1 - Increasing Energy use, Efficiency & Wealth are one process

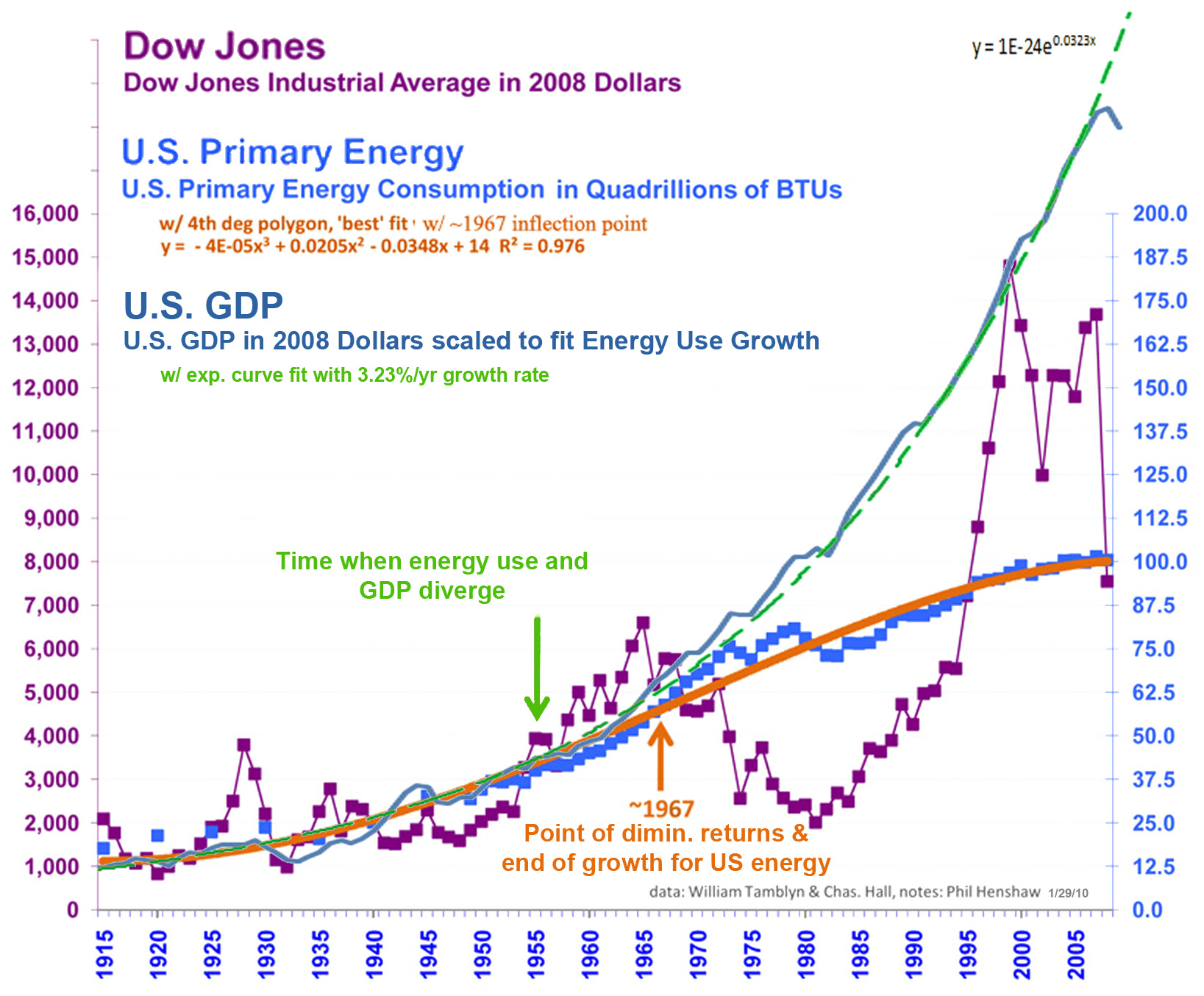

2 - US Energy use, Stock market & GDP show separate processes

(click the figures to enlarge images), ref's below

(tap your head to find the misinformation...)

It's almost intuitively obvious that how productive you are in using energy is going to be directly proportional to your wealth. Energy is nature's universal resource needed to turn anything into anything, and easily moved around to where it will be used more productively. Figure 1 shows that the world economy does that rather smoothly, that when you add up the economic wealth of the world, and the energy the world uses to produce it, you can visually see that they are part of the same smooth process. Even the ratio how much wealth is created for the energy used, the economic efficiency in using energy, also changes in constant proportion to the others.

Still, because money is treated as a number, detached from the energy that is used to deliver what you exchange it for, whether money is energy becomes confusing again. We're missing the information. Using money as wealth makes it seem as if real wealth is a matter of collecting and trading scraps of paper, and bidding up the price of things, buying low and selling high, all that stuff. The energy isn't gone, just hidden. When people pass along their products they don't pass along the information about what they had to do to get them, just the price. That lets our imaginations spin out of control.

People often only get their information from other information, with no way to check, so minds wander... and sometimes get lost.

What this is about is also the special debt many of the readers of this have. We need to use our time wisely and give back in proportion to the windfall we gained, somewhat at the expense of others, for having taken part in the great financial bubble of the past three decades. We have a special obligation to discover and help communicate how our world can get back to reality. The financial spree we were all on amounted to a grand Ponzi scheme, played on ourselves.

Those who profited from our global financial overshoot need to give it back somehow, to unwind the distortion instead of holding our crippled economy hostage to making good on the false promises it made.

When people get their information mostly from other people's information the only way the chains of retelling can stabilize is for some group to come to agreement on what that group will believe... So, in solving the problem with mutual agreement, rather than some confirmable source, the meanings held by that group become uniquely disconnected from others, which gives such a group a functional fixation on being misinformed, of course. That seems to be a whole lot of what stock markets do, as you see in figure 2.

I've also been, for years, trying to figure out why different sciences seem to often study the same thing, but not seem to have their knowledge overlap, like ecology and economy! From the word roots one is supposed to be "the logic of" and the other "the measure of" what the Greeks called "housekeeping". The two groups agree on entirely different meanings for their words, though, and so seem to have nothing to say to each other.

Could it be just getting most of our information from information that does that?

Can you see in figure 1 how on a worldwide basis GDP moves

in regular relation to energy use...? In figure 2 do you see how the energy use

of the US was growing with GDP, but only up to the mid 60's. Then if

the US was contributing to the growing wealth and energy use of the world,... as

in the trends of figure 1, it was by having other people in other

countries do the work, and our transferring the knowledge and technology to them

so they could provide the value added to the use of energy that creates wealth,

not the US.

The stock market as you see in figure 2 as well, doesn't follow either trend, at all. The stock market has historically wandered all over the place, seemingly with no direction at all. It seems to show no tendency to track the economy's energy use or GDP, at all. I'm suggesting it's a "blind indicator", probably caused by being a trend that very largely follows itself.

It looks to me like stock traders only know one thing, that they themselves don't know anything about where the market is going. So as they brag and bluster they are also craning their necks to look over the shoulder of someone who does know, they think, and peek over the cubical wall to copy the bets of their neighbor... Something of that kind seems evidently happening, and highly persistent.

One of the other apparently surprising realities these curves show it that the real limit to growth for the US economy (when regular increase by %'s ended) was in ~1967. You may recall there was some discussion at that time... Knowing what has happened since makes it evident that discussion was thoroughly obfuscated by rather assertive people with magical thinking, all coming to agreement. One part of that was the theory that letting investors keep more of their profits to reinvest would remove the limits to growth, "supply side economics".

The irony is that for US investors, is it was the actual end of real economic growth (the energy productivity type) when investment stopped having the effect of moving the limits... that prompted the invention of the theory that it always would.

What actually did work is that Increasing the reinvestment of profits did inflate the value of investments that were not any more productive, like housing. It's was a great miracle, though, if you were led to think that money was real wealth. What it did not do was remove the natural resistance to US energy use and productivity growth between natural complications and resource scarcity and the relative ease of transferring the energy use and technology for value added work elsewhere.

What actually followed, starting about 1980, was a twenty five year whole system financial bubble instead... Financial profits were increasingly recycled for raising self-fulfilling financial bets. Everyone's favorite investment was the kind of "sure thing" in which you could reinvest your winnings to multiply your bets, without needing to actually "do" anything. We all know "there is no free lunch" but apparently make an exception for "ever multiplying free lunch". That's how powerful group hallucinations are, allowed only by agreement on information of unknown source making us believe literally anything, becoming self-fulfilling until it shatters.

Money was also being made, and profits continually reinvested in, what look like the other two main "sure bets", transferring real wealth producing abilities to others, and borrowing on the future of being able to do both at indefinitely accelerating rates. It seemed so secure. Of course... the real trick in helping others find out what's real, is you can't tell them. That would just be giving them information they would be unable to know the source of!

Lots of people just give up at that point, because it kind of means paying more attention to what we are NOT in control of, the natural world, rather than to what we ARE in control of, our information. Trusting what you are in control of, in this case anyway, seems to be the problem.

You can also see in the figure 2 curve for the stock market that about the same kind of decade long market overshoot seems to have happened before the great depression of the 1930's. It looks like in 1920's only a one decade period of run-away market inflation preceded, till the accumulation of misinformation about reality it represented collapsed. How the professions and government responded was to upgrade the financial regulatory system, so it would be more stable, so run-away markets could continue and not collapse for a little longer. It resulted in a 25 year global spree of multiplying misinformation about real values, rather than just a ten year one, it seems...

If you're not thinking about this "phone game effect" and the self-fulfilling agreement on falsehoods it can produce, one is more likely to just get all bound up in the various fixations of your own group, and when talking to people in some other group, with other fixations, have no way to discuss much at all. It's very natural to get bound up in what you think it true, and be unable to take a break and look at the "tabula rasa" evidence in front of you as telling its own story, and not that of your own, using all your own concepts and definitions. That's the frustration.

1) Fig. 1- lEA world data 1971-2006: Economic product (GDP in 2000$), Energy use (TPES in btu's) & Economic Energy Efficiency ($lbtu), each scaled to their relative growth rates and indexed to 1971 value; The "efficiency effect" is implicitly the result of improving 'know-how' in using energy to create what people will buy.

2) Fig. 2 - Historical US energy use in quads and Dow Jones prices adjusted to inflation by Charles Hall and Wm Tamblyn with trend curve for energy data, notes and historical US GDP curves from US BEA data added by P. Henshaw.

(text and figures may be occasionally updated.)