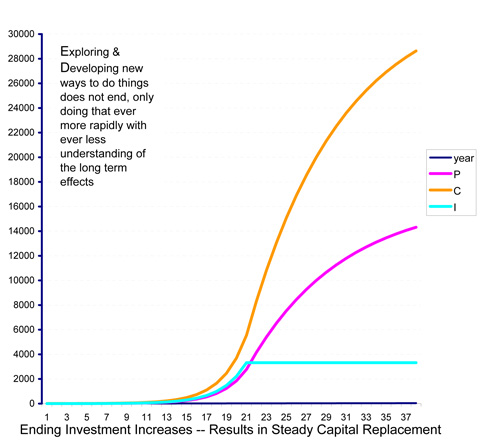

No doubt ending growth would be a big adjustment, but it need not mean slowing things down. It just means slowing down expansion. Nature slows down its growth systems at the point where they begin to mature, to be able to perfect them. This is a way to copy nature's method. At the point where our freedoms are being lost, turn off the the feedback pumping up the size and complexity of our system. Stabilizing investment, would not need to cause recessions, but would let the economies climax at a high stable level. If the policy is simply to unplug the accelerator, and leave everything else alone, physical changes in technologies and business would continue at just as rapid a pace with physical capital being continually replaced and upgraded as always.

The graphs are of a very simple but very natural economic "through-put" model (1):

1) Investment funds build Capital goods

2) Capital goods build Products

3) Capital goods and Products both decay over time

4) Investment funds produce a and do not decay

5) The returns are added to Investment at first so Investments multiply

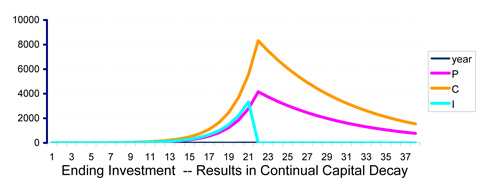

After year 20 in the model, to keep it simple, either investment is stopped or compounding the returns is stopped, causing a developmental turning point. These demonstrate the control potential for these two types of 'intervention', one destructive and the other constructive. What Keynes noticed was that in the long run if the constructive choice was not made the destructive one would eventually happen.

A. In limitless economic growth, investment builds capital goods, and

capital goods build products. Returns of a small %

then add to investment, and this forms a continually multiplying spiral of

expansion.

A. In limitless economic growth, investment builds capital goods, and

capital goods build products. Returns of a small %

then add to investment, and this forms a continually multiplying spiral of

expansion.

B. If investment were suddenly ended, capital goods would decay with some

parts wasting away more quickly than others, and everything would wind down.

It's hard to imagine a choice people could make to end investment permanently.

It's easier to imagine futuristic scenarios of ecological collapse or social

chaos that might cause a premature failure of civilization of this magnitude.

Many complexly organized societies of the past have done something to themselves having this kind of effect.

B. If investment were suddenly ended, capital goods would decay with some

parts wasting away more quickly than others, and everything would wind down.

It's hard to imagine a choice people could make to end investment permanently.

It's easier to imagine futuristic scenarios of ecological collapse or social

chaos that might cause a premature failure of civilization of this magnitude.

Many complexly organized societies of the past have done something to themselves having this kind of effect.

C. Ending the compounding of investment is a small change having a large accumulative effect. Here only the increment by which investment is increased each year is restricted. The behavior switches from a run-away explosion to seeking a self-defined natural balance. This represents transformative cybernetic control. It is a large conceptual leap to imagine, but satisfies the necessity that we somehow end our exploding economic footprint on the earth. It does so without disrupting the physical economy of the time except to alter its rate of change. What most people don't realize is that this is the growth sequence of their own original biological growth and development. We all started from a short period of exponential expansion (starting from a single fertilized cell). That 'immature' explosive growth was followed by switching to maturation and leading to our independence in the world. Maturation is the step to independence. That's actually the normal development sequence for all living things, and an option that is available for economies. If you consider the time scale in the charts to be hundreds of years, give or take, this might also suggest the general time scale over which this kind of change might take effect, starting growth for a short period and maturing growth for a long period.

notes:

(1) definitions of the variables and the model and a few notes are to be

found in

GrowthSwitch.xls It's a series of 3 simultaneous relationships, Economic

Product: P1=C0*R, Capital: C1=C0-C0*d+I0

and Investment: I1=I0+I0*r.

Run 2 makes I0=0 at step 20, and run 3 makes r=0 at

step 20. That's the entire difference. Many more features

could be added, but the result is the same if, as here, 'r' includes all

the regularly reinvested returns on investment and setting it to zero has no

other effect on how returns on investment are used.