Bill Rees asked some excellent questions about my submission to the Long Term Capitalism Challenge to use natural principles for managing growth to sustain the profitability of our economic system. I think I made good responses too.

_________

Hi Jessie –

Thanks for the opportunity to review your proposal.

I agree with your diagnosis of our economic malady but admit to struggling a bit with the remedy. Let me start with this sentence:

“When people spend their financial profits on good works it also [reduces the growth of money], with the added advantage when spent as for endowments instead of to compound profits, of doing a lot of good.”

Now, at the limits to material growth, the goal of policy should be to reduce the throughput of energy and materials to biophysically sustainable limits. So the above passage raises two questions. First, what do you mean by ‘good works’? and second, would the redirection of profits from investment in productive capital to ‘good works’ reduce total throughput?

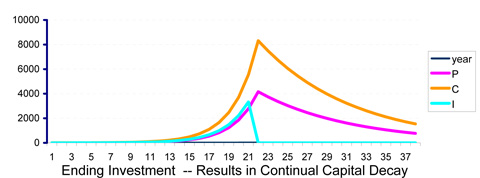

/When financial earnings are not compounded to multiply investment, and the returns are not added to savings, it stops the automatic compound growth of investments. I’m using “investment” more broadly than usual, to make my statements inclusive, to include all ways in which money is spent with the intent of having it return profits. I then break spending and investing in components if I want to study the details, using a “figure 8” model. That’s a way to construct a global model of how income is allocated and returned as income, as a closed system with regulated money supply (Concept$).

/So, “spending” then means the opposite of investment, as money spent without an expectation of return, i.e. final consumption. Then “good works” most generally means final consumption used to maintain the profitability of the economy, as a universal good and necessity for survival. One thing that economists would recommend, it think, if the added spending seemed to increase aggregate demand, is to make sure enough of it was used for non-consumption expenses like to retire debt. The intent is to have investors treat their financial investments as endowments, and think of themselves as fiduciaries for the earth in general, to keep it profitable and using their money as the world is best served.

/Spending financial returns would reduce total throughput if it kept the funds available for expanding production systems from growing. How the restraining aggregate savings would affect the movement of funds between ‘producing’ and ‘non-producing’ investments I have not really thought through. One part seems to be that businesses would need to give their profits to their shareholders, to be spent, rather than to use them to grow while the whole economy is trying not to.