P.F. Henshaw

id, at synapse9.com 12/16/08

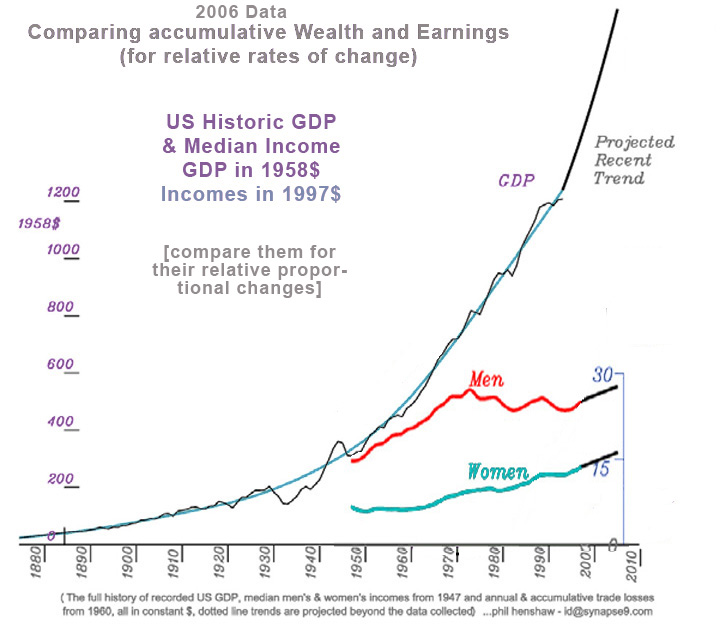

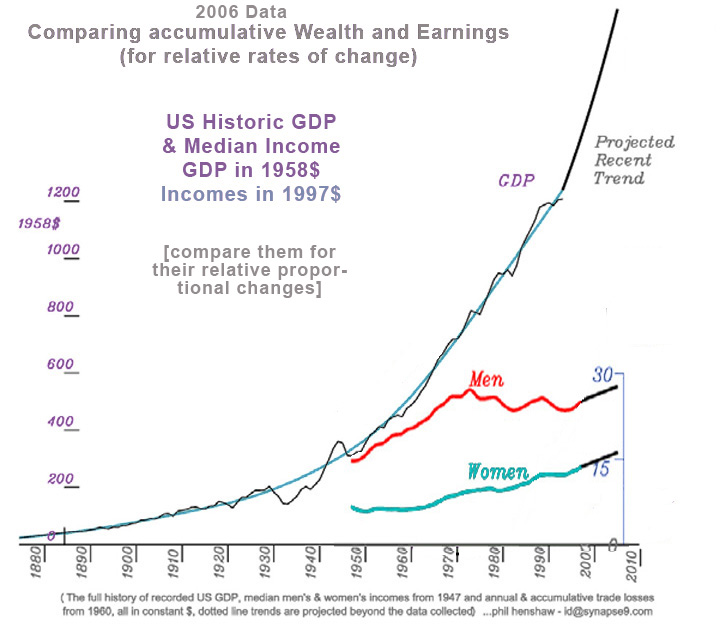

...It would help explain the wild divergence between total US wealth and the regular incomes of people, now followed by a financial and economic collapse that shows much of that exuberant growth was actually some kind of betting that created only illusory wealth.

What most people don't seem to recognize is that ANY form of guarantee of endless compound returns will produce a bubble of the same kind as Ponzi's scheme. What indicates where it's happening is the guarantee of unusual returns, followed by investor trying to run off with their imaginary share, usually called their "flight to safety". Like the scheme Ponzi used, any guarantee of compound returns for a Give/Take scheme will come up short, and come to need to use investor funds as the source of the returns. That would be whenever the growth of the Earn/Spend "business" invested in stops growing to provide them. The idea of assured compound returns has been tricking us, for a couple hundred years at least. Relatively steady investment growth has seemed assured by continual real economic growth. Real economic growth has been lagging, though, as the economies have become very big and the earth relatively smaller and limited in comparison. We seem to have been filling in with price speculation in housing and lots of other things to offer assured compound returns in the absence of real economic performance. Now people all over the earth are trying to escape in their "flight to safety", taking 'their' imagined share of what now looks a lot like a global Ponzi scheme with them. That is what is actively causing the world economic collapse, people taking their money out of collapsing investments and hording it. That, of course, also collapses the value of the funds being hoarded, in a self-defeating consequence of not spending them when they had the chance. If those 'takings' were spent, on the other hand, the Earn/Spend economy wouldn't need to collapse too.

The two interesting widespread classes of investment strategies that produce this same misleading effect are "investment return insurance" and "investment return selection". The latter amounts to a "self-Ponzi" scheme, and almost everyone does it. The real fault of the famous investment insurance and hedge funds collapsing all around us is having been designed to guarantee compound returns, and then having the economy begin slowing to make their promises false. I think to keep up appearances they were then stuck with making up their earnings with attracting increasing investments, a natural Ponzi scheme hedge. As you look around you find these are remarkably widespread, and being relied on throughout the financial investment industry.

The sneakiest one is the "self-Ponzi" scheme, because we do it to ourselves. That is created by adopting a rule for yourself to invest only in things that appear to assure continual compounding returns. "Yes, Virginia....", that's a natural system crime, and nearly everyone of us is doing it. Most of us who saw it would or was crashing, and that someone would take the money and run if not us, made haste to withdrew our investments in a "flight to safety" to "cash out" before others could. Now we're hoarding our illegitimately inflated funds, withholding them from circulation, and deflating the economy and the value of the money we took and are hoarding.

The *two features* that identify this more generalized Ponzi scheme "bubble" and "systems game" are that 1) something appears to guarantee limitless compounding returns, and 2) some investors are able to take everyone else's money and run off with it as the scheme collapses, leaving the original investment starved for funds and shrinking suddenly.

Step 1) is what people are fooled bye, that everyone in our culture seems to want, an assurance that taking a growing risk is not risky...

Step 2) is the "flight to safety" we see happening all around us now, as people who were investing in things appearing to offer endless compounding returns decide to pull their money out before everyone else does!! It's actually the act of pulling your money out, gained by false earnings from what other investors put in, that does the lasting harm to both the community of investors that was relying on the false promises and the core businesses whose customers were thus lost. Far less harm would come to the economy if people accepted the loss of expected unearned income, OR... if those who took the money and ran were to spend it right away instead. It's really withholding it from circulation that collapses the physical economies.

The even more curious part is that our financial regulators are actually not aware the problem exists, because they believe the theories that economies can produce endless multiplying returns. As a result, they have no means prepared for responding to it.

So... it appears the historical Charles Ponzi was just a copy cat, and

The Real Charles Ponzi was whoever sold the idea we

could all have continually multiplying returns, persuading us that we only

needed to give the task of assuring them to the investment and regulatory

community as a whole !!