There are problems that get progressively worse as you work on solving them,

often because strategies don’t fit a change of circumstance. The worst trouble,

of course, comes from having strategies that define the environment as part of

the model. Then if the environment changes behavior your model would not have a

way of telling you about it.

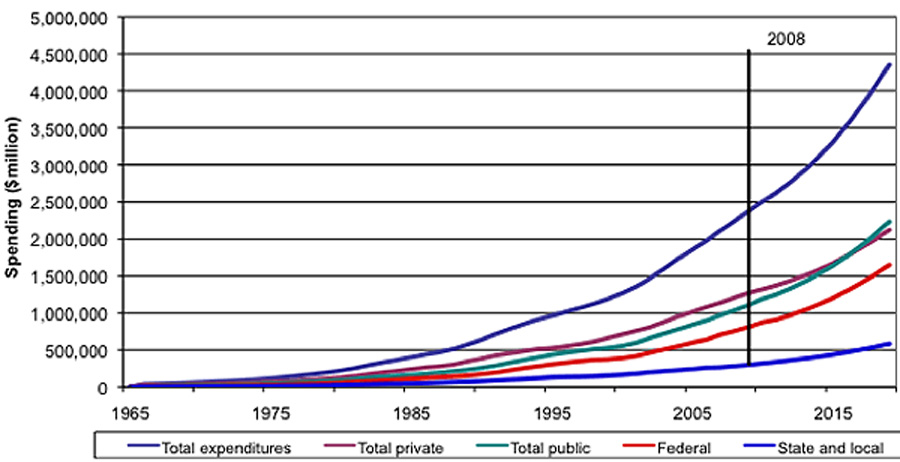

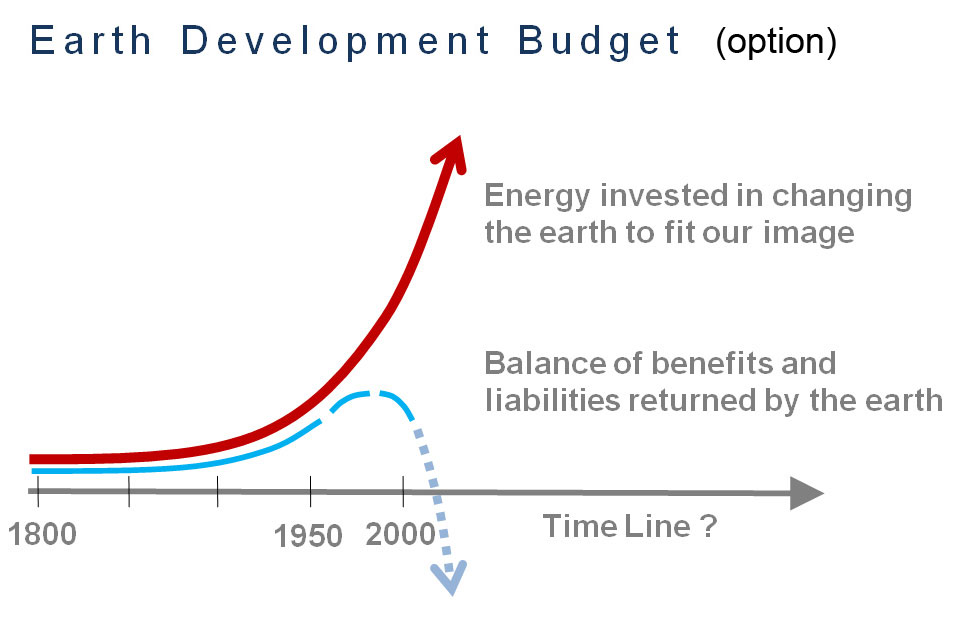

Once you see the pattern of wonderful solutions resulting in multiplying problems as for the health care cost explosion, it becomes a Type III problem, i.e. “solving the wrong problem”. It’s evidence of an entry strategy without an exit strategy. The same pattern is visible in the world environmental impact explosion and the great financial bubbles. You find people sticking with an old solution and failing to notice the emerging moral dilemmas that could guide them to better choices.Figure 1 US Healthcare costs, doubling at 2x the rate of GDP

J. M. Keynes was the first, apparently, to see that dilemma coming for the economies as a whole, but was ridiculed for it. Everyone’s best solution for all economic problems was accumulating investment. He brought up the approaching natural limits of money and what a sustainable economy would need(1). Paraphrasing, he observed that a non-growing economy would still need to maintain a positive rate of return on investments. It would then also go ever deeper in debt to itself if its creditors did not spend enough of their earnings to keep the level of financial investment and physical production in balance, bringing about “peak money” at the same time as “peak stuff”.

He of course didn’t phrase it in modern terms that way. He told it as a parable, he called “the widow’s cruse”(2). He told it as a story of Elijah and a “more favorable possibility” for limiting the growth of debt as the economy approached natural limits than having conditions become “sufficiently miserable” to bring the net rate of returns on investment to zero. It’s a variation of the very ancient tradition of debt forgiveness, nicely researched by Michael Hudson (3). In Keynes version, though, *there are no defaults*. It’s really tragic that his thinking on the subject was treated so dismissively.

The reason it seems so strange is that it implies changing the entire financial game at a time when it’s working fine, and doesn’t need to, an idea that people might use foresight. It seems irrational! Many natural growth systems do the very same strange thing, as they grow beyond their zone of limitless freedom and discover the new environments they are entering. They change their game from one of multiplication to one of refinement and adaptation. You can begin to understand the systems ecology of it to think of a single living cell that discovers a way to continually multiply its control of its environment. A single cell in the womb does that, autonomously taking up the nutrients that, to it, are “just free for the taking” and multiplies furiously from one cell to many billions before being born to try its luck with a new environment.

Any kind of natural system that begins with compound growth has to face the same dilemma. For human economic choices in the same situation the problem is not having an explicit genetic map of how to do it. We have to use our limited view of the world with alternately brilliant and somewhat ‘flaky’ mental equipment and make up choices as we go. Our entry plan was multiplying our control of nature, and now we need an exit plan.

I’ve been looking at the problem regarding healthcare for a long time, but only last week really understood the moral quandary it poses. It seems to raise the subject to the level of mortal and moral threats we face with the energy crisis, climate change, the growing extinction of species, or the financial insolvency of the world. We're profoundly addicted, to buying extensions to our lives for growing profit. It started with the great early achievements of healthcare, like the universally acclaimed combination of great science and our societal commitment to good works in eradicating Smallpox.

It seems *especially* the best of solutions like these that tend to lead people to not have foresight into the deepest sort of trouble ahead. Eradicating Smallpox was one of the kinds of proof we took as meaning we could overcome any great threat of nature. We didn’t notice that it incidentally also served to greatly multiply people and give a start to the wonderful but quite unaffordable teamwork between modern science, public service, and growing profits, quite outpacing GDP. It dawned on me that we really must face the complex moral dilemmas of turning that teamwork off somehow.

What makes healthcare an all but incurable growing addiction is the combination of 1) our being mortal, so the more healthcare we get the more we physically need, 2) that this has become the ultimate growth industry for capitalism (except circular lending.. of course) and 3) that healthcare is a net resource consumer, not a producer. The earth is in a resource crisis and we need resources to become sustainable. The threat combines the economic arts we are most proud of, science, finance, good works and marketing, to make a completely incurable and unaffordable economic addiction and disease. It seems that healthcare has become a genuine cancer, multiplying cures and costs toward the exhaustion of the economy, a true Gordian Knot of moral quandaries rapidly bankrupting everyone.

That there must be *some* other solution is hinted at by how nearly the same dilemma is solved by nature with literally every perfect thing she makes. Everything that becomes perfect switches plans in the middle of the story. Growth is an amazing run of luck for some system multiplying its control of nature, and then to become sustainable finding its way of giving that up. The models of how to do it in nature may display better timing, yes, but the also clearly show there are ways to not get carried away with limitless problem solving. It seems there’s a way to go forward at a dead end, by switching to a strategy of making things whole and complete instead of ever more complex.

It's "a long shot", of course, but getting the clear message that we need to change is a great start. If we weren't so busy telling nature how to behave, for example, maybe we could look and find secrets worth studying in how she does it. Most efforts are presently still looking the other way, of course, with most economic resources still going to people trying to hang onto the failing growth system. Even most of what is called “sustainability” is focused precisely on that, sustaining growth. What we rather need is a new purpose, to discover how to jump off the escalator of growth at a practical place.

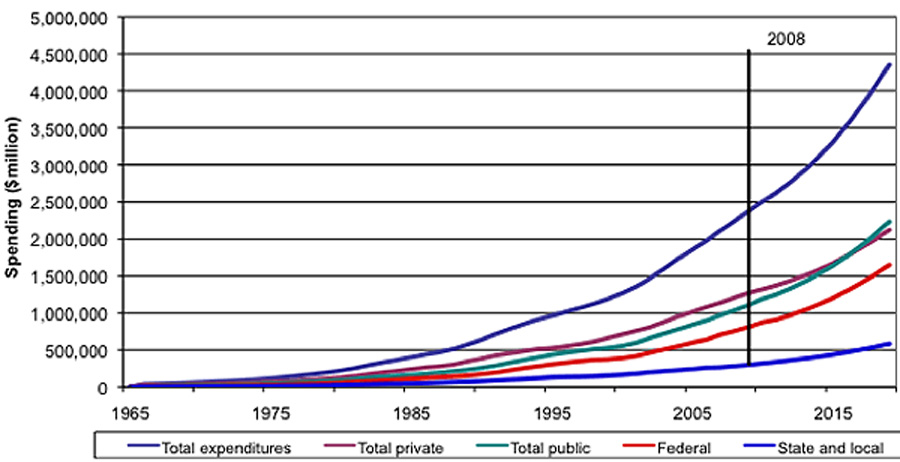

An important technical problem is that vicious spirals and their relief is partly a critical matter of timing. Figure 2 shows the basic options for when to make the switch from change in relation to the past to change in relation to the future. It illustrates the difference between a transition timed to be smooth and effortless, and one that’s late and increasingly destabilizing. Because physical systems have momentum, as in driving a car, late turns at too high a speed lead to fishtailing, repeated over-corrections, and then spinning and tumbling with complete loss of control. So it’s important that the turn match the vehicle.

Figure 2 Having the time to make changes smoothly, or not

That view at least parallels the human dilemma of having gotten used to a limitless earth that seemed to follow our models, and belatedly realizing our need to change. All our institutions and finances are designed for doubling assets every 20 years, for example. Now that we’re running into nature, at scale, the vague models we had for how things worked “out there” also are clearly not what nature is following. There are major omissions from our models, such as how natural systems have all kinds of independently animated parts, that learn as they go like we do. Our kinds of models can’t be defined that way.

Another intriguing example of a vicious spiral is in our response to resource depletion and search for sustainable energy and other resources. Growth naturally uses up resources at ever faster rates. That we’re even trying to use sustainable resources for sustaining growth is the oddity. Sustainable resources are only at all sustainable for a stable economy, not an exploding one. Solar panels simply don’t get an ever doubling amount of sunshine is the problem. Growing at our traditional “constant” doubling rate our energy use doubles every 30 years, along with the scale, speed and complexity of change. We’d get confused with the speed of change long before, but also run out of earth to put solar panels on in only about 250 years, completely covering the globe.

An equally odd, but actually much more telling error is the quite widely accepted plan to reduce energy and other resource uses by conserving and making growth more efficient. The telling thing about that is that improving economic efficiency has been known for 150 years to increase the rate of resource use and depletion, the opposite of what people now use it for. It’s become our plan for slowing resource use and depletion. The ratio of efficiency reductions to stimulus for energy us is 2.5. On average saving 1 unit of energy make it easier for the economy to use energy and results in 2.5 units of new uses (4).

The telling feature of is how clearly it separates what we think we can explain from what the economic system actually does. It’s a key question for trying to understand what anyone is to believe. It points to the possibility that the natural systems we refer to in conversation may not physically exist. That’s a great question to ask, “is anything real out there?” If you can tell the difference between mental models and physical things it’s easier to see the answer.

Telling the difference can be tricky of course. To help there are a long list of things that logical constructs can do that physical systems can’t, and others that physical systems can do that logical ones can’t. One thing physical systems can do that logic can’t is to change organization fluidly by themselves. One thing that logic can do that physical systems can’t is change without a proportional use of energy or continuous complex processes.

One way people are trying to make a better fit between perceived and natural worlds are in the various environmental partnership programs and group learning practices. In a complex world groups of stakeholders with different theoretical models, life experience, approaches and interests have a common need to find ways to help solve each other’s problems creatively.

Getting scientists and non-scientists to work together is part of the challenge. Scientific models are defined without any environment and without any individually animated parts. It seems the work is hardly begun of making them into better operating manuals for environments that display little else.

There are lots of people struggling with the basic problems of sustainability science, but the field doesn’t have a voice yet and there seem very few who appreciate the basic questions yet. I’m sure there are many others worth mentioning for general reading but people who are careful thinkers, have a fresh real world view of natural systems and are sometimes easy to read include: Elinor Ostrom, Helena Norberg-Hodge, Jane Jacobs, Joseph Tainter and Gerald Midgley.

One nice quote from Helena Norberg-Hodge(5) illustrates the point, speaking about practical choices in response to global warming instead of as a political or economic contest:

“First, people in the South simply cannot replicate the development path taken by the North: not only has our ‘development’ already used up too much of the planet’s resources – including its ability to absorb CO2 emissions – but the South has no colonies to supply it with cheap resources and labor, no ‘Third World’ to exploit. Second, arguing for equity ignores the fact that development and globalization do not benefit the majority; they have instead been responsible for a dramatic increase in poverty, while primarily benefiting only a small wealthy elite.”

In nature, seeing the practical choices is what lets you discover the moral questions you really face, and anything else is simply abdicating the choice to understand enough to make your own choices.

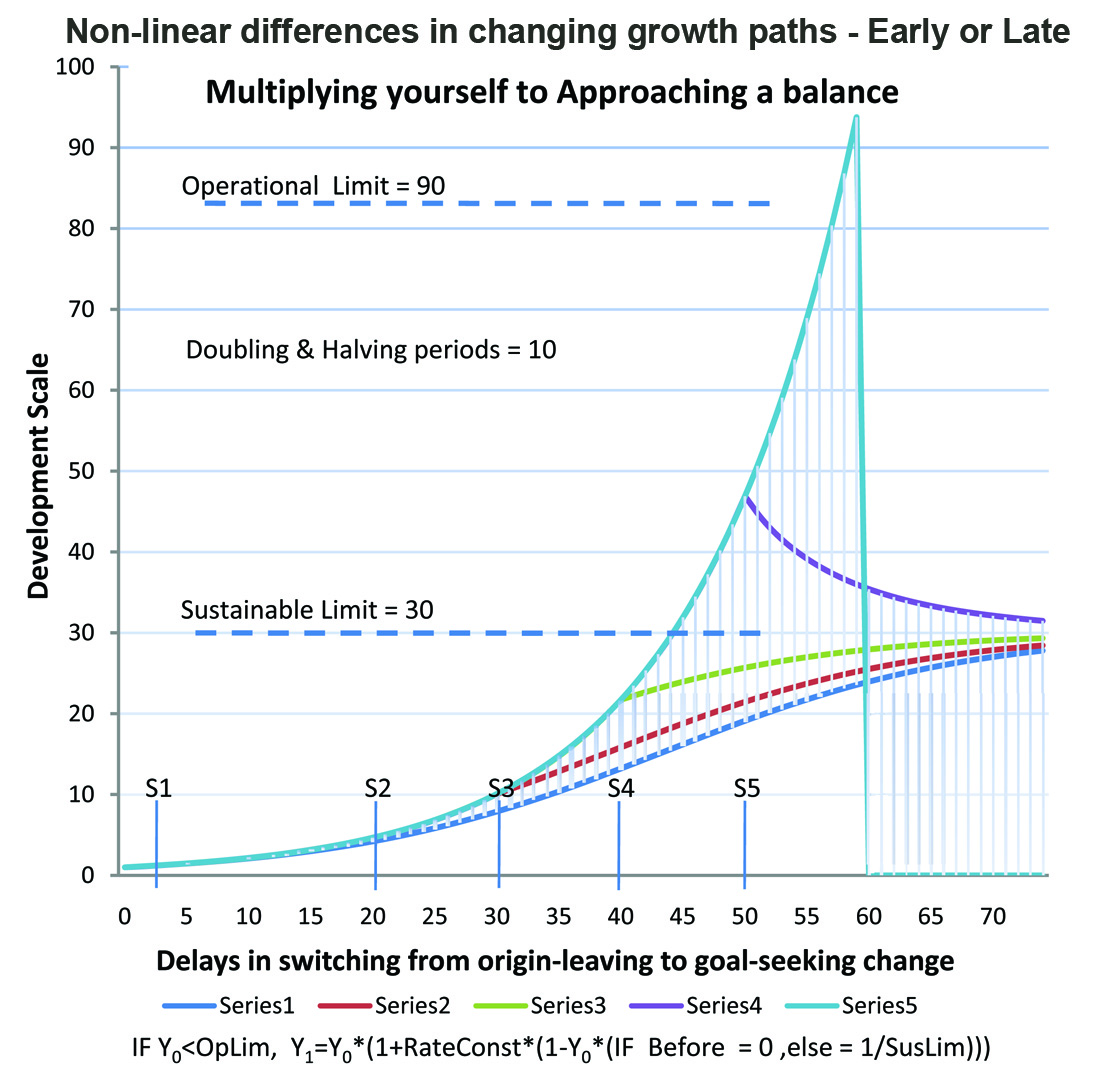

The worst problem before us is how the combined effect of all these multiplying problems, the enormous catalog of liabilities that a strapped future economy won’t be able to afford. Figure 2 is a conceptual sketch of the problem of “Throwing our energy at an impossible dream” (6). Putting ever more energy into maintaining a growth system rapidly depletes the resources that are most profitable to deplete, while creating ever expanding overhead costs throughout the system. Multiplying complexity till it quits is no solution.

Figure 3 The cost of investing in insolvable problems

Only very conceptual work has been done on the question of where we cross the line of vanishing physical system returns for energy invested (7)(8). It’s nature’s version of whole system bankruptcy, when the energy overhead costs for obtaining energy exceed the returns. There is no actual limit to our energy supplies, only to affordable energy. Using up cheap energy supplies before methods of using expensive ones are available is as great a threat as banking on Ponzi schemes. It’s also ironically, the best choice for quick financial returns.

To end on a positive note, being pushed into discovering what our real choices are only works if we find some rather positive things. We need to discover what animates the world around us, and how nature succeeds in both respecting the genius of every individual thing and finishing what seem like completely impossible design tasks. Somehow when running out of seed resources at the limits of their initial growth is when nature switches to completing and perfecting her most lasing designs. Whatever nature does always sounds impossible, but mysteriously also often found easier to do than understand. Immersing ourselves in studying that for a while might have large hidden rewards.

References:

1) J.M. Keynes 1935 The

General Theory of Employment Interest and Money, chapter 16

2) P.F. Henshaw 2008 Natural Climax http://synapse9.com/issues/NaturalClime.htm

note #1

3) Michael Hudson - 1992 The Lost Tradition of Biblical Debt Cancellations

http://michael-hudson.com/articles/debt/Hudson,LostTradition.pdf

4) P.F. Henshaw 2009 Inside Efficiencies, for BioPhysical Economics 09

http://synapse9.com/pub/EffMultiplies.htm

5) Helena Norberg-Hodge 2010 North-South Divide And Tackling Global Warning,

Countercurrents http://www.countercurrents.org/hodge280210.htm

6) P.F. Henshaw 2009 Throwing our energy at an impossible dreams, picked up by a

number of sites, http://energybulletin.net/50990

7) Charles A. S. Hall, Stephen Balogh, David J. R. Murphy 2009 What is the

Minimum EROI that a Sustainable Society Must Have?, Energies 2009, 2, 25-47;

8) P.F. Henshaw 2009 Profiting from Scarcity, The Oil Drum

http://www.theoildrum.com/node/5478

Figures:

1. Rand 2008 Current and Projected Health Care Spending http://www.randcompare.org/us-health-care-today/spending

2. P.F. Henshaw 2009 Growth & response model, comparing 5 development curves

with constant % rates of change, switching from growth in relation to the past

to growth in relation to the future at different times.

3. P.F. Henshaw 2010 Conceptual model of increasing present investment for

diminishing future returns for growth systems using current returns on

investment for a guide.